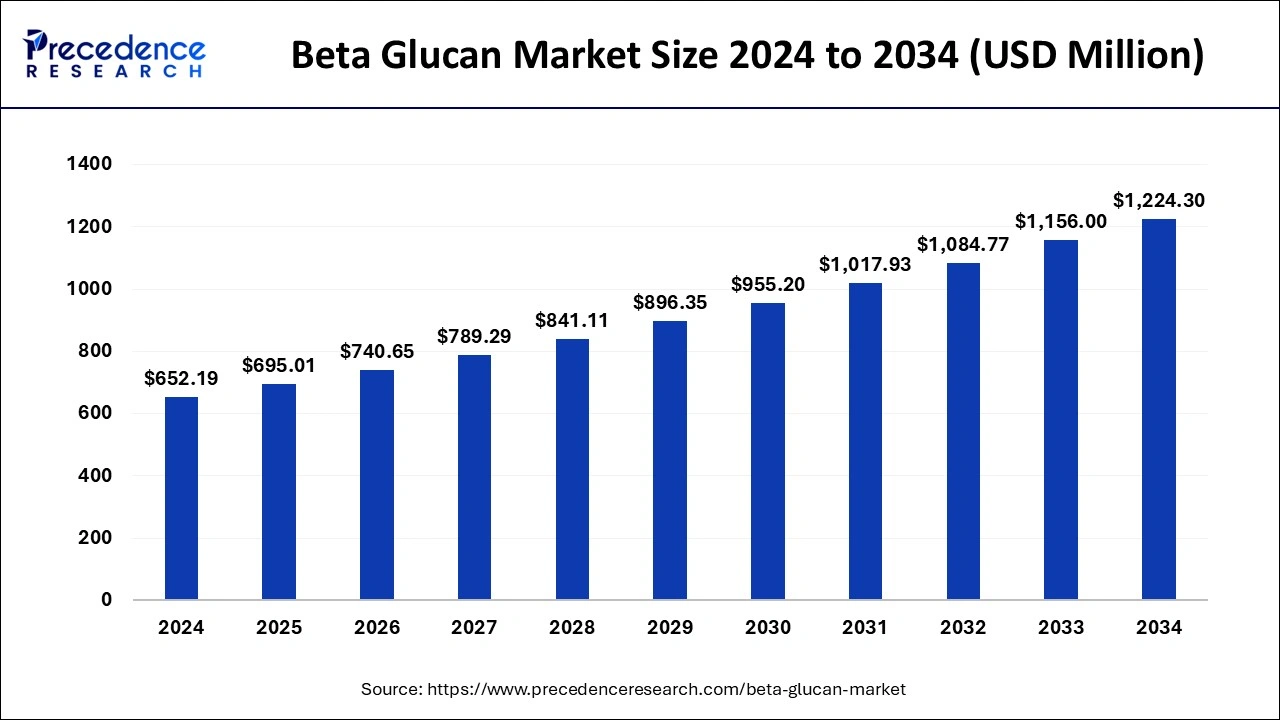

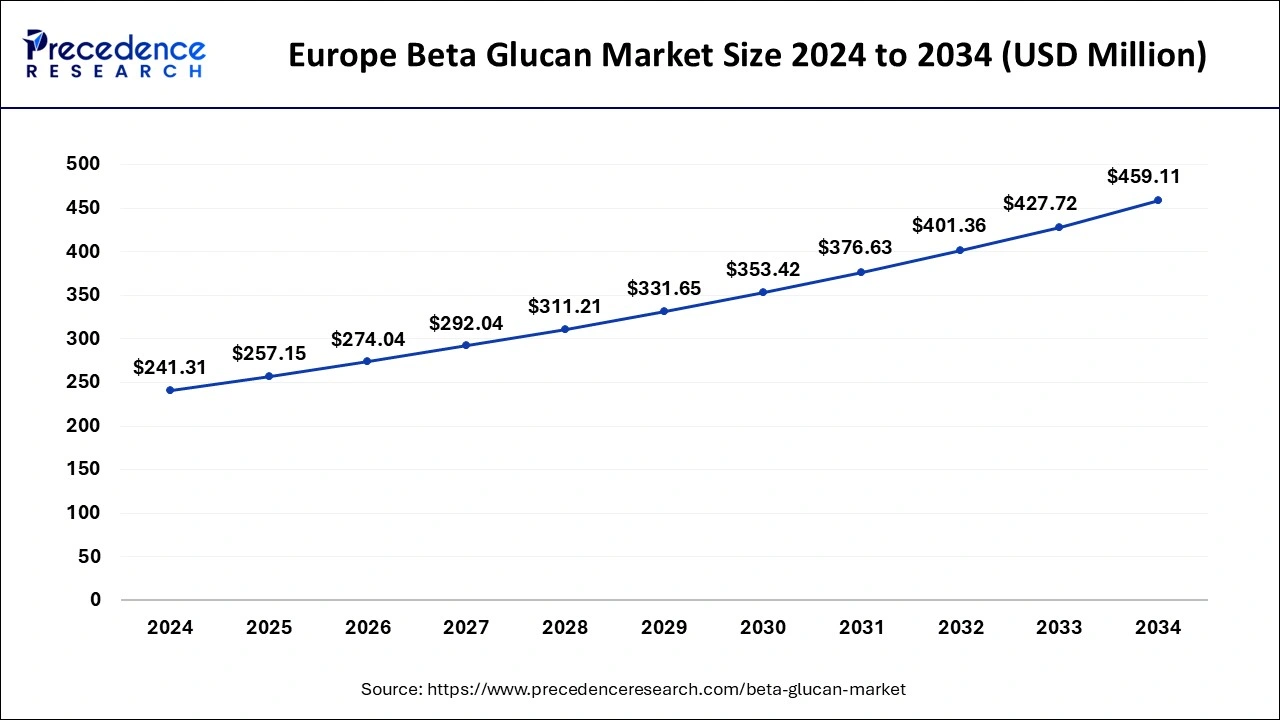

The global beta glucan market size is calculated at USD 695.01 million in 2025 and is forecasted to reach around USD 1,224.30 million by 2034, accelerating at a CAGR of 6.50% from 2025 to 2034. The Europe beta glucan market size surpassed USD 257.15 million in 2025 and is expanding at a CAGR of 6.64% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global beta glucan market size was estimated at USD 652.19 million in 2024 and is predicted to increase from USD 695.01 million in 2025 to approximately USD 1,224.30 million by 2034, expanding at a CAGR of 6.50% from 2025 to 2034. Consumer demand is being driven by growing awareness of beta-glucan's health benefits, which include support for the immune system, lowering of cholesterol, and possible anti-cancer characteristics.

The Europe beta glucan market size was valued at USD 241.31 million in 2024 and is anticipated to reach around USD 459.11 million by 2034, poised to grow at a CAGR of 6.64% from 2025 to 2034.

