May 2024

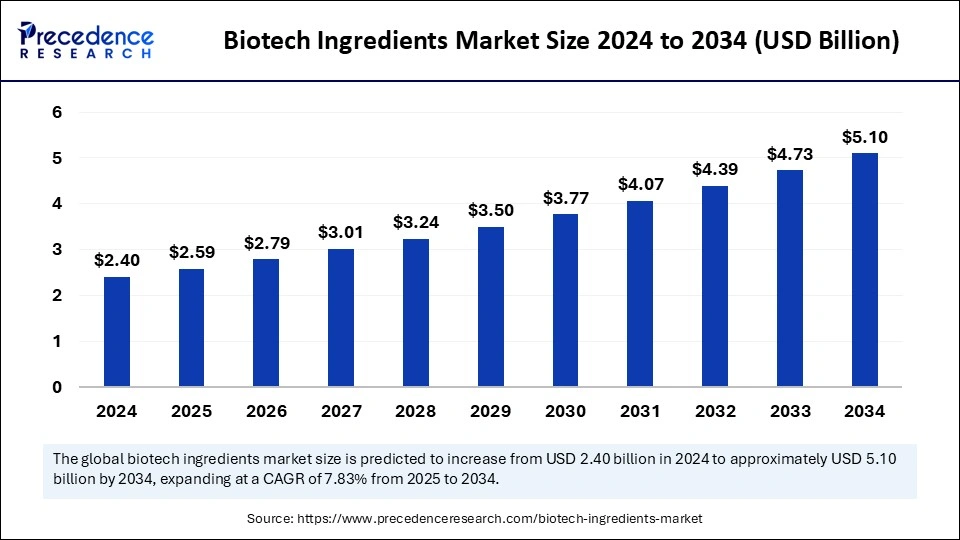

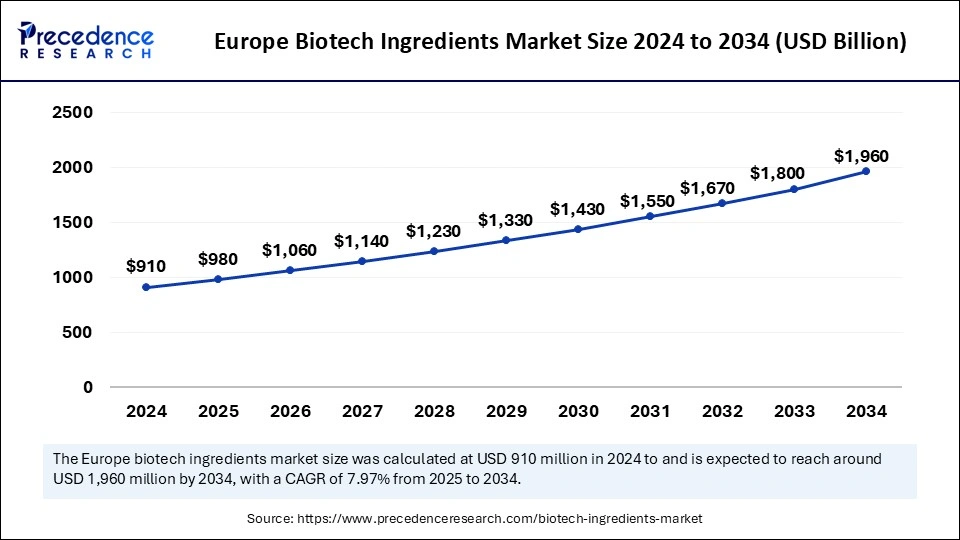

The global biotech ingredients market size is calculated at USD 2.59 billion in 2025 and is forecasted to reach around USD 5.10 billion by 2034, accelerating at a CAGR of 7.83% from 2025 to 2034. The Europe market size surpassed USD 910 million in 2024 and is expanding at a CAGR of 7.97% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global biotech ingredients market size was estimated at USD 2.40 billion in 2024 and is predicted to increase from USD 2.59 billion in 2025 to approximately USD 5.10 billion by 2034, expanding at a CAGR of 7.83% from 2025 to 2034. Advancements in biotechnology and rising demand for sustainable alternatives drive the growth of the biotech ingredients market.

