January 2025

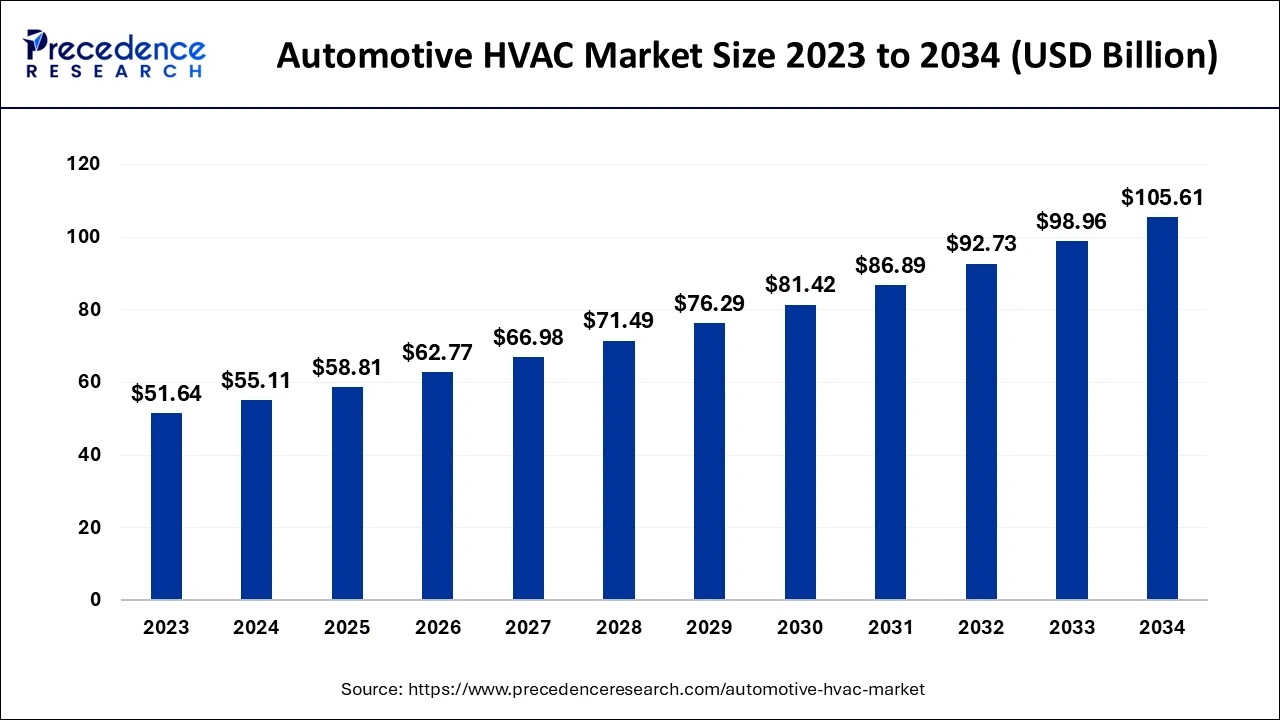

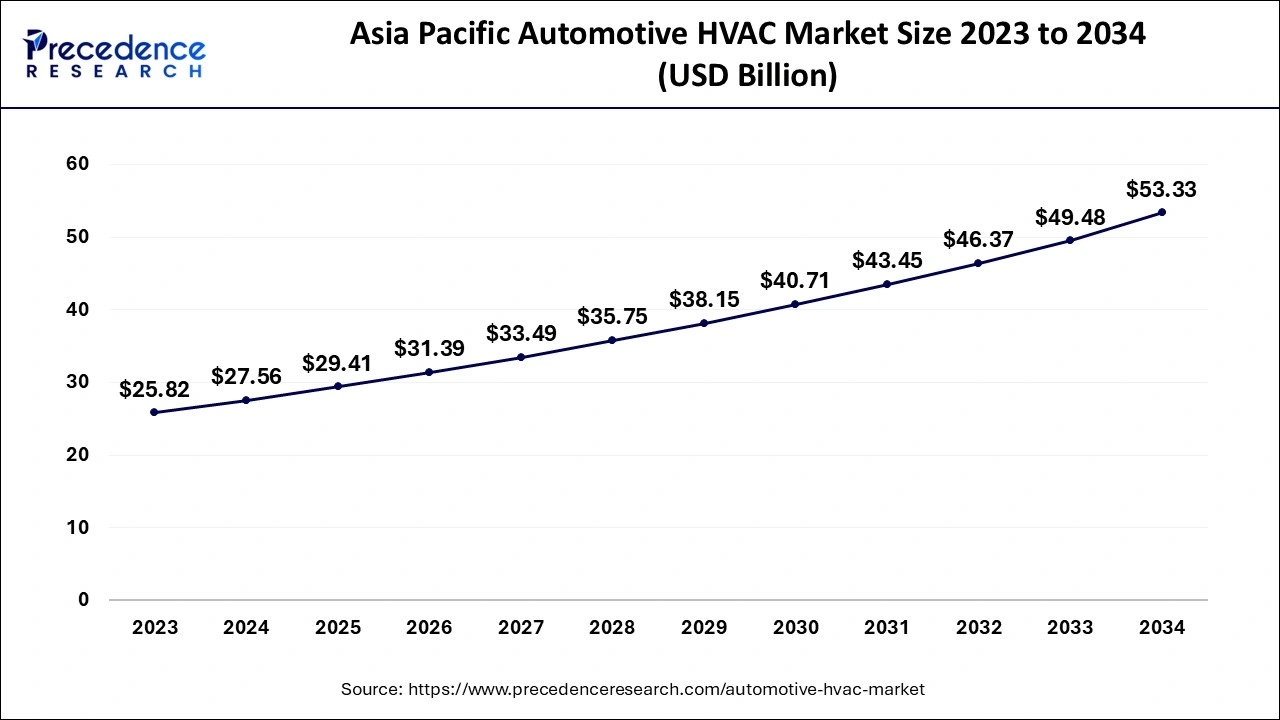

The global automotive HVAC market size accounted for USD 55.11 billion in 2024, grew to USD 58.81 billion in 2025 and is expected to be worth around USD 105.61 billion by 2034, registering a solid CAGR of 6.73% between 2024 and 2034. The Asia Pacific automotive HVAC market size is evaluated at USD 27.56 billion in 2024 and is expected to grow at a CAGR of 6.81% during the forecast year.

The global automotive HVAC market size is calculated at USD 55.11 billion in 2024 and is predicted to reach around USD 105.61 billion by 2034, expanding at a CAGR of 6.73% from 2024 to 2034. The automotive HVAC market growth is attributed to the increasing demand for energy-efficient and advanced climate control solutions in vehicles, driven by consumer expectations for enhanced comfort and regulatory pressures for sustainability.

The Asia Pacific automotive HVAC market size is evaluated at USD 27.56 billion in 2024 and is projected to surpass around USD 53.33 billion by 2034, growing at a CAGR of 6.81% from 2024 to 2034.

