January 2025

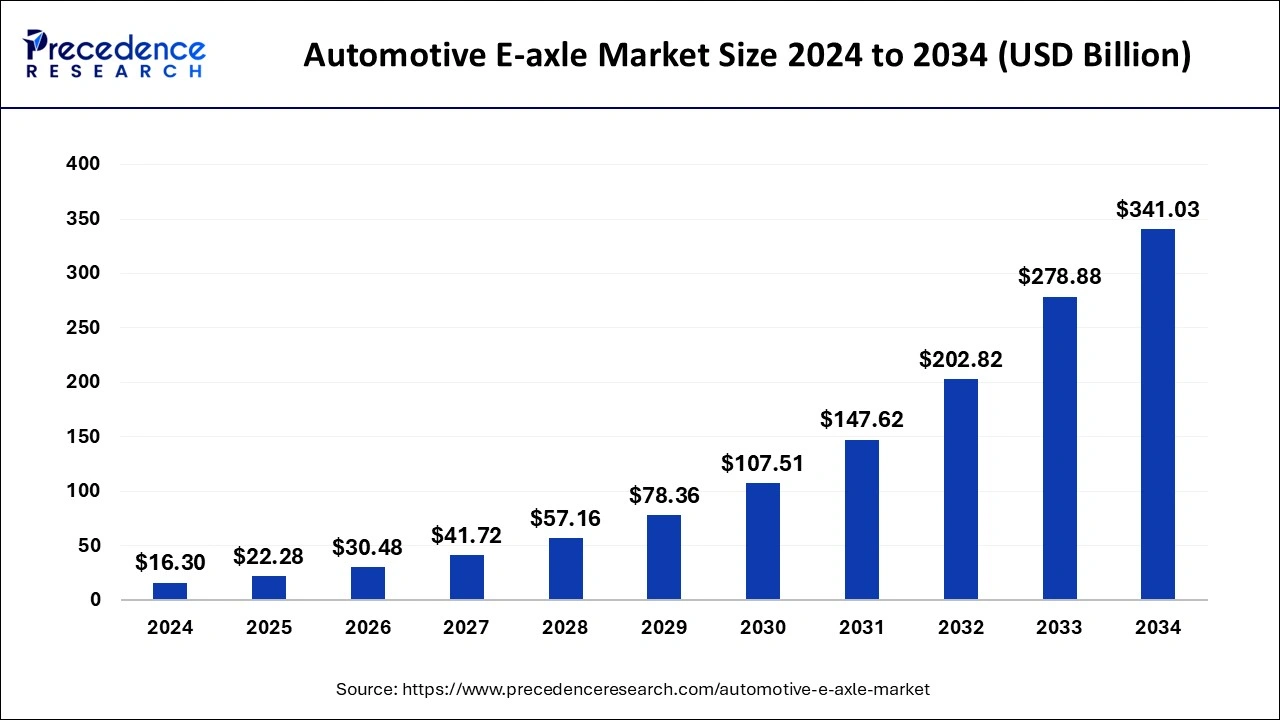

The global automotive E-axle market size is accounted at USD 22.28 billion in 2025 and is forecasted to hit around USD 341.03 billion by 2034, representing a CAGR of 35.54% from 2025 to 2034. The North America market size was estimated at USD 7.17 billion in 2024 and is expanding at a CAGR of 35.57% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive E-axle market size was calculated at USD 16.30 billion in 2024 and is predicted to increase from USD 22.28 billion in 2025 to approximately USD 341.03 billion by 2034, expanding at a CAGR of 35.54%.

