January 2025

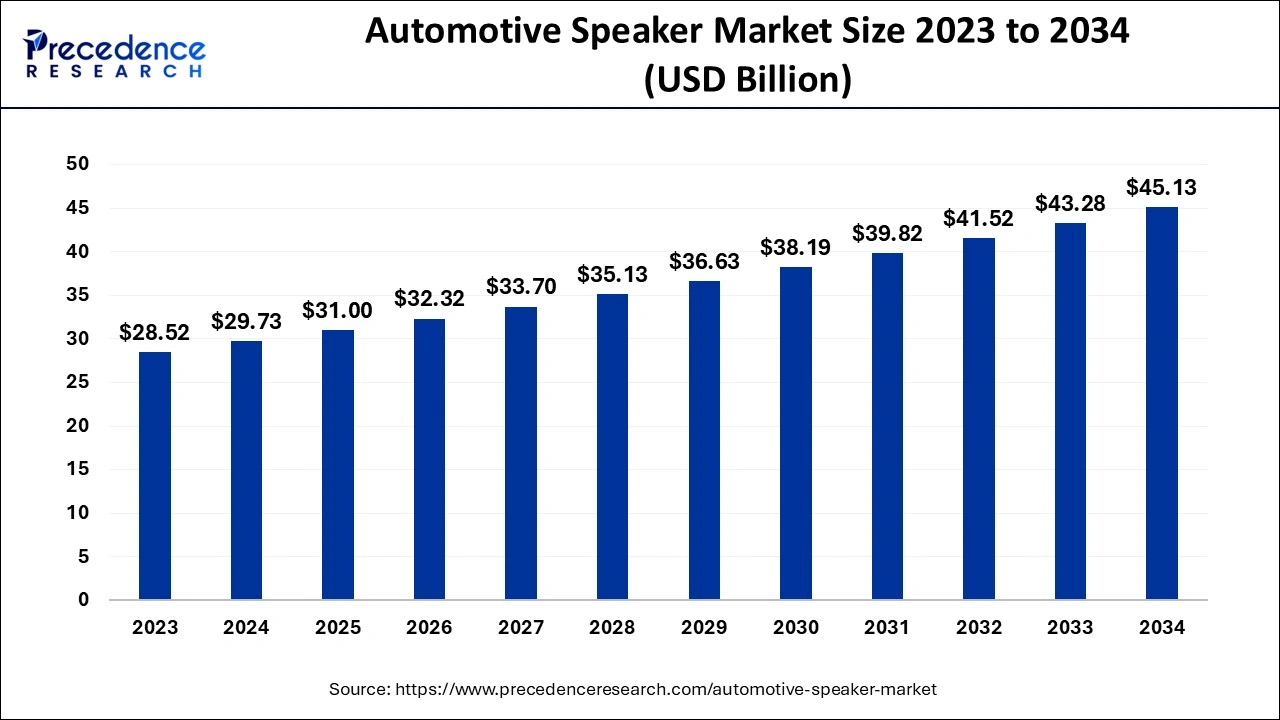

The global automotive speaker market size accounted for USD 29.73 billion in 2024, grew to USD 31.00 billion in 2025 and is expected to be worth around USD 45.13 billion by 2034, registering a CAGR of 4.26% between 2024 and 2034. The North America automotive speaker market size is calculated at USD 10.70 billion in 2024 and is growing at a CAGR of 4.39% during the forecast year.

The global automotive speaker market size is worth around USD 29.73 billion in 2024 and is projected to surpass around USD 45.13 billion by 2034, growing at a CAGR of 4.26% from 2024 to 2034. The automotive speaker market is gaining traction due to the rising demand of consumers to have a vehicle that offers an immersive and enjoyable audio experience.

Artificial intelligence algorithms have the capability to transform the driving experience in the automotive speaker market. The AI algorithms are designed and continuously improved through over-the-air updates to enhance the driving experience. AI integration allowed for a flexible and efficient user interface, a new way of approaching audio experience design. The innovations in the automotive industry, such as systems-focused development platforms, artificial intelligence, and stronger processors, are providing drivers and passengers with advanced adaptive, real-time responsiveness.