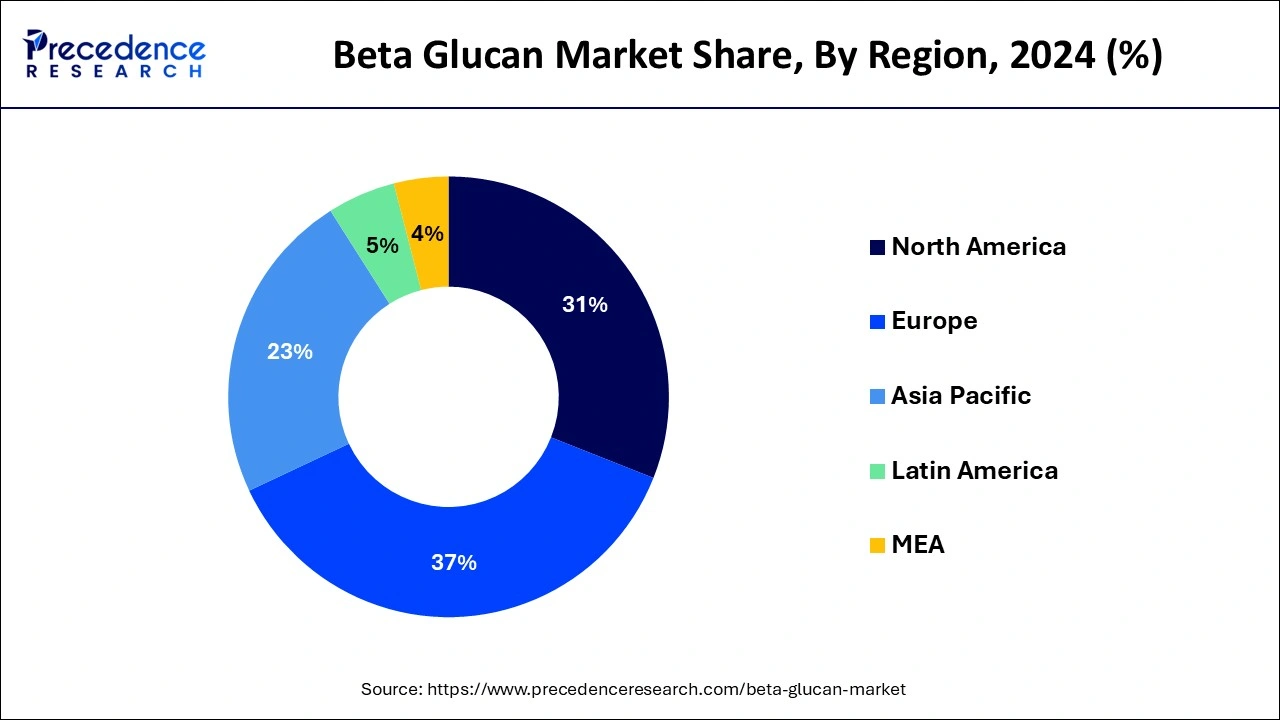

Europe led the global market with the highest market share of 37% in 2024. Oats, barley, yeast, and some types of mushrooms contain a soluble fiber called beta-glucan. It has drawn interest due to its possible advantages for the immune system, lowering cholesterol, and controlling blood sugar. Because of their emphasis on health and wellness, European nations like Sweden, Finland, and Norway have been especially active in marketing foods and supplements high in beta-glucan.

Furthermore, the market's expansion has been aided by the approval of health claims associated with it by the European Food Safety Authority (EFSA). Numerous product improvements have hit the market, such as cosmetic goods, dietary supplements, and food and drink items enhanced with beta-glucan. Businesses in the area have been spending money on R&D to improve the efficacy of beta-glucan products and develop new formulations.

Asia Pacific is expected to grow significantly during the forecast period. The consumers in this region are looking for products with practical benefits as they become more health concerned. Due to its ability to decrease cholesterol and strengthen the immune system, beta-glucan is becoming more and more popular as a functional ingredient in food, drinks, and dietary supplements.

The market for nutraceutical products has surged in nations like China, India, and Japan due to a burgeoning middle class and rising disposable incomes. To meet this need, beta-glucan is added to various items, such as medications, dietary supplements, and functional foods. Asia Pacific's food and beverage businesses are increasing due to convenience food preferences, changing lifestyles, and urbanization.

A significant factor propelling the beta glucan market has been the rise in consumer interest in health and wellness. Customers are looking for functional foods and supplements that include beta-glucan because of its many health advantages, which include heart health and immunological support. Beta-glucan is a typical functional ingredient in food and beverage goods such as bread, cereals, drinks, and supplements. Its increasing integration into different food and beverage formulations can be attributed to its purported health advantages and potential to improve the nutritional profile of products. Novel products and formulations have been introduced due to ongoing research and development efforts aimed at comprehending beta-glucan's roles and health benefits.

