September 2024

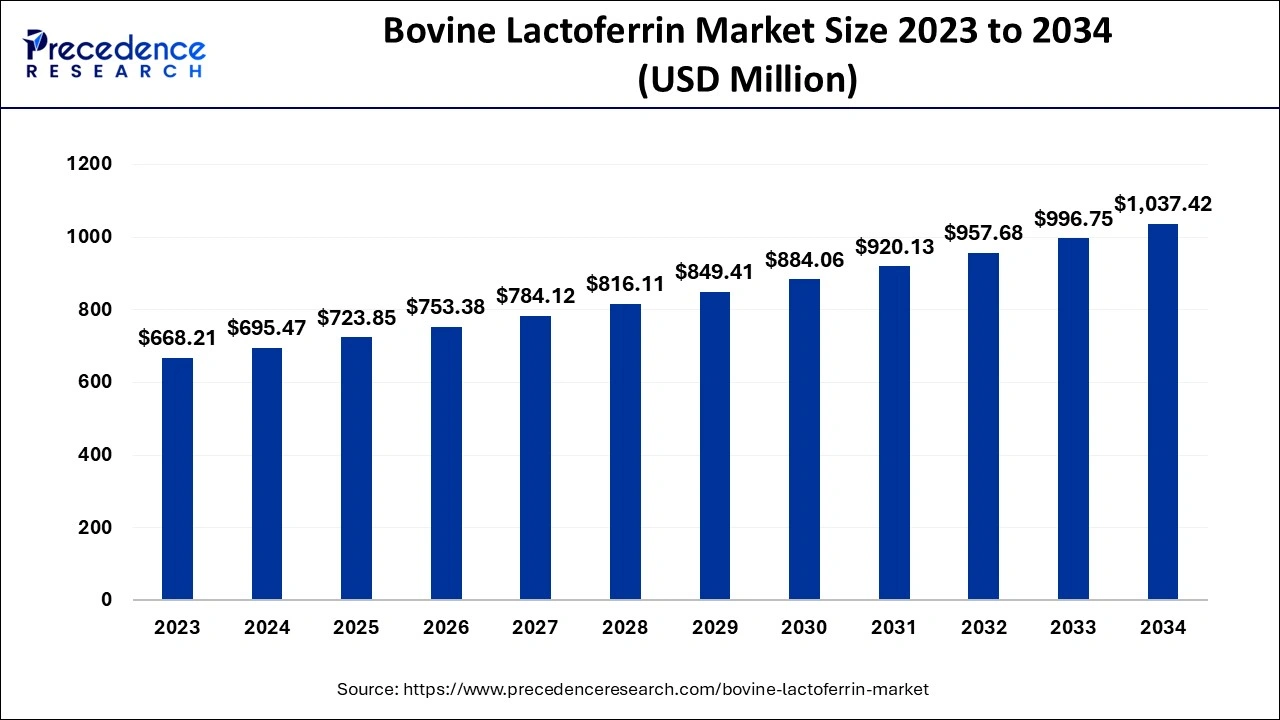

The global bovine lactoferrin market size accounted for USD 695.47 million in 2024, grew to USD 723.85 million in 2025 and is projected to surpass around USD 1,037.42 million by 2034, representing a CAGR of 4.08% between 2024 and 2034. The Asia Pacific bovine lactoferrin market size is calculated at USD 389.46 million in 2024 and is expected to grow at a CAGR of 4.16% during the forecast year.

The global bovine lactoferrin market size is calculated at USD 695.47 million in 2024 and is predicted to reach around USD 1,037.42 million by 2034, expanding at a CAGR of 4.08% from 2024 to 2034. The bovine lactoferrin market is driven by the increasing consumer knowledge of the many health advantages of lactoferrin.