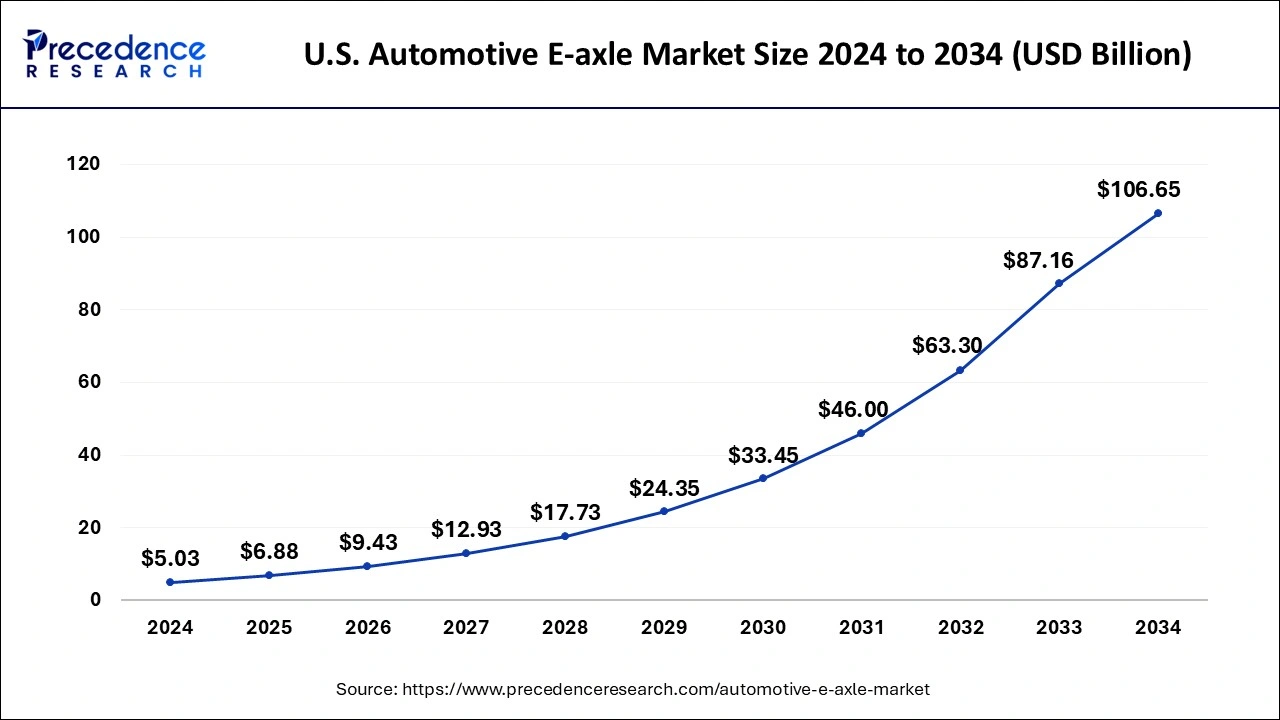

The U.S. automotive E-axle market size was exhibited at USD 5.03 billion in 2024 and is projected to be worth around USD 106.65 billion by 2034, growing at a CAGR of 35.72% from 2025 to 2034.

