Biosurfactants Market (By Product: Rhamnolipids, Sophorolipids, Methyl Ester Sulphonates (MES), Alkyl Polyglucosides (APG), Sorbiton Esters, Sucrose Esters, Others; By Application: Household Detergents, Personal Care, Industrial & Institutional Cleaners, Food Processing, Oilfield Chemicals, Agriculture Chemicals, Textiles, Other Markets) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

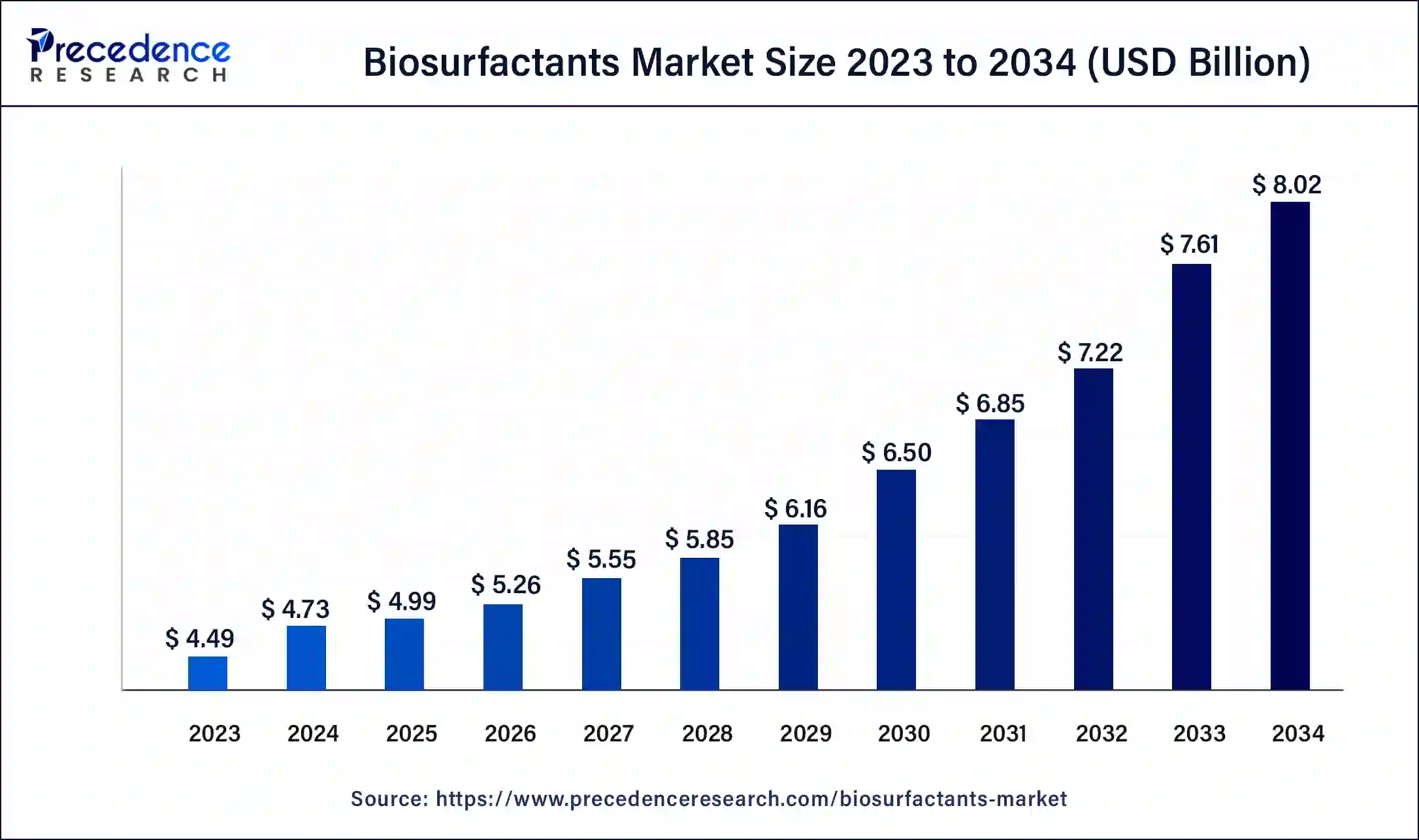

The global biosurfactants market size was USD 4.49 billion in 2023, calculated at USD 4.73 billion in 2024 and is expected to reach around USD 8.02 billion by 2034, expanding at a CAGR of 5.42% from 2024 to 2034. The benefits of biosurfactants include long-term physiochemical stability, functionality under high temperature and pH conditions, production from renewable sources, low risk of toxicity, and a high biodegradability profile. The applications include textiles, agriculture chemicals, oilfield chemicals, food processing, industrial & institutional cleaners, personal care, and household detergents. These factors help to the growth of the market.

