March 2025

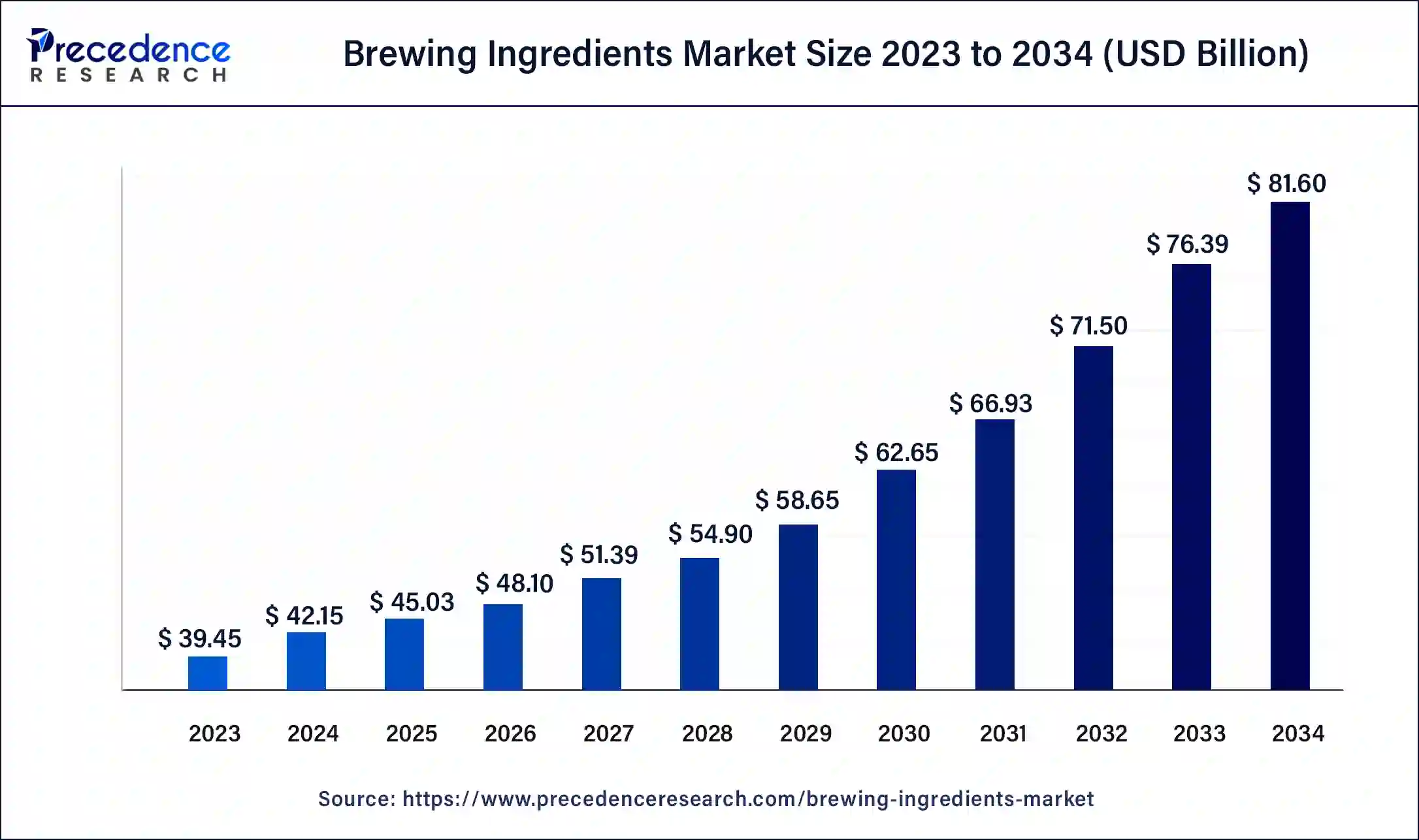

The global brewing ingredients market size was USD 39.45 billion in 2023, calculated at USD 42.15 billion in 2024 and is expected to be worth around USD 81.60 billion by 2034. The market is slated to expand at 6.83% CAGR from 2024 to 2034.

The global brewing ingredients market size is projected to be worth around USD 81.60 billion by 2034 from USD 42.15 billion in 2024, at a CAGR of 6.83% from 2024 to 2034. The benefits of brewing ingredients include natural antibacterial properties that help to preserve beer, flavor & aroma, bitterness, etc. contributing to the growth of the market.