Because beta-glucan possesses calming, anti-aging, and moisturizing qualities, it is widely used in the cosmetic and personal care industries. Skin care products containing beta-glucan are becoming increasingly popular among consumers looking for natural and efficient skincare treatments. Market dynamics can be influenced by regulatory approvals and recommendations about using beta-glucan in food, beverage, and cosmetic products. Manufacturers must adhere to rules and specifications, as this affects product availability and customer confidence. The presence of diverse participants, such as food producers, ingredient suppliers, and pharmaceutical companies, characterizes the beta-glucan industry. Factors like product innovation, pricing, and distribution channels generate competition in the beta glucan market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.50% |

| Market Size in 2025 | USD 695.01 Million |

| Market Size by 2034 | USD 1,224.30 Million |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Source, By Application, and By Product |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expanding application areas

The primary driver of the beta glucan market is the incorporation of beta-glucan into functional foods and beverages is attributed to its ability to enhance gut health, decrease cholesterol, and modulate the immune system. Goods fortified with beta-glucan, such as fruit juices, cereal bars, yogurt, and oatmeal, are gaining popularity among consumers concerned about their health. Because of its immunomodulatory qualities, beta-glucan is being investigated for use in medicinal formulations.

Its potential to improve vaccination efficacy, its use as an adjuvant in cancer therapy, and its anti-inflammatory qualities in treating autoimmune illnesses are all reasons it is being researched. The animal nutrition industry uses beta-glucan as a feed supplement because it can boost immune system performance and promote growth in cattle, poultry, and aquaculture.

High cost

Polysaccharides called beta-glucans are present in the cell walls of lichens, bacteria, fungi, yeasts, algae, and plants, including barley and oats. It can be difficult to extract pure beta-glucans from these sources without using extraction, purification, and concentration processes. These procedures frequently require expensive staff and specialized equipment, raising costs. Although beta-glucans can be obtained from a variety of natural sources, some of these sources are scarce or require particular growing conditions. Developing novel extraction methods, combinations, and uses for beta-glucans frequently necessitates significant investments in research and development processes that can hinder the growth of the beta glucan market.