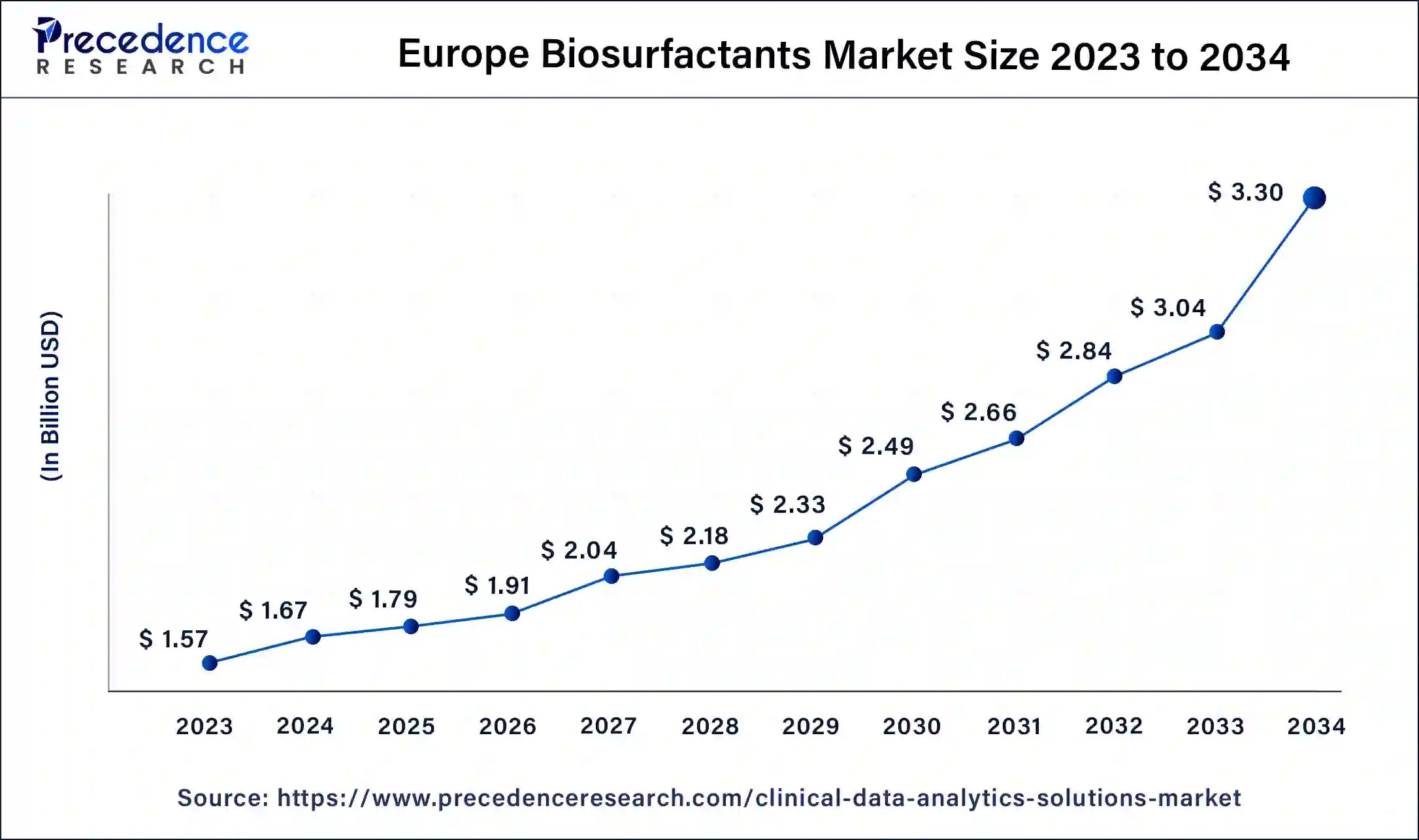

The Europe biosurfactants market size was exhibited at USD 2.20 billion in 2023 and is projected to be worth around USD 3.97 billion by 2034, poised to grow at a CAGR of 5.51% from 2024 to 2034.

