January 2025

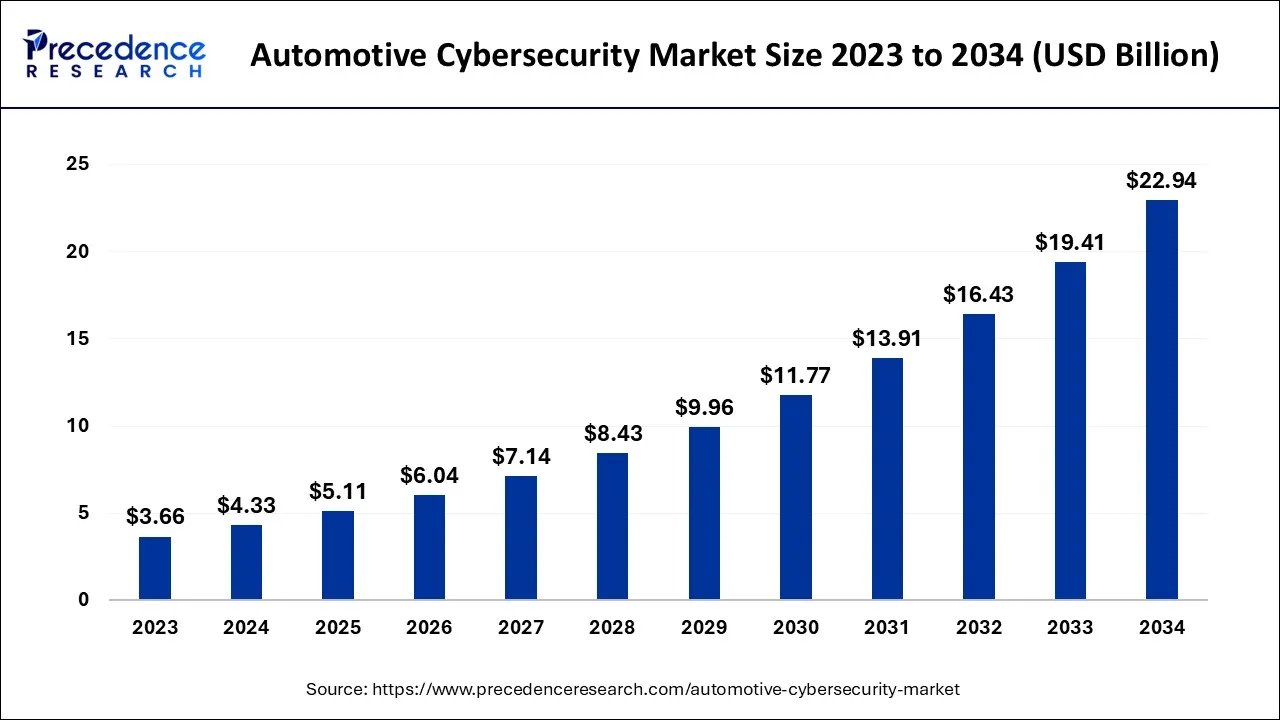

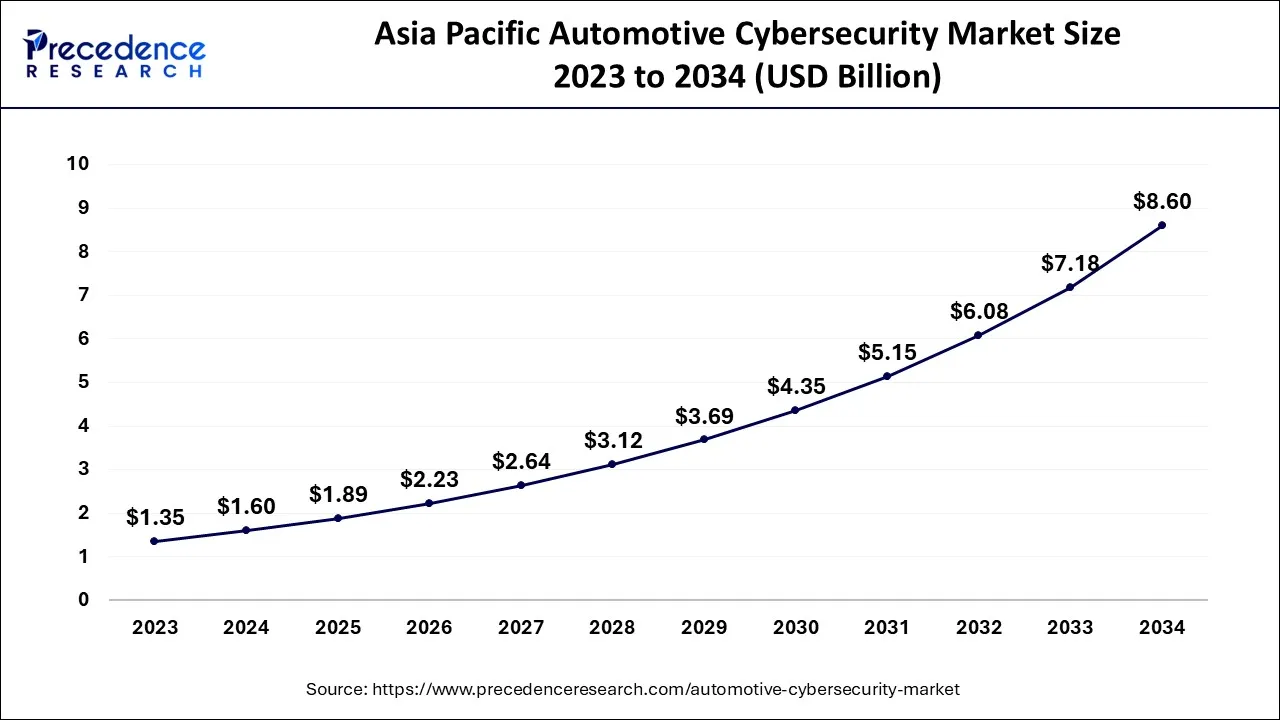

The global automotive cybersecurity market size accounted for USD 4.33 billion in 2024, grew to USD 5.11 billion in 2025, and is expected to be worth around USD 22.94 billion by 2034, poised to grow at a CAGR of 18.14% between 2024 and 2034. The Asia Pacific automotive cybersecurity market size is predicted to increase from USD 1.60 billion in 2024 and is estimated to grow at the fastest CAGR of 18.3% during the forecast year.

The global automotive cybersecurity market size is expected to be valued at USD 4.33 billion in 2024 and is anticipated to reach around USD 22.94 billion by 2034, expanding at a CAGR of 18.14% over the forecast period from 2024 to 2034.

The Asia Pacific automotive cybersecurity market size is exhibited at USD 1.60 billion in 2024 and is projected to be worth around USD 8.60 billion by 2034, growing at a CAGR of 18.3% from 2024 to 2034.

