January 2025

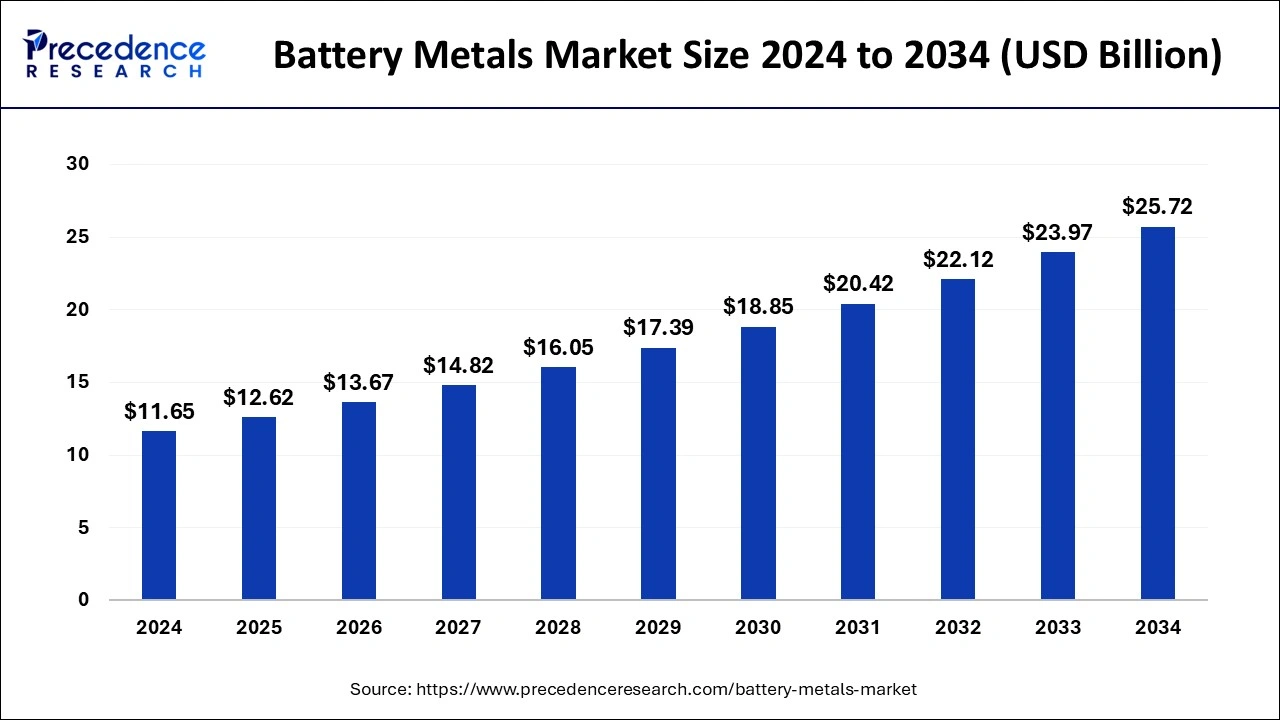

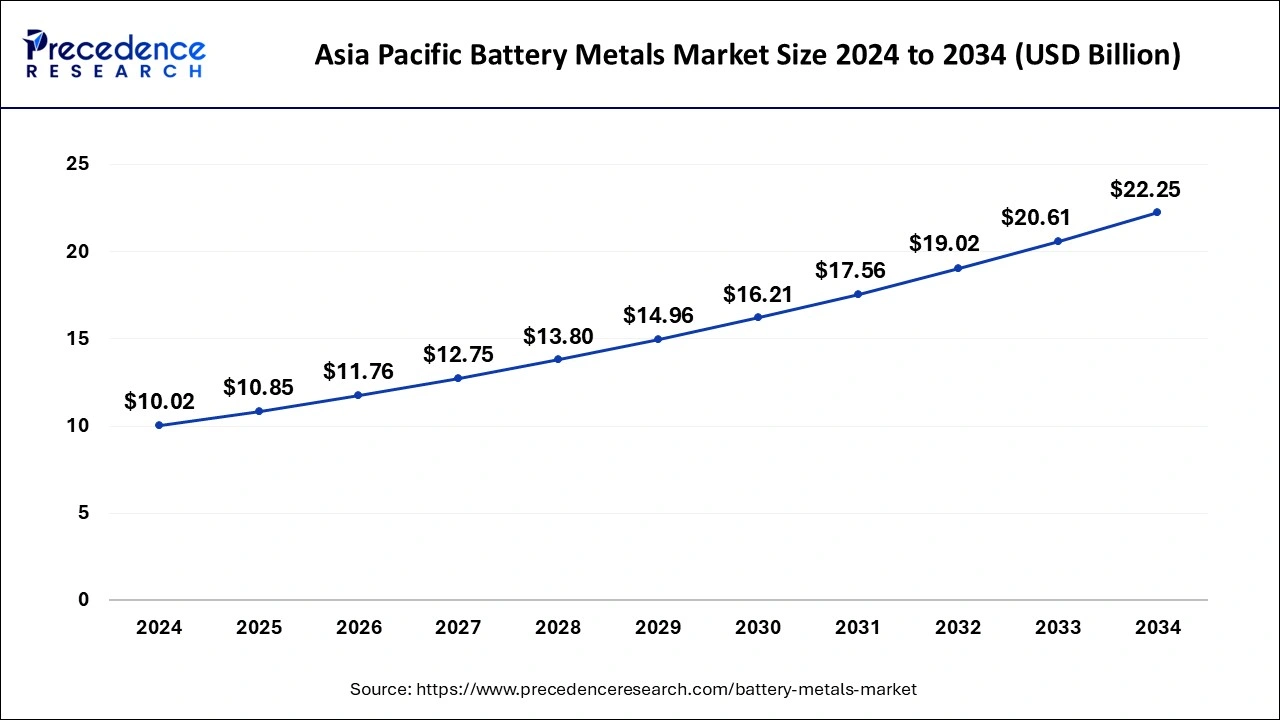

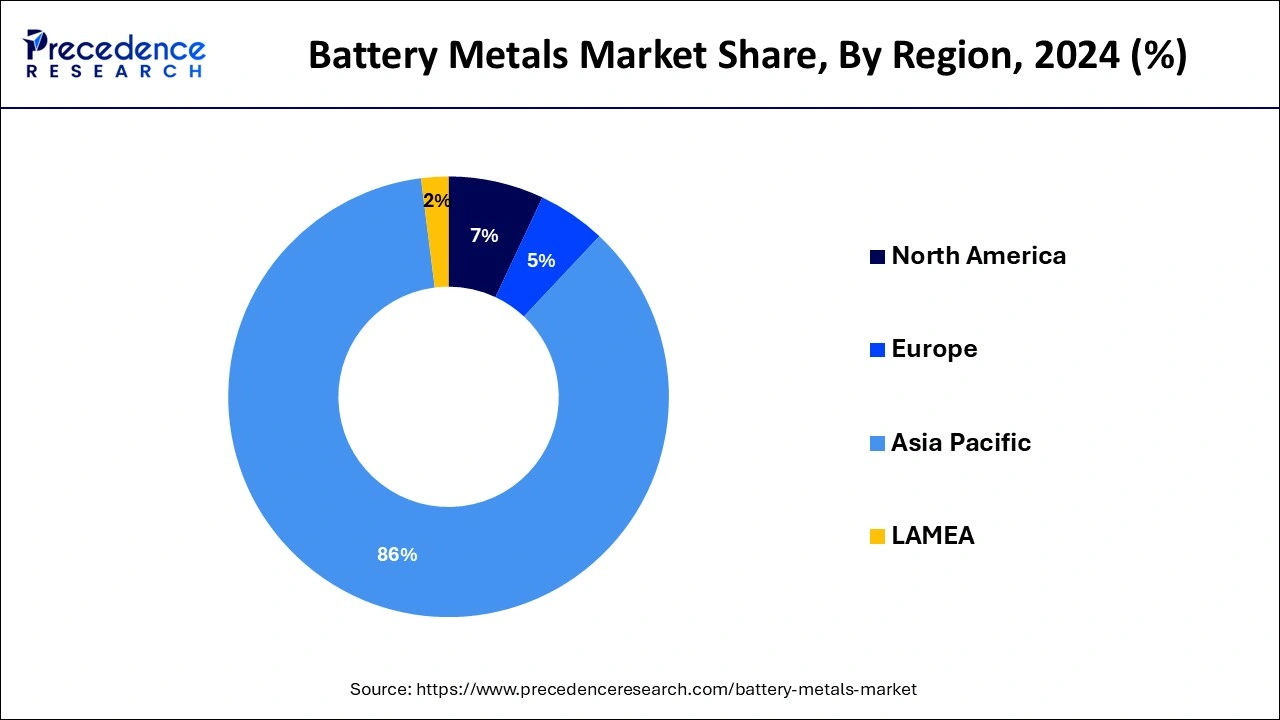

The global battery metals market size is calculated at USD 12.62 billion in 2025 and is forecasted to reach around USD 25.72 billion by 2034, accelerating at a CAGR of 8.24% from 2025 to 2034. The Asia Pacific battery metals market size surpassed USD 10.85 billion in 2025 and is expanding at a CAGR of 8.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global battery metals market size was estimated at USD 11.65 billion in 2024 and is predicted to increase from USD 12.62 billion in 2025 to approximately USD 25.72 billion by 2034, expanding at a CAGR of 8.24% from 2025 to 2034. Due to the increase in EV sales, battery metals, including lithium, cobalt, nickel, and other elements, are in high demand, which has risen the battery metals market.

The Asia Pacific battery metals market size was estimated at USD 10.02 billion in 2024 and is predicted to be worth around USD 22.25 billion by 2034 with a CAGR of 8.30% from 2025 to 2034.

