July 2024

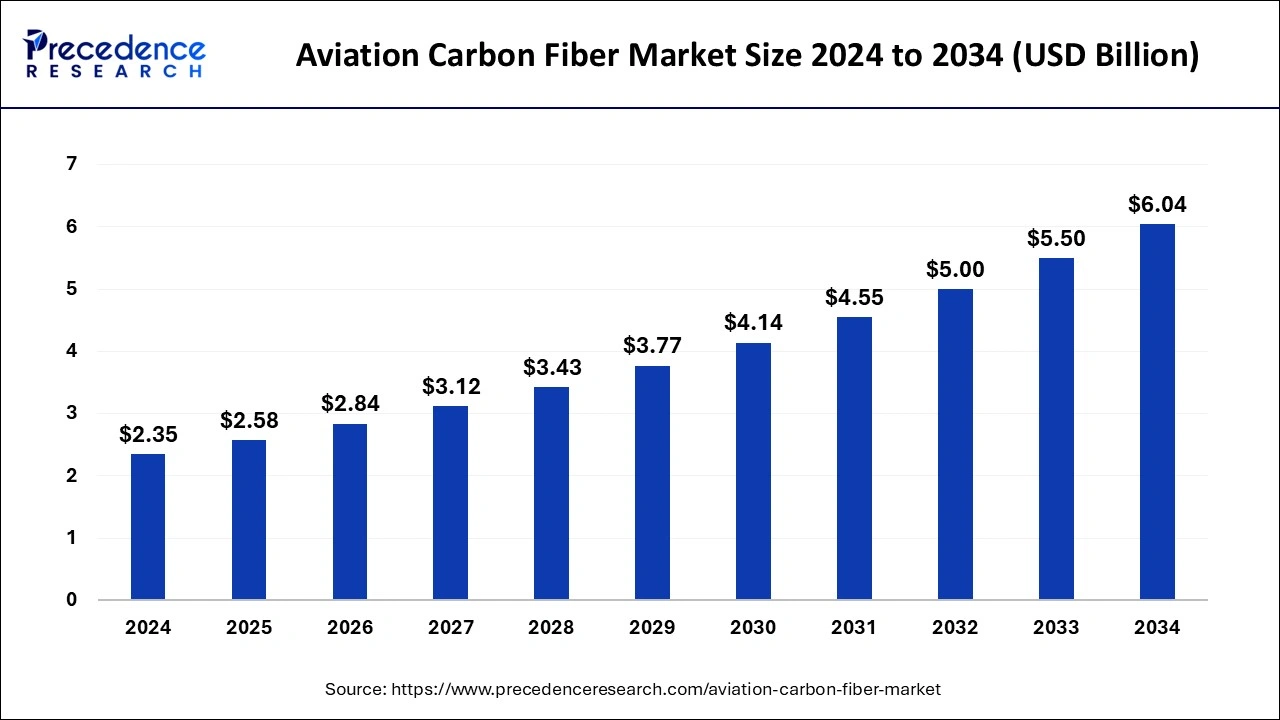

The global aviation carbon fiber market size is evaluated at USD 2.58 billion in 2025 and is forecasted to hit around USD 6.04 billion by 2034, growing at a solid CAGR of 9.90% from 2025 to 2034. The North America market size was accounted at USD 800 million in 2024 and is expanding at a CAGR of 10.02% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global aviation carbon fiber market size accounted for USD 2.35 billion in 2024 and is expected to exceed around USD 6.04 billion by 2034, growing at a CAGR of 9.90% from 2025 to 2034. There is a rising demand in the aviation carbon fiber market for lightweight and fuel-efficient aircraft coupled with increasing environmental standards imposed on airplane manufacturing industries.

The combination of artificial intelligence (AI) and automation systems in the manufacturing processes of the aviation carbon fiber market. Advanced data analytics and machine learning support manufacturers in enhancing production techniques, improving quality control, and decreasing waste. Moreover, automation streamlines operations, resulting in lower labor costs and improved production efficacy. The use of AI in research and development can speed up the discovery of new carbon fiber materials and compounds personalized for particular aviation applications.