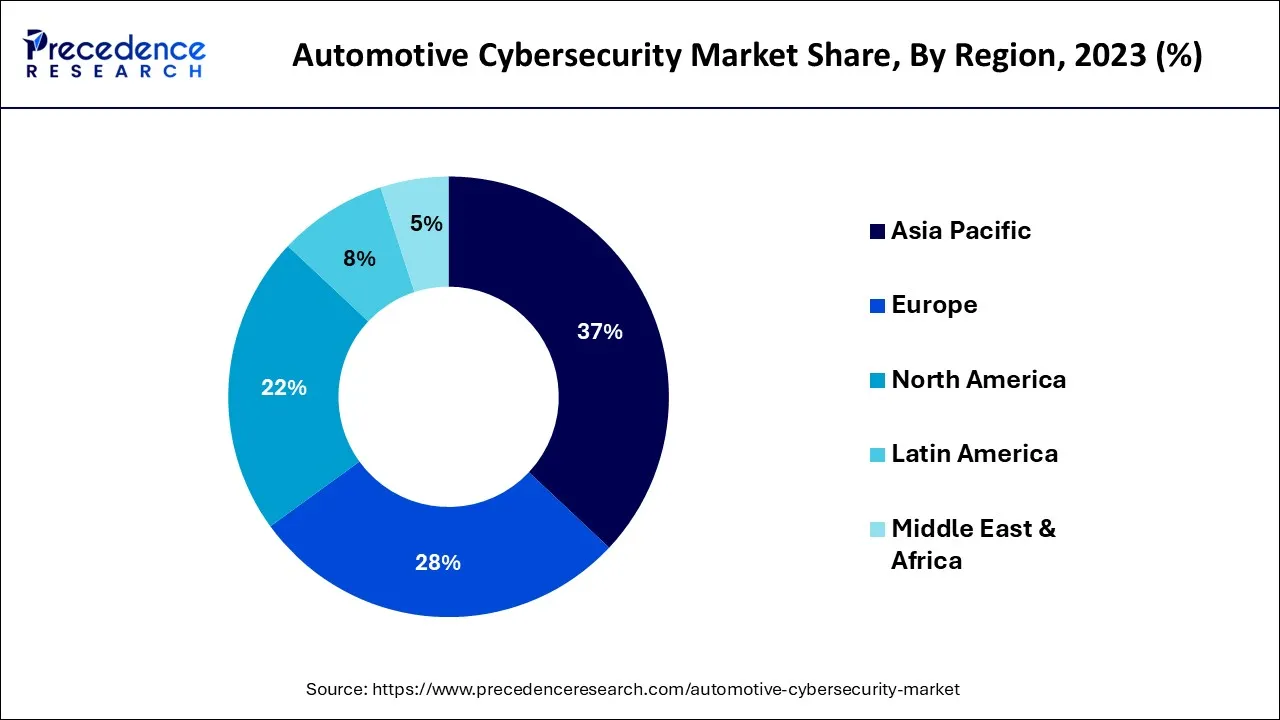

Asia Pacific held the maximum market share of around 37% in 2023 and is anticipated to continue expanding over the course of the projection. The number of cyberattacks has been rising steadily across APAC. Yet, a lack of security measures and the rising popularity of work-from-home policies have led to a rapid increase in cyberattacks. The two most prevalent kinds of cyberattacks are malware and ransomware assaults.

The number of malware and ransomware attacks in APAC nations is still 1.6 times greater than worldwide. During 2018, ransomware assaults have increased in frequency across the globe. Cyberattacks on the auto industry have become more frequent as connected cars and digitization have proliferated. These attacks target the car and compromise crucial vehicle data, causing owners to incur significant losses.

Throughout the forecast period, North America became the second-largest market for automotive cybersecurity. The market for automotive cybersecurity in North America will expand due to the widespread use of automated passenger vehicles. Due to the increased focus on reducing vehicle emissions, the automobile industry's focus has switched to hybrid vehicles, which are currently dominating the market.

In response to expanding environmental concerns, governmental organisations and environmental agencies are enforcing emission standards, regulations, and laws. This could push up the price of delivering electrical drivetrain components and energy diesel engines during the projection period.

Automotive cybersecurity is a programme that guards against unauthorized access, damage, assaults, and other wrongdoing on internet-connected automobiles, automotive communication systems, users, and data. Today's cars can connect to the internet, giving them increased independence, improved communication capabilities, and mobility sharing capabilities. Cars can now transmit data to both their makers and consumers, despite the fact that this better connection has left them more susceptible to hacks.

All contemporary vehicles include electronic brake, accelerator, control, engine, steering, and security system controls, making it easy for hackers to remotely commandeer the vehicle. Also, there can be a security issue with connected intelligent security systems for cars. Moreover, cybersecurity solutions for data protection are required by a number of governmental rules and regulatory frameworks. The need for automotive cybersecurity has grown as a result of the industry's increasing demand for cybersecurity.

The market for automotive cybersecurity is expanding as a result of rising demand for automotive cybersecurity solutions brought on by a rise in cyberattacks on the car industry. Cybercrime is on the rise, and it is anticipated that customer comprehension of information security will result in lucrative business opportunities. As a result, owners and organisations are urged to put automotive cybersecurity safeguards in place, which is what propels the sector.

The development of connected cars and the enforcement of vehicle data security regulations by regulatory bodies are expected to fuel further market expansion.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.33 Billion |

| Market Size by 2034 | USD 22.94 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 18.14% |

| Largest Market | Asia Pacific |

| Second Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Security Type, By Vehicle Type, By Application and By Form |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased use of electronics per vehicle and growing number of connected cars

The weight of a car has been decreased because to electrification. As a result, the need for electronics in the automotive industry has dramatically increased. The increasing use of electronics has made vehicles more vulnerable to cyberattacks.

The electronic components used in telematics, infotainment, engine, body, communication, and advanced driver assistance systems (ADAS) systems, among other purposes, might be the subject of cyberattacks. As a result, parties with an interest in providing trustworthy electronic platforms for autos have started to invest in cybersecurity technology.

Due to the increase in car connectivity, a vehicle is becoming increasingly susceptible to hackers. The complexity of in-vehicle applications is growing as more ECUs and software with 30 to 40 million lines of code are used. Each line of software code needs to be secure.

