January 2025

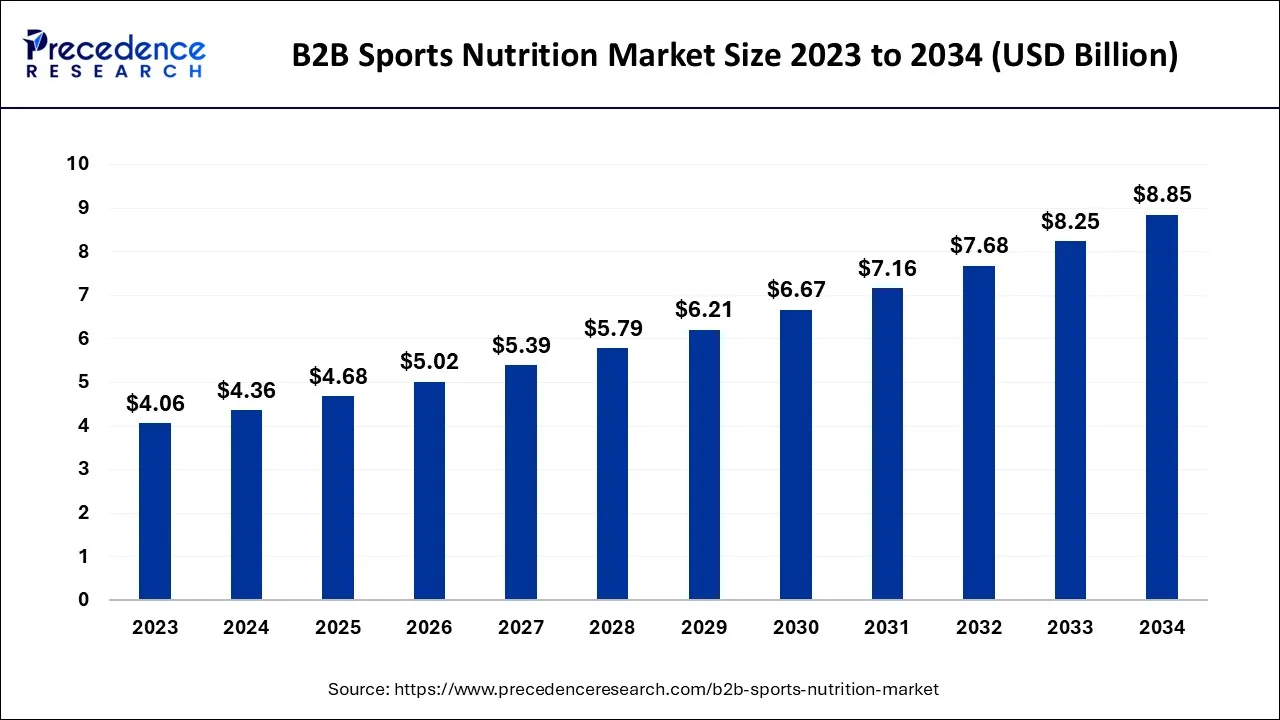

The global B2B sports nutrition market size accounted for USD 4.36 billion in 2024, grew to USD 4.68 billion in 2025, and is expected to be worth around USD 8.85 billion by 2034, poised to grow at a CAGR of 7.34% between 2024 and 2034. The North America B2B sports nutrition market size is predicted to increase from USD 2.75 billion in 2024 and is estimated to grow at the fastest CAGR of 7.42% during the forecast year.

The global B2B sports nutrition market size is expected to be valued at USD 4.36 billion in 2024 and is anticipated to reach around USD 8.85 billion by 2034, expanding at a CAGR of 7.34% over the forecast period from 2024 to 2034. The growing interest in leading a healthy lifestyle and emerging consciousness of sports nutrition products make the market expand internationally.

