February 2025

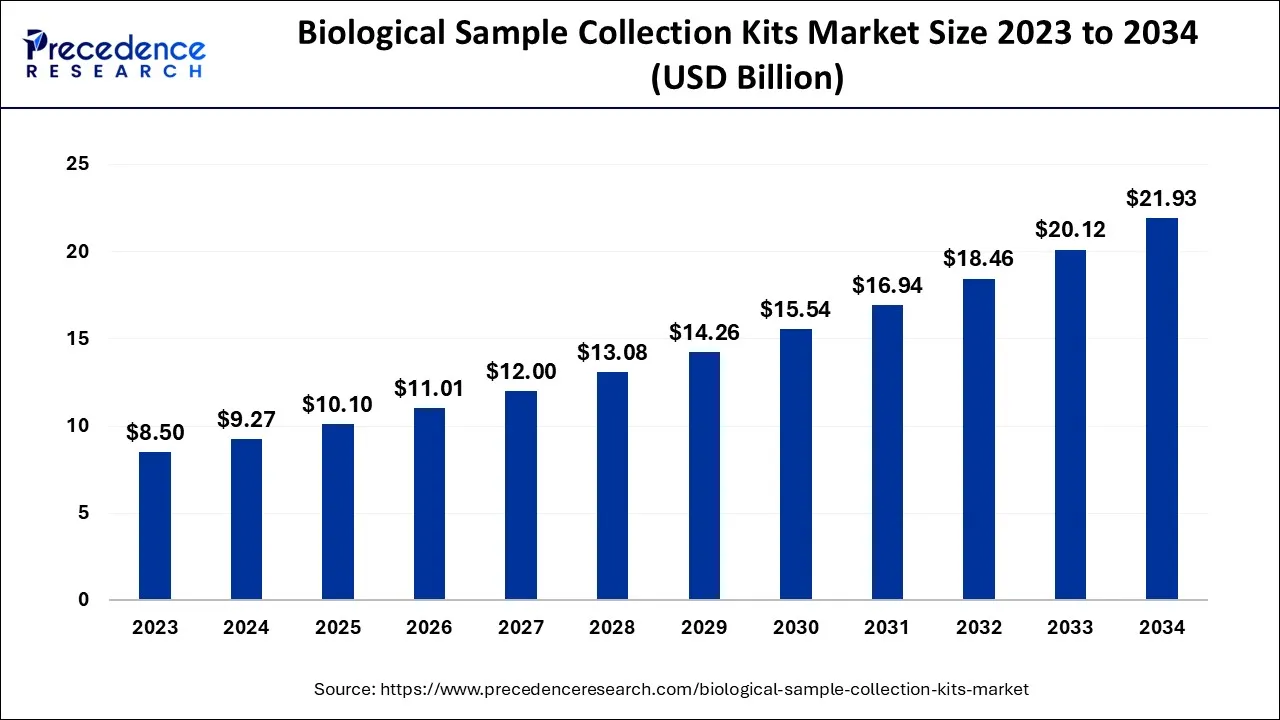

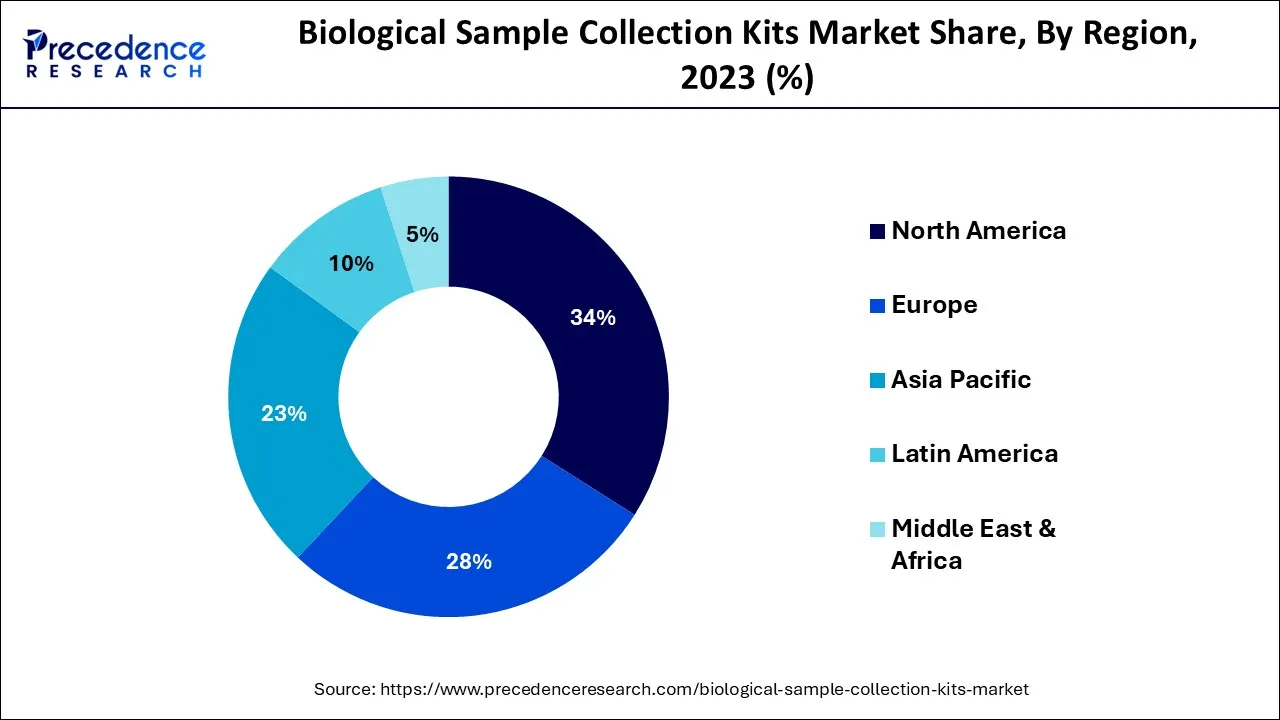

The global biological sample collection kits market size accounted for USD 9.27 billion in 2024, grew to USD 10.10 billion in 2025 and is expected to be worth around USD 21.93 billion by 2034, registering a CAGR of 8.99% between 2024 and 2034. The North America biological sample collection kits market size is calculated at USD 3.15 billion in 2024 and is estimated to grow at a CAGR of 9.15% during the forecast period.

The global biological sample collection kits market size is calculated at USD 9.27 billion in 2024 and is projected to surpass around USD 21.93 billion by 2034, growing at a CAGR of 8.99% from 2024 to 2034.

