July 2024

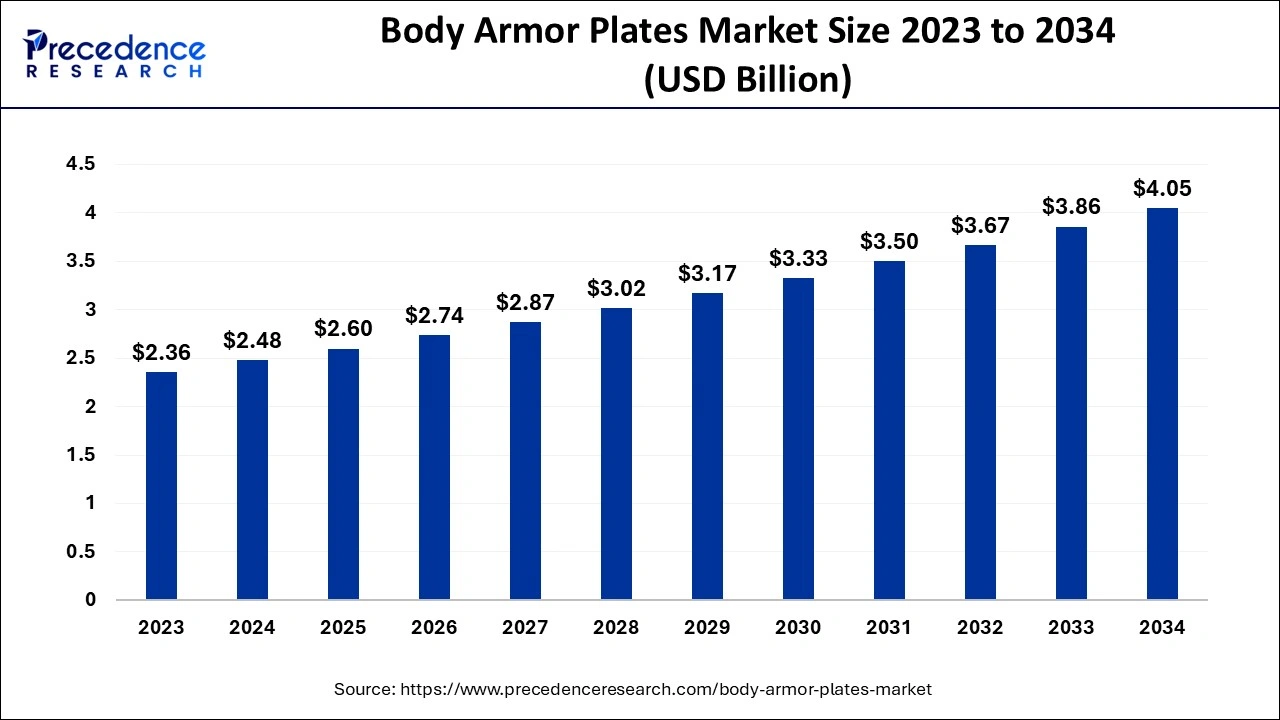

The global body armor plates market size accounted for USD 2.48 billion in 2024, grew to USD 2.6 billion in 2025 and is projected to surpass around USD 4.05 billion by 2034, representing a healthy CAGR of 5.04% between 2024 and 2034. The North America body armor plates market size is calculated at USD 790 million in 2024 and is expected to grow at a fastest CAGR of 5.15% during the forecast year.

The global body armor plates market size is estimated at USD 2.48 billion in 2024 and is anticipated to reach around USD 4.05 billion by 2034, expanding at a CAGR of 5.04% between 2024 and 2034. The rising demand for armor plates from the defense sector is observed to drive the growth of global body armor plates market.