Asia Pacific dominated the battery metals market in 2024. The area, which includes nations like South Korea, China, Japan, and India, is rapidly becoming more urbanized and industrialized. The need for battery metals is rising due to this expansion, and these industries include consumer electronics, energy storage solutions, renewable energy systems, and electric cars. Globally, the greatest market for electric cars in terms of production and consumption is Asia Pacific. To encourage the use of electric vehicles, the governments in the area are enforcing strict pollution standards and providing incentives. Due to the increase in EV sales, battery metals, including lithium, cobalt, nickel, and rare earth elements, are in high demand.

The government has invested around USD 2.5 billion in this incentive scheme, which seeks to establish a local manufacturing capacity of 50 GWh of ACC and 5 GWh of niche ACC capacity (planned). The program intends to improve exports and generate economies of scale, helping big domestic and international manufacturers develop a competitive ACC battery production in India. To receive incentives under the program, the government has agreements in place with three bidders, namely Reliance New Energy Solar, Ola Electric, and Rajesh Exports.

North America is expected to grow at a significant pace in the battery metals market during the forecast period. The use of electric vehicles increased significantly throughout North America, especially in the United States. The demand for battery metals like nickel, cobalt, and lithium increased due to the spike in EV sales because these metals are necessary for electric car batteries. The leading technologies and automakers that are actively working to advance battery technology are based in North America. The research expenditures for these developments have increased customer interest in electric cars and fueled the expansion of the battery metals industry in the area.

North American governments, particularly the federal government of the United States and several state governments, offered incentives and assistance to encourage the development and use of electric cars. These incentives came in the form of tax breaks, refunds, subsidies for infrastructure related to charging, and emission-reducing regulations. Support like these pushed investment in electric vehicles by manufacturers and customers alike, increasing demand for battery metals.

