October 2024

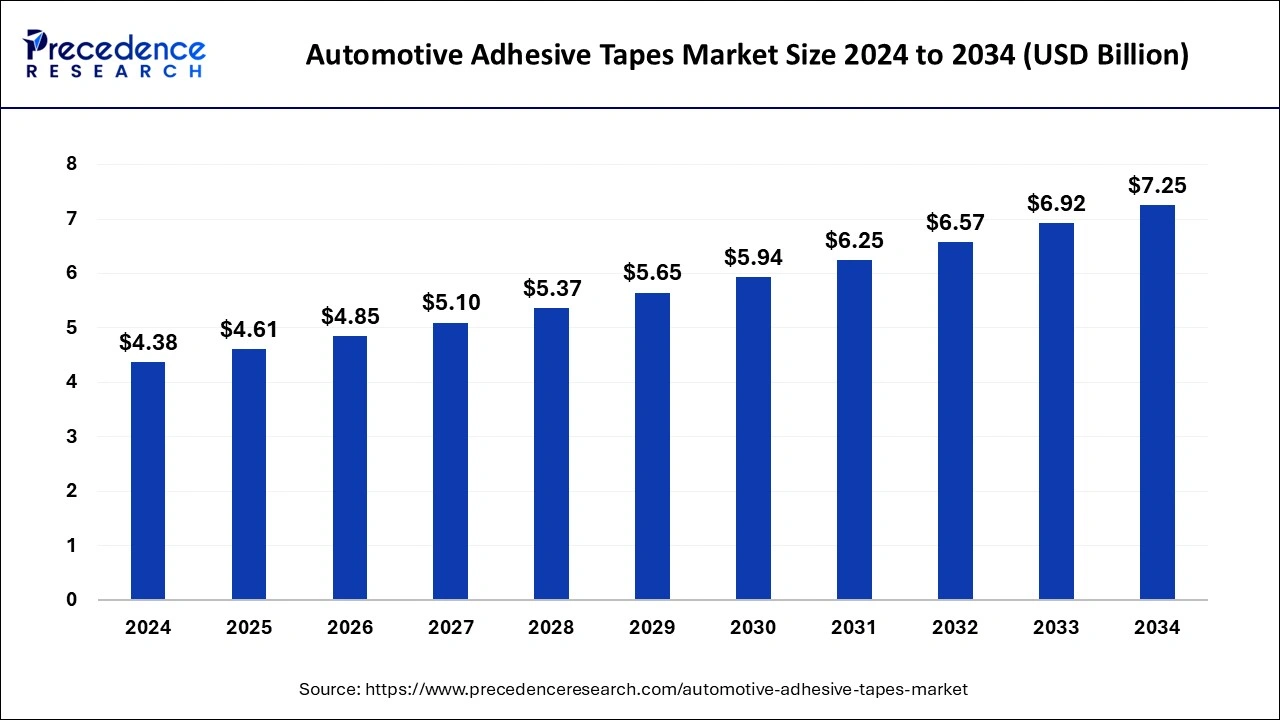

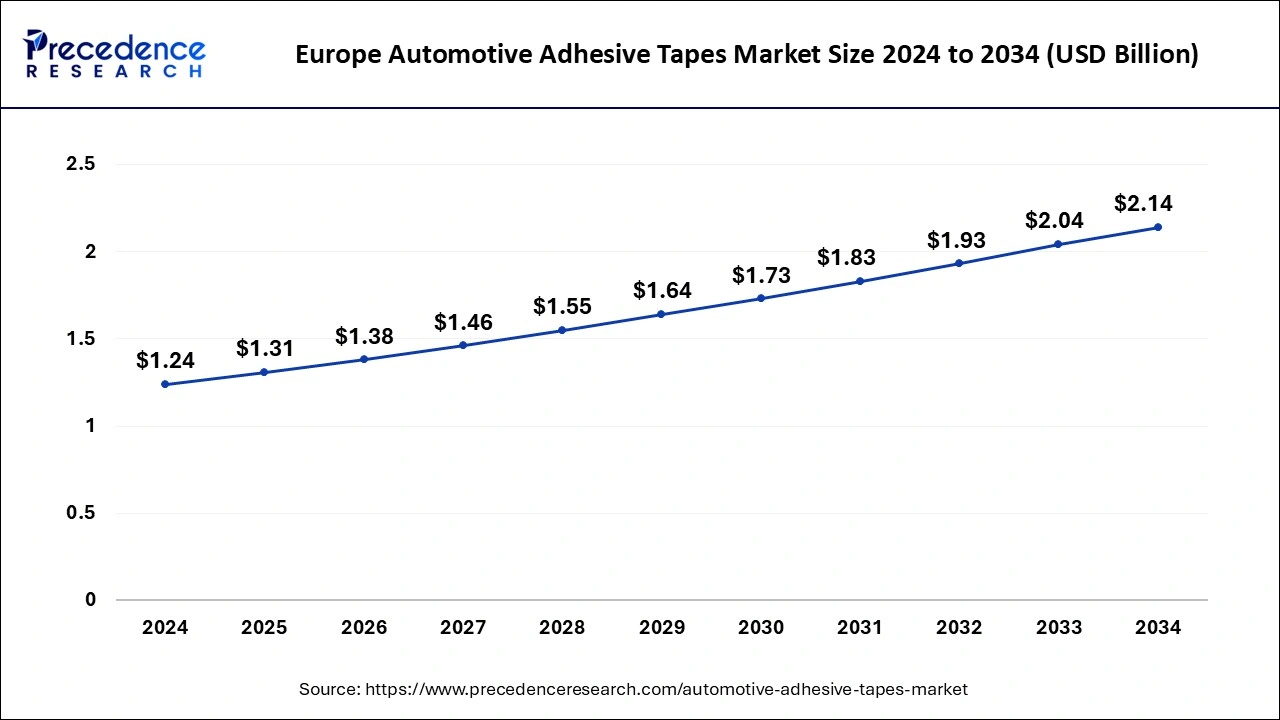

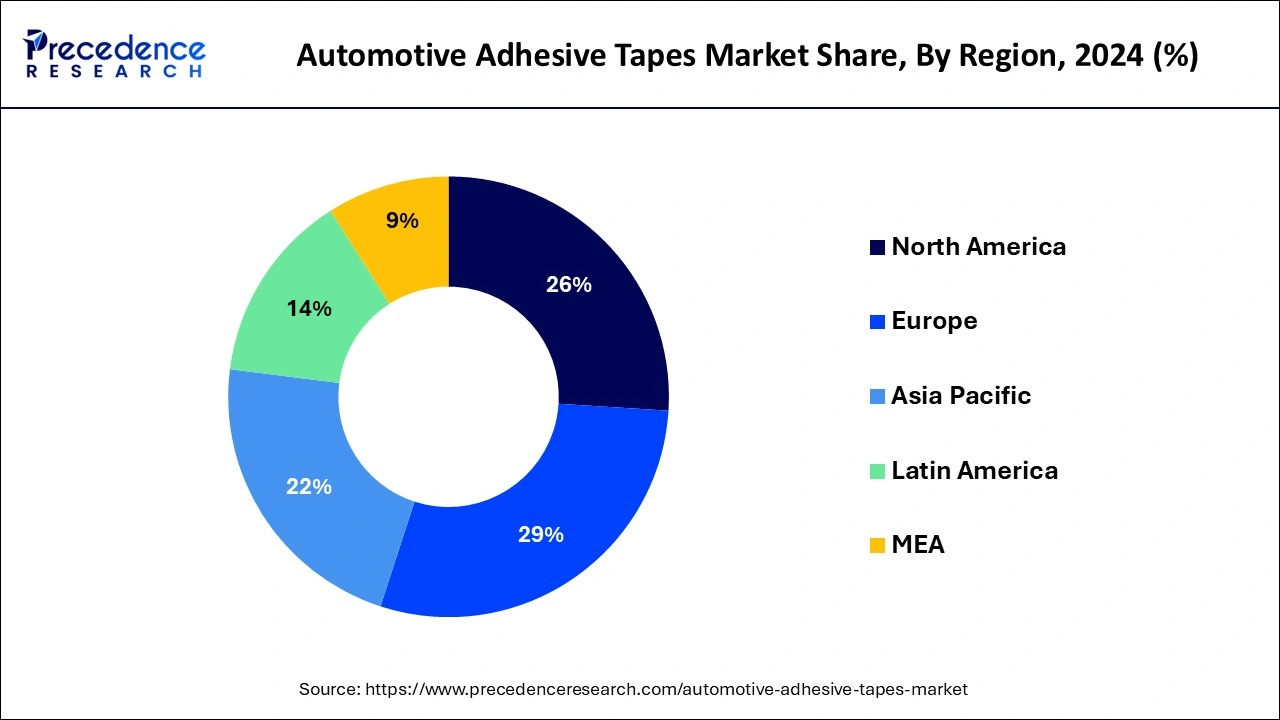

The global automotive adhesive tapes market size is accounted at USD 4.61 billion in 2025 and is forecasted to hit around USD 7.25 billion by 2034, representing a CAGR of 5.17% from 2025 to 2034. The Europe market size was estimated at USD 1.24 billion in 2024 and is expanding at a CAGR of 5.61% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive adhesive tapes market size was calculated at USD 4.38 billion in 2024 and is predicted to reach around USD 7.25 billion by 2034, expanding at a CAGR of 5.17% from 2025 to 2034.

The Europe automotive adhesive tapes market size was exhibited at USD 1.24 billion in 2024 and is projected to be worth around USD 2.14 billion by 2034, growing at a CAGR of 5.61% from 2025 to 2034.

Europe acquires almost 28.14% of the total market revenue share, and the region is expected to boost significantly during the forecast period. The presence of major automotive companies, including Volkswagen AG, Mercedes-Benz Group, Stellantis AV and Renault SA, has contributed to the great demand for automotive adhesive tapes in Europe.

The automotive adhesive tape market in North America is expected to expand at a robust rate during the projected time. Increased automobile production, changing customer requirements as well as research and development (R&D) activities for new product development are significant factors to propel the market’s growth in the region. With the rising development of electric vehicles, the market