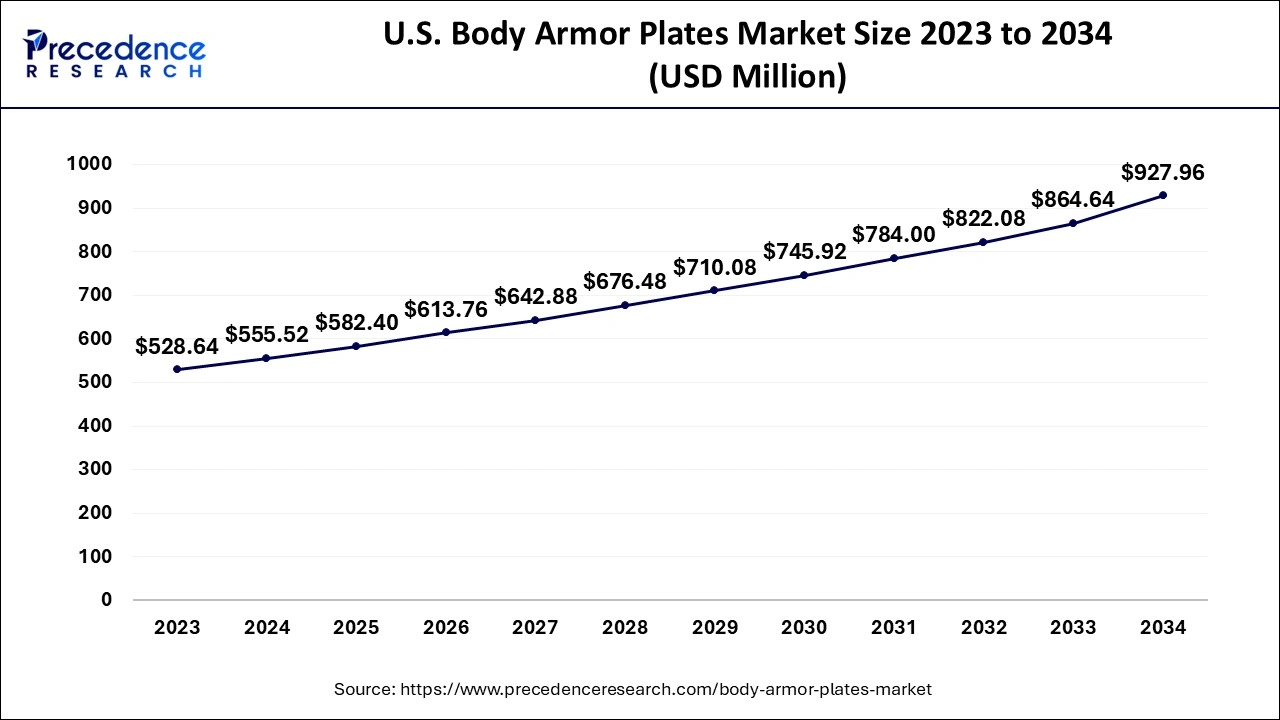

The U.S. body armor plates market size accounted for USD 555.52 million in 2024 and is expected to be worth around USD 927.96 million by 2034, expanding at a CAGR of 5.24% between 2024 and 2034.

