January 2025

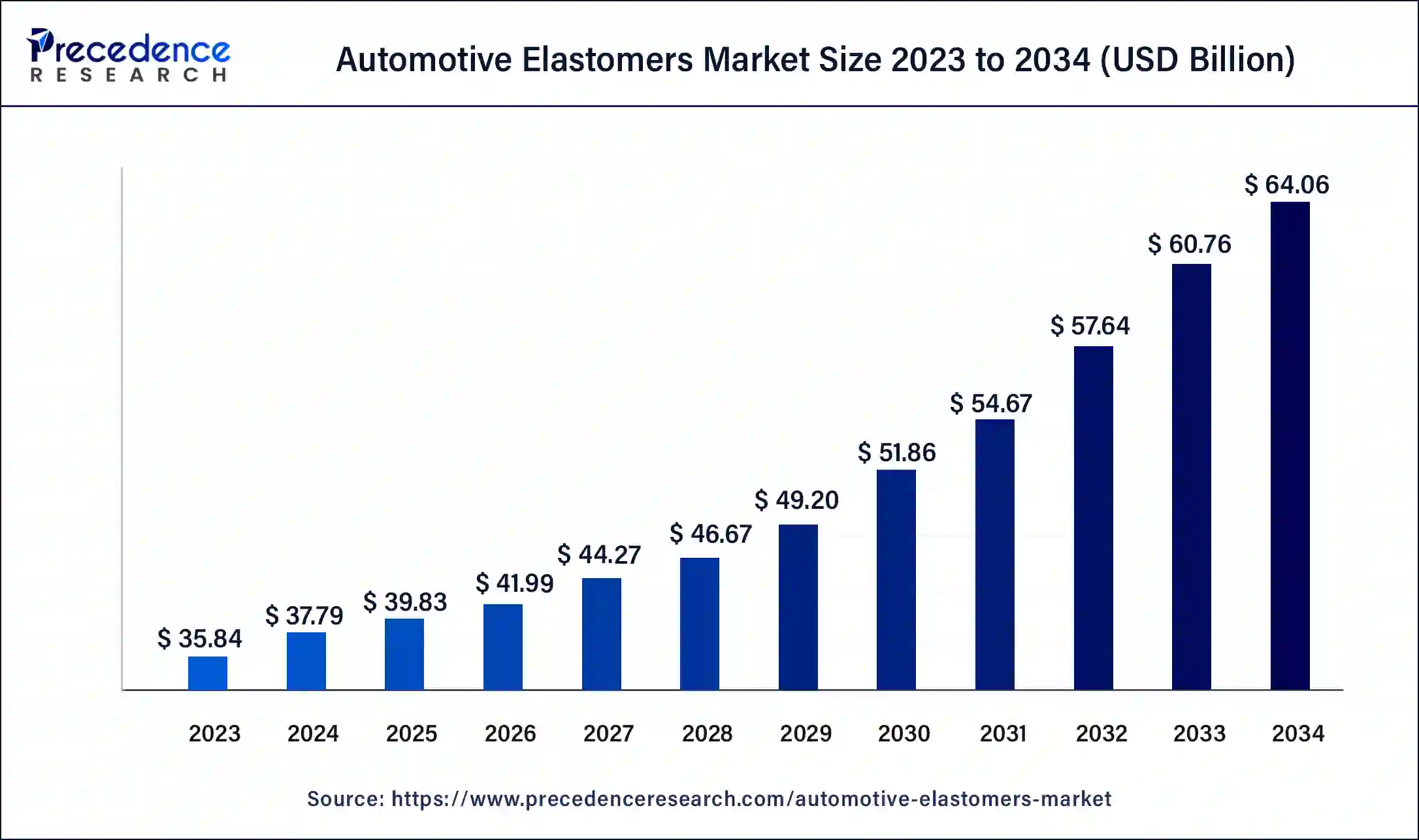

The global automotive elastomers market size was evaluated at USD 35.84 billion in 2023 and is predicted to hit from USD 37.79 billion in 2024 to approximately USD 64.06 billion by 2034. It is projected to grow at a CAGR of 5.42% from 2024 to 2034.