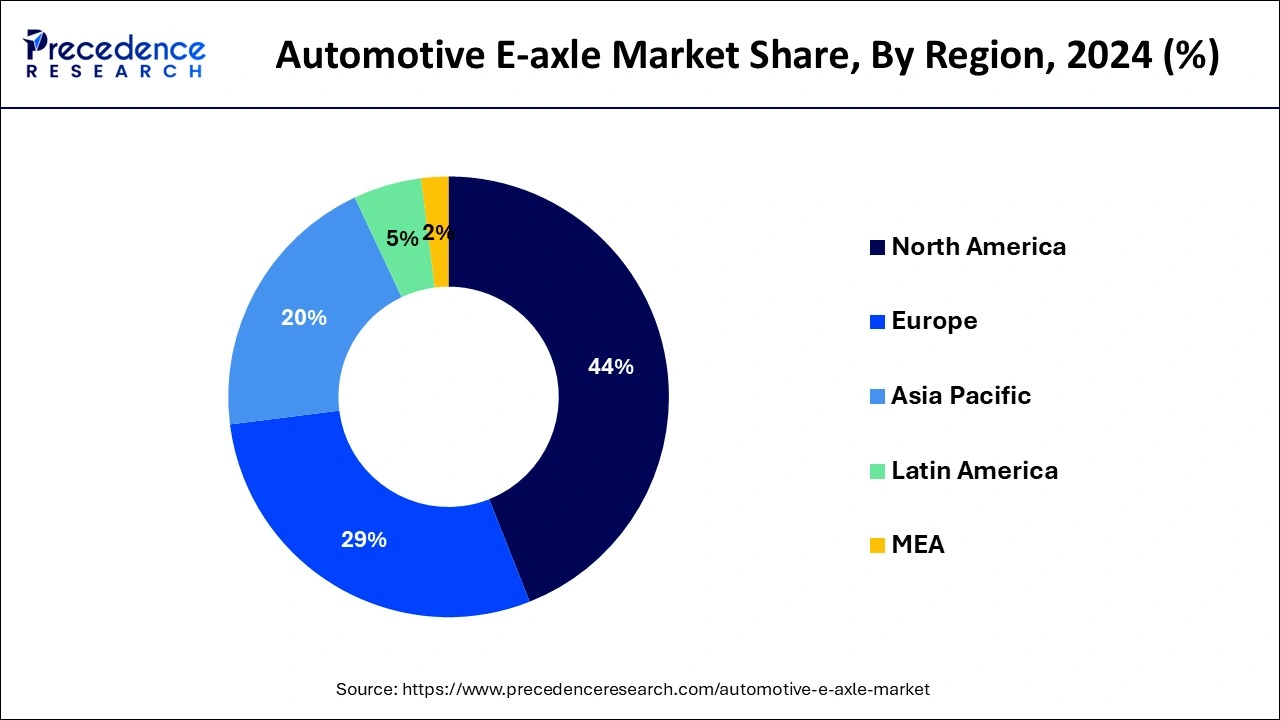

In 2024, North America held a share of 44% in the automotive E-axle market due to a combination of factors. The region exhibits a strong demand for electric vehicles, driven by environmental concerns and government incentives. Established automotive manufacturers in North America are actively investing in E-axle technology to meet the rising demand for electric and hybrid vehicles. Additionally, the presence of a well-developed charging infrastructure and a tech-savvy consumer base further propels the adoption of E-axles, contributing to North America's prominent position in the market.

Asia-Pacific is positioned for rapid growth in the automotive E-axle market due to several factors. Governments in the region are actively promoting electric vehicle adoption through incentives and supportive policies. Additionally, the escalating demand for cleaner and sustainable transportation solutions aligns with the environmental goals of many Asian countries. The region's robust manufacturing capabilities and the increasing focus of automotive companies on developing electric vehicles contribute to the optimistic outlook for E-axle technology, making the Asia-Pacific market a key player in the global electric mobility landscape.

Meanwhile, Europe is experiencing notable growth in the automotive E-axle market due to several factors. The region's strong push for sustainable transportation, coupled with stringent emission regulations, has led to increased adoption of electric vehicles. Government incentives, robust charging infrastructure, and a heightened environmental awareness among consumers further drive the demand for E-axle technology. Additionally, collaborations between automakers and advancements in battery technology contribute to the growth, making Europe a key market for the development and adoption of E-axles in the automotive sector.

An automotive E-axle, short for electric axle, is a compact and integrated unit that combines the electric motor, power electronics, and gearbox within a single housing. This innovative technology is designed to propel electric vehicles efficiently and seamlessly. The E-axle replaces the traditional internal combustion engine and transmission, providing a more compact and simplified solution for electric propulsion. By consolidating essential components, the E-axle enhances the overall efficiency of electric vehicles, offering benefits such as reduced energy loss, improved power distribution, and simplified vehicle design. This streamlined approach contributes to the growing trend of electrification in the automotive industry, as manufacturers seek to create more sustainable and high-performance electric vehicles with the help of advanced technologies like the E-axle.

Automotive E-axle Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 35.54% |

| Global Market Size in 2025 | USD 22.28 Billion |

| Global Market Size by 2034 | USD 341.03 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application and Electric Vehicle Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing electric vehicle adoption

The surge in electric vehicle (EV) adoption is a major catalyst propelling the demand for automotive E-axles. As more consumers and businesses transition towards environmentally friendly transportation, there's a growing need for efficient electric propulsion systems. E-axles play a pivotal role in this shift by integrating essential components like electric motors and power electronics into a compact unit. This consolidation enhances the overall performance of electric vehicles, making them more appealing to a broader audience.

The increased focus on sustainability and the recognition of EVs as a cleaner alternative to traditional vehicles drive the market demand for E-axles. Governments worldwide are also incentivizing the adoption of electric vehicles, further accelerating the demand for E-axle-equipped automobiles. As electric vehicles become increasingly mainstream and the automotive industry aligns with green initiatives, the E-axle market is experiencing a robust upswing, providing an essential solution for the evolving landscape of sustainable transportation.

Battery technology challenges

Battery technology challenges pose significant restraints on the market demand for automotive E-axles. The limitations in current battery technologies, such as energy density, charging speed, and overall lifespan, directly impact the performance and feasibility of E-axle systems. The need for more powerful and efficient batteries is critical for maximizing the range and capabilities of electric vehicles (EVs) equipped with E-axles. Consumers are often concerned about the limited driving range of electric vehicles and the time it takes to recharge them.

As E-axles are closely tied to advancements in battery technology, addressing these challenges becomes pivotal to enhancing the appeal of EVs in the market. Manufacturers and researchers are actively working on improving battery technologies to overcome these limitations, but until these advancements are widespread, the automotive E-axle market may experience a slower adoption rate due to the perceived constraints related to battery performance.