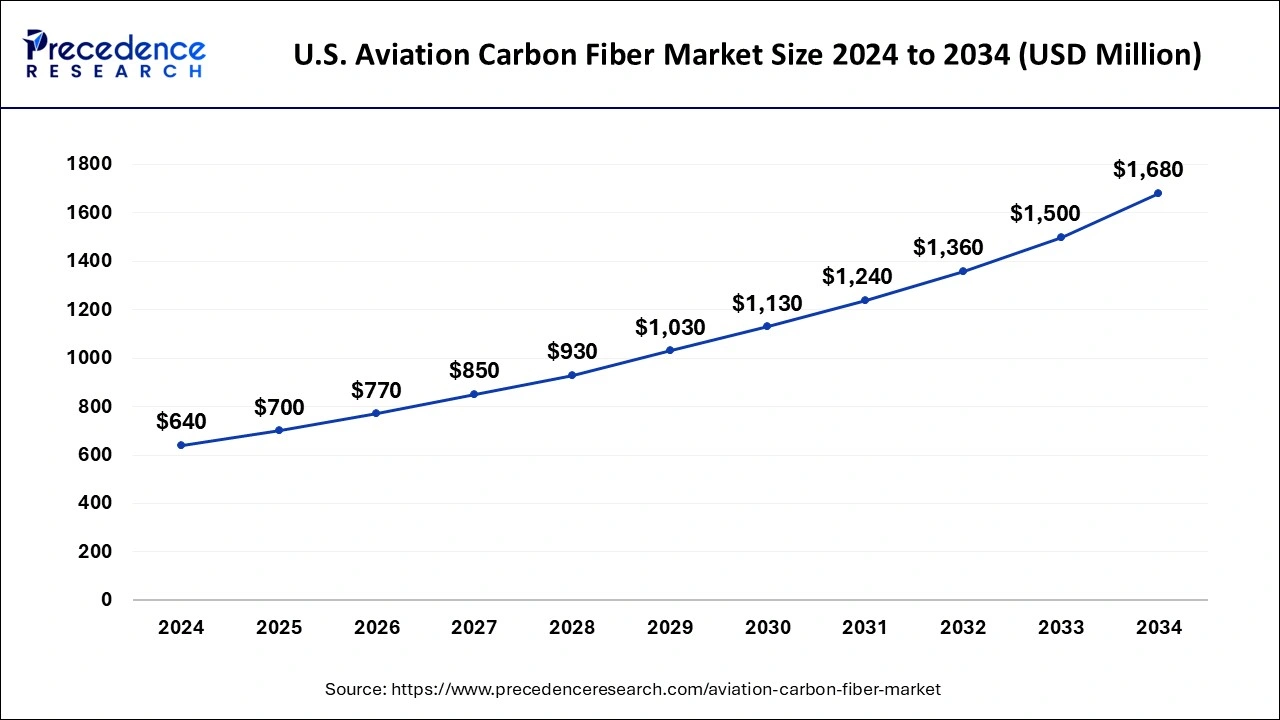

The U.S. aviation carbon fiber market size was exhibited at USD 640 million in 2024 and is projected to be worth around USD 1,680 million by 2034, growing at a CAGR of 10.13% from 2025 to 2034.