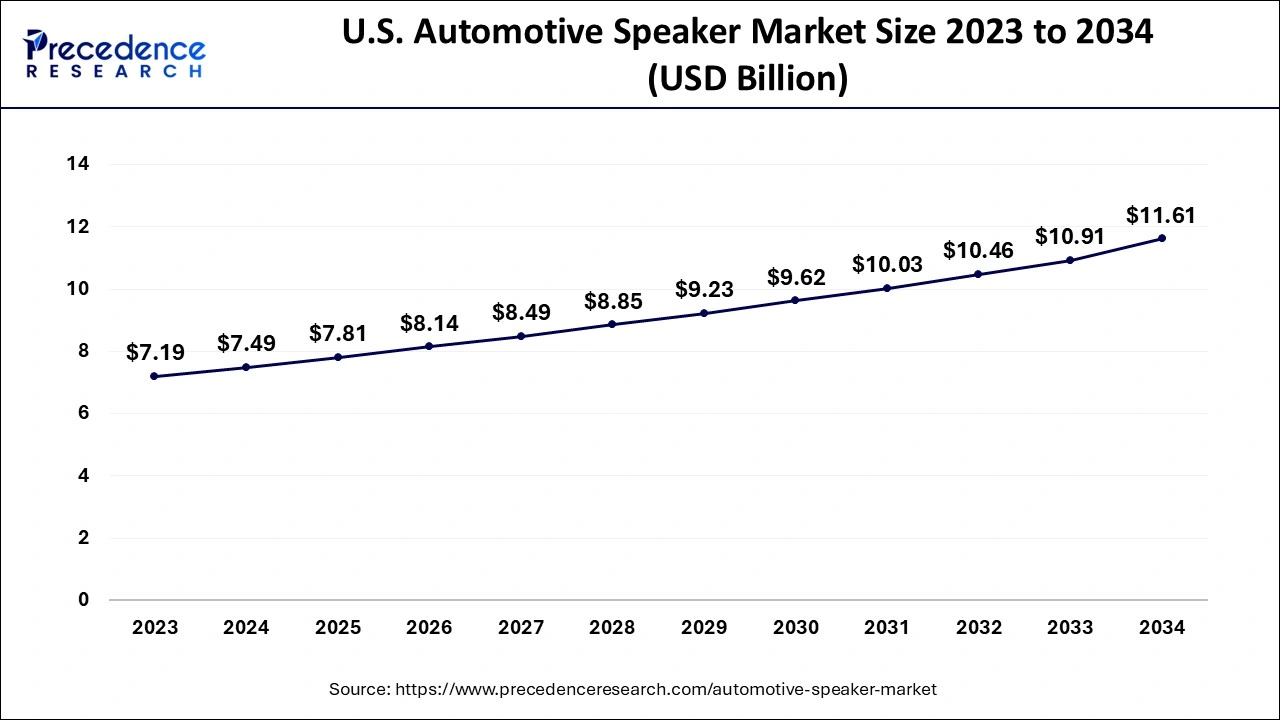

The U.S. automotive speaker market size is evaluated at USD 7.49 billion in 2024 and is projected to be worth around USD 11.61 billion by 2034, growing at a CAGR of 4.45% from 2024 to 2034.