The battery metals market refers to elements or minerals termed battery metals that are essential to the manufacturing of rechargeable batteries, especially those used in energy storage systems and electric vehicles (EVs). Graphite, cobalt, nickel, and lithium are a few examples of battery metals. These metals are necessary for the development of renewable energy and transportation technologies because they have a significant impact on the functionality and efficiency of batteries. The market is driven by the growing popularity of electric cars and the energy storage systems of metal batteries.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.24% |

| Market Size in 2025 | USD 12.62 Billion |

| Market Size by 2034 | USD 25.72 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Metal, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing electric vehicle adoption

The growing popularity of electric cars is one of the main factors propelling the battery metals market. An integral part of electric vehicles (EVs) is lithium-ion batteries, which are made of battery metals like manganese, nickel, cobalt, and lithium. The automobile industry's shift to electric vehicles in an effort to cut pollution is driving up demand for battery metals.

Energy storage systems

The energy storage system of metal batteries can grow the battery metals market. In order to stabilize renewable energy sources like solar and wind power, energy storage systems, including grid-scale batteries and residential energy storage options, are becoming more important. The energy sector's need for battery metals is fueled by their criticality to various storage systems.

Environmental concern

The battery metals market may be slowed down by environmental concerns since the mining and processing of these metals may have a negative influence on the environment, including carbon emissions, habitat loss, and water contamination.

Advancement in technology

The advancement in battery metal technology may be an opportunity to boost the battery metals market. The demand is further increased by advances in battery technologies, such as solid-state batteries and enhanced lithium-ion batteries, which require a larger concentration of particular metals.

The cobalt segment dominated the battery metals market in 2024 Because cobalt is a necessary component of lithium-ion batteries, which power a large number of electronic products and electric cars, cobalt dominates the market. Cobalt has a special quality, which includes stability and high energy density; it is essential for improving performance and prolonging battery life. The cobalt’s value and the market are driven by its limited supply and manufacturing capabilities.

The cobalt resources in India are estimated to be around 44.91 million tonnes. The majority of these resources are located in the state of Odisha, with smaller amounts in Jharkhand and Nagaland.

The lithium segment is expected to grow at the highest CAGR in the battery metals market during the forecast period. Lithium is important to lithium-ion batteries, which are needed to power electric vehicles (EVs), renewable energy storage systems, and a variety of portable electronic devices. Lithium is expected to expand in the market. The demand for lithium is a result of the world’s transition to more environmentally friendly sources of energy and the electrification of transportation.

The starter, lighting, and ignition (SLI) segment dominated the battery metals market in 2024. Significant expansion in the automobile sector in 2023 was a major source of dependence for the SLI segment. The need for batteries increased along with the production and sales of electric cars (EVs) and hybrid vehicles, especially those that included battery metals like nickel, cobalt, and lithium. The battery technology has advanced, making batteries more attractive for a wider range of applications, especially in terms of energy density and efficiency. This covered consumer electronics, renewable energy integration, energy storage systems, and conventional SLI applications. Worldwide, a large number of countries have enacted laws and other incentives to encourage the use of electric vehicles and lower greenhouse gas emissions. The demand for battery metals was further fueled by rising investments in the production of EVs and related batteries.

The electric vehicles segment is expected to grow rapidly in the battery metals market during the forecast period. Consumers are becoming more interested in electric cars due to ongoing developments in battery technology, notably in terms of energy density, charging speed, and longevity. Better battery performance solves issues like limited charging infrastructure and range anxiety, which promotes EV adoption.

The purchase decisions are being influenced by a growing awareness of environmental problems among businesses and consumers. Compared to conventional internal combustion engine cars, electric vehicles are thought to be cleaner, resulting in reduced carbon emissions and less air pollution in cities. The global investments in charging infrastructure are increasing, which makes owning and operating an electric car more convenient for customers. The acceptance of EVs is also being aided by the availability of fast charging stations and faster charging times.

By Metal

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

January 2025