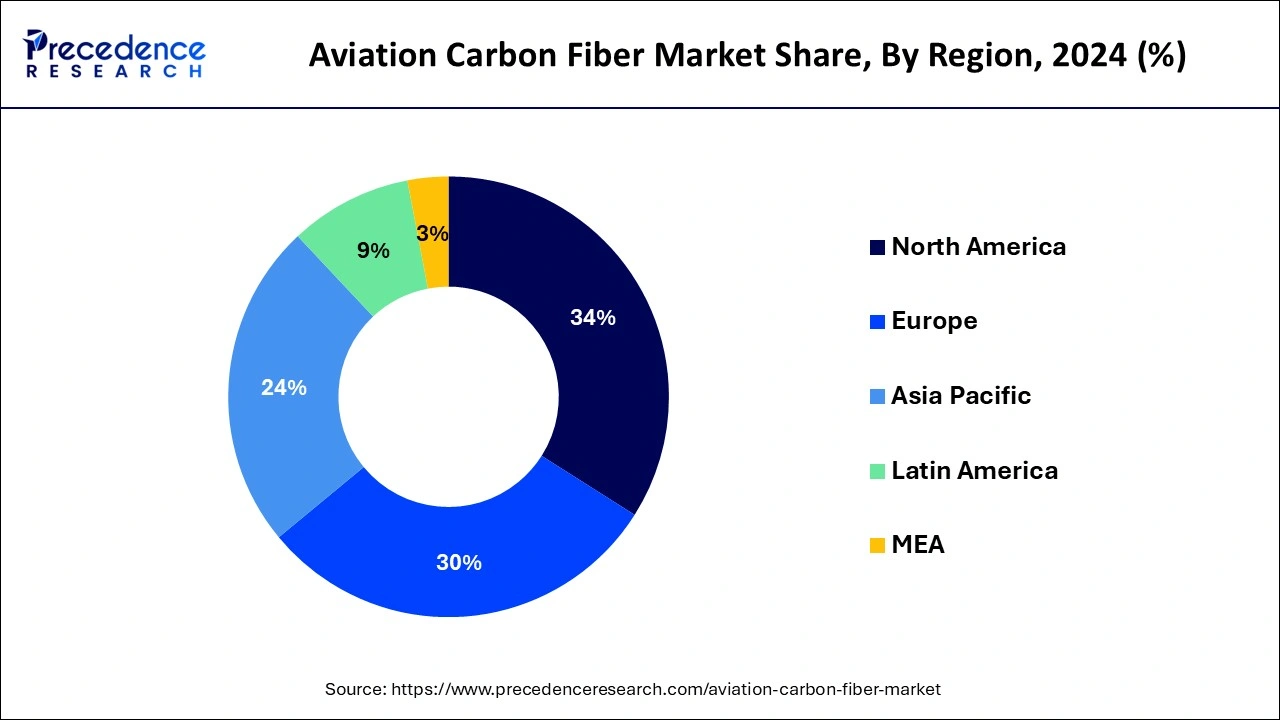

North America accounted for the largest share of the aviation carbon fiber market in 2024. The strong presence of the large airline industry and the increase in investments for enhancement in aircraft fleets by governments and the military are set to promote the development of the market. The increase in the number of military aircraft bought by the U.S. due to safety issues increases the demand for carbon fiber. Also, commercial aircraft have a higher growth rate due to higher traffic volumes. Moreover, North America has a strong research and development infrastructure that allows the advancement of carbon fiber production and applications.

Asia Pacific is anticipated to witness the fastest growth in the aviation carbon fiber market during the forecasted years. The growth of orders and deliveries in the regions is currently fuelling the growth of the market. Japan, currently a leading supplier of carbon fiber, is seeking to develop new uses for the material with the help of its international aerospace partners. Likewise, the concerns about carbon emissions in aviation and sustainability within the region are boosting the adoption of carbon fiber.

Carbon fiber is a strong and lightweight synthetic fiber particularly made by carbonizing acrylic fiber at high temperatures. Due to its mechanical properties such as high strength, low weight, and higher durability, it is being introduced in the aviation industry. Carbon fiber reinforced polymer (CFRP) composites have aided weight reduction of airframe components, supporting in decreasing fuel consumption and carbon emissions. The acceptance of modern manufacturing technologies, such as additive manufacturing, and the development and initiation of new aircraft models are major drivers of the market.

The aviation carbon fiber market is expanding fast as airplane manufacturers, as well as other industries that require light composite materials, demand improvement in fuel efficiency and performance. The growing prominence of sustainable practices in the aerospace sector also increases the adoption of carbon fiber, as it helps reduce carbon emissions. Moreover, new technological developments & research associated with carbon fiber in the aviation business, increased usage of electric aircraft, and the emerging usage of carbon fiber for 3D printing in aviation are primary growth factors for the key market players.

| Report Coverage | Details |

| Market Size by 2024 | USD 2.35 Billion |

| Market Size in 2025 | USD 2.58 Billion |

| Market Size in 2034 | USD 2.84 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.90% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Type, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for lightweight, fuel-efficient aircraft components

Airframe elements are expected to be as light as possible, strong enough, and stiff enough to withstand different loads on an aircraft during the flight. Manufacturers build metal structures for aircraft that deliver optimum performance with minimum weight. As airlines and military sectors aim to lessen operational costs and carbon emissions, carbon fiber-reinforced composites are progressively favored for their high strength-to-weight ratio.

