January 2025

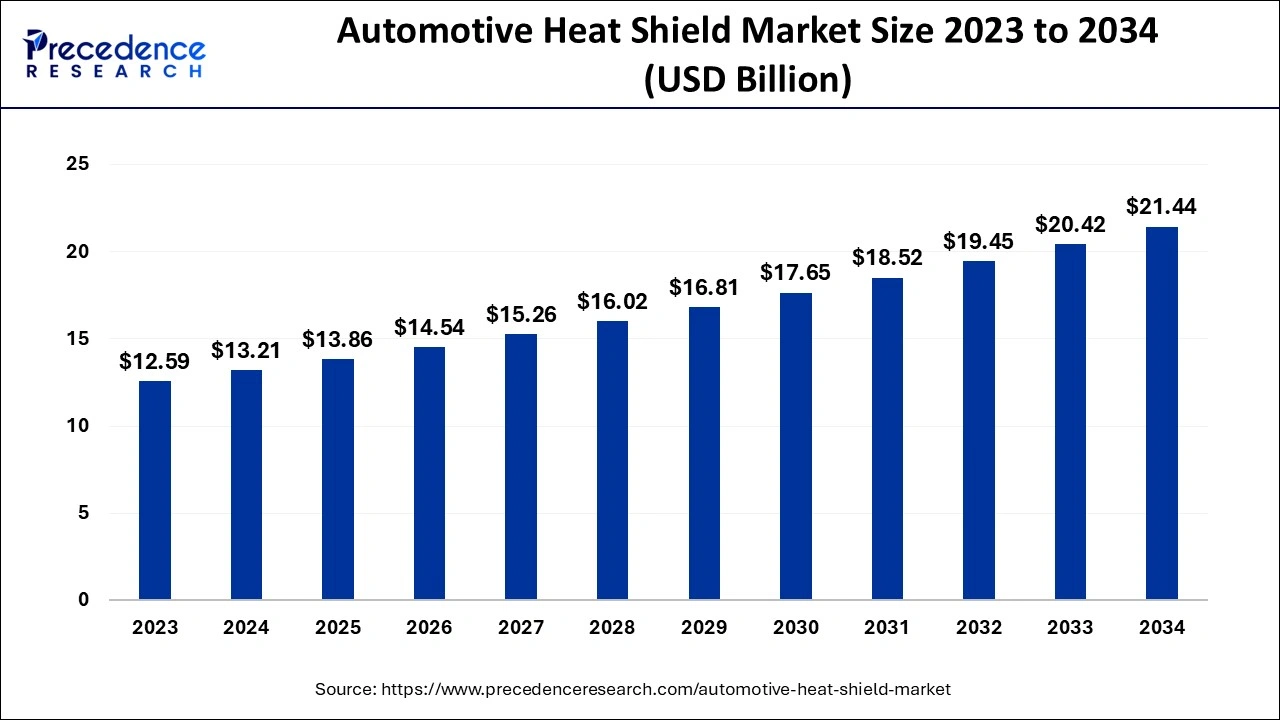

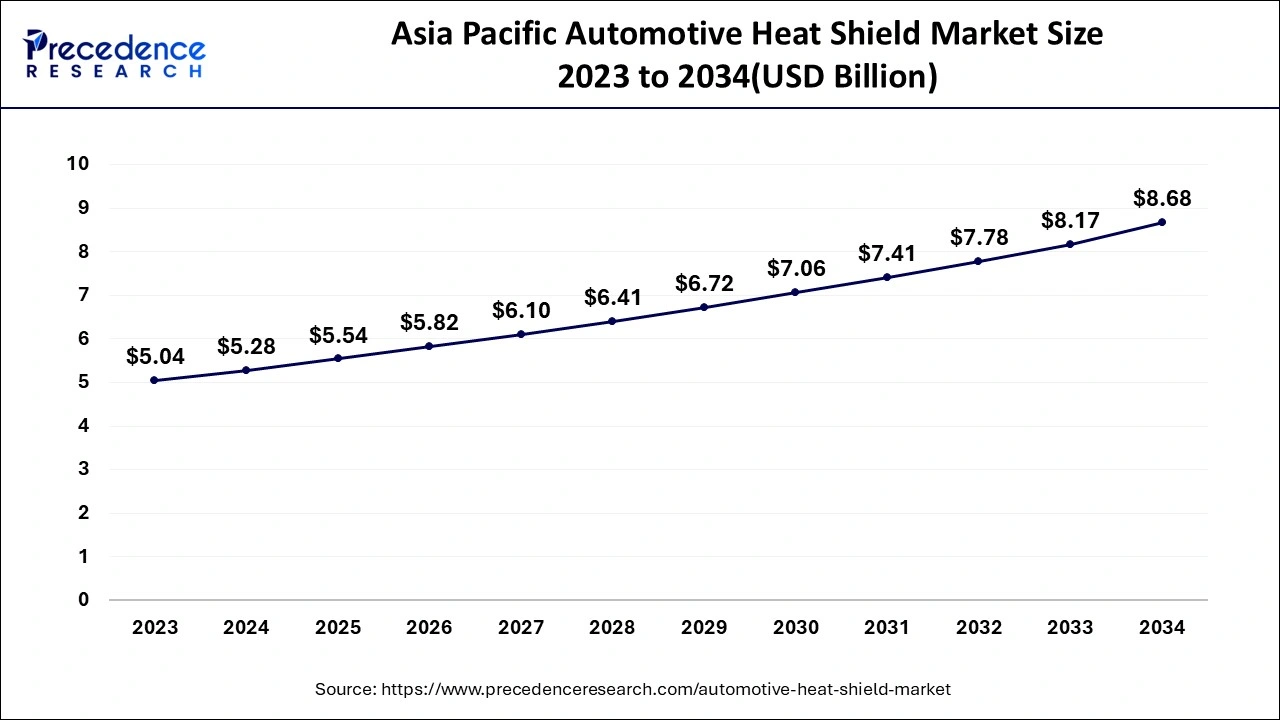

The global automotive heat shield market size is calculated at USD 13.21 billion in 2024, grew to USD 13.86 billion in 2025 and is anticipated to reach around USD 21.44 billion by 2034, expanding at a CAGR of 4.96% between 2024 and 2034. The Asia Pacific automotive heat shield market size is evaluated at USD 5.28 billion in 2024 and is expected to grow at a CAGR of 5.07% during the forecast year.

The global automotive heat shield market size accounted for USD 13.21 billion in 2024 and is expected to exceed around USD 21.44 billion by 2034, growing at a CAGR of 4.96% from 2024 to 2034. The rising implementation of strict emission standards is the key factor driving the market growth. Also, increasing demand for hybrid and electric vehicles coupled with the ongoing advancements in lightweight materials can fuel the automotive heat shield market growth further.

The integration of artificial intelligence (AI) technologies is substantially revolutionizing the automotive heat shield market. AI-powered simulation software and design tools enable producers to boost the performance of heat shields more effectively, decreasing the cost and time for development. Furthermore, AI automation in the manufacturing process improves the accuracy and consistency of heat shield production, which then leads to raised production efficiency.

The Asia Pacific automotive heat shield market size is exhibited at USD 5.28 billion in 2024 and is projected to be worth around USD 8.68 billion by 2034, growing at a CAGR of 5.07% from 2024 to 2034.