The global automotive elastomers market size is expected to be worth USD 37.79 billion in 2024 and is anticipated to reach around USD 64.06 billion by 2034, growing at a CAGR of 5.42% over the forecast period 2024 to 2034. The automotive elastomers market is driven by the increasing demand for automobiles that are lightweight and fuel-efficient.

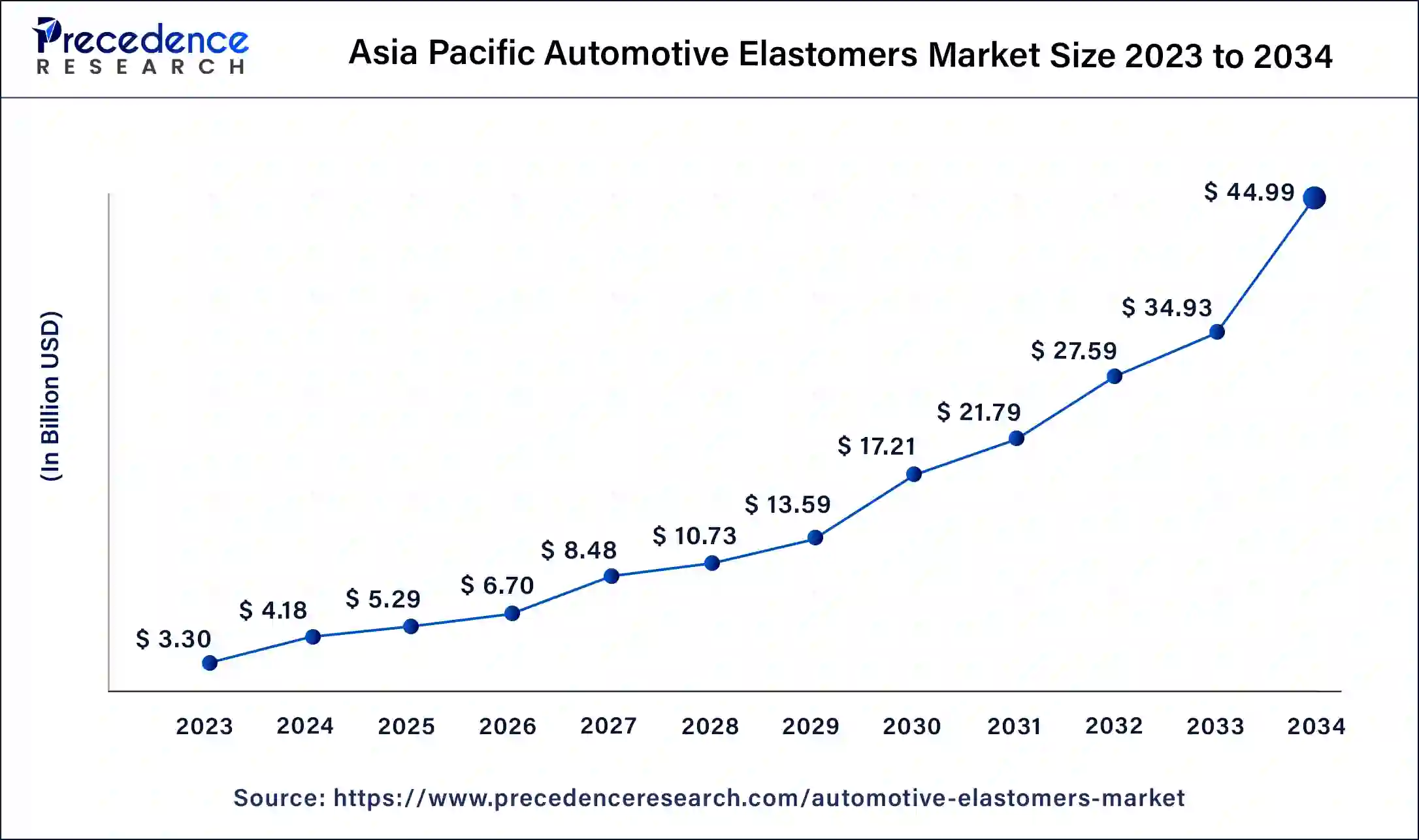

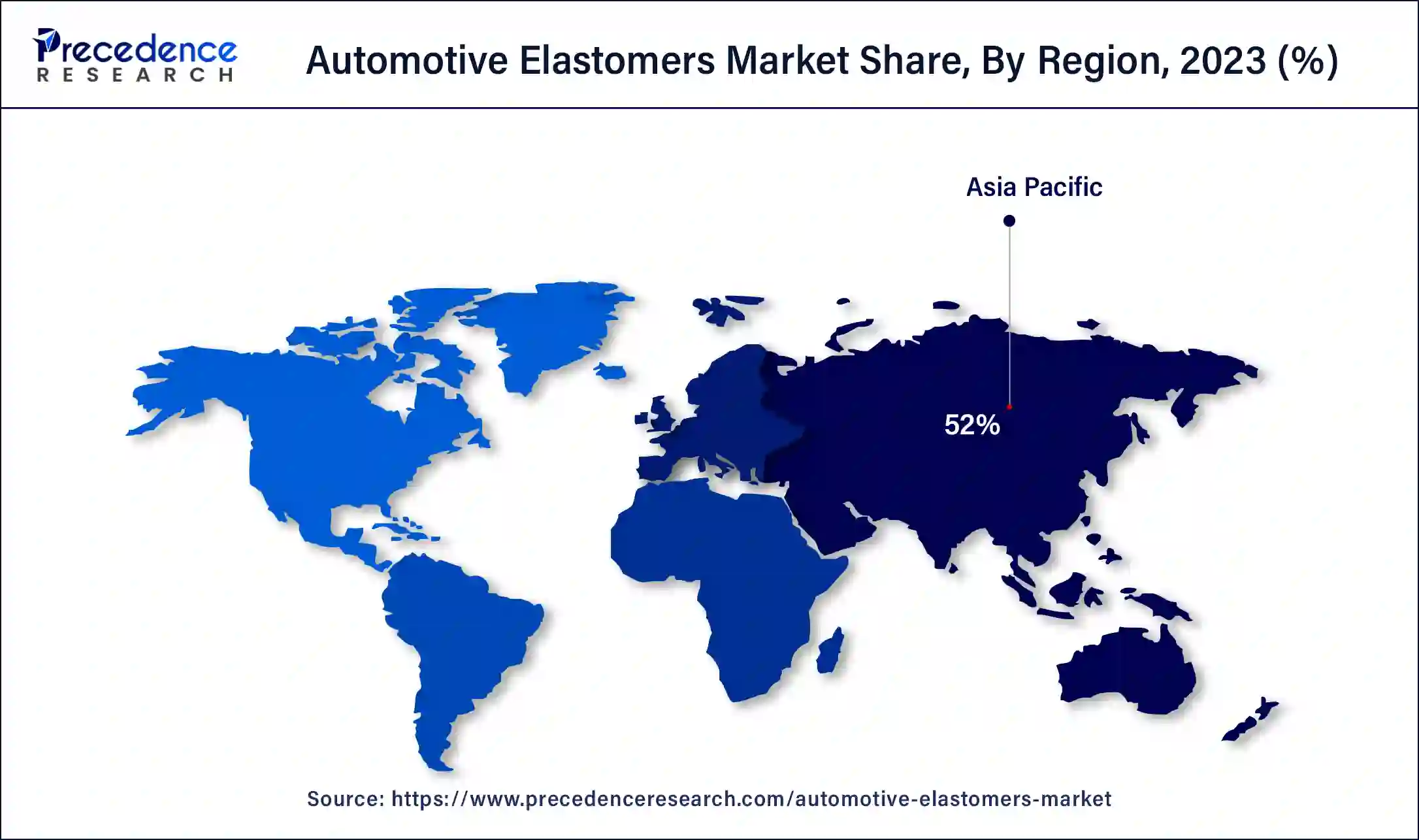

The Asia Pacific automotive elastomers market size was exhibited at USD 18.64 billion in 2023 and is projected to be worth around USD 33.63 billion by 2034, poised to grow at a CAGR of 5.51% from 2024 to 2034.