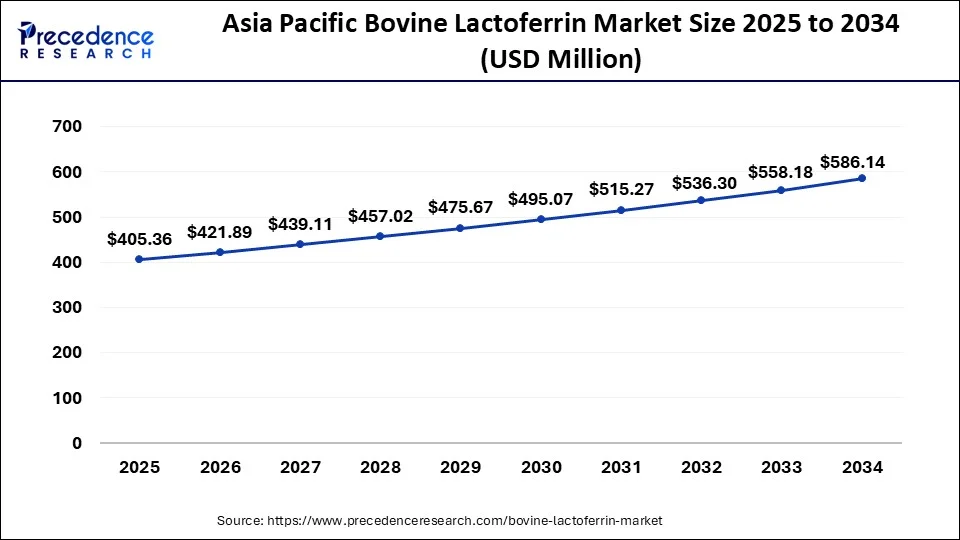

The Asia Pacific bovine lactoferrin market size is evaluated at USD 389.46 million in 2024 and is projected to be worth around USD 586.14 million by 2034, growing at a CAGR of 4.16% from 2024 to 2034.

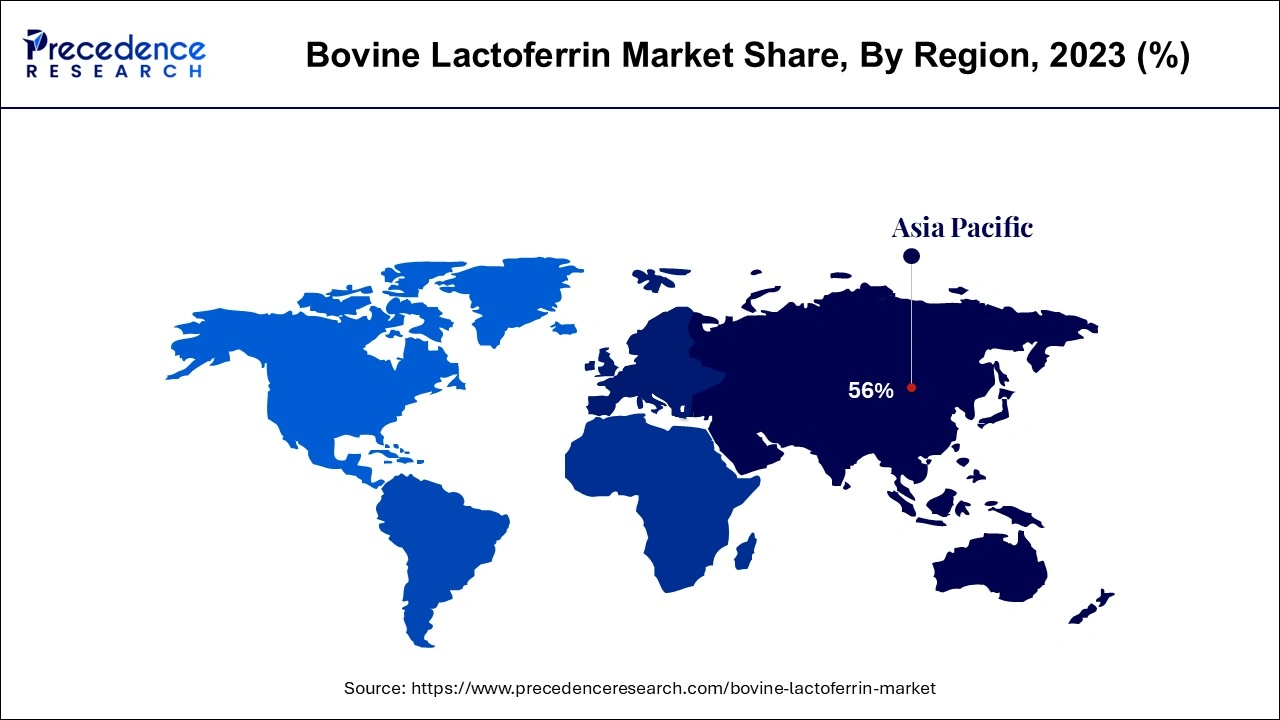

Asia Pacific accounted for the largest market share in 2023 and, thus, dominated the global bovine lactoferrin market. The growth of this region is primarily due to the increasing demand for dietary supplements in the general population and along with the demand for infant formula. The surging demand for lactoferrin formula with other nutritious formulas can be beneficial to proliferate the market further in the Asian region. Another key factor for driving the market is decreasing rate of breastfeeding among new mothers which necessitates the specialized infant formula according to the child's growth and bodily requirement. According to the data, nearly 64% of parents in China recognize the importance and benefits of the infant formulation and willing to give this to their child.