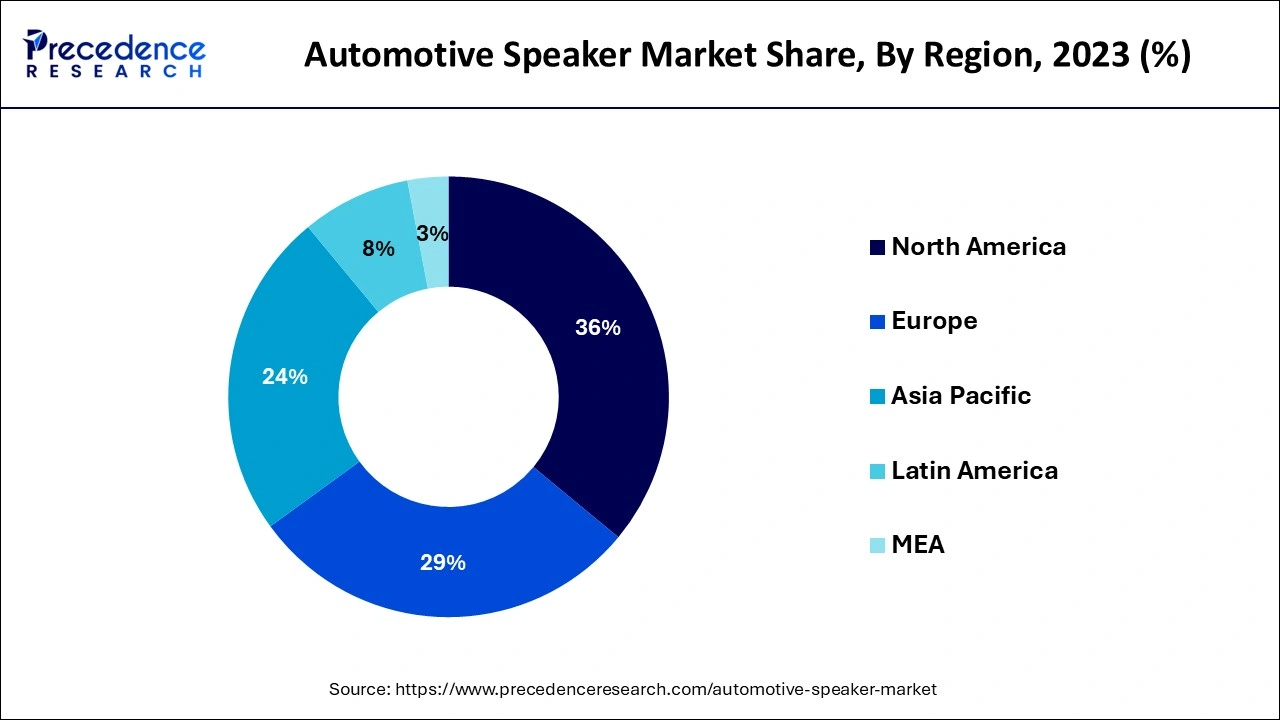

North America dominated the global automotive speaker market in 2023. The growth in the region is especially noticed in the United States and Canada. The significant dominance is due to the high consumer demand for advanced audio technology. Additionally, the market is expanding in the region due to the increasing hours spent in cars while in traffic congestion. Traffic in America costs both time and money. On average, Americans spend 51 hours stuck in traffic. Adding to the statement, the constant stop-and-go traffic causes a waste of gas. People seek a high-quality audio system for entertainment, music, and traffic-free navigation purposes to pass their time in traffic.

Europe is expected to host the fastest-growing automotive speaker market during the forecast period. The expansion of this is due to the presence of key players in Germany, France, the U.K., and Italy. The market in the region is driven by innovation and urbanization. European Union employment in manufacturing is about 2.6 million people working in direct manufacturing of motor vehicles. The widely known car manufacturers in Europe are Volkswagen AG, Stellantis NV, Mercedes-Benz Group Ag, Bayerische Motoren Werke AG, and Renault SA.

Automakers have changed the dynamics of automotive with original equipment manufacturer (IEM) systems. Every car audio system consists of three main components. The first is the radio or head unit that controls the entire system and generates the audio signal. The second is the amplification, which optimizes the strength of the audio signal so that it can successfully drive the third component, the speaker that reproduces the sound. Most of the basic automotive speakers are designed to be ‘full range’ and cover the entire frequency range. It is essential to choose the right speaker that can elevate the driving experience, turning everyday commute into an immersive audio journey.

| Report Coverage | Details |

| Market Size by 2034 | USD 45.13 Billion |

| Market Size in 2024 | USD 29.73 Billion |

| Market Size in 2025 | USD 31.00 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.26% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Speaker Type, Power Handling, Frequency Response, Mounting Location, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Advancing music in the automotive industry

In recent years, many automotive companies have partnered with premium audio system brands to enhance the vehicle experience. The combination of audio systems and vehicles enables a new category of in-car capabilities that completely transform the automotive speaker market. The motive to have a high-quality sound system is to eliminate the noise from the road, the engine, and the wind. The sound engineers have dedicated themselves to ensuring a rich, deep, and authentic sound.