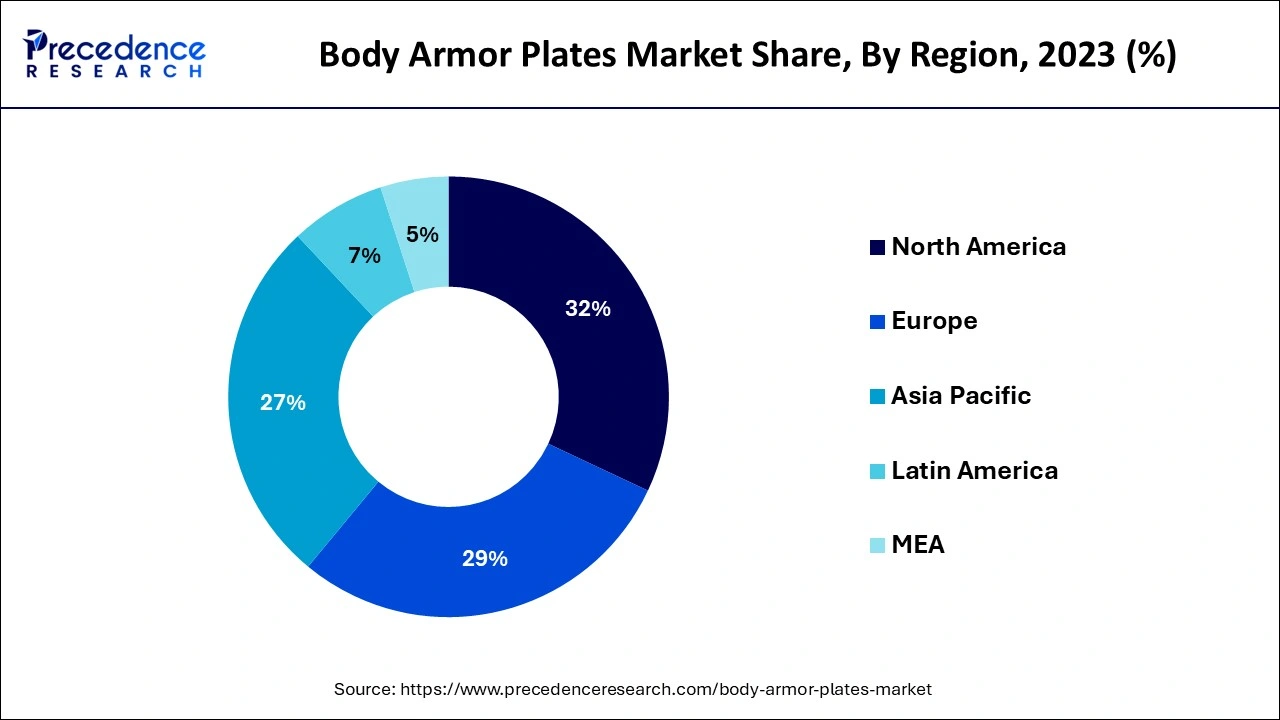

North America dominates the global body armor plates market and generated more than 32% of the revenue share in 2023. The massive potential of purchasing advanced body armors for military personnel and the vast military budget have supplemented the growth of the body armor plates market in North America. The United States ranks in the market's list of contributors to the development. The immense growth in the U.S. defense market is said to be a significant factor in the country’s contribution.

The U.S. Department of Defense had submitted a budget request of $715 billion for the fiscal year 2022, which included funding for all military branches, including the U.S. Army. Growing political tension and airborne attacks are raising the demand for advanced body armor plates.

Asia Pacific is the fastest-growing marketplace for body armor plates. The rising defense spending in various Asian countries is considered to boost the demand for body armor plates, and China’s improving defense exports are propelling the market’s growth. Rising terrorist activities in the Philippians, India and China have become an issue of concern, which is predicted to boost the demand for advanced body armor plates from the defense sector. Moreover, the availability of low-cost raw materials in India and China is supporting the development of body armor plates.

Europe is expected to remain the most lucrative marketplace for body armor plates during the forecast period. Prominent manufacturers in the region are focused on developing lightweight ballistic armor vests; this is expected to bring innovation in body armor plates during the analyzed period. Being an active contributor to the North Atlantic Treaty Organization (NATO), the United Kingdom has witnessed an essential requirement for the contribution of ballistic materials during the Russia-Ukraine war in 2022.

For instance, in August 2022, United Kingdom-based NP Aerospace delivered 20,000 sets of life-saving body armor plates to Ukraine on behalf of NATO governments. With this humanitarian support, the UK's production rate of armor body plates increased spontaneously.

Countries such as United Arab Emirates, Qatar and Morocco are highly focused on increasing their military capabilities; this factor is seen as a significant driver for the market’s growth in the Middle East. At the same time, Africa’s body armor plates show steady growth due to limited military budgets in various countries.

Body armor plates are protective plates worn by individuals, such as law enforcement officers, military personnel, and civilians, to protect against bullets and other projectiles. The level of protection offered by body armor plates is measured by their level rating, which is determined by independent testing organizations such as the National Institute of Justice (NIJ) or the Underwriters Laboratories (UL). The higher the level rating, the greater the protection the plate provides.

The advancements in the global body armor plates market have brought the customization option in plate manufacturing; this includes options for different levels of protection, sizes, and shapes. Overall, body armor plates are a valuable tool to protect individuals against high-velocity projectiles.

The rising military spending is a significant factor in fueling the demand for advanced and innovative body armor plates from the defense sector. With the increasing geopolitical tensions, countries such as India, China, Russia and the United States have increased their military spending, which focuses on the improvement of the capabilities of the nation’s army.