Europe is anticipated to witness the fastest growing rate during the forecasted years in the global bovine lactoferrin market. The growth of this region is related to significant factors like the rising consumption of nutritional food due to health-conscious people and the rising awareness about it among the majority of European people. Such nutritional food may be in the form of beverages and dietary supplements, dairy products that contain bovine lactoferrin as a main ingredient. In addition to this, major companies in the European region are launching innovative facilities and products to spread awareness about bovine lactoferrin which further enhances the production of the bovine lactoferrin as per the increasing demand.

North America witnessed a significant growth rate in the bovine lactoferrin market in 2023. Nutraceuticals, supplements, and functional foods that provide health advantages beyond simple nourishment are gaining popularity among North American consumers. This pattern is supported by the immune-stimulating, antibacterial, anti-inflammatory, and antioxidant qualities of bovine lactoferrin. Generally, found in baby formula, sports nutrition products, and supplements that improve immunity, digestive health, and iron absorption and the enterprises adhere to stringent quality regulations and extensive safety testing, thereby improving the legitimacy of bovine lactoferrin products.

Lactoferrin is a glycoprotein that is found naturally in colostrum and breast milk. Because of its anti-pathogenic and iron-absorbing qualities, lactoferrin has been associated with several health advantages. The market for lactoferrin generated from cow's milk (a bovine source) is known as the "bovine lactoferrin market." Lactoferrin is a multifunctional glycoprotein that is mostly found in tears, saliva, and milk.

Its capacity to bind iron and carry out a number of biological functions, including immune-modulating, antimicrobial, and anti-inflammatory properties, is well documented. As consumer knowledge of health and well-being increases, there is a growing desire for functional meals that contain bioactive substances such as lactoferrin. Market expansion in the food and beverage industry is driven by this tendency.

How is AI helping the bovine lactoferrin market growth?

Artificial intelligence (AI) algorithms can examine enormous amounts of information from research papers, clinical studies, and already-marketed goods to determine bovine lactoferrin's possible advantages and uses. This expedites the research and development process for novel product formulations.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,037.42 Million |

| Market Size in 2024 | USD 695.47 Million |

| Market Size in 2025 | USD 723.85 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.08% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Growing demand for infant nutrition

When it comes to strengthening a newborn's immune system, lactoferrin is essential. Babies are shielded against illnesses during their delicate early years by the antibacterial, antiviral, antifungal, and anti-inflammatory qualities of this substance. A baby's immune system is still developing, therefore lactoferrin can offer significant protective benefits. Because more people are aware of the advantages of bovine lactoferrin, dairy farmers worldwide have been boosting their production capacity to meet the growing demand from infant formula companies. This has fueled the market's growth by increasing the quantity and consistency of the supply of bovine lactoferrin.

Limited consumer knowledge about the benefits of bovine lactoferrin

Few customers are aware of the health benefits of bovine lactoferrin. Lactoferrin is not as well-known as popular supplements like probiotics or vitamins. Common nutrients that most people are aware of are iron and calcium. However, less is known about lactoferrin's roles in strengthening the immune system, promoting iron absorption, and preventing infections. It's not always clear how to take bovine lactoferrin as a standalone supplement, in infant formula, or in combination with other nutrients. Customers may make bad decisions because of their ignorance because they have a propensity to stick with what they know and trust.

Increasing demand for natural and effective ingredients in cosmetics

The demand for "clean beauty" products, those made with natural, non-toxic ingredients, has increased dramatically in the cosmetics industry in recent years. A savvy customer base avoids parabens, artificial preservatives, and synthetic chemicals in favor of environmentally responsible, sustainably derived, and skin-safe goods. Modern consumers are looking for multipurpose cosmetics that not only improve skin health but also beauty. Skincare products gain functional value from lactoferrin's capacity to support tissue repair and wound healing as well as its anti-inflammatory properties.

The freeze-dried powder segment dominated the bovine lactoferrin market in 2023. Manufacturers found it simple to work with and incorporate freeze-dried bovine lactoferrin powder into various product compositions, such as functional meals, infant formulae, and supplements. Baby formula is one of the main uses for powdered bovine lactoferrin. Adding lactoferrin to baby formula helps replicate some of the immune-stimulating qualities of human breast milk, an essential component of human milk. The freeze-dried form of lactoferrin is the recommended option because it can be readily included during the production process and maintains its efficacy.