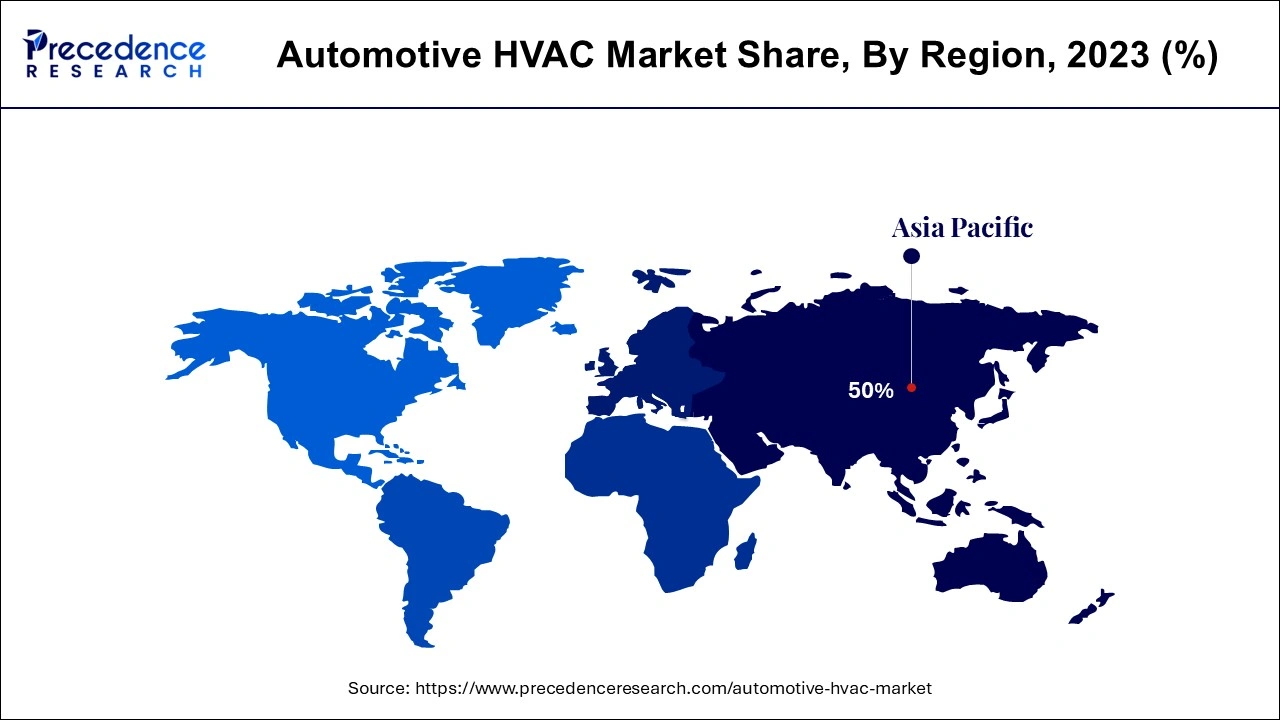

Asia Pacific dominated the automotive HVAC market in 2023 due to the development of the automotive industry and, subsequently, the demand for automobiles. Countries, including China and India, have continued to manufacture and sell more vehicles, creating requirements for better climate control systems.

The growing middle class in these countries has led to increased disposable income levels, and this has made consumers look for comfort features in vehicles, such as heating, ventilation, and air conditioning systems. Furthermore, the strategic drive to make electric cars is expected to increase the demands of the automotive HVAC market since cars require effective climate control to ensure they are energy efficient.

North America is projected to host the fastest-growing automotive HVAC market in the coming years. The automotive original equipment manufacturers in the region continue to embrace new HVAC systems for their growing numbers of EVs. These trends indicate an increase in the sophistication of climate control systems that lead to vehicle efficiency and passenger comfort. Furthermore, there is a rising demand for smart technology components in vehicles, including connected climate controls.

Consumers increased need for effective climate control systems in automobiles is facilitating the automotive HVAC market. These systems increase passengers’ comfort and help them realize energy-saving goals that are compatible with sustainable goals worldwide. Components, such as heat pumps and enhanced thermal conditioning, are used to heat/cool electric and hybrid car cabins efficiently while consuming minimum power.