High cost

Despite its enjoyable benefits, there is a challenge in the high cost of purchasing and installing premium audio systems. There is always a drawback of cost and compatibility. However, the automotive speaker market leaders have overcome this problem by investing in R&D for cost-effective solutions, collaborating with tech firms for seamless integrations, and emphasizing user-friendly designs, which have grown customer satisfaction.

Emerging smart technologies

The automotive speaker market is expected to witness rapid growth in the future due to the integration of advanced audio technology and smart technologies in vehicles. Innovation in the sound system is increasing the demand for connected vehicles and electric vehicles (EVs). As consumer demand for premium in-car audio systems is rising, companies are under pressure to fulfill the demands of high-end sound solutions. Leading audio system brands such as Bose, Harman, Bang & Olufsen, and Bowers & Wilkins are innovating advanced technologies such as active noise cancellation, 3D surround sound, and immersive audio experience. Additionally, the integration of smart technology in vehicles, such as virtual assistance from well-known brands such as Amazon Alexa, Google Assistance, and Apple Siri, is transforming the automotive industry by enhancing user interaction, using voice commands, and adjusting audio settings.

The coaxial segment contributed the highest share of the automotive speaker market in 2023. The dominance of this segment is noted owing to its less complicated installation and full-range speaker. These speakers are combined with all the elements, including the woofer and tweeter, into a single unit. Additionally, it offers versatile sound quality and is available in various sizes and print points, making it easily accessible for any budget.

The component segment is projected to grow at a significant CAGR in the automotive speaker market during the forecast period. The growth of this segment is observed due to its top-tier sound quality. The speaker component is designed with separate drivers such as woofers, tweeters, and external crossovers that each handle certain sound frequencies. The greatest advantage of the component speaker is its installation flexibility.

The 40-100 watts segment captured the biggest share of the automotive speaker market in 2023. The dominance of these segments is observed due to their affordability and extensive usage in entry-level and mid-range vehicles. If the vehicle owner is using just an aftermarket stereo for power, the ideal speaker with power handling is no higher than 75 watts RMS.

The 100-200 watts segment is expected to grow at the fastest CAGR in the automotive speaker market during the projected period. The growth of this segment is experienced due to the sizeable premium audio system, demanded by luxury vehicles.

The 20-20,000 Hz segment contributed the highest share of the automotive speaker market in 2023. The dominance of this segment can be attributed to the ideal speaker frequency response that covers the full range spectrum of human hearing, which is 20-20,000Hz. However, it depends on individual preferences and environmental factors.

The 20-30,000 Hz segment is projected to grow at a significant CAGR in the automotive speaker market during the forecast period. The growth of this segment is observed due to the increasing demand for high-quality audio systems in luxury vehicles.

The door segment dominated the global automotive speaker market in 2023. Two speakers are in the front of the vehicle, one on each door. Some have four speakers in front, two per side. They use a full- range. Door speakers are generally woofers on the door and tweeter either higher up in the door, in the corner pillar, or at the dash. The rear door speaker offers sound to the backseat passenger. However, they do not have a significant contribution to the sound experience in the front seat.

The dashboard segment is anticipated to grow at a significant CAGR in the automotive speaker market during the forecast period. Many vehicles have center dash speakers, which are typically responsible for vehicle essentialities such as door chime and navigation prompts, along with playing music.

The passenger car segment contributed the largest share of the automotive speaker market in 2023. The dominance of this segment is highly observed as passenger car systems provide music, and navigation prompts, promoting safety, enjoyment, and hand-free calls. The segment is driven by the consumer's demand for high-quality sound with advanced features systems such as smartphone connectivity and voice recognition.

The commercial vehicle segment is projected to grow at a notable CAGR in the automotive speaker market during the forecast period. The expansion of this segment is noted as the audio system in commercial vehicles is integrated with GPS and telematics which helps the drivers in navigation and logistics management.

By Speaker Type

By Power Handling

By Frequency Response

By Mounting Location

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

April 2025

January 2025