By 2023, a sizable majority of new cars, according to industry estimates, will be network connected. Several OEMs and security solution providers are acting to mitigate cyber dangers. Yet, no guarded architecture will ever offer unwavering security over the long run. Security codes must be used regularly in connected vehicles as a result. Manufacturers are focusing on lowering the possibility of security flaws and strengthening software updates as a result. As a result, the market for automotive cybersecurity is anticipated to grow in the next years as the number of connected cars increases.

Restraint

Growing complexity in vehicle electronic system

Due to the increased demand for vehicle safety in terms of accident avoidance, driver safety, and sophisticated communication & data safety, electronic driver aid systems are becoming more and more necessary (parking, speed regulation, lane assist, blind spot detection, pre-collision warning, etc.). Because of this, automotive electronic designs are now more complicated, which makes it simpler for hackers to attack a car. Also, there is a desire for modern infotainment systems and comfort features like automatic cooling, memory-assisted seat adjustment, automated tailgate opening, and performance control.

The software in a modern, high-end car currently has 100 million lines of code (greater than Windows 7 and Boeing 787). There are several lines of code because of the potential for a Man in the Middle attack during an over-the-air software upgrade. As a result of the physical hardening of the hardware and more intricate software solutions needed to solve these problems, OEM implementation costs will rise, slowing the market's growth momentum.

Introduction of electric vehicle wireless battery management system

For OEMs worldwide, the introduction of wireless battery management systems (wBMS) has opened a sizable Return on Investment (ROI) possibility. For the next generation of EVs, wBMS can reduce the volume of battery packs by up to 15% and up to 90% of the wiring. In addition, the battery life span is extended with this new system.

As a result, it is essential that the wireless power pack management system maintain a strict security procedure. General Motors and Analog Devices, Inc. (Analog) partnered to deploy Analog's wBMS in its Ultium battery platform once the company debuted its wBMS in 2020.

By integrating all integrated circuits, hardware, and software for power, battery management, RF communication, and system functions into a single system-level product that supports ASIL-D safety and module-level security, the new wBMS expands on the company's well-established, leading-industry BMS battery cell measurement technology. As a result of the expanding use of wBMS, it is projected that the demand for cybersecurity solutions in the global automotive industry would rise.

Based on vehicle type, commercial vehicles, passenger cars, and electric vehicles make up the market segments (EV). The market's electric vehicle (EV) category, which took the lead in 2023, is anticipated to grow at a CAGR of 29%. Due to more people becoming aware of the negative effects of hybrid vehicles and paying attention to economic development, the market has grown. However, in anticipation of greater infrastructure development, local governments in a number of locations are providing incentives to encourage the purchase of electric vehicles.

Innovations in energy and information technologies are transforming how EVs generate, manage, store, and use energy. This has increased the likelihood that cyberattacks will have undesirable results. The rising automation and connectivity of electric and modern automobiles has raised the potential of cybersecurity breaches.

The majority of OEMs and other large electric vehicle operators rely on security because of the rise in cyberattacks and the management of this more complex environment, whether it be network security or in-car security. Many businesses also feel obligated to rely on independent producers and publicly available resources in the absence of knowledge or control.

Based on security insights, endpoint, application, and wireless network security are the market segments. In 2023, the wireless network security segment generated more than 43% of revenue share. In order to track vehicle operational aspects and adjust the test as it is being done, automotive specialists can use the Wi-Fi-based wireless system to simultaneously monitor hundreds of data channels during test runs.

A modern vehicle incorporates numerous networks for information sharing, including wireless channels, to enable a variety of application scenarios.

As the automotive industry advances, vehicles will support more complicated wireless communication use cases; therefore, it will be crucial to think about building protected wireless technology based on a strong equipment foundation and software layers created to secure software development methodologies.

Application security accounted for a sizeable revenue share of 35% of the market in 2023. Automobile Makers now frequently provide mobile applications that provide a smooth user and owner interface. These applications provide a wide range of capabilities, such as wireless vehicle starting, fuel level monitoring, and enhanced inspections. Also, the development of new mobile applications has included a number of advantages for users of vehicles.

