January 2025

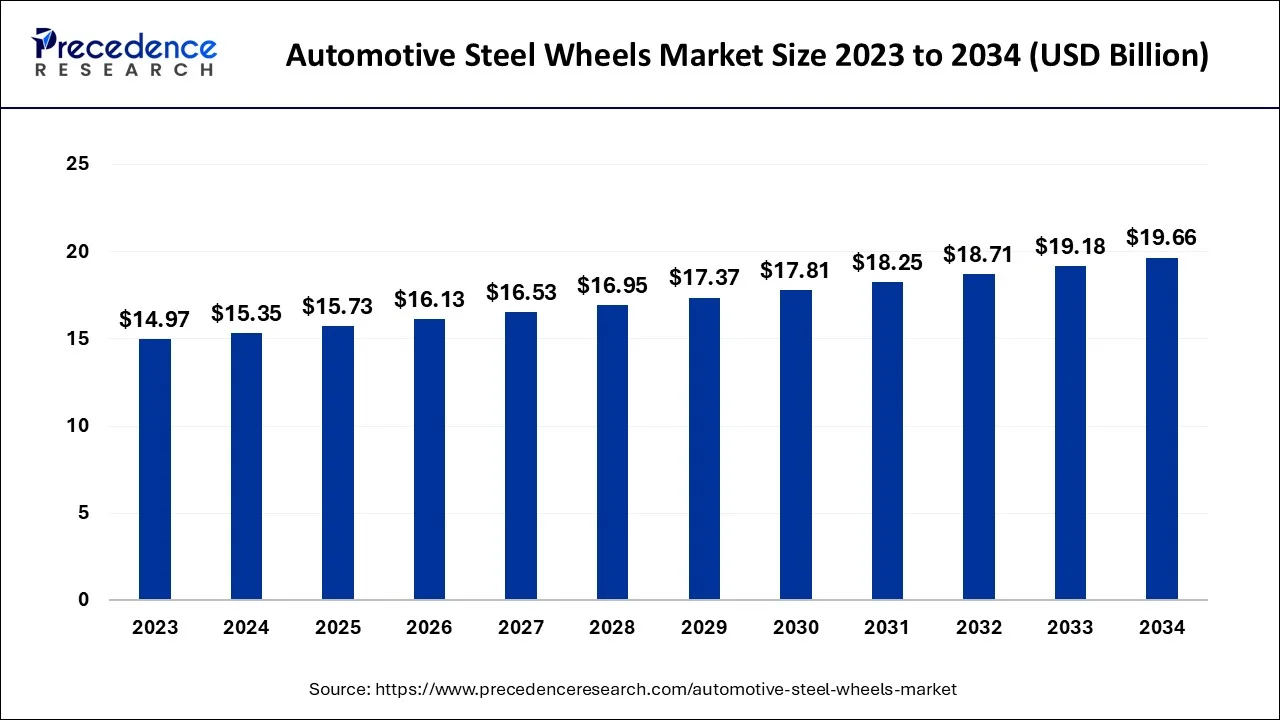

The global automotive steel wheels market size accounted for USD 15.35 billion in 2024, grew to USD 15.73 billion in 2025 and is expected to be worth around USD 19.66 billion by 2034, with a CAGR of 2.51% between 2024 and 2034. The Asia Pacific automotive steel wheels market size is calculated at USD 7.37 billion in 2024 and is estimated to grow at a CAGR of 2.60% during the forecast period.

The global automotive steel wheels market size is calculated at USD 15.35 billion in 2024 and is projected to surpass around USD 19.66 billion by 2034, expanding at a CAGR of 2.51% from 2024 to 2034. The cost-effectiveness of steel wheels is the primary factor driving the growth of the market. Also, the growth in automotive industry along with the increasing demand for steel vehicles in emerging markets are expected to fuel market growth shortly.