The United Kingdom has proposed a budget for the year 2023, which states an increased defense budget of up to $53 billion. Along with this, the ongoing conflict in the Middle East has boosted the demand for body armor plates.

The rising focus of the defense sector on increasing the survivability of military officials and troops acts as a significant driving factor for the growth of the global body armor plates market. Some governments have mandated using body armor plates for specific personnel, such as law enforcement officers. This has driven demand for the plates in these markets and has helped to create a stable market for manufacturers.

The advancement of manufacturing technologies, such as 3D printing and laser cutting, has reduced the cost and time required to produce body armor plates. This has made body armor plates more accessible to a broader range of consumers and has spurred innovation within the market. In situations where the wearer may be exposed to ballistic threats, body armor plates can significantly reduce the severity of injuries sustained, potentially saving lives. Wearing body armor plates can give the wearer a sense of increased confidence and security, which can be especially important in high-risk situations. Such benefits of armor plates have supported the market’s growth by raising its demand globally.

At the same time, the evolving nature of modern warfare is predicted to generate the demand for advanced body armor plates globally. Moreover, the rising demand for armor shields to protect civilians in critical zones is observed to provide lucrative opportunities to market players. However, considerable limitations of body armor and high production charges may hinder the growth of the body armor plates market.

Additionally, the rising focus on developing lightweight body armor plates to make the ballistic vests wearable for long hours is supplementing the development of the market with new product launches. For instance, in April 2022, a team of researchers at John Hopkins University in Baltimore found an innovative way to develop armor vests with the most lightweight elastomer material. The material relies on complex liquid crystal structures, which makes the body armor plates/vests reusable, lighter and stronger than ever before.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.48 Billion |

| Market Size by 2034 | USD 4.05 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.04% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Material and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising military expenditures

The increase in military expenditure by various countries has driven demand for body armor plates as part of the more significant defense industry. Rising threats of war, political conflicts and tensions between two countries are significant factors behind the increased military spending. Countries such as Russia, Brazil and India have increased their spending on the defense sector to boost the overall nation's security. For instance, according to the Union Budget 2023 by the Indian government, the country has raised its defense budget by 13% more than the previous year. Overall, India's defense sector is expected to continue to grow in the coming years, with the government emphasizing self-reliance and indigenization of defense production.

At the same time, the United States and China top the list of army spending in 2022. Many governments' rising expenditures on the defense sector are significantly impacting the body armor plates market growth by raising the demand for advanced military equipment. Military personnel requires body armor plates for a range of applications, from peacekeeping missions to combat operations.

High-cost manufacturing of body armor plates

The technology and manufacturing process required for armored items are expensive. Additionally, investments in research and development, trial procedures and required raw materials increase the production cost of body armor plates. The high production costs of ballistic protection items create an obstacle for underdeveloped or economically weaker countries to invest in such products. Along with this, many small-scale players fail to participate in the market due to the high cost.

This high cost can limit the adoption of body armor plates, particularly among individual consumers or smaller law enforcement agencies that may have limited budgets. Thus, the production cost or initial investment required for ballistic protection equipment manufacturing hinders the market’s growth.