In the airline industry, the lower weight of the aircraft is related to the low operating cost since lower weight improves fuel efficiency. Fabrication processes of the aviation carbon fiber market can create very smooth yet complex geometries, allowing aircraft designers and manufacturers to enhance the aerodynamics of aircraft with the growing need for fuel-efficient and environmentally friendly aviation and transportation.

Concerns regarding durability and high cost

The aviation carbon fiber market has several advantages for applications. Its durability and maintenance concerns remain a challenge for operators and maintenance suppliers. One of the major concerns is the long-term durability of carbon fiber composites in real-world operating conditions. Furthermore, the cost for maintenance and repair of carbon fiber, compared with conventional metallic material, can be rather expensive because the processes require sophisticated equipment, materials, and expertise. Carbon fiber elements attached to airplanes might prove to be costly for aircraft operators in terms of repair and maintenance, as well as overall airplane downtimes.

Newer models

Carbon fiber and other high-performance composites are deployed for next-generation aircraft engines to achieve fuel efficiency enhancement and noise reduction. Furthermore, carbon fiber materials help in the advanced design of the future generation’s submerged power systems, such as electric or combined hybrid power plant structures, to provide enhanced and sustainable systems for aviation propulsion. Also, the aviation carbon fiber market products are utilized in some aircraft types and operation classes like UAVs, rotorcraft, as well as experimental aircraft. Carbon fiber materials have advantages; for example, they are lightweight, strong, and versatile and, therefore, are suitable for enhancing performance and agility in these particular uses. Carbon fiber composites are used largely for experimental airplanes, mainly for the advancement of innovation in aerodynamics, engines, and material sciences in the aerospace sector.

The PAN-based carbon fiber segment noted the largest share of the aviation carbon fiber market in 2024. PAN-based carbon fiber is a type of carbon fiber that is produced from the polyacrylonitrile (PAN) precursor material. It is characterized by high strength, stiffness, and durability and therefore it is widely used in various applications. PAN-based carbon fiber is used in aircraft structures like wings, fuselages, and empennages. Furthermore, the growing acceptance by the aerospace sector across several countries is the accountable factor for the segment’s demand.

The pitch-based carbon fiber segment is projected to witness the fastest growth in the aviation carbon fiber market during the forecast period. Although pitch-based carbon fiber is lower in strength than fiberglass, it has a very high elastic modulus value. Due to their high modulus and relatively high strength, pitch-based carbon fibers have many applications. These fibers are used in the aerospace industry since they possess high thermal and electrical conductivity. They are usually applied in the aircraft brake system and other high-temperature applications.