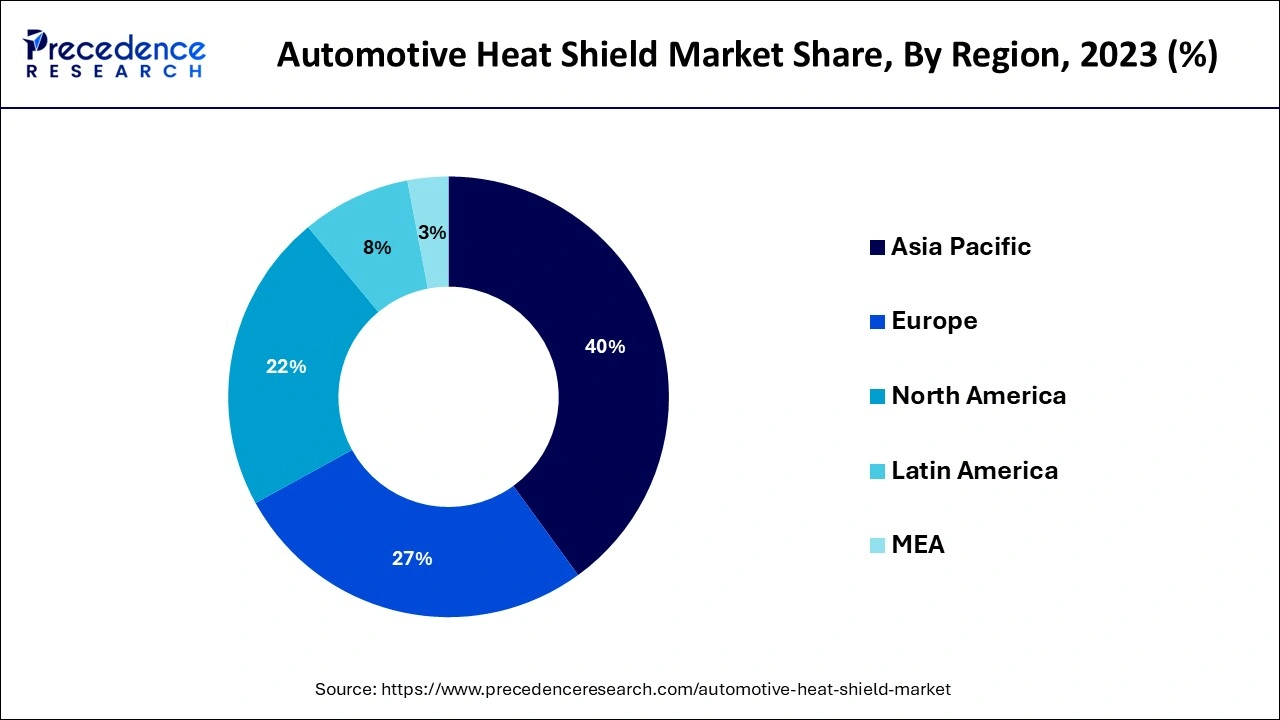

Asia Pacific led the automotive heat shield market in 2023. The dominance of the region can be attributed to the surge in the automotive industry in developing countries such as India, China, and Japan. With growing manufacturing and sales of commercial and passenger vehicles, the requirement for high-performance heat shields is increasing to safeguard automobile components from high-intensity heat generated by the exhaust systems. Moreover, the expansion of hybrid and electric vehicles in economies such as China can contribute to market growth.

North America is expected to show the fastest growth in the automotive heat shield market during the forecast period. The growth of the segment can be linked to the surging demand for automobiles equipped with innovative functional and safety features. Also, the presence of key automotive players in countries like Canada and the U.S. is further positively impacting the market growth in this region. In addition, there is a rising implementation of strict emission regulations.

The automotive heat shield market is the market that produces and sells heat shields for vehicles. Heat shields protect the automobile components and body from excessive heat generated by the exhaust system or the engine. Heat shields can be manufactured from different types of materials, such as stainless steel, aluminum, and titanium. These heat shields can be used on a wide range of automobiles like light commercial vehicles, passenger vehicles, and heavy commercial vehicles.

Top 5 car manufacturers in India and their market share as of September 2023

| Brands | Market Shares as of September 2023 |

| Maruti Suzuki | 41.6% |

| Tata Motors | 12.3% |

| Mahindra & Mahindra | 11.4% |

| Hyundai Motor Company | 14.9% |

| Nissan | 1% |

| Report Coverage | Details |

| Market Size by 2034 | USD 21.44 Billion |

| Market Size in 2024 | USD 13.21 Billion |

| Market Size in 2025 | USD 13.86 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.96% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Material, Vehicle Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Rising adoption of turbocharged engines

The growing adoption of turbocharged engines is the major driver of the automotive heat shield market. Turbochargers improve the overall engine function by propelling excessive air into the combustion chamber and enhancing power output. Sometimes, this whole process creates more heat, which can affect the vehicle's performance and components. Hence heat shields are important in this manner because they safeguard delicate parts from the harsh temperatures generated by turbocharged engines.

Complex vehicle designs

Modern vehicles are built with complex architectures and integrated systems which can make it challenging to deploy heat shields. Automobiles are designed to be aerodynamic and compact, which leaves very little space for heat shields. Moreover, the cost of raw materials such as composites, metals, and ceramics can tremendously fluctuate, impacting the revenue of the automotive heat shield market manufacturers.

Increasing demand for luxury vehicles

The luxury vehicles feature high-end components and powerful engines that create a great amount of heat during operation. Hence, the automotive heat shield market services are important in these vehicles to keep their high performance and preserve the longevity of their parts along with the comfort of the passenger. Furthermore, the need for these vehicles is growing in developing economies, as market players in these countries are heavily investing in research and development activities.