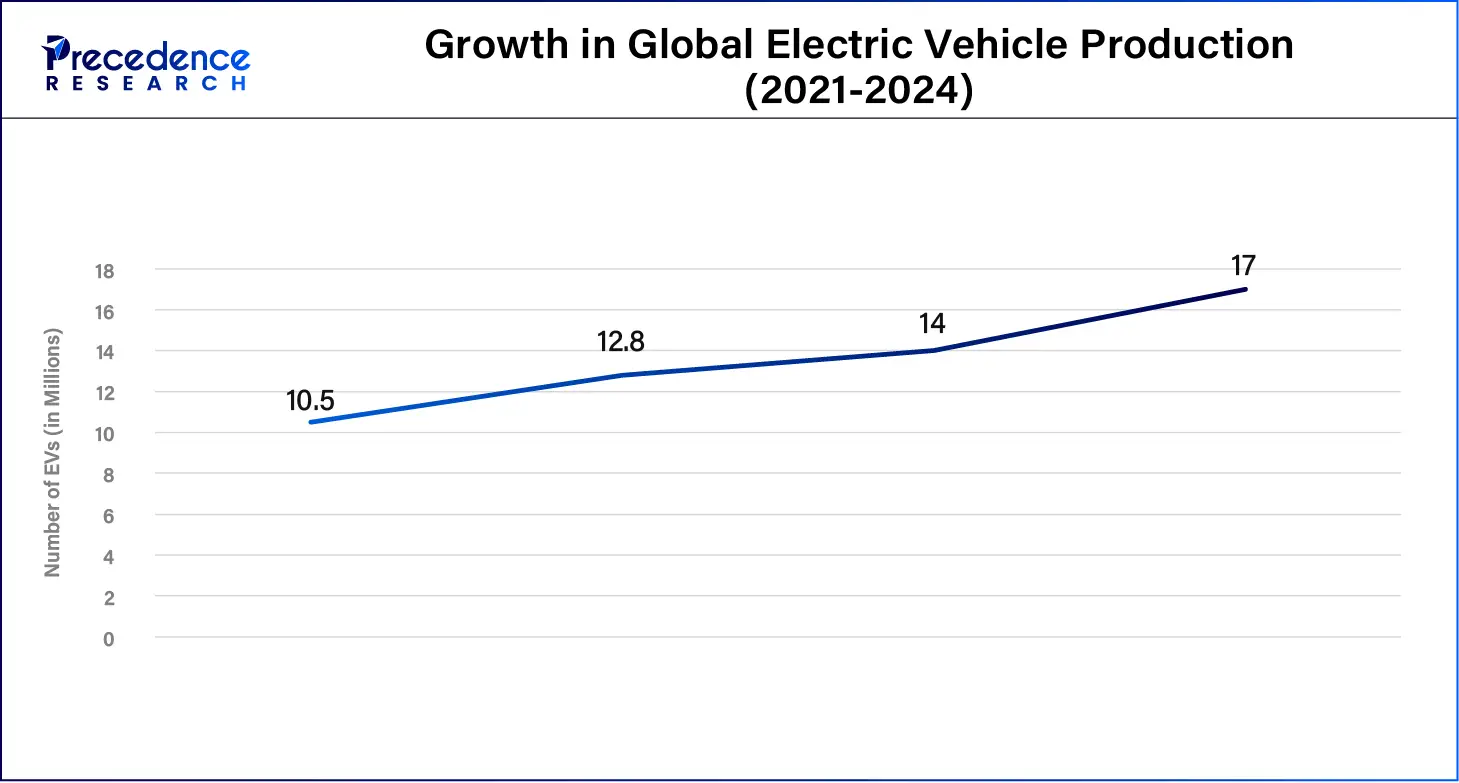

The increase in electric vehicles causes an increase in the demand for improved automotive HVAC market products. The EU’s European Commission has, in the recent past, passed even tighter emission policies, which called for energy-efficient technologies. Moreover, there is an increasing concern about global environmental challenges and concerns for passenger comfort while passenger car manufacturers improve the progress of HVAC systems.

Impact of Artificial Intelligence on Automotive HVAC Market

Artificial Intelligence (AI) is helping to advance the HVAC market to embrace intelligent and responsive systems that are energy efficient, thus increasing comfort to passengers and higher performance levels in the current vehicle models. Intelligent HVAC systems use real-time data from internal and external sources, such as weather and traffic conditions, to adjust temperature and air distribution. It saves the energy of conventional HVAC systems and relates to the new trend of demanding fuel-efficient, environmentally friendly vehicles. Furthermore, it also assists in prescriptive maintenance since possible defects of HVAC parts are detected and repaired before compounding to maintenance costs and shortened system lifespan.

| Report Coverage | Details |

| Market Size by 2034 | USD 105.61 Billion |

| Market Size in 2024 | USD 55.11 Billion |

| Market Size in 2025 | USD 58.81 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.73% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Vehicle Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rising production of electric and hybrid vehicles

Rising production of hybrid vehicles and electric vehicles in 2023 and 2024 is projected to drive significant demand for HVAC, thus boosting the market. Consumers continue embracing vehicles with zero emissions. Some of the parameters of combustion vehicles need to be controlled to regulate energy demand and achieve better results than those in regular cars. This has been accelerated by policies and incentives worldwide focusing on the emission of carbon and the use of fossil energy.