Asia-Pacific dominated in the automotive elastomers market in 2023. China is the world's largest automobile market, and as such, the demand for automotive elastomers is greatly impacted by its enormous production and sales volumes. The nation serves as a global manufacturing center for foreign and domestic automakers. Governments in the Asia-Pacific area frequently offer tax breaks and financing for research and development of innovative materials and other incentives and subsidies to encourage the automobile sector. Demand for automotive components, such as elastomers, has increased due to rising middle-class populations and the desire of people in nations like China and India to own a car.

North America shows a significant growth in the automotive elastomers market during the forecast period. Vehicle production has steadily risen in North America due to rising customer demand and technological developments in the car industry. The need for automotive elastomers, which are necessary for various vehicle components like tires, hoses, gaskets, and seals, is naturally increased by this increase in manufacturing. Innovation in automotive elastomers is being fostered by large research and development expenditures made by major industry participants and academic institutions in North America. This invention is essential for creating more resilient, efficient, and affordable elastomers while promoting market expansion.

Automotive Elastomers Market Overview

The automotive elastomer market is the part of the automotive industry that produces, distributes, and uses elastomeric materials made especially for automotive purposes. Since they can regain their original shape after deformation, elastomers, polymers with elastic properties, are perfect for a variety of automobile components that are subjected to mechanical stress, vibration, and temperature changes.

To ensure dependable performance over extended periods, vehicles need elastomers that can survive various climatic conditions, such as heat, cold, and exposure to chemicals. Growing environmental restrictions encourage elastomer innovation toward environmentally benign materials that improve recyclability and lower emissions, affecting market dynamics. Elastomers are utilized in various automobile parts, including vibration dampers, tires, hoses, gaskets, suspension systems, and seals. These properties allow them to be flexible, strong, and resistant to abrasion.

| Report Coverage | Details |

| Market Size by 2034 | USD 64.06 Billion |

| Market Size in 2023 | USD 35.84 Billion |

| Market Size in 2024 | USD 37.79 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.42% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Vehicle Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rapidly growing and expanding automobile industry

As the automotive industry expands, there is a growing need for different elastomer-based vehicle components. These include gaskets, hoses, belts, interior and external parts, and seals. Naturally, higher car production rates translate into higher elastomer usage. Elastomers offer excellent performance and durability in various settings, such as high temperatures and mechanical stress. Their demand rises due to their suitability for crucial automotive applications where durable components are essential. This drives the growth of the automotive elastomers market.

Increasing manufacturers of automotive elastomers

Increased manufacturing capacity from more producers guarantees a consistent supply of elastomers to meet rising demand. This aids in keeping pricing steady and cutting lead times. Manufacturing competition encourages innovation. Businesses spend money on R&D to produce elastomers with greater qualities, like increased toughness, enhanced thermal resistance, and enhanced performance under pressure. This cycle of constant innovation advances the market by providing better goods.

The emergence of new manufacturers in various places often extends the geographic scope of elastomer production. This lessens reliance on imports, cuts down on lead times and transportation costs, and effectively serves local markets.

Fluctuating price of raw material for thermoplastic elastomers

Changes in crude oil prices, disruptions in the supply chain, geopolitical instability, and fluctuations in demand can all lead to regular swings in the prices of raw materials used in thermoplastic polymers (TPEs), such as polypropylene, polystyrene, and different rubbers. Production costs are unknown due to this fluctuation. Supply chain problems frequently accompany price volatility. For instance, abrupt increases in raw material prices might be brought about by shortages or issues with transportation resulting from geopolitical tensions or natural disasters. This discrepancy may cause production schedules to slip and make it more challenging to satisfy client requests. This limits the growth of the automotive elastomers market.