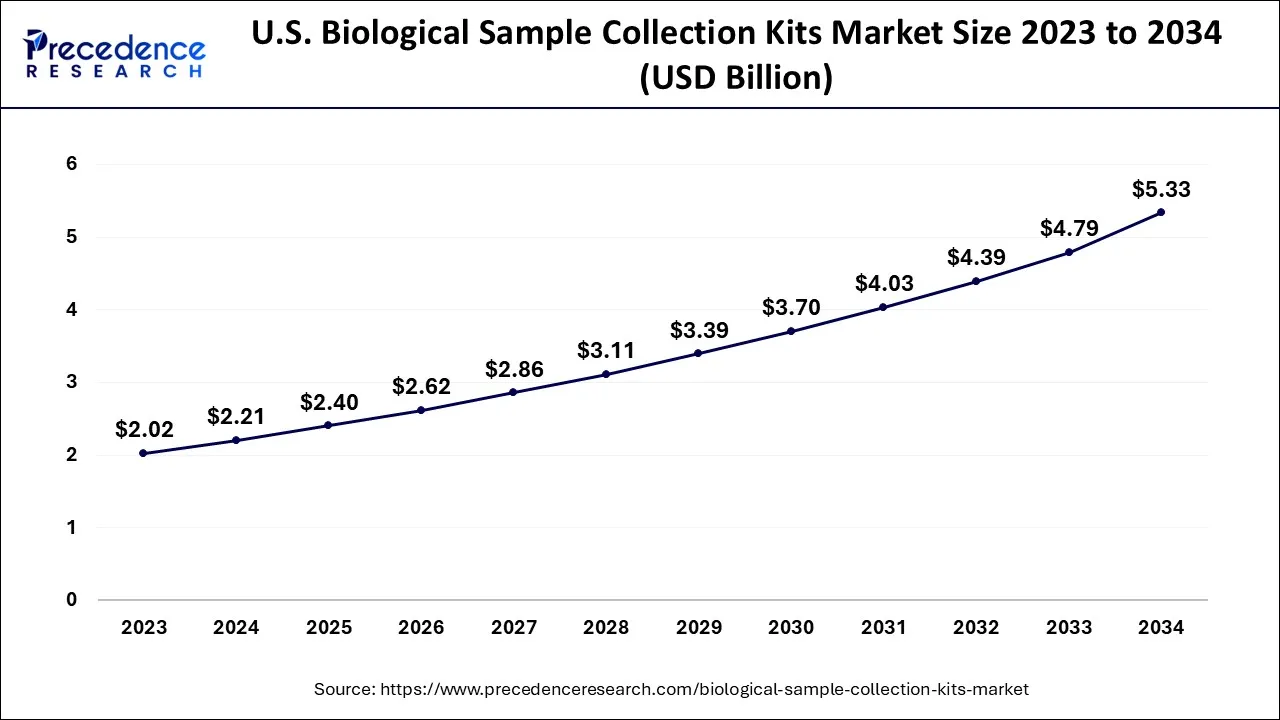

The U.S. biological sample collection kits market size is exhibited at USD 2.21 billion in 2024 and is projected to be worth around USD 5.33 billion by 2034, growing at a CAGR of 9.23% from 2024 to 2034.

North America is dominating the market during the forecast period. The rising need for high-quality kits for data reproducibility, the presence of top-notch pharmaceutical businesses in the United States, high technology growth from top companies' support, and the growing need for customized medicine are the factors implementing the growth of the biological sample collection kits market. Even the senior population's regular health checkup has promoted homemade sample collection kits. The rapid development and adoption of advanced healthcare services also acts as a major driver for the market’s growth in North America.

Asia-Pacific is the fastest-growing segment in the biological sample collection kits industry during the predicted period. In Asia Pacific, more populated countries such as India and China, have a vast patient pool in diabetes, cardiovascular diseases, and infectious disorders, such elements act as a driver for the market's growth. Along with the rising cases, the demand for biological sample collection kits for the proper diagnosis and treatment fuels the market’s growth in the region. The increasing investments by significant associations and governments in medical research activities stimulate the expansion of the biological sample collection kits market. As per the news in the Times of India, India is reported as the diabetes capital of the world, accounting for 17% of the total world diabetes patient population. It has also been forecasted to rise to 135 million in 2045. Considering the rising cases of diabetes, the requirement for sample collection kits is prone to grow in the upcoming period which is observed to initiate the phase of innovation of sample collection kits in the region.

The global biological sample collection kits market revolves around the development, innovation, and distribution of kits and devices used in the collection, transportation and preservation of biological samples for diagnostic, research, and other medical purposes. Such kits ensure the safe and efficient collection and transportation of multiple biological specimens including blood, urine, saliva and others.

Specimen containers, swab collection tubes, pipettes, collection devices, and preservatives are some basic components involved in the global biological sample collection kits market. The market players involved in the global market offer a wide range of products from standard sample collection kits to specialized kits for specific applications. The development of specialized and customized/personalized kits for the collection of biological specimens is expected to accelerate the growth of the market.