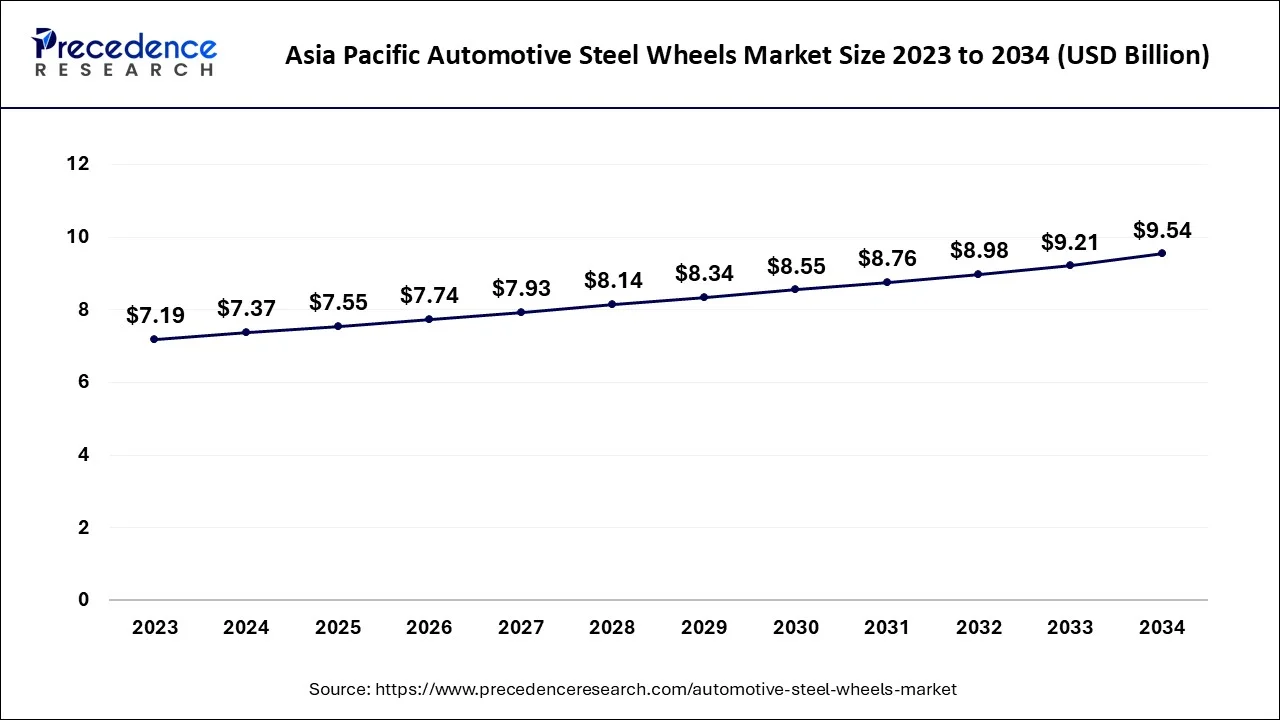

The Asia Pacific automotive steel wheels market size is evaluated at USD 7.37 billion in 2024 and is projected to be worth around USD 9.54 billion by 2034, growing at a CAGR of 2.60% from 2024 to 2034.