Customization for various vehicle types

Customization for various vehicle types is a key factor creating significant opportunities in the automotive E-axle market. The adaptability of E-axle systems to different vehicle categories, such as passenger cars, commercial trucks, and buses, allows manufacturers to tailor solutions based on specific performance, size, and efficiency requirements. This versatility ensures that E-axles can meet the diverse needs of a broad range of customers in the automotive industry. As electric mobility gains traction across various vehicle segments, the ability to customize E-axle systems for different applications becomes a competitive advantage.

Manufacturers can cater to the unique demands of passenger vehicles seeking efficiency and performance, as well as the specific requirements of commercial fleets aiming for enhanced payload capacity and operational efficiency. This flexibility positions E-axle technology as a versatile solution, fostering growth and adoption across multiple sectors of the automotive market.

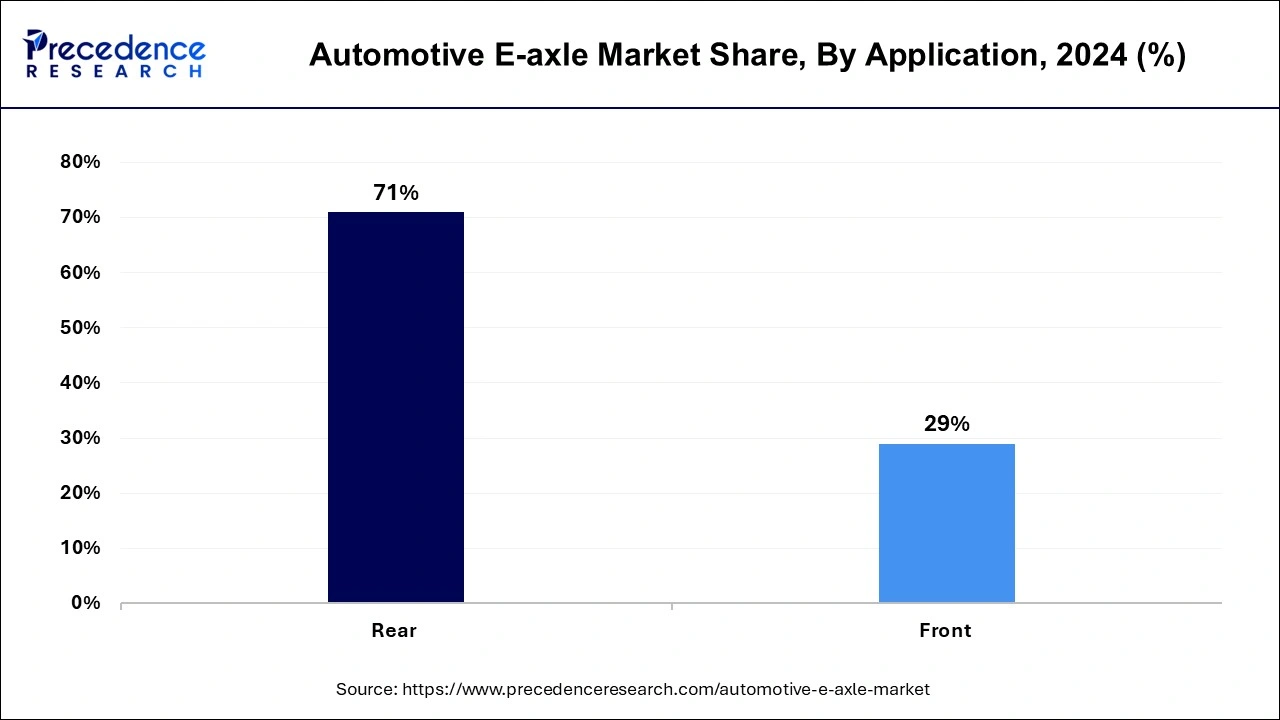

The rear segment held the highest market share at 71% in 2024. In the automotive E-axle market, the rear segment refers to the integration of electric axle systems specifically designed for the rear wheels of a vehicle. This configuration is commonly employed to enhance traction, performance, and overall driving dynamics. A growing trend in this segment involves the adoption of rear E-axles in electric sports cars and high-performance vehicles. Manufacturers are leveraging rear E-axle setups to optimize power distribution, improve handling, and deliver a more dynamic driving experience in the evolving landscape of electric mobility.