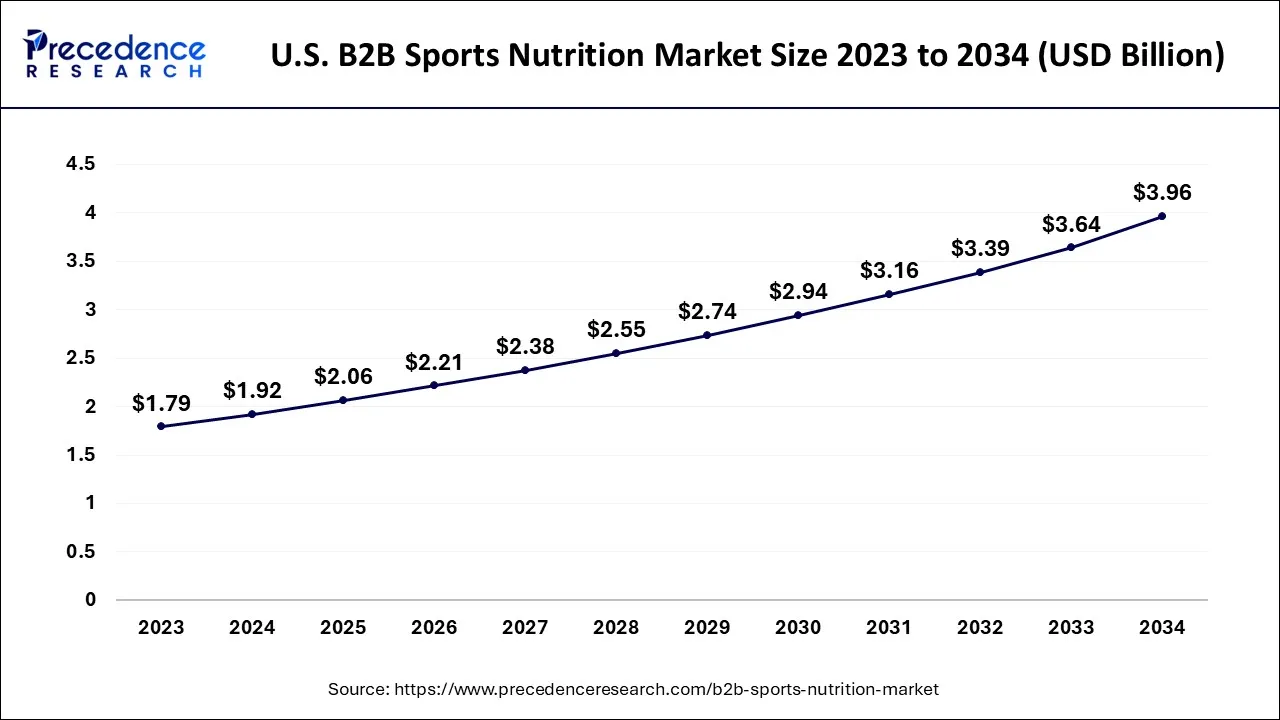

The U.S. B2B sports nutrition market size is exhibited at USD 1.92 billion in 2024 and is projected to be worth around USD 3.96 billion by 2034, growing at a CAGR of 7.5% from 2024 to 2034.

