January 2025

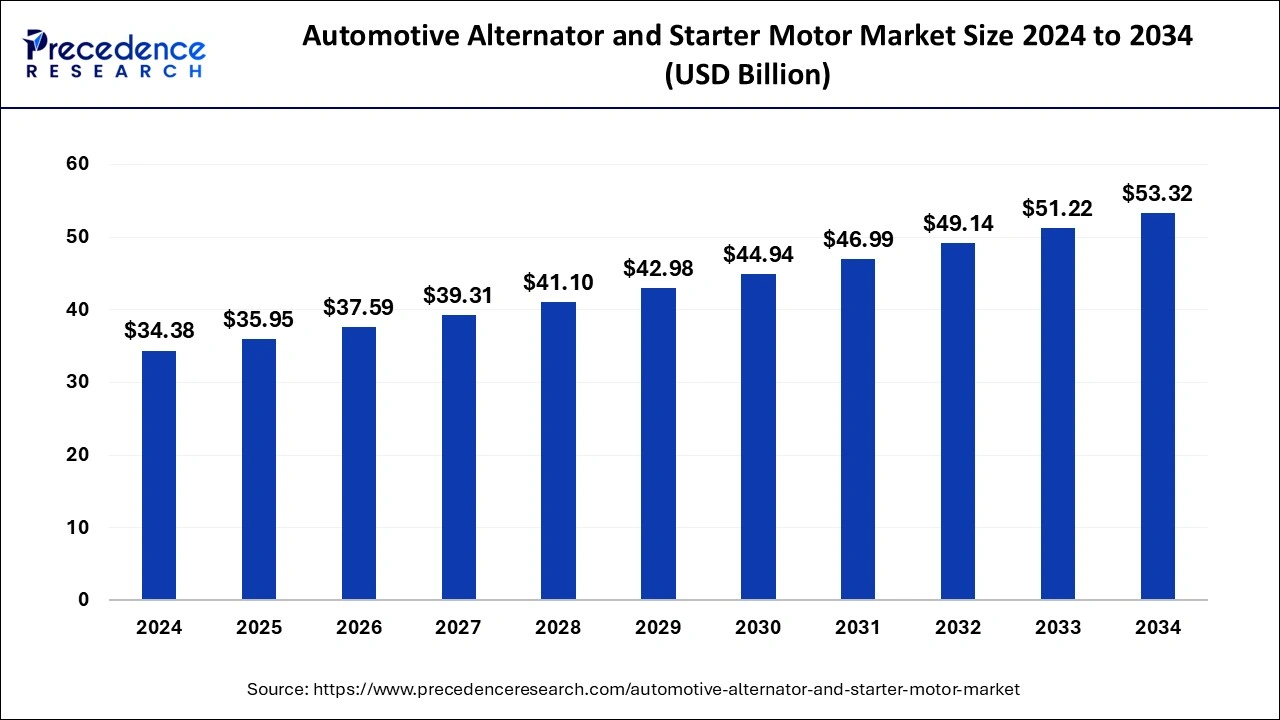

The global automotive alternator and starter motor market size is calculated at USD 35.95 billion in 2025 and is forecasted to reach around USD 53.32 billion by 2034, accelerating at a CAGR of 4.49% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive alternator and starter motor market size was estimated at USD 34.38 billion in 2024 and is anticipated to reach around USD 53.32 billion by 2034, expanding at a CAGR of 4.49% from 2025 to 2034. The automotive alternator and starter motor market is influenced by factors such as the rapid expansion of the automotive industry, rising demand for lightweight and fuel-efficient vehicles, and the increasing production of vehicles.

Artificial intelligence (AI) is becoming an integral part of predictive maintenance in the automotive industry. AI facilitates predictive maintenance for vehicles equipped with advanced alternators and starter motors. It analyzes the function of alternators and starter motors and predicts potential failures before they occur. This, in turn, reduces the risk of breakdown. Moreover, AI technologies streamline manufacturing processes by reducing errors, thereby increasing production output.

An automotive alternative is used in advanced automobiles to charge the battery and supply power to the vehicle's electrical system when the engine runs. The most popular misunderstanding is that the battery powers every electrical device in the car, including the windscreen wipers, headlights, and radio. Most of the electricity in a car is actually generated by an alternator.

The battery's principal functions are to start the engine and further provide power when it isn't running. On the other hand, a starter motor turns the engine through the ignition and permits the rest of the process. Starter motors are ultimately used to protect the motor from overload and short circuit faults and to reduce the starting current while maintaining the motor's starting speed.

| Report Coverage | Details |

| Market Size in 2025 | USD 35.95 Billion |

| Market Size by 2034 | USD 53.32 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.49% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Alcoholic Content and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rise in the global automotive production and demand

One of the most popular manufactured goods in the last century is vehicles. It is regarded as a quick, adaptable, comfortable, and reasonably priced mode of transportation and has evolved into a symbol of status or a way to express one's personality. A dramatic increase in the demand for commercial vehicles and passenger vehicles is one of the prominent reasons for the growth of the automotive alternator and starter motor market.

For instance, global vehicle sales increased from 78.8 million in 2020 to 82.7 million in 2021. Global passenger vehicle sales increased from 54 million in 2020 to 56.4 million in 2021. On the other hand, global commercial vehicle sales increased from around 24.9 million in 2020 to 26.3 million in 2021.