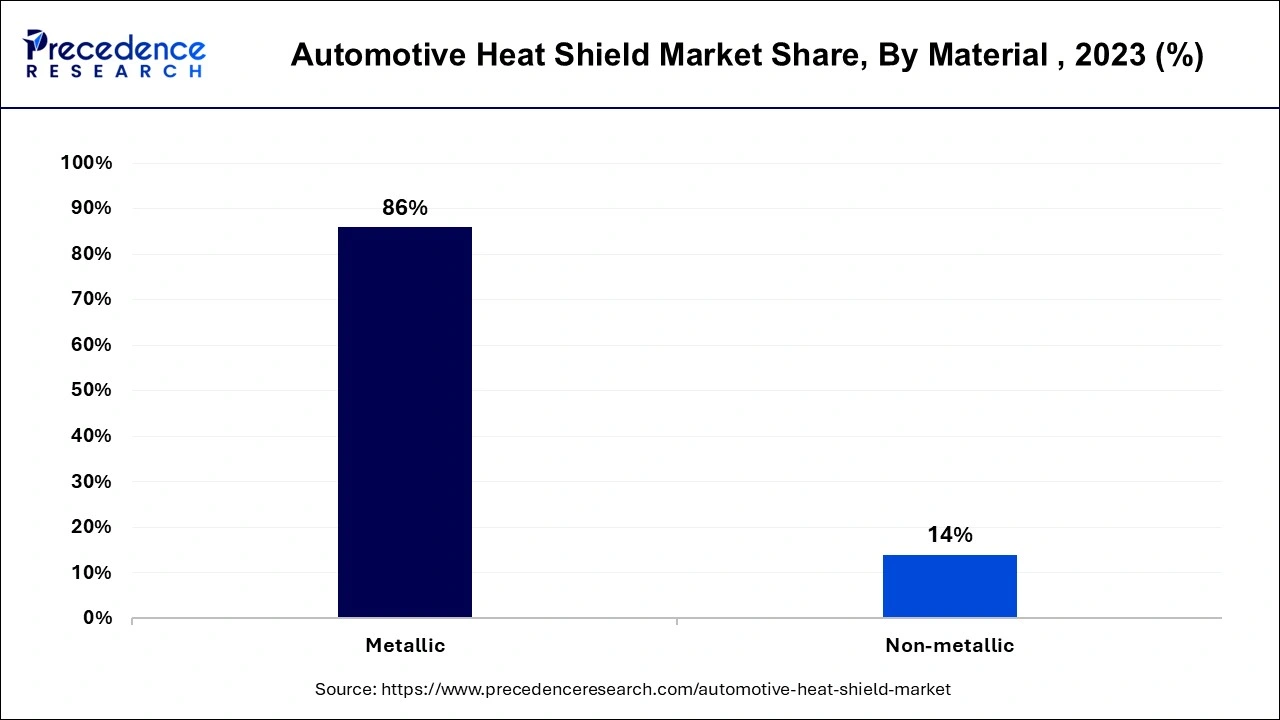

The metallic segment dominated the global automotive heat shield market in 2023. The dominance of the segment can be attributed to the higher thermal resistance property and durability of metallic shields as compared to non-metallic options. Metallic heat shields are made from steel or aluminum, which provide good thermal conductivity and can bear high-temperature conditions. Also, this robustness ensures the longevity of the components, decreasing their frequent replacements.

The non-metallic segment is expected to grow at the fastest rate in the automotive heat shield market over the forecast period. The growth of the segment can be credited to the growing need for lightweight materials in automobile manufacturing. Non-metallic shields are made from composites, advanced ceramics, and polymers which are gaining traction because of their better heat insulation characteristics and lighter weights compared to conventional shields.

The passenger car segment dominated the automotive heat shield market in 2023. The dominance of the segment is due to the escalating consumer demand for improved cabin temperature control and vehicle comfort. Heat shields safeguard the cabin from exhaust heat, enabling a more sophisticated driving experience. Moreover, innovative heat shielding technology is able to isolate heat in high thermal zones.

The HCV segment is expected to grow significantly in the automotive heat shield market over the forecast period. The growth of the segment is because of growing regulatory pressure for the reduction of emissions coupled with the development of engine technology. In addition, the surge in e-commerce and the growth in freight and logistic services have led to greater demand for these vehicles, which necessitates strong heat management systems.

The single shell segment led the global automotive heat shield market. The dominance of the segment can be driven by the simple design and cost-effective solutions offered by this segment, which makes it a more attractive option for automobile market players. Furthermore, a single shell provides convenient thermal protection for a number of vehicle components, particularly in conditions where moderate heat insulation is necessary.

The sandwich segment is projected to grow at the fastest rate in the automotive heat shield market during the forecast period. This is due to the improved performance and durability of sandwich heat shields under harsh conditions. These heat shields are created to bear harsh environments and high temperatures by ensuring better protection for delicate components like turbochargers, exhaust systems, and engine parts.

The engine compartment segment led the global automotive heat shield market in 2023. The dominance of the segment can be linked to the rising demand for enhanced automobile functions along with advanced heat management systems. Additionally, the increasing trends towards more compact engine design in the latest vehicle models focus more on efficient space use and appropriate heat dissipation techniques to improve overall engine performance.

The turbocharger segment is estimated to grow at the fastest rate in the automotive heat shield market during the projected period. The growth of the segment is driven by the growing adoption of turbocharged and downsized engines to meet emission and fuel efficiency standards. Due to their high-performing ability, these engines generate substantial amounts of heat that need to be dissipated properly to manage engine performance and integrity.

By Product

By Material

By Vehicle Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

February 2025

July 2024