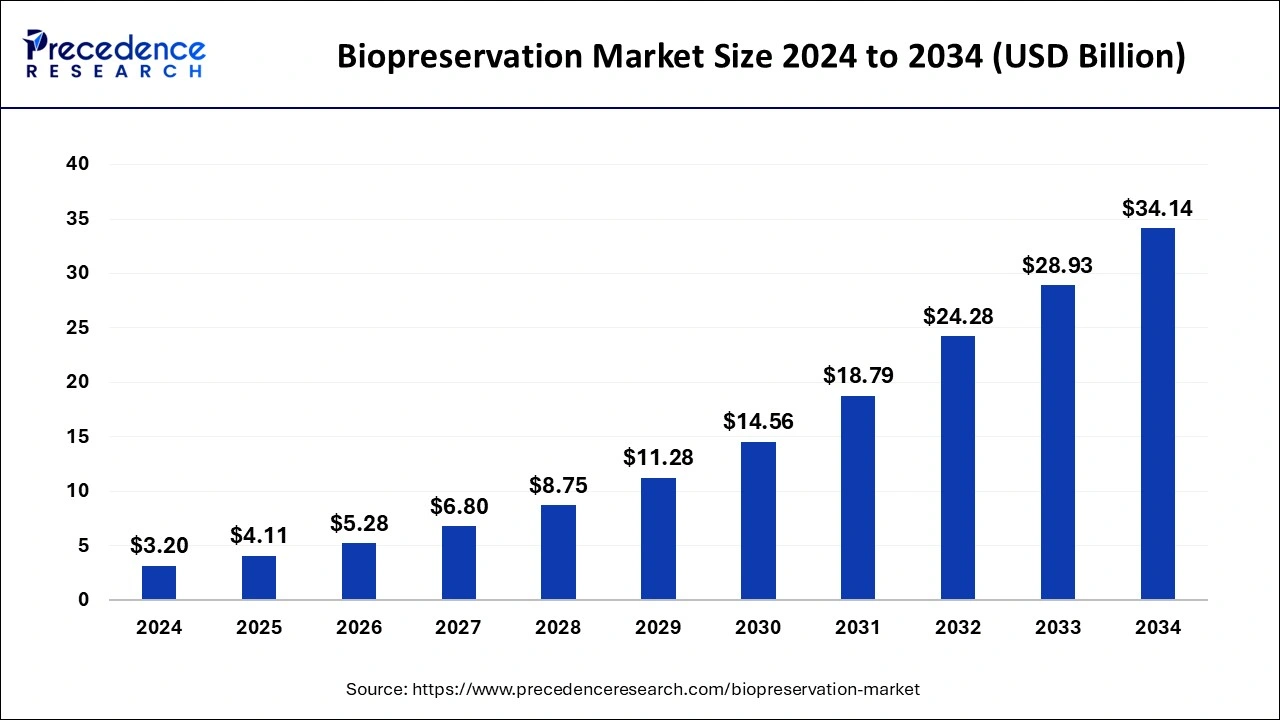

The global biopreservation market size is calculated at USD 4.11 billion in 2025 and is forecasted to reach around USD 34.14 billion by 2034, accelerating at a CAGR of 26.71% from 2025 to 2034. The North America biopreservation market size surpassed USD 1.50 billion in 2024 and is expanding at a CAGR of 26.75% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biopreservation market size accounted for USD 3.20 billion in 2024 and is expected to be worth around USD 34.14 billion by 2034, growing at a CAGR of 26.71% from 2025 to 2034.