for automotive adhesive tapes is developing at a noticeable rate in Latin America, the Middle East and Africa. Increased investment in electric automobiles in the gulf countries is a major factor in boosting the market’s growth in the Middle East. Considering Latin America, Brazil dominates the market, whereas Argentina is expected to grow significantly during the forecast period.

Automotive adhesive tapes bond surfaces together in order to improve the function of vehicle components. Automotive adhesive tapes are used in vehicles for numerous reasons, including wire harnessing, sealing, insulation and surface protection. Automotive adhesive tapes have reduced the use of screws, nuts and bolts by adding unmatched value to modern vehicles without negotiating with the quality.

Adhesive tapes have a wide range of applications in the automotive industry. Automotive adhesive tapes ensure cell-to-cell bonding, and integrity of the structure, act as compression pads, offer busbar shield and proper electrical insulation, and reduce vehicle weight by making it light and fuel efficient.

Moreover, adhesive tapes provide additional safety and support for components in vehicles. Masking tapes, acrylic foam, and harness tape are a few types of automotive adhesive tapes. While increasing the line productivity in the automotive industries, these adhesive tapes are likely to reduce the cost of vehicles. Due to rising environmental concerns, manufacturers involved in the global automotive adhesive tape market are focused on developing biodegradable adhesive tapes.

Due to their strength, durability and excellent temperature resistance properties, double-sided adhesive tapes have enormous demand from the automotive industry.

The global automotive adhesive tape market is predicted to expand at a CAGR of 6.5% during the forecast period. Adhesive tapes are considered a key component in the automotive industry; improving the automotive industry and economies across the globe are seen as significant driving factors for the market’s growth. The rising requirements for enhanced performance of vehicles have boosted the demand for automotive adhesive tapes globally.

The global automotive industry is focused on utilizing advanced and efficient materials for wire harnessing in vehicles; this is observed as a significant driver for the growth of the global automotive adhesive tape market. Moreover, the rising demand for adhesive tapes from electric vehicle manufacturers is fueling the market’s growth at a noticeable rate. Proper use of automotive adhesive tape may reduce the requirement for maintenance and repair services; this beneficial factor will increase the demand for tape in the automotive industry.

Increasing awareness about electric vehicles globally positively impacts the automotive adhesive tape market. Prominent companies involved in the automotive adhesive tape market are focused on developing more environmentally friendly yet efficient adhesive tapes. This factor is considered to boost the market’s growth during the projected time. Moreover, rising investments in developing critical components in the automotive industry are propelling the market’s growth.