Advancement in materials

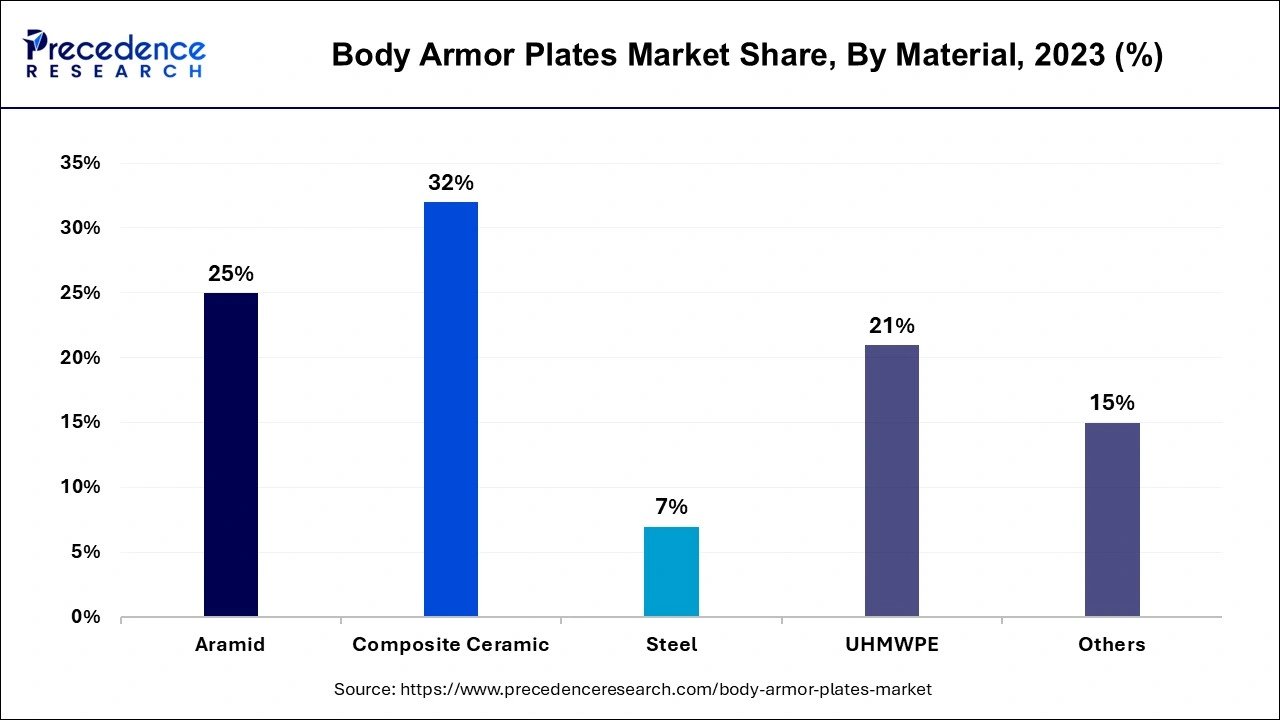

The development of new lightweight and high-strength materials, such as ceramic composites and ultra-high molecular weight polyethylene (UHMWPE), is intended to improve the effectiveness of body armor plates while reducing their weight and bulk. This will increase the demand for more advanced body armor plates that offer better protection and comfort.

The development of body armor plates using bonded fiberglass, overlapping lightweight aluminum and steel plates is likely to gain profit during the analyzed period, which is seen as a lucrative opportunity for market players. The development of technically advanced body armor plates material made with ceramic is crucial in strengthening the position of market players involved in the global ballistic protection market.

The composite ceramic segment captured a maximum revenue share of around 32% in 2023. Ceramic armor plates are considered to be highly effective for personal protection due to their high tensile strength and multi-hit capability. Ceramic armor plates are typically much lighter than other types of armor, making them more comfortable to wear for extended periods of time and allowing for greater mobility. Ceramic armor plates are highly durable and resistant to wear and tear, which means they have a long lifespan and require minimal maintenance. Such benefits of composite ceramic material have supported the growth of the segment.

The steel material segment is predicted to hold a significant market share during the forecast period owing to the rising utilization of durable and high-strength steel material for the production of body armor plates. Steel is generally less expensive than other materials used for armor plates, such as ceramic. The availability of steel material is supporting the growth of the segment, and steel is a standard and readily available material. Thus, steel armor plates can be produced in large quantities and are widely available.

The defense segment generated the largest share of over 52% in 2023. The enormous need for body armor plates in the defense sector is driven by the need to protect military and security personnel from ballistic threats while performing their duties.

The use of body armor plates in the defense sector can help to save lives and prevent injuries. By providing a layer of protection against ballistic threats, body armor plates allow military and security personnel to operate with greater confidence and reduce their risk of injury or death while on duty.

The unmatched benefits of body armor plates for police officers and other security officers within the country’s borders are predicted to boost the growth of the law protection enforcement segment during the forecast period. Rising concerns of riots and terrorist activities are observed to fuel the segment's growth. Additionally, the use of body armor plates can help to increase the effectiveness of security operations by allowing personnel to remain on the front lines longer and operate in more dangerous environments.

Segments Covered in the Report:

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024