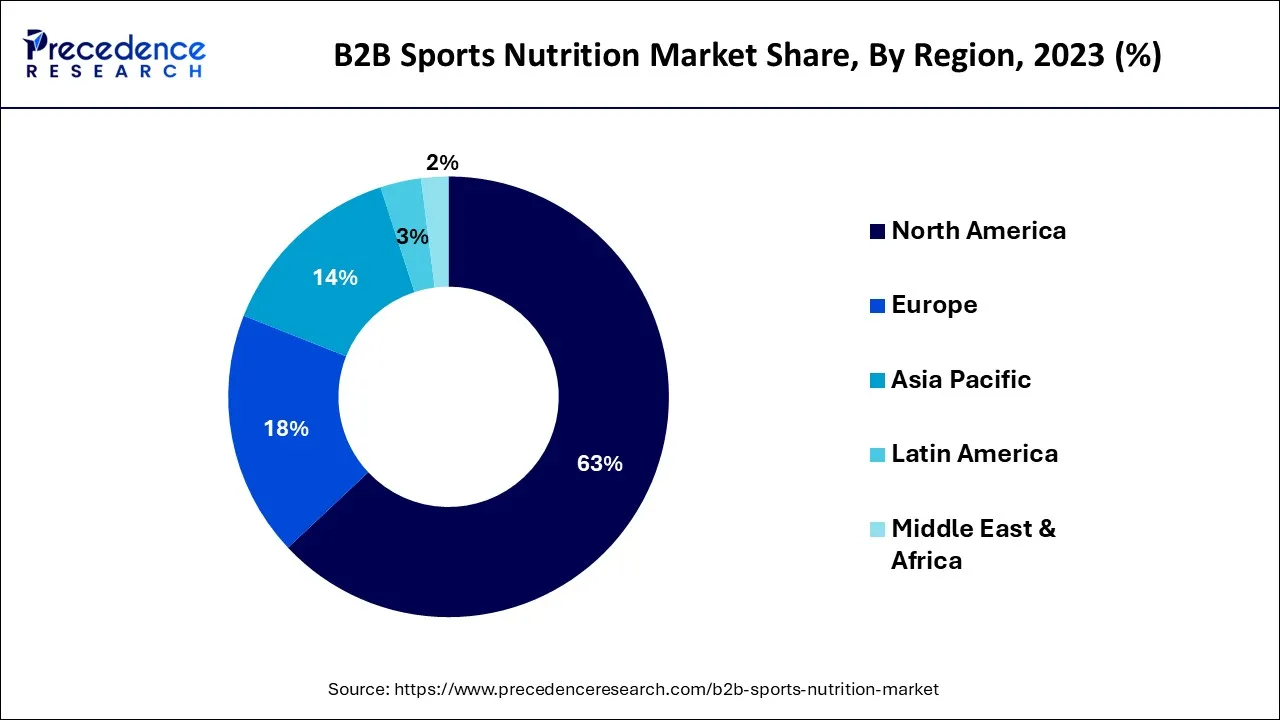

North America led marked and accounted for more than 63% of revenue share in 2023. The growing government initiatives encouraging sporting activities in the U.S. furnish a spike in need. Emerging leaning upon obtaining a healthy and vibrant lifestyle and raising consciousness concerning the value of sports nutrition goods among the community in North America is estimated to positively impact the expansion of the market for B2b sports nutrition. In addition, growing gyms and fitness centres across the United States and Canada bolster market growth. Growing product launches and the presence of key regional players are fundamental reasons leading the trade for B2B sports nutrition in the region.

Europe region is anticipated to growing at a fastest CAGR over the predicted period, attributed to an increasing realization of the prominence of a healthy lifestyle in the area. A rise in the number of athletes and recreational sports enthusiasts in Europe ultimately influences the demand. Progress in the digital framework in Europe supports development facilities for web-based platforms. The upsurge in the need for innovative, new, and tested elements that boost endurance and construct muscle is estimated to push demand for sports nutrition goods in Europe.

The expanding trend of external sporting activities is also predicted to induce the region's demand for B2B sports nutrition. Moreover, web-based sales channels are evolving to render improved availability and possibility to users that would remarkably ride the market for B2B sports nutrition.

Sports Nutrition refers to consuming nutrients such as proteins, minerals, amino acids, vitamins, and carbohydrates to increase power and stamina and improve athletic performance. It helps to increase muscle mass, speed up muscle recovery, and give the body the fuel for high-intensity activities requiring sufficient energy and stamina. Sports nutrition includes post-workout supplements used for muscle growth and healing and pre-workout nutraceuticals used to boost energy levels and hydration and increase muscle strength. Protein supplements lead the market, with a share of 70% in overall consumption.

Sports nutrition companies see this as an opportunity to bridge the gap and capitalize on the growing demand. They ensure that the products are approved by the food safety and standards authority of India (the regulatory body for food products) and adhere to the guidelines of the Indian Council of Medical Research (ICMR) and the World Health Organisation’s good manufacturing practices (GMP).

Nutrition influences athletes’ performance, but various individuals react differently to the same meals, nutrients, and supplements. The government has created more facilities for sportspersons through professional sporting leagues, which provide services for more athletes to take up sports as a profession.