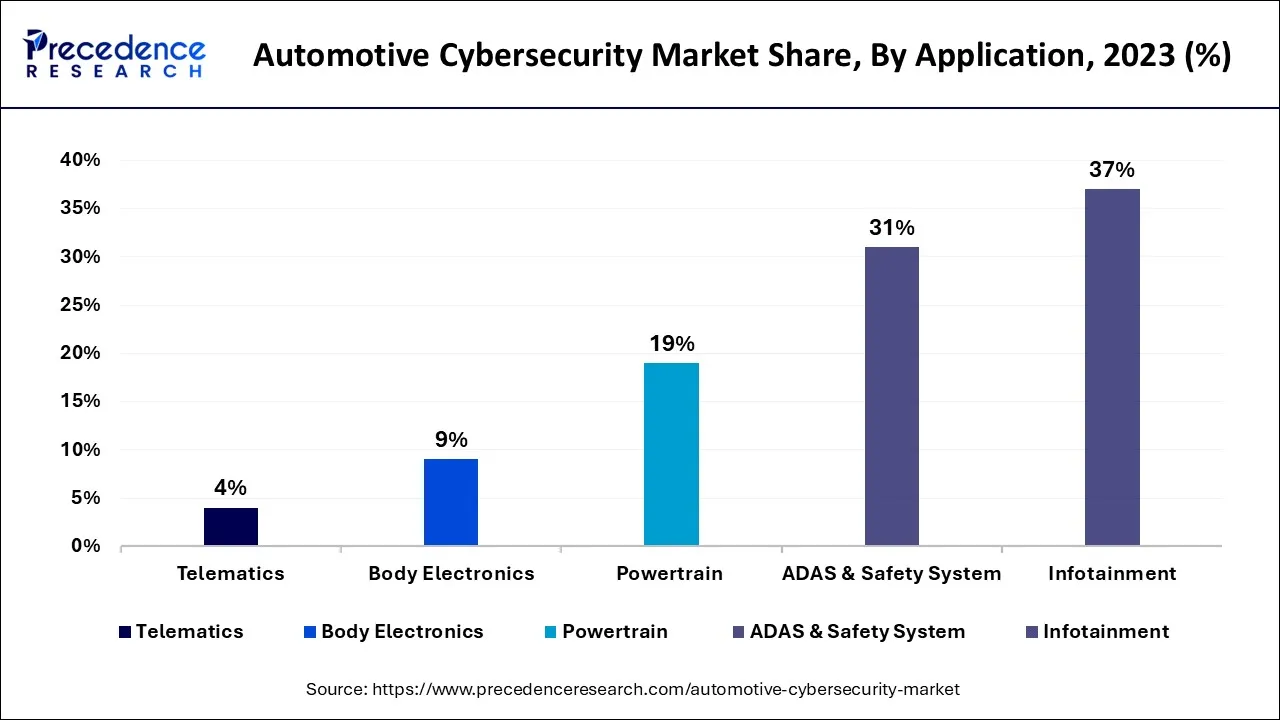

Based on application, the ADAS & safety system, powertrain, infotainment, body electronics, and telematics segments of the vehicle cyber security market. The infotainment sector captured more than 37% of revenue share in 2023 and is anticipated to increase rapidly over the next few years.

The entire automotive industry is working hard to develop cutting-edge technology to give better connectivity options, increase vehicle safety, and enhance the in-car user experience. One of the key technologies, known as the "In-Vehicle Infotainment System," serves as the focal point for all modern automobile systems, integrating their functions so that they can be managed and controlled from a single hub.

The ADAS & safety system market is anticipated to grow at a remarkable CAGR of 22% from 2024 to 2034. Vehicles may behave similarly to a driver watching the weather, recognizing objects on the road, and making a decision in real-time to boost safety with the aid of ADAS technology. Some examples of ADAS capabilities include automatic clutch control, driver monitoring, front pedestrian recognition, and collision avoidance.

The requirement for a constant link from the car's electronic control unit (ECU) to a number of cloud services that enhance sensor processing and subsequent vehicle navigation is expected to rise as a result of the market's rapid advancements in autonomous driving technology.

In 2023, the in-vehicle category was the market leader. In-vehicle-connected services are technologies that allow links between internal systems and those present in remote or external systems. Due to its mobile connectivity, the device with the most connections in a modern automobile. Car OEMs had to adjust to changing consumer demands and expectations, which resulted in the development of ever-more-advanced technologies.

Also, the growth of external cloud services is accelerated by improvements in cloud infrastructure and framework. Cloud services offer a very dependable technology because automated vehicles generate a large amount of data. Moreover, cloud technology will lead to a faster pace of information as more vehicles and devices become cloud-connected.

Segments Covered in the Report

By Security Type

By Vehicle Type

By Application

By Form

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025