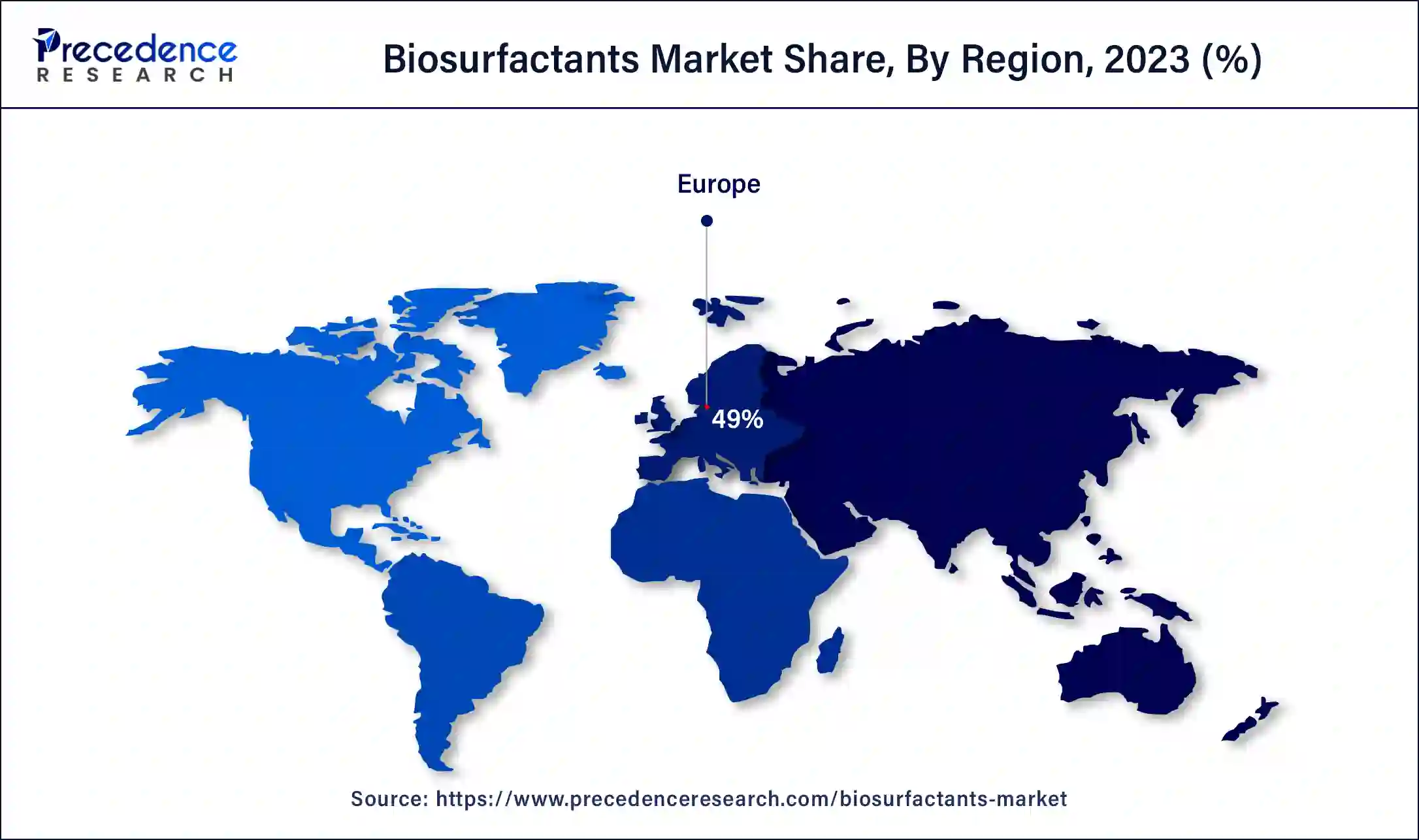

Europe dominated the biosurfactants market in 2023. Increasing awareness related to the health hazards linked with chemical or synthetic surfactants and increasing demand for biobased products leads to the growth of the market. With regard to plant-based dietary supplement usage, Europe has taken the lead worldwide. For decades, nations like Sweden, Germany, France, Italy, and the United Kingdom have seen an increase in the consumption of BSs.

Asia Pacific is estimated to be the fastest-growing region during the forecast period of 2024 to 2034. India and China are the leading countries in the growth of the biosurfactants market in the Asia Pacific region. Tribes and ethnic groups have been utilizing BSs in fermented traditional drinks since prehistoric times.

Numerous bioactive substances (BSs) have been approved for use in food and medicine by the USFDA and FSSAI (India), including quillaja saponin, mohave yucca, and Sapindus saponin. India uses a lot of plants and trees that provide saponin, which is used to make soap, shampoo, and detergent. It also quantifies these biosurfactants. Due to their natural lather, powder, and aqueous pericarp extracts, they are frequently used as traditional hair cleansers, shampoos, bathing soap, body cleansers, etc., in Asian nations like India.