The incorporation of artificial intelligence (AI) can transform the biotech ingredients market landscape. AI technologies help identify new ingredients. AI algorithms are designed to automate the analysis of a vast amount of data, dramatically decreasing the time and effort typically required for manual interpretation. This automation not only accelerates the analysis process but also enhances the ability to manage large datasets efficiently. AI algorithms help identify promising drug candidates with unprecedented accuracy. AI can uncover subtle patterns and unique features within diagnostics tools that may escape the notice of human observers. Moreover, AI can process extensive datasets, enabling it to understand and gather records of chronic diseases and immune system responses and optimize them to develop precise, effective, and tailored treatments. As a result, researchers are empowered to design diagnostic tests that are not only more effective but also safer, thereby reducing the necessity for expensive and time-intensive drug trials. As a result, this technological integration fosters a deeper comprehension of disease mechanisms and can unveil new potential therapeutic targets for further exploration and treatment development.

The U.S. biotech ingredients market size was exhibited at USD 910 million in 2024 and is projected to be worth around USD 1.96 billion by 2034, growing at a CAGR of 7.97% from 2025 to 2034.

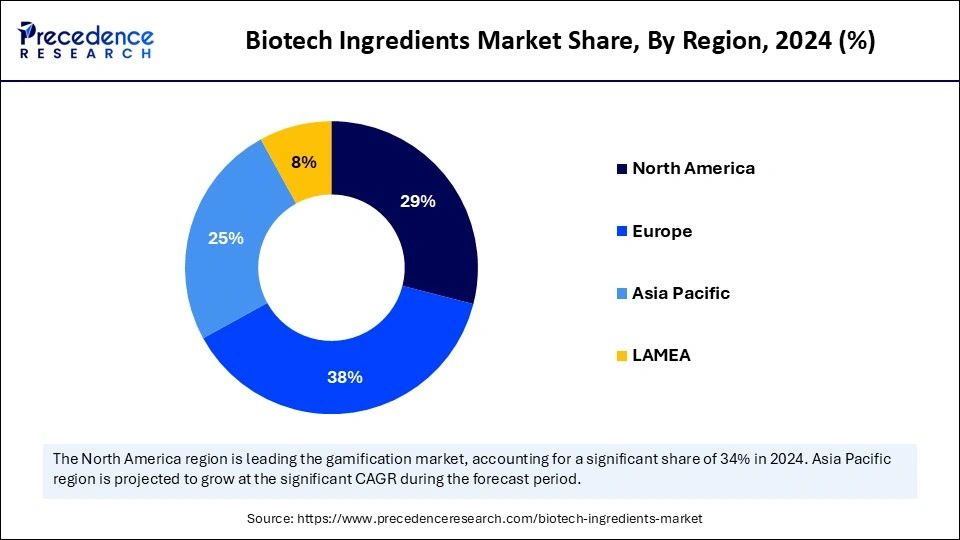

Europe registered dominance in the biotech ingredients market by capturing the largest share in 2024. This is mainly due to the increased integration of biologics in disease management. The region's strong foothold can be attributed to several factors, including a strong focus on sustainability. This boosts the demand for bio-based and environmentally friendly ingredients, resonating with the fundamental principles of biotechnology. Germany, in particular, boasts a robust chemical and pharmaceutical industry, which supports the production and distribution of biotech ingredients.

Asia Pacific is likely to expand at the highest CAGR in the coming years, driven by the rising incidence of chronic diseases such as cardiovascular conditions, cancer, and diabetes. The region is home to some of the world's most rapidly developing economies, including China, India, and various Southeast Asian nations, which are experiencing heightened demand for healthcare, cosmetics, and food products. This, in turn, boosts the demand for biotech ingredients. Notably, India stands out as a major contributor to pharmaceutical manufacturing, especially in the realm of generic drugs and active pharmaceutical components. The rapid expansion of the pharmaceutical and biopharmaceutical industries further contributes to regional market growth.

North America is seen to grow at a notable rate in the foreseeable future. This is mainly due to the presence of a well-established pharmaceutical sector. The U.S. and Canada are major contributors to the North American biotech ingredients market. This is mainly due to the rising investments in biotechnology research. In addition, increasing healthcare expenditure and the rising demand for personalized medicine.

The biotech ingredients market is centered around the production and distribution of biological molecules and substances that originate from living organisms, achieved through advanced biological processes. A defining feature of this market is the utilization of sophisticated biotechnology techniques, including genetic engineering, fermentation, and enzyme-based methods, which facilitate the creation of unique ingredients. Unlike conventional chemical synthesis methods, biotech ingredients are known for their distinct biological activities and functional attributes.