However, solvent-based adhesives are harmful to the environment, and the rising environmental concerns are prone to hamper market growth due to solvent-based adhesives. Considering the same restraint, the growing number of stringent policies regarding VOC emission is another restraining factor for developing the global automotive adhesive tape market. Moreover, the cohesive failure of adhesive tapes will likely hinder the market’s growth. Improper use of automotive adhesive tapes can result in failure; this factor restraints the development of the market.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.61 Billion |

| Market Size in 2024 | USD 4.38 Billion |

| Market Size by 2034 | USD 7.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.17% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Adhesive Type, Backing Material, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising trend of electric vehicles across the globe

The demand for electric vehicles is increasing due to rising concerns of environmental crises across the globe. The increasing manufacturing of electric vehicles is a proven driver for the growth of the automotive adhesive tape market as they provide unmatched advantages in the overall design of electric vehicles. Adhesive tapes have a wide range of applications in electric vehicles. Double-sided automotive adhesive tapes ensure the structural integrity of the vehicle. The acrylic foam technology of adhesive tapes reduces the weight of vehicles.

Moreover, automotive adhesive tapes control the electric vehicle battery temperature skillfully. Electric vehicles contain multiple cells, and double-sided automotive adhesive tapes are applied in electric vehicles to protect sensitive components of the vehicle from the continuous current flow. Single-sided and double-sided automotive adhesive tapes are observed to replace nuts and bolts by reducing the significant weight of the vehicle. Considering these advantages of adhesive tapes for electric vehicles, the rising electric vehicle industry will propel the growth of the automotive adhesive tape market.

Fluctuating prices of raw materials

The raw materials required for manufacturing automotive adhesive tapes include polymers, solvents, rubber, dispersions, acrylic resins and silicon. The prices of solvent-based materials are vulnerable to fluctuation. Moreover, the set-up cost for an acrylic resin factory is expensive, and the lack of manufacturers in the market apparently results in volatility in the prices of acrylic resins.

The volatility in the availability of raw materials required in the manufacturing of adhesive tapes adversely impacts the costs of such materials. Price fluctuations result in delayed or minimized production, and such conditions negatively affect the company’s revenue. Thus, changes in raw materials prices hinder the growth of the automotive adhesive tape market.

Utilization of nanotechnology in the manufacturing of adhesive tape

The short span of adherence of adhesive tapes causes an obstacle by limiting the purchasing of tapes. Prominent companies in the automotive adhesive tape market are focused on developing adhesive tapes by utilizing nanotechnology to boost their function. Nanotechnology deals with nanomaterials, whereas nanomaterials are proven materials to function in a wide range of temperatures.

Unlike traditional adhesive tapes, automotive adhesive tapes made with nanotechnology are less prone to lose their adherence. Nanotechnology's application in adhesive tapes makes the tapes ultra-light and thin yet strong. The possibility of improved performance of automotive adhesive tapes by utilizing nanotechnology will bring standardization in the manufacturing process for companies by offering unmatched advantages.

Covid-19 Impacts:

The coronavirus outbreak has shown adverse effects on almost every industry globally. Similarly, the global automotive adhesive tape market suffered a massive loss during this critical period. The growth of the automotive adhesive tape market is directly linked to the automotive industry. The pandemic disrupted the automotive industry, resulting in reduced demand for automotive adhesive tapes.

The prolonged lockdown and moving restriction impacted business activities, including partnerships, acquisitions and new product launches. Moreover, the disturbed supply chain and prolonged halt in manufacturing due to the lockdown adversely affected the global automotive adhesive tape market.

The acrylic segment is leading the automotive adhesive tape market. However, the fluctuating prices of acrylic resins may hamper the segment’s growth. The water and thermal resistance properties of acrylic have boosted its importance in the automotive adhesive tape market. Acrylics are used for masking adhesive tape, and acrylic resins offer additional pressure-sensitive adhesion for tapes along with optical clarity. Additionally, acrylics have high shear strength and excellent durability, which makes them an ideal adhesive for mechanical tapes.

Moreover, the silicone segment in adhesive type is growing significantly. Silicone is a flexible and durable adhesive for automotive components that can withstand extreme weather conditions. The pressure-sensitive automotive adhesive tapes made with silicone polymer can maintain their performance in various temperature ranges and moisture conditions.

The polyvinyl chloride (PVC) segment is expected to boost at a significant rate during the forecast period. PVC is a thermoplastic material which offers excellent mechanical properties, and Polyvinyl chloride (PVC) backing material is flame and water-resistant. PVC is considered an ideal backing material for interior and exterior applications in the automotive industry. PVC, for instance, has the potential to be soft and is best suited for insulation applications and masking.