The biosurfactants market refers to biosurfactants, also known as microbial surfactants, and are defined as amphipathic molecules with both hydrophobic and hydrophilic moieties that partition preferentially at the interface between fluid phases with different degrees of polarity and hydrogen bonding like water or air/oil/water interfaces. The applications of biosurfactants include textiles, agriculture chemicals, oil field chemicals, food processing, industrial & institutional cleaners, personal care, and household detergents. The benefits of biosurfactants include that they may be used in improved oil recovery and can be considered for other environmental applications, improving emulsification of hydrocarbons, surface moisturizing characteristics, versatility, biodegradability, and low toxicity. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.02 Billion |

| Market Size in 2023 | USD 8.02 Billion |

| Market Size in 2024 | USD 4.73 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.42% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for bio-based solutions

Rising demand for biobased solutions helps to the growth of the market. The benefits of biosurfactants include eliminating environmental concerns due to chemical products, new green economy biosurfactant products reducing global carbon footprint, estimated to biosurfactant is a sustainable waste to health perspective, agro-food wastes are suitable for feedstock for sustainable biosurfactant production, and these are important, safe, and multifunctional agents. Nontoxic and biodegradable surfactants are used in personal care product formulations like skin care products, shampoos, and soaps for customer safety and to reduce their negative environmental effects. These factors help the growth of the biosurfactants market.

Downsides of biosurfactants

The downsides of biosurfactants include difficulty in obtaining pure substances, which is important for applications in the cosmetic, pharmaceutical, and food industries. Lack of knowledge in bioreactor systems for biosurfactant production limits commercialization, production costs may be expensive, and productivity may be low. These factors can restrict the growth of the biosurfactants market.

Development of production technologies

The production cost of biosurfactants is high as compared to synthetic surfactants. There is an opportunity in the field of sustainable chemistry and biotechnology to create affordable methods for biosurfactant production. Exploring renewable substrates and cost-effective technologies for biosurfactant production can make the process more affordable. Focusing on bioprocessing conditions and optimizing culture medium can help improve biosurfactant production. These factors help the growth of the biosurfactants market.

The methyl ester ketone (MEK) segment dominated the biosurfactants market in 2023. The methyl ester ketone (MEK), also called fatty acid methyl crystals (FAMCs), have many benefits as surfactants. Biosurfactant production from methyl easter ketone (MEK) derived from seed oils, palm oil, or coconut oil. Biodiesel production provides an abundant supply of methyl easter ketones (MEK), which act as chemical intermediates or enzymes for the production of biosurfactants. These factors help the growth of the methyl ester ketone (MEK) segment and contribute to the growth of the market.

The alkyl polyglucosides (APG) segment is expected to grow at the fastest rate in the biosurfactants market during the forecast period. Alkyl poly glucosides (APG) are a class of non-ionic surfactants highly used in many industrial, cosmetic, and household applications. Plant-derived from sugars and biodegradable, these surfactants are fatty alcohols and glucose derivatives. Alkyl polyglucoides (APG) are used to improve foam formation in detergents.

It is used in the personal care industry because it is safe for sensitive skin and biodegradable. It is also used in bathroom cleaners, laundry products, and other cleaning products. They act as dispersants and hydrotropes, synergize with other surfactants, have high stability in a high pH range, hard water, and electrolyte tolerance, and exhibit favorable wetting and surface tension reduction. These factors help the growth of the alkyl polyglucosides (APG) segment and contribute to the growth of the market.

The rhamnolipids segment is anticipated to grow at a notable rate during the forecast period. In therapeutic applications, biosurfactant rhamnolipids are used because eco-friendly biological properties make them potent materials. It is also known to induce apoptosis and, thus, able to inhibit the proliferation of cancer. Rhamnolipids may also act as immunomodulators to regulate the humoral and cellular immune systems. Rhamnolipids applications include cleaning oil spills, enhanced oil recovery, environmental cleanup, pharmaceuticals, food processing, cosmetics, agriculture, bioremediation, and the petroleum industry.

The rhamnolipids have many beneficial uses, including being non-toxic, easily degradable, non-mutagenic, having minimum inhibitory concentration values, and having the highest surface tension reduction index of any other surface tension-reducing agents. These factors help the growth of the rhamnolipids segment and contribute to the growth of the biosurfactants market.

The household detergent segment dominated the biosurfactants market in 2023. Biosurfactants have many benefits over synthetic surfactants, such as synthesis from renewable substrates, low toxicity, and biodegradability. It is important to replace chemical or synthetic surfactants in detergents with these biologically derived biosurfactants. These are safe for human and environmental health. In the detergent industry, biosurfactants are highly used as cleansers, personal cleaning items, household detergent, dishwashing, dispersants in the formulations of laundry, emulsion forming agents, solubilizers, wetting agents, foaming agents, etc.

The benefits of cleaning agents include detergents and soaps, which play a significant role in daily life, meeting the demands of several industries, maintaining a safe and clean living environment, and ensuring personal hygiene. These factors help the growth of the household detergent segment and contribute to the growth of the market.

The personal care products segment is expected to be the fastest-growing during the forecast period. In personal care products like cosmetics, biosurfactants are amphiphilic molecules that are used due to their biological activity and surface properties. Biosurfactants may act as emulsion-forming agents, detergents, cleansers, foaming agents, dispersants, solubilizers, and wetting agents. These factors help to grow the personal care products segment and contribute to the growth of the biosurfactants market.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client