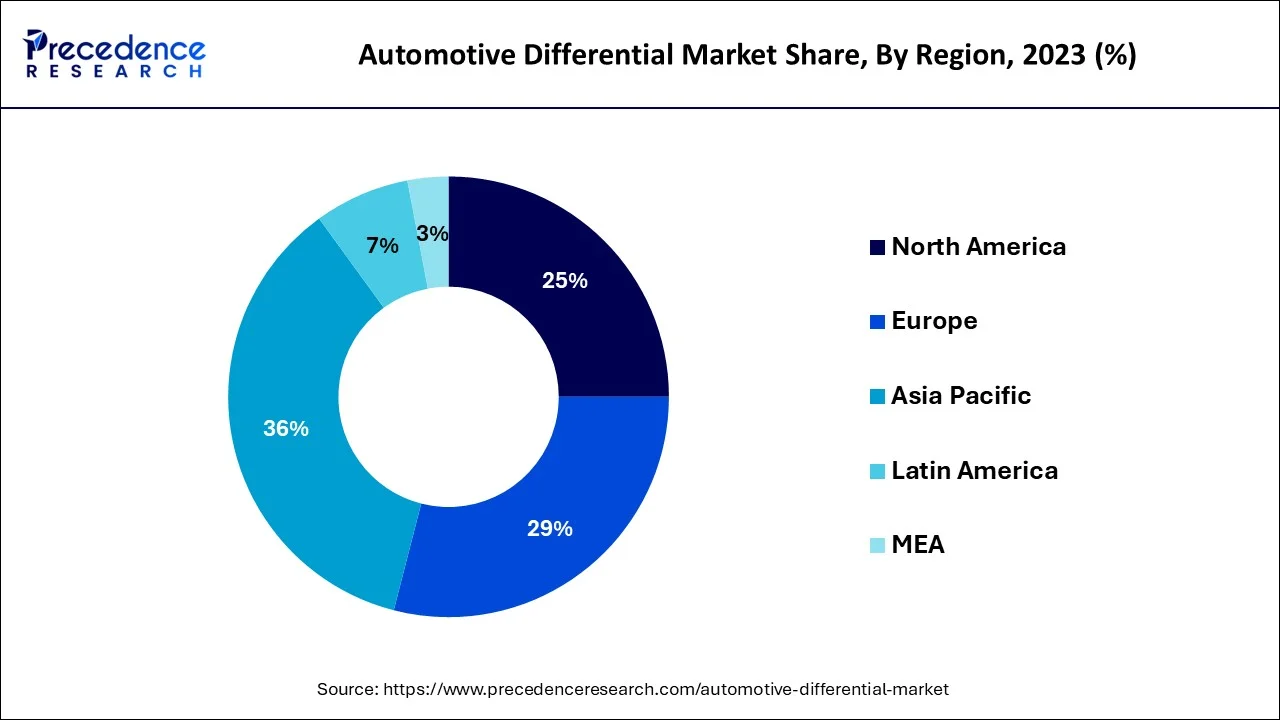

Asia Pacific led the automotive steel wheels market with the largest market share of 48% in 2023. The dominance of the region can be attributed to the increasing urbanization and economic expansion in developing countries such as China and India, which are seeing substantial economic growth, leading to the growth of a larger middle class with rising disposable income. Furthermore, this economic shift is fueling higher vehicle sales, especially in the budget and economy segments.

North America is anticipated to show the fastest growth over the projected period. The growth of the automotive steel wheels market in the region can be linked to the presence of major automotive manufacturing players and a huge consumer base. However, North America's focus on sustainability and recycling relates to the utilization of steel wheels because they are fully recyclable. This environmental consideration further propels the ongoing demand for steel wheels in the North American market.

Automotive steel wheels are cylindrical shapes of rims on which the tires are fixed. These rims are both cheaper and stronger compared to the alloy wheel. Steel wheels help with easy movement and the vehicle's overall weight. The automotive sector across the globe has been obligated to modernize and find new methods. To reduce carbon discharge and develop energy efficiency. which in turn increases the application of stainless steel in the automotive industry.

Commercial Vehicles and Car Production Global Statistics 2023

| Country/Region | Cars | Commercial Vehicles |

| ARGENTINA | 3,04,783 | 30,594 |

| AUSTRIA | 1,02,291 | 11,900 |

| BELGIUM | 2,85,159 | 46,944 |

| BRAZIL | 17,81,612 | 5,43,226 |

| CANADA | 37,68,881 | 1,76,138 |

| INDIA | 47,83,628 | 10,67,879 |

Impact of AI on the Automotive Steel Wheel Market

Artificial Intelligence (AI) is playing a transformative role in the market. AI enhances production and design processes by enabling more accurate optimizations and simulations, which improve wheel performance and safety. Furthermore, the utilization of AI-driven analytics also helps in predictive maintenance and quality control by decreasing downtime and enhancing overall product reliability. These technological advancements can stimulate innovation within the automotive steel wheels market.

| Report Coverage | Details |

| Market Size by 2034 | USD 19.66 Billion |

| Market Size in 2024 | USD 15.35 Billion |

| Market Growth Rate | CAGR of 2.51% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Low development costs and advantages of steel wheels

Compared to aluminum alloy wheels, the cost required to manufacture steel wheels is very low. This is the key advantage of steel wheels. Steel wheels are more durable and rarely bend or crack. Furthermore, in the last few years, the time required to manufacture steel wheels has significantly reduced, and the quality has increased. Hence, the whole process becomes cost-effective. Which in turn lowers manufacturing costs and leads to market growth.

Increasing geopolitical tensions

Escalating geopolitical conflicts is impacting the automotive steel wheels market significantly by impelling disruptions in the supply chain international trade and soaring raw material costs. Moreover, the volatile geopolitical scenario is affecting consumer confidence and industry investments, creating a substantial threat to the stability and growth of the market. Stakeholders should navigate these hurdles with strategic agility and resilience.

Rising demand for fuel-efficient vehicles

The growing requirement for fuel-efficient vehicles is considered the key factor that fuels the market expansion of the automotive steel wheels market. The implementation of stringent regulations by the government across the globe has impelled automakers to construct lighter vehicles. Additionally, steel wheels weigh much less than aluminum wheels, which aids in raising fuel efficiency and reduction of emissions. The high rigidity and damage resilience of steel can further drive the demand for steel vehicles.