At the same time, polypropylene is widely used for economic reasons. Long and unbreakable strips of polypropylene-based adhesive tapes are widely used for interior applications in a vehicle. However, the temperature resistance limitations of polypropylene challenge its application in automobiles.

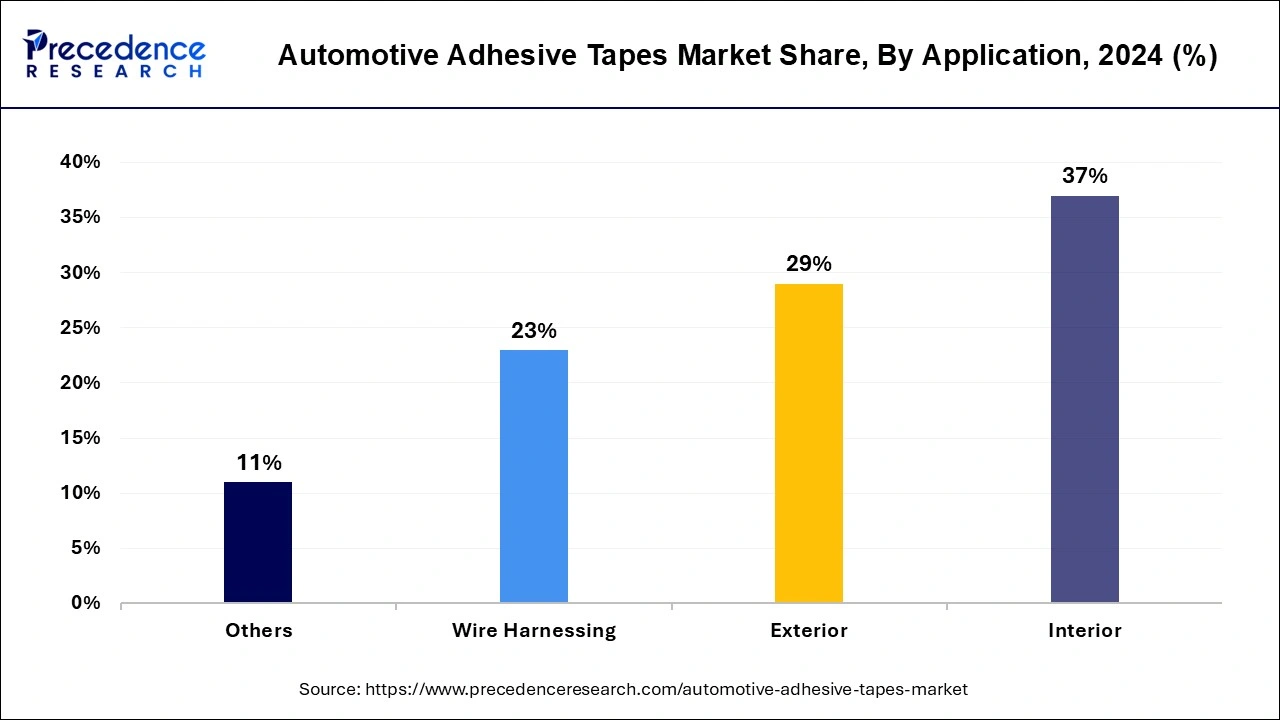

The interior segment of the application accounts for 37% of the global market revenue share. Double-sided automotive adhesive tapes are widely used in the interior decoration of a car to enhance its aesthetics. Automotive adhesive tapes are applied to mirrors, caravans and motor homes for car interiors. The rising trend of complex infotainment systems in automobiles has boosted the demand for pressure-sensitive automotive adhesive tapes in the market.

Along with this, the increasing inclination of consumers towards luxury goods for vehicles is propelling the growth of the interior application segment. Small-scale vendors and workshop owners have enormous requirements for internal automotive adhesive tapes. Interior applications such as electronic mirror mounting, seating detection sensor mounting, display mounting and infotainment system mounting are possible with automotive adhesive tapes.

Moreover, a vehicle requires harnessing for almost 2.5-5 kilometers of wire. Adhesive tapes are considered to be the ideal material for mechanical harnessing. The rising requirements for reliable harnessing in electric vehicles are expected to fuel the growth of the wire harnessing segment. Soft PVC adhesive tapes are widely used for wire harnessing in a vehicle.

Recent Developments

By Adhesive Type

By Backing Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

February 2025

July 2024

December 2024