The spray-dried powder segment is anticipated to witness significant growth in the bovine lactoferrin market during the forecast period. There is an increasing need for bovine lactoferrin in functional foods and nutraceuticals due to consumer knowledge of immunity and digestive health. Because of its great versatility, spray-dried powder is a simple addition to many formulas, including probiotic products, protein powders, and health supplements.

The product’s adaptability, which meets the realistic demands of a customer base that is health-conscious, is driving its expansion. Compared to other drying methods, spray drying is a more affordable and productive industrial process. It lowers operating expenses by enabling producers to make bovine lactoferrin powder in large quantities with uniform quality. The spray-dried form is more alluring because of this financial advantage, especially in light of the market's increasing price sensitivity and competition.

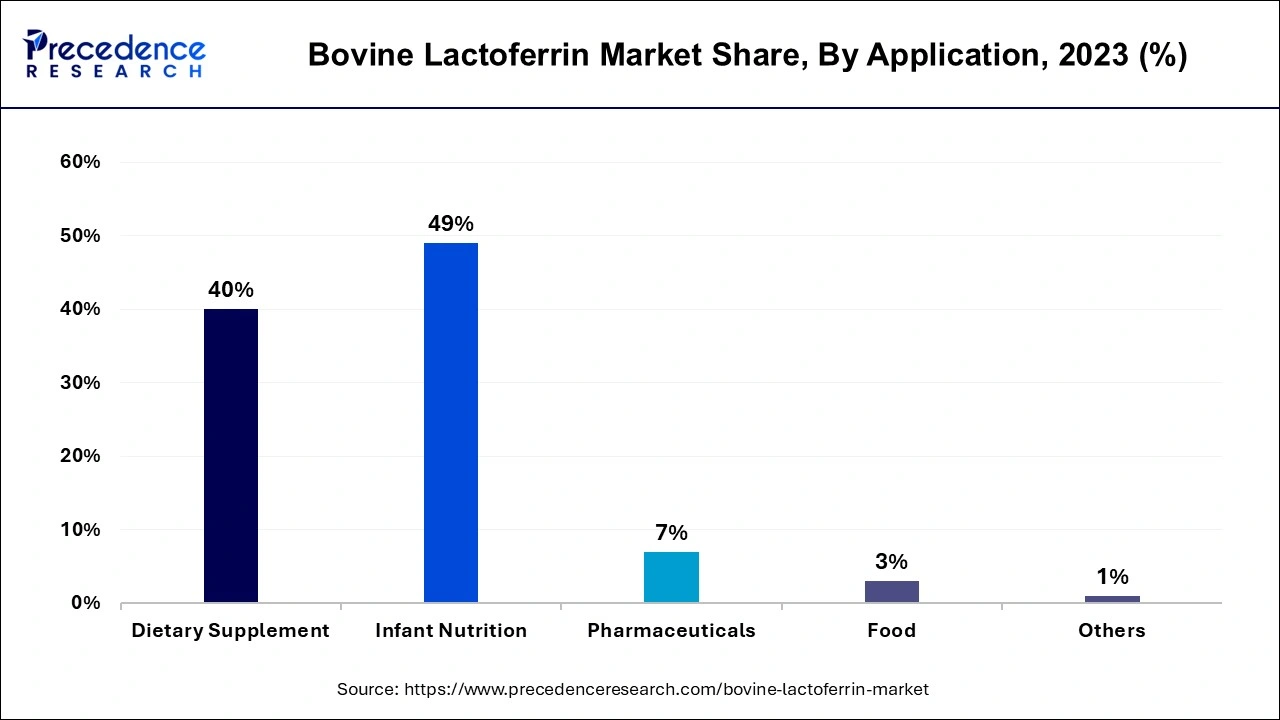

The infant nutrition segment dominated the bovine lactoferrin market in 2023. The use of infant formula has steadily expanded across many regions, including North America, Europe, and parts of Asia, due to changing lifestyles, a rise in the proportion of working-age women, and improved knowledge of the nutritional advantages of the product. Bovine lactoferrin is a popular addition to formula because it mimics some of the immunological benefits of breast milk. Its safety profile reassures healthcare professionals and parents, mainly owing to its remarkable resemblance to human lactoferrin found in breast milk.

On the other hand, by application, the dietary supplement segment is observed to be the fastest growing in the bovine lactoferrin market during the forecast period. Globally, the prevalence of lifestyle-related health issues like diabetes, heart disease, and obesity is rising. To prevent or treat these disorders, further other therapies, many customers resort to dietary supplements. Because it helps with weight management and enhances metabolic health, lactoferrin is a highly sought-after component of supplements meant to treat these issues.

Segments Covered in the Report

By Product Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024