Growing demand in the food and beverage industry

Functional foods and drinks are becoming increasingly popular since they provide health advantages over a simple diet. Producers are adding beta-glucan to various goods, including bread, cereal bars, drinks, and dairy products, to improve the nutritional value and attract customers concerned about their health. To satisfy customer requests for healthier options, food and beverage firms always develop new ideas. They are creating novel product variations and formulations that inventively use beta-glucan to cater to various dietary requirements and consumer preferences. The expansion of the health and wellness industry and growing consumer interest in functional ingredients are driving the rise of the beta glucan market itself.

The cereal segment held the largest share, in 2024, of the beta glucan market. The use of beta-glucan derived from cereals, including wheat, barley, and oats, is the cereal segment in the market. Certain grains and fungi's cell walls contain a soluble fiber called beta-glucan. It is well-known for its numerous health advantages, such as decreasing cholesterol, strengthening the immune system, and boosting heart health. Oats and other cereals are exceptionally high in beta-glucan and have been the subject of much research due to their possible health benefits. Therefore, food makers frequently add beta-glucan from cereals into various items, including breakfast cereals, bread, snacks, and beverages, to improve their nutritional profiles and appeal to health-conscious consumers.

The yeast segment is expected to gain a significant share in the beta glucan market during the forecast period. Due to their numerous health advantages and diverse industrial applications, yeast-derived beta-glucans, particularly those isolated from strains of Saccharomyces cerevisiae (baker's yeast) and other yeast species, are becoming increasingly well-known. Beta-glucans are frequently found in medications, cosmetics, food and beverage additives, and dietary supplements. Beta-glucans generated from yeast are well known for strengthening the immune system. They are frequently found in nutritional supplements meant to boost immune function since they are thought to enhance the body's immunological response. Pharmaceutical formulations also employ yeast-derived beta-glucans. They could be used to create medications and dietary supplements to treat ailments like diabetes, high cholesterol, and specific kinds of cancer.

The food & beverages segment held the largest market share in 2024. The food and beverage segment in the beta-glucan industry has grown steadily over the last several years. Oats, barley, yeast, and some types of mushrooms contain a soluble fiber called beta-glucan. It has become well-known for its many health advantages, which include lowering cholesterol, boosting the immune system, and possibly having anti-inflammatory qualities. Within the food sector, beta-glucan is frequently used in many products, including dairy products, cereal bars, bread, and beverages. It is commonly added to improve these goods' nutritional profiles and satisfy consumer desire for functional foods—foods that provide health advantages beyond simple sustenance.

The cosmetic & personal care segment is expected to grow significantly during the forecast period. Over the past few years, the beta glucan market's cosmetics and personal care category has grown steadily. Because of its many health benefits, beta-glucan, a naturally occurring polysaccharide in foods like yeast, barley, and oats, has become increasingly popular in skincare and personal care products. Antioxidant qualities of beta-glucan aid in the fight against free radicals, which hasten the skin's aging process. Additionally, it increases the creation of collagen, which improves skin elasticity and minimizes the appearance of fine lines and wrinkles. Due to these qualities, it is a highly sought-after component of skin care products that fight to age, like eye creams and serums.

The soluble segment held the largest share in 2024. Typically, beta-glucans soluble in water are referred to as the solubles. A class of polysaccharides called beta-glucans is present in the cell walls of lichens, bacteria, fungi, yeasts, algae, and plants, including barley and oats. Soluble beta-glucans can lower cholesterol, modulate the immune system, and possibly even reduce inflammation. Because of its valuable qualities, this sector of the market is frequently pursued by various businesses, including food and beverage, medicines, cosmetics, and dietary supplements. It is possible to extract soluble beta-glucans from foods such as barley, oats, yeast, and mushrooms.

The insoluble segment is expected to expand at the fastest rate over the forecast period. A class of beta-glucans that are insoluble in water is called the insoluble segment in the beta glucan market. Polysaccharides called beta-glucans can be found in various natural foods, including yeast, oats, barley, and mushrooms. The primary source of insoluble beta glucans is the cell walls of certain fungi and plants. Insoluble beta-glucans do not dissolve in water, in contrast to soluble beta-glucans, which do so and create a gel-like substance. Instead, they help maintain bowel regularity by giving the digestive system more mass.

By Source

By Application

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client