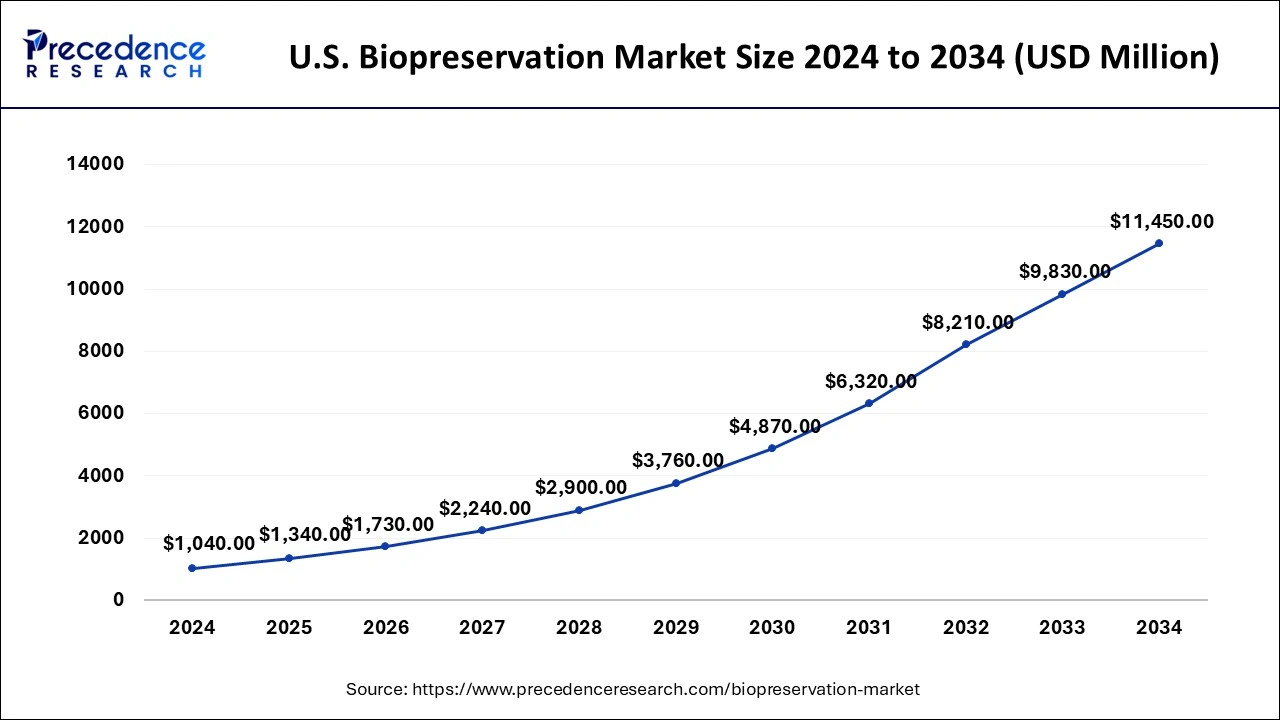

The U.S. biopreservation market size reached USD 1,040 million in 2024 and is anticipated to reach around USD 11,450 million by 2034, poised to grow at a CAGR of 27.11% from 2025 to 2034.