The passenger vehicles segment dominated the automotive steel wheels market in 2023. The dominance of the segment can be attributed to the increasing demand for passenger vehicles across the globe along with the growing urbanization, especially in developing countries like China and India, where more people have higher disposable incomes. Additionally, these vehicles are generally equipped with steel wheels as a standard feature because of their reliability and lower production cost. This trend can sustain the growth of the automotive wheels market in developing regions.

The light commercial vehicle segment is expected to grow at the fastest rate in the automotive steel wheels market during the studied period. This is due to the rising demand for light commercial vehicles from emerging markets along with the increasing e-commerce industry and logistics industry. Light commercial vehicles such as pickups and vans are anticipated to contribute to a larger portion of the commercial vehicles segment. The vehicle’s multi-purpose abilities and affordability are driving the higher sales for this segment.

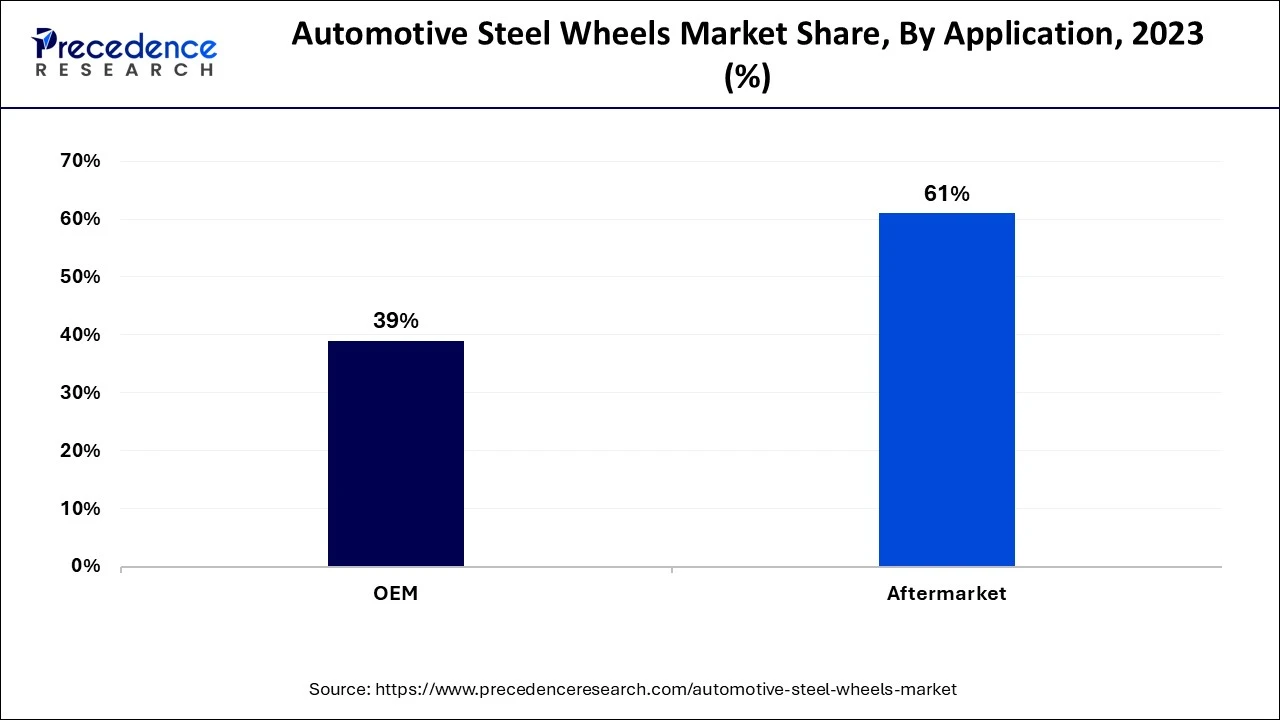

In 2023, the aftermarket segment led the automotive steel wheels market by holding the largest market share. The dominance of the segment can be driven by the increasing need for wheel replacement due to wear and tear. Also, Steel wheels are generally used in vehicles that work under challenging environments such as rough roads or harsh atmospheres where they face a great amount of stress. This demand is particularly strong in nations with poor road infrastructure or where vehicles are utilized for heavy-duty purposes that ensure a steady flow of aftermarket sales.

The OEM segment is expected to show the fastest growth in the automotive steel wheels market over the forecast period. The growth of the segment can be credited to the increasing number of steel wheels supplied directly to vehicle producers coupled with the original installations in new vehicles. Moreover, the OEM segment is associated with new vehicle production and production partnerships with automotive companies globally. OEMs prefer steel wheels because of their strength, durability, and cost-effectiveness.

Segments Covered in the Report

By Vehicle Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

July 2024

December 2024