The market's growth is attributed to the increasing need for faster diagnosis of chronic diseases, increasing population awareness, and demand for sample preparation for various diagnoses. Moreover, improving clinical trials, growing research and development activities in different life science sectors, and the emergence of new innovative drug production and supply companies are contributing to the development of the biological sample collection kits market across the globe.

The rising emphasis on new product development is observed to act as a major driver for the market’s growth in the upcoming period. For instance, a startup incubated at the Indian Institute of Science (IISc) by the Society for Innovation and Development, Azooka Labs, launched mWRAPR, which focused on biobanks, research labs, and genomic sequencing labs handling biological samples for molecular analysis in February 2022. It helps preserve genetic content in all biological samples, including saliva, tissues, cells, blood, microbiomes, and body fluids.

The growing popularity of the self-home testing kit has increased its adoption among the population as it is available as pocket friendly. The growing government initiatives to spread awareness regarding sample testing are spurring the adoption of the presence of the most elevated manufacturers. Their heavy investments in research and development activities have stimulated innovation in product design, improved distribution, and enhanced product quality, which is projected to bolster the growth of the global biological sample collection kits market.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.27 Billion |

| Market Size by 2034 | USD 21.93 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.99% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Site of Collection, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing requirement for accurate and rapid diagnostics

Accurate diagnosis of disease plays a vital role in understanding the cause and biology of disease so that later the physician can prescribe a better treatment. The rising cases of chronic disorders has especially boosted the demand for rapid diagnosis. Diagnosis has important implications for patient care, research, and policy, and early diagnosis effectively saves time, resources, and money. Good diagnostics is central not only to the treatment but also to the prevention and control of diseases. With the emergence of new and more diagnostic centers, awareness and the requirement for trained professionals have become necessary. Bridging the knowledge gap will assist in providing and fostering new alternatives for all those engaged in changing the face of this industry. They enhance therapy results and represent a crucial public health strategy.