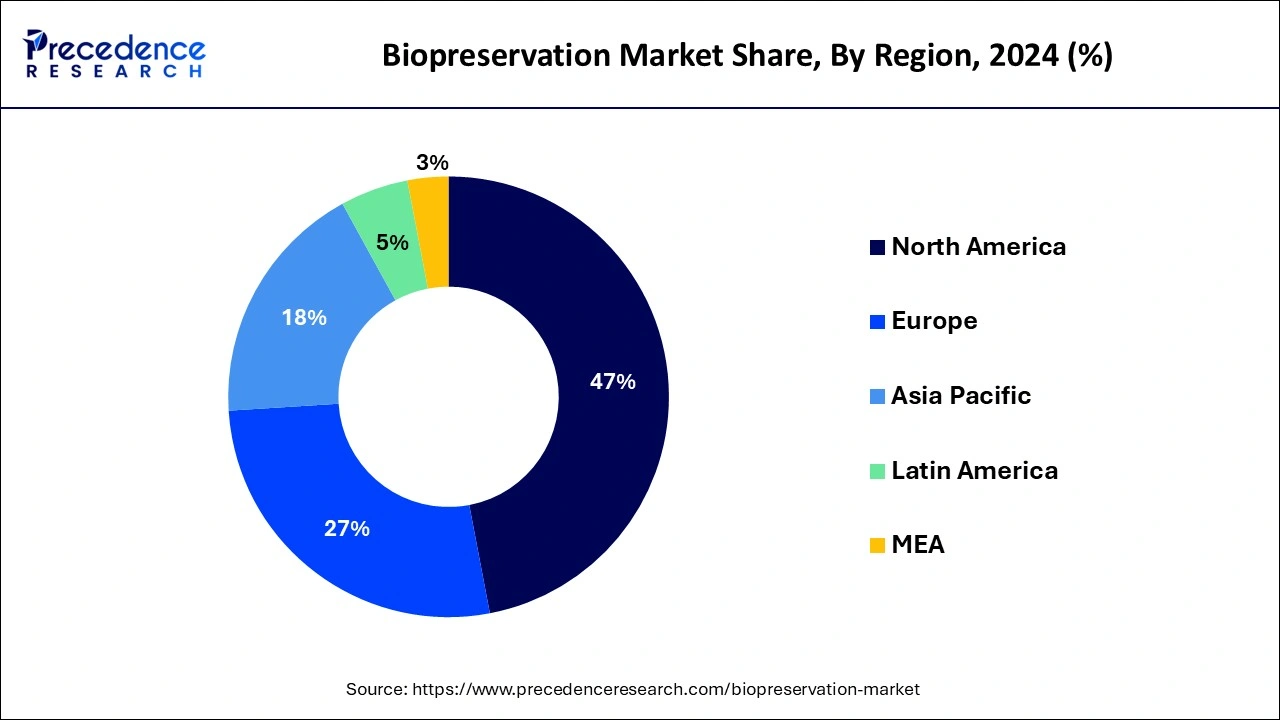

North America is leading the market with the highest revenue share. This is due to advances in biomedical research and the development of improved medicines. Furthermore, the increasing prevalence of chronic diseases necessitating treatment increases demand for biopreservation in the region, bolstering its market position. These actions will likely contribute to expanding biopreservation products on the market, hence propelling growth. The United States is expected to increase significantly during the forecasted period due to government organizations and numerous biobanking institutes contributing to the spread of biopreservation techniques.

For example, the National Institutes of Health (NIH) funds biospecimen collection in biobanks and biorepositories, while the National Cancer Institute (NCI) assists with managing such bio-banking programs. These biobanks help fund clinical trials and research programs in the United States, which increases the need for biopreservation techniques.

Europe is expected to be the most attractive segment of the market during the forecast period. Germany is predicted to progress the quickest in Europe over the forecast period, owing to increased funding support for biobanking techniques and services and increased partnerships and collaborations, including bio-preservation techniques.

Biopreservation employs microorganisms and their metabolic by-products to boost food safety and shelf life. It keeps biospecimens alive for longer periods and protects them from harm outside of their natural environment. Biospecimens are material samples like urine, tissue, blood, DNA, cells, and others stored in a bio repository for future research or used in laboratory tests.

Bio-preservation media and bio-preservation equipment are the two basic types of bio-preservation. Bio-preservation equipment includes tools that preserve biospecimens such as bio-based therapeutics, cells, clinical biomarkers, diagnostic biochips, viruses, etc. Many biospecimens, such as human tissue samples, stem cells, organs, and others, are processed using it.

Improving healthcare expenditure, implementing in-house storage of samples in labs and hospitals, and increasing R&D investment are all factors driving the market growth.

Biopreservation is critical in the advancement of regenerative medicine. The increase in investment for bio-preservation-based pharmaceutical businesses to meet the growing need for tissue and cell preservation is expected to drive market growth. For example, X-Therma Inc., a biotechnology business developing organ preservation and regenerative medicine technology, completed an oversubscribed USD 13 million Series A fundraising round in December 2021. LOREA AG, an entrepreneur-run investment firm, handled the fundraising, including involvement from renowned return angel investors and Graphene Ventures, Zen11 Holdings, Methuselah Foundation, V.U. Venture Partners, and others.

Increasing investments in research and developments, biobanking advancements, and the growing practice of preserving newborn cord blood stem cells are significant factors predicted to propel the market throughout the forecast period. Rising investments in research of regenerative medicine, as well as rising demand for personalized treatment, are driving the biopreservation market growth.

Some of the primary drivers expected to drive market expansion throughout the forecast period include advancements in the hypothermic storage solutions formulation, next-generation systems of cryopreservation, and design and integration with nanoscale technologies.