The front segment is anticipated to witness rapid growth at a significant CAGR of 41.7% during the projected period. In the automotive E-axle market, the front segment refers to the application of E-axle systems in the front axle of vehicles. This configuration is commonly found in electric and hybrid vehicles, where the electric motor of the E-axle is integrated into the front axle, contributing to improved traction and dynamic performance. Trends in the front E-axle segment include a growing preference for front-wheel-drive electric vehicles, as this setup often enhances stability and handling. Manufacturers are increasingly adopting front E-axles to optimize vehicle dynamics and overall driving experience.

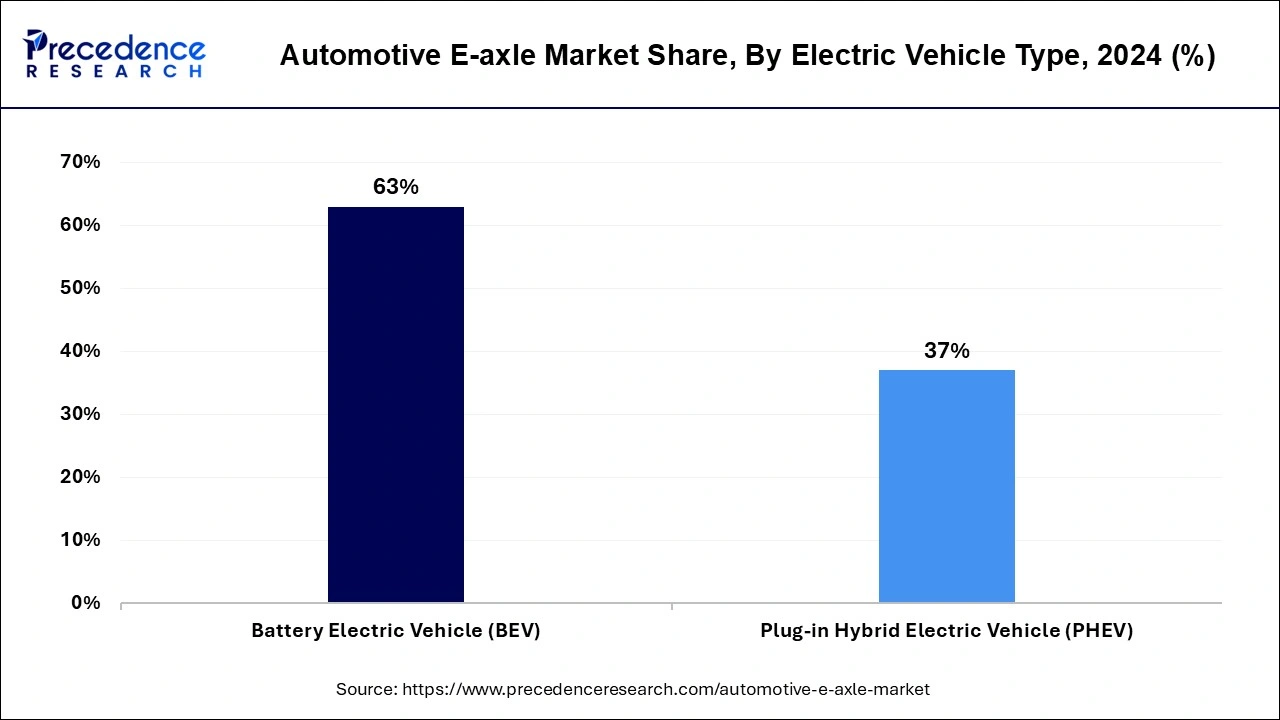

The BEV segment has held 63% market share in 2024. In the automotive E-axle market, the Battery Electric Vehicle (BEV) segment specifically refers to electric vehicles powered solely by electric batteries without an internal combustion engine. In this segment, E-axles play a crucial role by integrating electric motors, power electronics, and gears into a compact unit, enhancing the performance and efficiency of BEVs. The trend in the BEV segment indicates a growing preference for E-axle technology due to its contribution to increased range, improved energy efficiency, and simplified design, driving the adoption of electric mobility.

The PHEV segment is anticipated to witness rapid growth over the projected period. In the automotive E-axle market, the plug-in hybrid electric vehicle (PHEV) segment refers to vehicles that combine an internal combustion engine with an electric motor, allowing them to operate on both traditional fuel and electric power. The PHEV segment is witnessing a growing trend in E-axle adoption, as automakers aim to enhance the electric-only range of these vehicles. E-axles in PHEVs contribute to improved efficiency, reduced emissions, and greater flexibility for drivers who may switch between electric and conventional modes based on their needs and preferences.

By Application

By Electric Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025