The requirement for diverse types of protein bars, energy drinks, dietary & health supplements, and among sportspersons and bodybuilders has accelerated the market expansion. Various natural components are used to build sports nutrients derived from vegetable starch, sugars, milk, fiber, egg protein, herbs, vitamins, and minerals. The most popular sports supplementation are energy amplifiers, recovery strengths, and performance enhancers sportsperson performance improvement, weight loss maintenance, health, and well-being.

The sports nutrition industry has seen massive growth, mainly using supplements, which have been tied to steroids. Growing sports engagement and concern about physical well-being amongst youth drive the need for sports nourishment commodities and serve the market expansion.

The government brought consciousness about the significance of health in daily life- Khelo India and Fit India. Campaigns have stimulated the country's renewal of sports culture and increased investment in sports infrastructure in recent years. The outbreak has put preventative healthcare in the center. Doctors advised wellness Nutritional Supplements during the pandemic, ensuing in higher consciousness and acceptance.

They help them to fulfill their body requirement and enhance performance and recovery ratios by nourishing them with essential vitamins, proteins, minerals, fats, and carbohydrates. The notable elements fostering market advancement are the growing popularity of organic food, drink, protein, and nutritional bars, ascending expenditure, evolving lifestyle, and emerging globalization.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.36 Billion |

| Market Size by 2034 | USD 4.36 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.34% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Application and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The fast pace of urbanization, non-traditional consumer growth, and increased health clubs and fitness centers are the dominating driving factors for the change throughout the forecasting market. Different innovations in the sports nutrition market for making the products safer and more effective to consume are expected to boost the need for sports fitness nutrition in the forthcoming years. Performance-improving supplements like creatine and protein powders have risen by about 80% over the past five years. Even probiotics and botanical extracts are predicted to have a greater need from athletes to improve their gut health.

Awareness about diseases, high commodity prices, low economic conditions, and shortage of suitable insurance methods limits the adoption of B2B sports nutrition products across developing regions of the globe. Therefore, announcing new products with low prices and growing efforts for market perforation in these regions can offer profitable growing facilities for the B2B sports nutrition players.

The regular rise in adolescence selecting sports as their career is also vital for the market's expansion. The increasing awareness of diseases, increased risk of damage, absorbing high-fiber nutritious food, and development of e-commerce bases also hit the market growth of sports nutrition—proficiency in R&D, mainly in developing nations that encourage sports nutrition and sports in general. Peoples are more deliberate about physically fit because of greater realization and literacy. Social media thrive with pictures of celebrities and youth posting images of their carved and toned bodies.

The recovery segment dominated the B2B sports nutrition market and held the largest revenue share of around 25% in 2023. Growing awareness concerning a physically healthy lifestyle with easy availability of commercial sports restoration goods on retailing shelves and web-based platforms is one of the primary reasons for the market growth. Additionally, the surge in fitness centers and gyms across the world is another significant reason contributing to growth.

Increasing health awareness and the emerging trend of self-diagnosis amongst customers are predicted to bolster the demand. Industries focus on product innovation, and consistently improving their pipeline with new constituents is estimated to enhance market growth throughout the forthcoming years. For instance, in November 2017, Apres announced vegan plant-derived protein beverages to help their full-body nutritional refilling. Later, in 2019, Israel-derived nutrition business InnovoPro Ltd launched vegan chick-pea protein powder.

The endurance section is estimated to register a substantial growth rate through the estimated period. This advancement is assigned to increasing involvement in sports and fitness activities such as marathons, running, weight lifting, cycling, etc. Raising health awareness and rising healthcare expenses are estimated to positively influence growth over the years. In July 2020, the Chelsea football club launched blue fuel, a new sports nutrition service to design a customized meal program to be checked by a mobile app.

It also addresses health purposes for the players to enhance their performance. According to a study, endurance sports were one of the most vital developing areas. Moreover, nature-based ingredients such as beet juice, amla, tulsi, and ashwagandha are gaining popularity in the stamina commodity stretch and are expected to serve market growth.