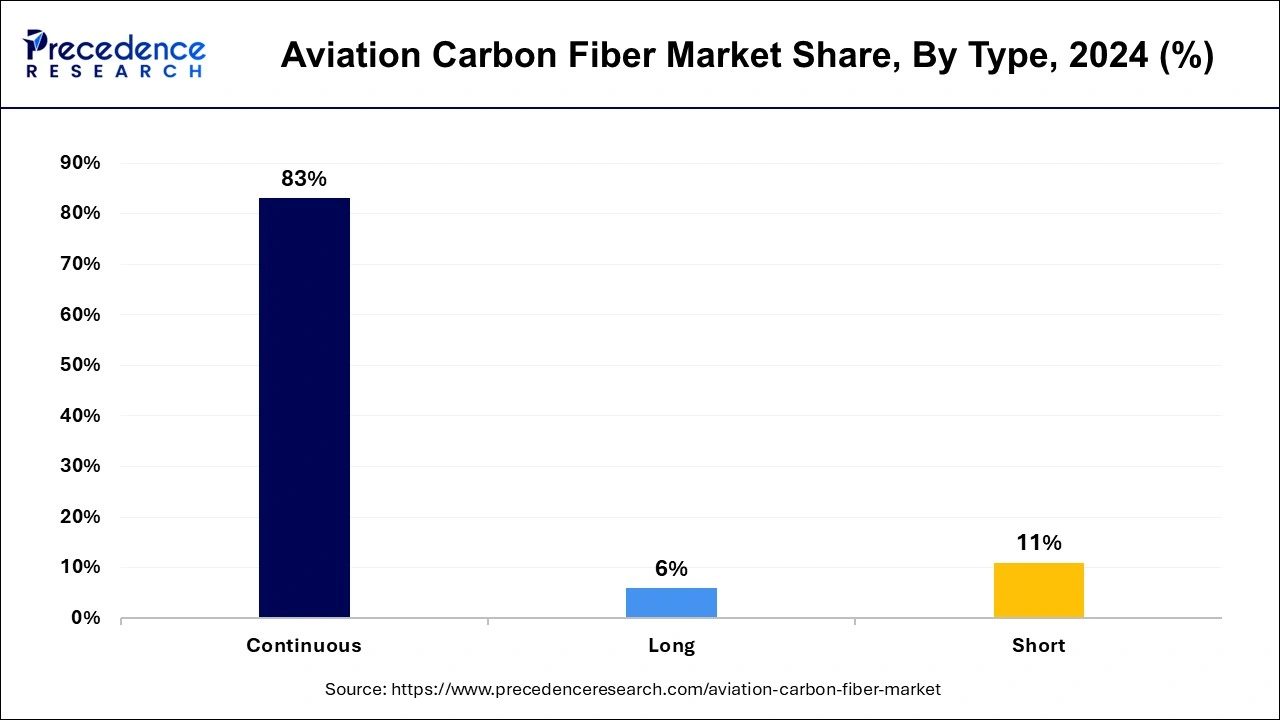

The continuous segment contributed the largest share of the aviation carbon fiber market in 2024. Continuous carbon fibers are one type of carbon fiber that is used in aircraft manufacturing to reinforce the strength and stiffness of structures. A few of the items made from carbon fiber reinforced plastics are air and spacecraft parts, racing car bodies, golf club shafts, bike frames, fishing rods, automobile springs, sailboat masts, and many other items for which light weight and high strength are paramount. In aerospace, automobile, and sports industries, strength and weight concerns place continuous carbon fibers as the best fit for use. Continuous carbon fiber is widely employed in aerospace applications for the fabrication of aircraft structures such as wing spars, fuselage panels, and bulkheads.

The long segment is projected to witness the fastest growth in the aviation carbon fiber market during the forecast period. Carbon fiber is a lightweight, strong material that is used in aircraft and other industries. It is made by heating a carbon-containing material to high temperatures, which causes the carbon atoms to bond together into long, thin strands. Carbon fiber is used to form complex shapes, which are stronger and much lighter than the same parts made of conventional metal. This is favored in the aviation industry as it assists in the creation of strong and durable aircraft.

The commercial fixed-wing aircraft segment has contributed the largest aviation carbon fiber market share in 2024. The constantly increasing frequency of air passengers and the requirement for airlines to decrease expenses prompt the use of carbon fiber in commercial aircraft. The increase in commercial air traffic has led to a rise in the contribution of the aviation sector to global emissions. Aviation causes greenhouse gas emissions that contribute to global warming. There is an increasing trend towards lightweight material for better fuel efficiency and a growing population of large commercial airliners with high composite content. The governing policies revolving around emission control also define the growth of this segment. This trend is further strengthened by activities that increase aircraft age, decrease maintenance costs, and increase efficiency.

The military fixed-wing aircraft segment is projected to witness the fastest growth in the aviation carbon fiber market during the forecast period. Carbon fiber is a vastly useful material with many applications in the military. Hence, features like high strength, lightweight, and high corrosion resistance make the composite material and its various products ideal for military use. All these properties help to enhance the performance, reliability, and survivability of engineered systems in various military applications. This material is widely employed in military planes and helicopter construction. It is used in components such as wings, fuselage sections, rotor blades, and tail sections.

North America accounted for the largest share of the aviation carbon fiber market in 2024. The strong presence of the large airline industry and the increase in investments for enhancement in aircraft fleets by governments and the military is set to promote the development of the market. The increase in the amount of military aircraft bought by the U.S. due to safety issues increases the demand for carbon fiber. Also, commercial aircraft have a higher growth rate due to higher traffic volumes. Moreover, North America has a strong research and development infrastructure that allows the advancement of carbon fiber production and applications.

Asia Pacific is anticipated to witness the fastest growth in the aviation carbon fiber market during the forecasted years. The growth of orders and deliveries in the regions is currently fuelling the growth of the market. Japan, currently a leading supplier of carbon fiber, is seeking to develop new uses for the material with the help of its international aerospace partners. Likewise, the concerns about carbon emissions in aviation and sustainability within the region are boosting the adoption of carbon fiber.

By Raw Material

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

July 2024