Furthermore, technological developments, increased product approvals, alliances, and acquisitions by key companies are assisting in market expansion. For example, Guy's and St Thomas' Hospital in the United Kingdom will begin a fertility preservation service for ovarian tissue cryopreservation for women receiving cancer treatment in February 2022. Growing technological developments and launches in biopreservation, as well as the cost-effectiveness of these devices, are likely to generate attractive chances for target market expansion throughout the timeframe specified.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.11 Billion |

| Market Size by 2034 | USD 34.14 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 26.71% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Application, and By Cell Providers Volume |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The rising prevalence of chronic illnesses, the advancement of regenerative medicine, and the growth of biospecimen testing are the primary factors driving the market growth.

The increased frequency of obesity and chronic diseases worldwide is one of the primary reasons driving the market growth. Patients with chronic diseases such as diabetes, heart disease, and degenerative illnesses affecting joints, nerves, and bones, among others, are increasing the demand for biopreservation.

The growing number of patients has significantly burdened the healthcare industry with utilizing improved biospecimen preservation techniques. This has resulted in the widespread adoption and use of bio-preservation technology, facilitating market expansion. Regenerative medications manage and treat various chronic illnesses and degenerative ailments.

To maintain the integrity and efficacy of regenerative treatments, biopreservation techniques are widely used. The increasing use of regenerative medicine has directly contributed to the exponential growth in demand for biopreservation. Furthermore, increased testing by the general public due to various health issues has raised the demand for the healthcare industry to retain biospecimens. The increasing preservation workload has directly raised the need for biopreservation approaches.

The high costs of biopreservation activities

Biopreservation is an advanced preservation technology with significant expenses due to the expensive processes and equipment utilized throughout the preservation process. Biopreservation also has significant stability concerns due to tissue damage during freezing and thawing. Furthermore, the introduction of low-cost preservation procedures like processes of room temperature preservation will hinder market growth.

Increasing investments in research and development of new drugs, increasing biobanks, and government attempts to create profitable market opportunities.

Major investments have been made by private and public organizations in research and development efforts connected to the creation of new medications, which could potentially assist in fighting the growing number of chronic diseases. The significant increase in expenditure is intended to provide access to superior medical care and advanced products, including biopreservation facilities.

The growing number of biobanks that especially maintain biospecimens has provided significant potential opportunities for the biopreservation market. Governments throughout the world are adopting a variety of steps to encourage cell therapies for the cure of different diseases. Government healthcare efforts provide grants, contracts, and cash for research work, resulting in increased R&D expenditure by organizations.

Due to increased demand for bio-banking for storing DNA, stem cells, plasma, and tissue culture, the equipment category represented the greatest revenue share in 2023. The broad adoption and use of preservation have resulted in low maintenance and sufficient storage capacity, which is anticipated to drive market growth.

From 2025 to 2034, the media sector is predicted to grow at a lucrative CAGR of 30.6%. The market has the potential to expand because it is an important aspect of the biopreservation method. Media applications provide more features and information that enable researchers to access and share research data and analysis, enhancing their ability to research, monitor, diagnose, and treat health conditions, which are expected to boost the market during the forecast period.

Tumor cells had the highest revenue share in 2024. This is due to an increase in cancer research, diagnosis, and treatment activities involving the creation of cancer therapies. Tumor cells, including colon, prostate, and breast carcinomas, are used as biomarkers in cancer research. The clinical value of tumor cells has aided the segment's expansion.

Because of its potential to replicate indefinitely, the iPSC segment is expected to rise significantly throughout the forecast period due to its use in therapeutic therapy. It encompasses a broad spectrum of biological studies focused on cells, including disease models, drug discovery, organ manufacturing, RBCs, and tissue repair. Rising finance support provides an additional lucrative prospect for business growth.

The biobanking category led the worldwide market. Rising knowledge of stem cell preservation, increased acceptance of egg and sperm banking, and use of animal-assisted reproductive technologies are driving the segment's growth. Pharmaceutical corporations work with reserve biobanks and hospitals to preserve tissue.

Due to the rising demand for technologically enhanced bio-storage techniques, the regenerative medicine category is predicted to grow at the fastest CAGR of 30.3% during the forecast period. Furthermore, introducing specific preservation procedures will drive industry expansion in the coming years.

By Product

By Application

By Cell Providers Volume

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client