An accurate diagnosis means physicians can make the best patient treatment decisions. For example, there are many types of cancer, each requiring a different treatment approach. An early cancer diagnosis can significantly increase a patient’s chance of survival. Biological sample collection kits offer effective and precise collection and transportation of various samples. Considering the rising demand for accurate and rapid diagnosis, the application of biological sample collection kits will also keep growing.

High cost of advanced kits

The high cost of advanced kits can limit the accessibility of certain research institutions, clinics, or small-scale laboratories with limited budgets. Developing and manufacturing biological sample collection kits requires significant research, development, and production investment. The high upfront cost may discourage potential competitors from entering the market, reducing competition and innovation. Customers may opt for less expensive alternatives or stick with the traditional collection methods that are most cost-effective and can impact the market's growth potential and slow the adoption of advanced technologies.

Advancements and innovation in technology

The improved analysis is characterized by a new type of measurement that improves current diagnostic techniques without measuring new human body indicators. These enhanced techniques could result in higher detection rates, earlier detection, or lower disease error margins. Technologies that are cheaper, more accurate, faster, portable, easily connected with healthcare systems, and user-friendly can increase productivity; with the growth of connected devices, wearables, and telemedicine, a wealth of health data is generated outside of traditional healthcare settings. Big data integrates data with electronic health records and other health data systems, giving a briefer view of patient health.

Established healthcare firms invest their additional revenue in seeking innovation that meets patient needs, enabling them to deal with more patients. The country has become the spot for high-end diagnostic services, with massive capital investment for advanced diagnostic facilities, thus sustaining a more significant proportion of the population. The sensitivity and accuracy of AI-based imaging and diagnostic applications have been impressive, even in identifying subtle bodily abnormalities.

The swabs segment is expected to increase rapidly during the forecast period. The rising geriatric population, rise in technological advancements such as developing new and improved swab products with better absorbency, antiseptic properties, and comfort, and increasing research and development for first aid kit manufacture contribute to the market's growth.

The viral transport media segment shows noticeable growth during the forecast period. Viral transport media is a buffer solution that maintains the level of antimicrobial agents along with the pH in samples before they are submitted for testing. It acts as a preservative. The rising risk of viral diseases has boosted the demand for safer transfer of samples to the clinic or laboratory. Viral transport media is considered one of the safest mediums for this purpose. Food and Drug Administration (FDA) does not approve every media as a secure medium for transporting samples. However, the FDA approved the use of viral transport media during the Covid-19 pandemic; the pandemic highlighted the application of viral transport media, which is expected to continue during the forecast period.

The diagnostics segment is the largest contributor to the market worldwide. The effectiveness and reliability of the kits play a significant part in diagnosing a disease as they provide accurate results for further treatment and cure. The rising emphasis on early diagnosis for several health conditions will boost the growth of the diagnostic segment.

Biological samples such as urine samples, serum samples, biopsy tissues, virology swabs, and cerebrospinal fluid are used in the diagnosis. The distribution network of different companies based on manufacturing and selling, with pricing and regulatory approvals for specific kits, generates a difference in this segment.

The research segment shows attractive growth during the forecast period. The market is projected to be fueled by increased research and development plans that use specimen-collecting kits to test the efficacy of various diagnostic procedures. The increasing investments in research and development activities around the world will promote the segment’s growth.

The hospitals & Clinics segment is expected to show lucrative growth with the highest revenue during the forecast period. Hospitals & Clinics assist in reducing the time and effort required to handle and process samples, and they can process large amounts of specimens efficiently and at a faster rate. It reduces the burden on healthcare infrastructure.

The home test segment shows lucrative growth in the biological sample collection kits market during the predicted period. The manufacturing industries nowadays aim at patient safety and convenience. Moreover, the Covid-19 pandemic has boosted the adoption of the home test segment in past years. The convenience offered by the home test segment and the availability of online sample collection kits will fuel the segment’s growth during the forecast period.

Segment Covered in the Report

By Product

By Application

By Site of Collection

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025

February 2025

February 2025