Manufacturers focus on engineering HVAC systems that do not drastically affect battery longevity, as HVACs can greatly draw electricity in electric vehicles. Furthermore, recently, in the United States, the Inflation Reduction Act provided tax incentives for the EV market, enhancing consumer and manufacturing points and giving further push to the HVAC technology for EVs.

High costs of HVAC systems

High costs of automotive HVAC systems are anticipated to restrain market growth, particularly for entry-level and budget vehicle segments. HVAC systems must use technologically enhanced materials and products to satisfy energy efficiency and emission requirements, which is why there are high production costs. These systems incorporate factors, such as compressor, condenser, and evaporator, which are costly to manufacture. Moreover, the increasing costs of raw materials and the increasingly difficult manufacturing profile, particularly for electric vehicles, are also anticipated to have an impact on the future market growth of selected segments in developing countries.

High investment in climate-control technologies

High investment in climate-control technologies, including multi-zone HVAC and personalized climate control, are expected to create immense opportunities for the players competing in the automotive HVAC market. Manufacturers are putting high investments in technologies, such as multi-zone HVAC systems and personalized climate control, which has led to production of favorable production ahead. Additionally, the current policies and regulations in the European and North American governments push for the sustainable production of cars by incorporating the necessity for climate-controlled features.

The automatic segment led the market in 2023, owing to the integration of technologies and the evolving needs of the customers. The adoption of climate control features in cars is also linked with the further growth of electric vehicle (EV) production, as manufacturers are to pay special attention to the development of advanced climate control systems that will augment user satisfaction. WEF sources point to the fact that automated HVAC systems incorporate solutions, such as air quality sensors and enhanced smart controls, leading to passengers’ health and comfort enhancement. Furthermore, the growing focus on developing cheap and easily installable automated technology for vehicles is anticipated to propel the segment in the coming years.