Additionally, the rise in the youth population and increasing middle-class income in major countries across the globe are other factors that augment the growth of this market. Furthermore, the presence of many enterprises in the industry and rising functional collaborations and acquisitions have led to the shift of automotive production toward emerging economies.

This, in turn, ultimately increases global automotive production and bolsters the growth of the alternator and starter motor market. For instance, according to the International Organization of Motor Vehicle Manufacturers, global motor vehicle production increased from around 77.1 million in 2020 to 80.1 million in 2021.

Growing demand for electric vehicles

Continuously growing demand for electric vehicles is a significant restraint for developing the alternator and starter motor market. Customers are increasingly shifting towards purchasing electric cars instead of internal combustion vehicles. For instance, sales of electric vehicles (EVs) doubled from 2020 to 2021, reaching 6.6 million, a new high.

Using electric cars eliminates the demand for alternator and separator motors, which creates a significant obstacle to the growth of the automotive alternator and starter motor market.

Rising automotive spending in emerging economies

Increased spending on the automotive industry by growing economies such as India creates extensive growth opportunities for market players. Due to advanced technologies, manufacturer investment in R&D, and the development of creative automotive parts, India and other developing and developed economies are expected to spend more on automobiles. This is predicted to boost the global automotive alternator and starter motor market over the forecast period.

Additionally, India has become the extensively preferable destination for the automotive industry. Government bodies in several countries prefer to sustain environmental sustainability by improving the automotive industry by adopting electric and hybrid electric vehicles. Nevertheless, despite multiple initiatives, a substantial market for internal combustion engine-powered vehicles still exists, particularly for commercial vehicles such as those used for mining and transportation infrastructure. This indicates lucrative growth opportunities in developing economies in automotive alternators and starter motors.

Based on the product, the global alternator and starter motor market is segmented into the alternator and starter motor. In 2024, the alternator segment accounted for the largest market share. The automotive alternator and starter motor market, by product type, includes brushless alternators and brushed alternators. Brushless alternators are increasingly popular due to their higher efficiency and longer lifespan than brushed ones.

Brushless alternators have a longer service life, are more reliable, and have fewer parts that need maintenance or replacement. As a result, they have become the preferred option for many automotive manufacturers and suppliers. On the other hand, brushed alternators use a system of brushes and commutators to produce electrical energy.

They have been widely used in the automotive industry for many years and are still prevalent in some applications due to their low cost and ease of maintenance. The demand for brushless alternators is expected to grow due to their higher efficiency, longer lifespan, and lower maintenance requirements.

By replacing the serpentine belt found on a typical engine with an electric motor, the starter motor lessens the load put on the machine. The electric motor serves dual purposes for both a starting motor and an electricity generator. The built-in starter generator is connected directly to the crankshaft and replaces the alternator and starter motor. An integrated starter generator powers the engine under specific operating circumstances, reducing fuel use.

Based on the vehicle type, the global alternator and starter motor market is segmented into passenger vehicles, commercial vehicles, and off-road vehicles. In 2024, the passenger vehicle segment accounted for the largest market share. This is attributed to the increasing youth population, growing automotive demand, and increased disposable income across the globe.

Additionally, the rise in the demand for fast-moving consumer goods is leading to an increase in the transport of goods through both heavy and light commercial vehicles. This in turn significantly augments the growth of this segment. Furthermore, growing customer preference towards online shopping, and free home delivery services, further increases demand for both heavy and light-duty vehicles which ultimately expands the growth of this segment.

Based on the channel insights, the global alternator and starter motor market is segmented into OEM and aftermarket. In 2024, the OEM segment accounted for the largest market share. Automotive alternators and separators are critical components of a vehicle's electrical system, providing the necessary electrical power to operate the vehicle's various systems and components. When it comes to original equipment manufacturer (OEM) automotive alternators and separators, these are the components that are made by the original manufacturer of the vehicle or the component.

OEM parts are designed to meet the exact specifications and standards of the vehicle manufacturer and are often of higher quality than aftermarket parts. In the automotive industry, OEM parts are typically sold to vehicle manufacturers or their authorized dealers, who then install them on the vehicles they produce. OEMs produce a range of alternators and separators for various vehicle makes and models and supply them to vehicle manufacturers and authorized dealers around the world.

Asia Pacific dominates the automotive alternator and starter motor market due to the growth of the automotive sector in the region. Several factors drive the market, including increasing consumer demand for convenient modes of transportation, a growing population, and a rise in disposable income. Swift industrial developments and rapidly growing economies in countries such as India and China are considered to be the prominent factors expanding the growth of this market in the Asia Pacific region.

China is the largest market for automotive alternators and starter motors in the Asia Pacific region, driven by the increasing adoption of vehicles and the growth of the automotive industry in the country. India is another significant market for automotive alternators and starter motors in the Asia Pacific, driven by the country's growing automotive industry with the utilization of advanced technology and improved automotive infrastructure, and the presence of major automotive manufacturers and suppliers.

Other countries in the region, such as Japan and South Korea, also have significant markets for automotive alternators and starter motors due to the presence of major automotive manufacturers and suppliers.

By Product

By Vehicle Type

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025