Rising preferences of light weight vehicles

Better handling and performance are two important selling factors for buyers of lighter cars. Elastomers, which offer components that are more durable, flexible, and lightweight, make this possible. Crucial safety devices, including vibration-damping systems, seat belts, and airbags, require elastomers. Their capacity to cushion and absorb impact improves the overall safety of lightweight vehicles.

By customizing elastomers to fulfill specific performance requirements, manufacturers can create components that precisely match the specifications of lightweight automobiles. Because of their adaptability, elastomers are recommended for a range of automotive applications. This opens an opportunity for the growth of the automotive elastomers market.

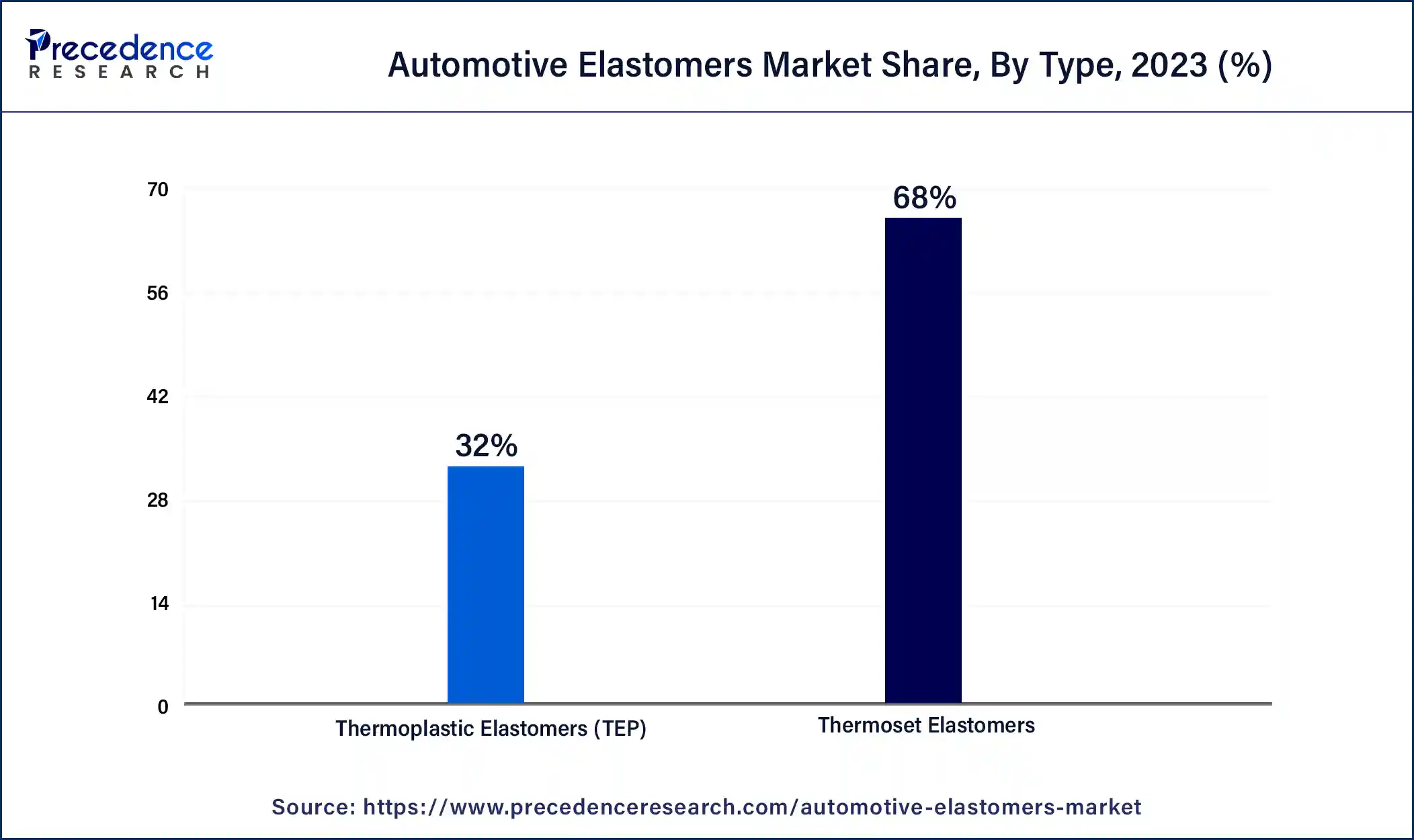

The thermoset elastomers segment dominated the automotive elastomers market in 2023. Thermoset elastomers exhibit Excellent thermal resilience, which is crucial in automotive applications where components are frequently subjected to high temperatures. These elastomers offer lifespan and dependability by preventing deterioration from vehicle fluids like fuels, oils, and coolants. They are appropriate for heavy-duty applications because of their exceptional mechanical qualities, which include tensile strength, tear resistance, and impact resistance.

The thermoplastic elastomers (TEP) segment shows a significant growth in the automotive elastomers market during the forecast period. One of the most adaptable polymers today is thermoplastic elastomers or TPE. TPE comprises two distinct phases: the easy-to-process soft phase, which represents the rubber segment and offers elastic qualities, and the difficult phase, which represents the thermoplastic segment and offers full recyclability. Traditional processing techniques can be used to model thermoplastic elastomers into desired shapes.

The passenger cars segment dominated the automotive elastomers market in 2023. Car ownership has increased due to rising disposable income and the growing middle class in emerging economies. Rising urbanization trends drive car sales since more people live in cities and depend on their cars for transit. To stop leaks and lessen noise, elastomers are widely used in car sealing and insulation applications, including window seals, door seals, and under-the-hood parts. Elastomers improve passenger car comfort and driving experience by effectively damping vibrations and lowering noise. They also provide better resistance to heat, chemicals, and wear, resulting in parts that last longer and require less maintenance.

The light commercial vehicles segment shows a significant growth in the automotive elastomers market during the forecast period. The demand for effective last-mile delivery solutions has increased due to the growth of e-commerce. Light commercial vehicles are indispensable to move items from warehouses to their final locations. The requirement for strong, flexible materials like elastomers directly correlates with this demand increase. Another key factor is the ongoing innovation in vehicle design and materials. Vehicle performance, safety, and comfort are improved by using elastomers in various components, including hoses, suspension systems, gaskets, and seals. Modern LCVs require elastomers because of their ability to adapt to various design requirements.