The manual/semi-automatic segment is observed to witness a significant rate of growth during the forecast period, the simplicity and relatively low maintenance cost are a few factors behind the growth of the segment. Customers prefer cheaper, especially in embryonic car markets where the prices of vehicles count a lot. The IEA added that while automatic systems were estimated at about 45% of entry-level vehicles, manual HVAC systems were simpler and cheaper to manufacture. Furthermore, the U.S. Department of Energy pointed out that since the manual system is easier to understand and use, it further contributes to boosting the segment.

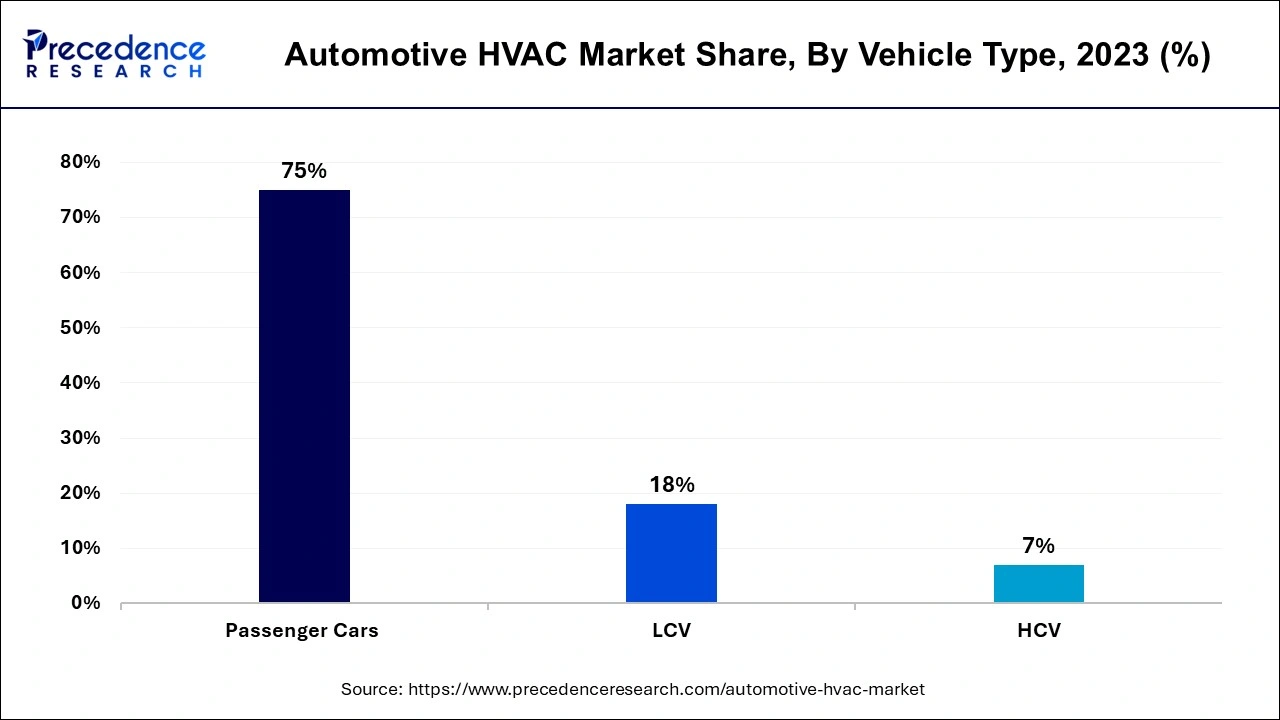

The passenger cars segment accounted for the largest share in the automotive HVAC market in 2023 owing to the rise in customer expectations in terms of the sophistication of some climate control functions. This change is mainly attributable to vertical revenues for better passenger comfort and the use of electric vehicles, where optimal conditioning puts less strain on batteries. Furthermore, the increase in disposable income and the consequent shifting lifestyles have called for more premium features in passenger cars.

The light commercial vehicles (LCVs) segment is seen to witness a significant rate of growth during the forecast period due to their rising implementation in the logistics and transportation industries. This segment is expected to grow rapidly as the global demand for goods transportation continues to rise. The drivers’ comfort for lengthy journeys is also relevant to the improved HVAC, which boosts the satisfaction of the drivers and decreases fatigue effects, according to the U.S. Department of Transportation. Additionally, the recent trends toward higher levels of energy efficiency in commercial vehicles are crucial in the adoption of newer technologies.

Segments Covered in the Report

By Technology

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025