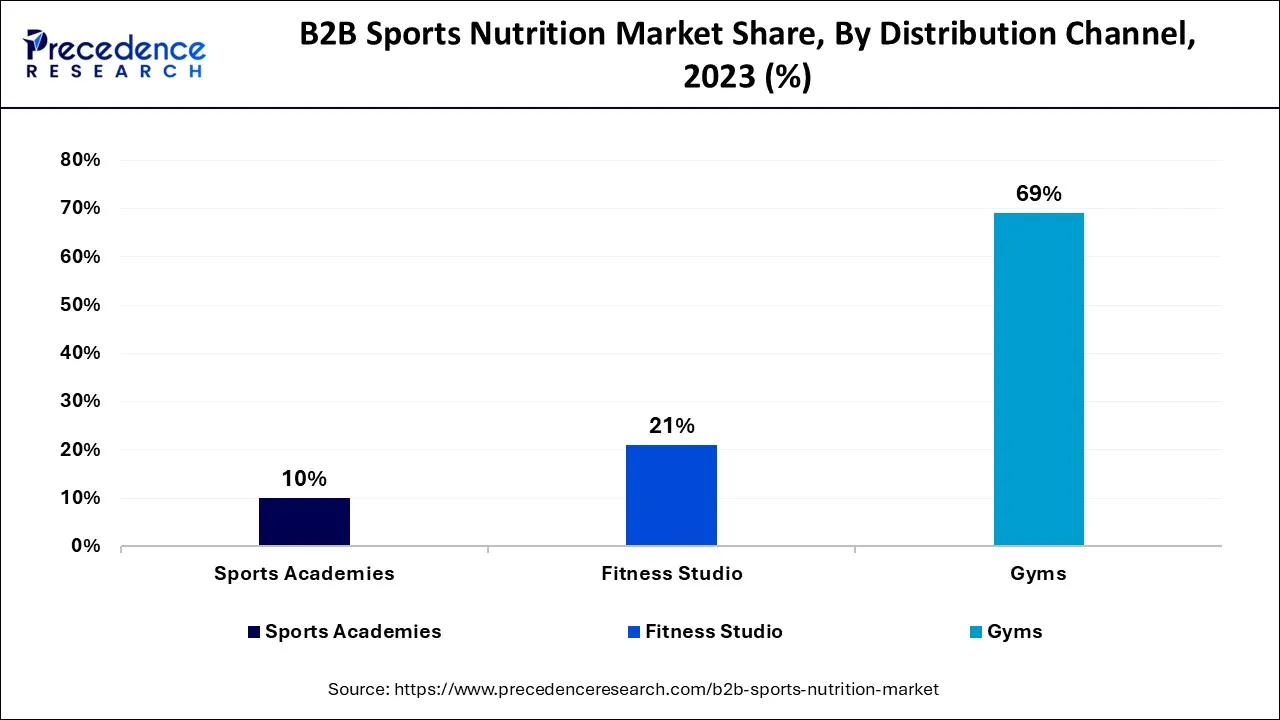

The gym segment led the market and hold a maximum market share of around 69% in 2023. Growing participation at gyms is the pivotal leading source for the region. Health awareness is rising amongst fitness freaks, influencing the need for sports nutrition products. Partnerships among sports nutrition firms and established gyms to meet dietary needs contribute to development. Gyms have been endorsing a vast range of sports nutritional goods that render buyers' consultation care before purchasing.

The fitness studio section is expected to register a lucrative CAGR for the predicted years. This incremental growth is attributable to the rising popularity of health studios, rendering a wide array of sporting and fitness activities like yoga, personal training, functional cross-training, children's fitness programs, and HIIT to align with the health and fitness freaks.

Personalized and customized nutrition programs and counselling are provided along with one-one consideration on training crews to bolster their fitness journey. Thereby, the rise in the need for nutritional guidance and healthcare is scaling up growth. The Covid-19 outbreak contrived these health clubs to formulate innovative approaches to review earning flows via online sessions and external training classes.

Segments Covered in the Report

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

November 2024

March 2023