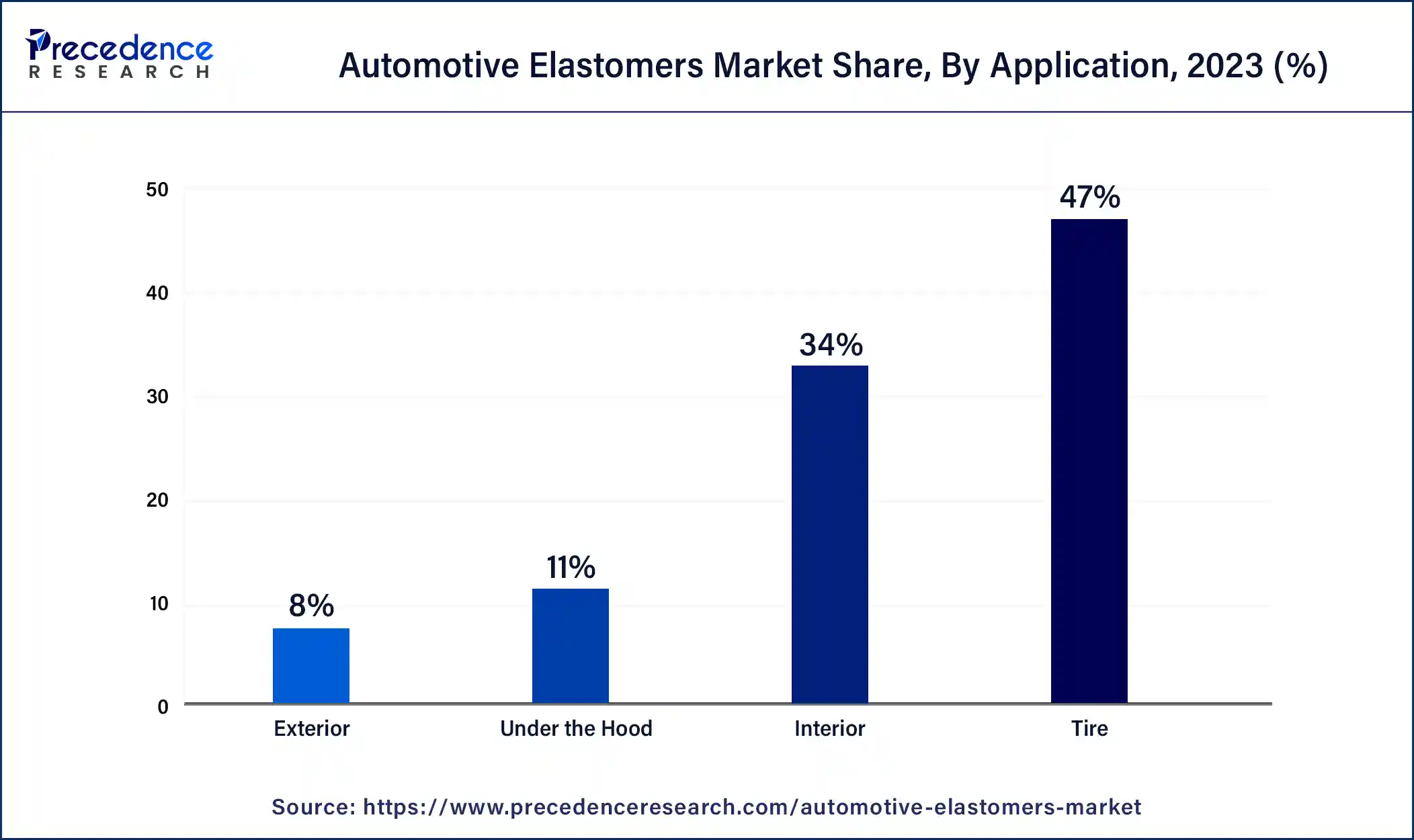

The tire segment dominated in the automotive elastomers market in 2023. Tire performance, safety, and longevity have all increased due to developments in tire technology, including better tread designs, higher-quality materials, and more advanced production techniques. Because of these upgrades, more people are buying newer, more energy-efficient tires to replace outdated ones. The industry has grown, and diversified consumer needs are being met by developing specialty tires for various vehicle types and situations (e.g., off-road, winter, and performance tires).

Elastomers balance manufacturing costs and performance, providing tire producers an affordable option. This economic efficiency supports the tire segment's dominance in the automotive elastomers market.

The interior segment is observed to be the fastest growing in the automotive elastomers market during the forecast period. Modern consumers are increasingly demanding higher standards of comfort, style, and elegance from car interiors. Elastomers are perfect for improving the comfort and aesthetics of car interiors because of their superior flexibility, cushioning capabilities, and aesthetic diversity. The desire for individualized and adaptable car interiors drives up elastomer demand. Elastomers' versatility allows automakers to offer a wider range of interior material, texture, and color options.

Requirements and growing environmental concerns are driving the use of recyclable and sustainable materials. The increased demand for elastomers in the automobile interior industry can be attributed to their numerous eco-friendly design options.

Segments Covered in the Report

By Type

By Vehicle Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025