One of the major factors driving the market growth is the increasing consumer demand for sustainable and naturally derived alternatives to synthetic ingredients. Biotech ingredients are frequently produced using more eco-friendly methods and are sourced from renewable resources, making them an appealing choice for environmentally conscious consumers. Continuous innovation in the field of biotechnology is propelling the development of new and improved ingredients characterized by enhanced functionality and performance.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.10 Billion |

| Market Size in 2025 | USD 2.59 Billion |

| Market Size in 2024 | USD 2.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.83% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Expression System, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Consumers are increasingly prioritizing environmentally friendly solutions, making sourcing biotech ingredients from renewable resources important. Technological breakthroughs in genetic engineering, fermentation, and synthetic biology are enhancing the efficiency and diversity of biotech ingredient production. As consumers become more discerning about the components in their food, cosmetics, and pharmaceuticals, there is a corresponding increase in demand for natural and functional biotech ingredients. The rising demand for plant-based ingredients further drives the biotech ingredients market growth.

The production of certain biotech ingredients can be prohibitively expensive due to the intricate technologies and specialized facilities required. Additionally, the regulatory landscape governing biotech ingredients can be complicated and varies significantly across different regions, posing challenges for companies looking to enter the market. Consumer apprehension regarding the safety and efficacy of biotech ingredients is another hurdle, particularly given the complexity of biotech production processes, which create challenges in the market.

Biotech ingredients hold substantial promise in the realm of personalized therapies and treatment innovations, signifying significant growth potential. The rising demand for functional foods and beverages that offer added health benefits is creating abundant opportunities for biotech ingredient development. In agriculture, biotech solutions such as biopesticides and biofertilizers present a sustainable response to environmental challenges. Furthermore, ongoing research and development efforts continue to unveil new and innovative biotech ingredients with expansive applications, creating immense opportunities in the market.

The active pharmaceutical ingredients (APIs) segment dominated the biotech ingredients market with the largest share in 2024. This is mainly due to the increased production of pharmaceuticals. APIs are the fundamental building blocks of pharmaceuticals. They enhance the efficacy of drugs and therapies. Innovations in API manufacturing processes and advanced synthesis methods have improved production efficiency while lowering costs. This evolution in manufacturing practices is pivotal in the pharmaceutical industry. Pharmaceutical companies are investing heavily in research and development efforts to discover and bring new drugs to market, thereby increasing the demand for APIs. Moreover, the rising healthcare costs and the expiration of patents are boosting the demand for generic drugs, which predominantly rely on APIs.

The biosimilar segment is expected to expand at a remarkable CAGR in the coming years. The segmental growth is mainly attributed to the increasing demand for cost-effective biologic therapies. As healthcare costs continue to rise steadily, biosimilars stand out as an affordable option, offering patients access to essential treatments without the high costs associated with their branded counterparts. In addition, advancements in biotechnology are enabling the development of effective biosimilars, contributing to segmental growth.

The monoclonal antibodies segment dominated the biotech ingredients market in 2024. This is mainly due to the increased need for affordable biologic treatments. Monoclonal antibodies are used in therapeutics because they target disease-causing cells. With the rapid increase in the prevalence of chronic diseases, the demand for novel therapies has increased, which significantly propelled the demand for monoclonal antibodies.

The vaccine segment is likely to grow at a significant rate during the forecast period. The ongoing threat and emergence of infectious diseases, particularly the global pandemic triggered by COVID-19, have underscored the indispensable role of effective vaccines in public health. As a result, there has been a substantial increase in investment dedicated to research and development. Furthermore, the rising prevalence of diseases such as influenza, respiratory syncytial virus (RSV), and human papillomavirus (HPV) boosts the demand for new and effective vaccines, in which biotech ingredients play a crucial role.

The microbial expression systems segment led the biotech ingredients market in 2024. The versatility and diversity of microbial organisms enable them to produce a wide range of products, including diagnostics, probiotics, biopharmaceuticals, and biopesticides. Additionally, microbes play a crucial role in bioremediation efforts, where they are utilized to detoxify and clean up various environmental pollutants. Recent advancements in biotechnology, particularly in the fields of genetic engineering and fermentation technology, have substantially facilitated developments in microbial expression systems, enhancing efficiency and production capacity.

The mammalian expression systems segment is projected to grow at the fastest rate during the projection timeframe. These systems are vital in the production of many therapeutic proteins, including monoclonal antibodies and other biologics, which require intricate post-translational modifications, such as glycosylation, to function effectively. These modifications are essential for ensuring the potency, safety, and overall efficacy of biopharmaceutical products, making mammalian systems increasingly vital in meeting the rising demands of modern therapeutics.

By Type

By Product

By Expression System

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

January 2025

June 2024

August 2024