The brewing ingredients market refers to the services that provide brewing ingredients, which is an important component of the worldwide beverage industry, providing important components for beer production. It includes many sources of hops, beer additives, malt extract, yeast, grains, water, starch/sugar sources, including cereals or pseudo cereals, and others. The benefits of beer ingredients include the preservation of natural antibacterial properties that help preserve beer and the addition of flavors and aromas that may be herbal, piney, citrusy, or floral, depending on the hop variety.

How is AI changing the Brewing Ingredients?

The AI used in brewing ingredients can help the growth of the brewing ingredients market. There are many ways to use AI in the brewing process, including recipe generation and ingredient selection based on the required flavor profile, beer style, and other criteria. AI can be used to generate unique, creative new label designs that match the personality and style of the beer and beer name generator. AI can be used to check the quality of beer by analyzing data like bitterness, alcohol content, and pH level. AI can also be used in BeerSmith analysis & automation, hop research, food pairing, and brewing calculations.

| Report Coverage | Details |

| Market Size by 2034 | USD 81.6 Billion |

| Market Size in 2023 | USD 39.45 Billion |

| Market Size in 2024 | USD 42.15 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.83% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Source, Brewery Size, Form, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising beer consumption

The rising beer consumption is due to its many potential health benefits that contribute to the growth of the brewing ingredients market. The health benefits of beer include it flushes out toxins from the body, promotes longevity, delays aging has positive effects on the hair and skin, helps to cure insomnia and promote sleep, helps to increase vitamin B levels, helps in the development of healthier and denser bones, helps to reduce the risk of developing kidney stones, minimizes the risk of diabetes, helps to improve eyesight by preventing mitochondrial damage, helps to boost mental health, minimizes the risk of cancer, it helps to improve cholesterol levels, helps in reducing weight, and good for the heart.

Downsides of brewing ingredients

The downsides of brewing ingredients can hamper the growth of the brewing ingredients market. Technical issues include products using various microorganism strains. It may create many challenges, including different fermenting time lengths, unused higher carbohydrate levels, etc., which can restrict the growth of the market.

Brewing technology innovations

Brewing technology innovations include vacuum separation, theologized yeast, which is a technology that was developed to improve beer aroma, and mash filtration technology, which is used to reduce the amount of water necessary to brew beer. Printing labels directly on bottles, also called bottle tattooing, IoT/AI solutions in breweries, meura technologies, Wonderware MES, and self-pour systems, which help smaller venues pour and store draft beer without large kegs.

The malt extract segment dominated the brewing ingredients market in 2023. The malt extract is associated with many potential health benefits. The benefits of malt extract benefits include improving bone health, supplying our body with B vitamins and antioxidants, reducing antinutrients, and boosting mood. Malt extract may help to improve heart health by reducing cardiovascular disease risks and lowering cholesterol levels. Malt extract contains soluble fibers which can support a healthy digestive system and promote regularity. It is a good source of carbohydrates that provide energy and performance for the body. It can be used to regulate blood glucose levels, helps to minimize diabetes concerns, and has cancer-fighting capabilities. It helps to enhance mental health and different antioxidants, which helps the market’s growth.

The beer yeast segment is expected to be the fastest-growing during the forecast period. The beer yeast plays an important role in the brewing process, which leads to the growth of the brewing ingredients market. The benefits of beer yeast include its efficiency in preventing diarrhea. It is also used to treat other digestive tract disorders, including lactose intolerance, clostridium difficile colitis, irritable bowel syndrome, traveler’s syndrome, and diarrhea caused by antibiotics. Beer yeast may provide energy and can help to maintain healthy hair, skin, mouth, and eyes.

It can be effective at improving the immune system and supporting the nervous system. Beer yeast is a nutritional supplement and may strengthen the immune system and improve energy levels. It is rich in magnesium, zinc, iron, potassium, selenium, protein, and chromium. It is also a great source of B vitamins, including biotin, folic acid, pyridoxine, pantothenic acid, niacin, riboflavin, and thiamine.

The macro brewery segment dominated the brewing ingredients market in 2023. Macro breweries are large breweries that produce above 6 million gallons of beer each year. This beer is mass-produced. It is more affordable than microbeers. The characteristics of macro breweries include large-scale production capabilities, a focus on quality control and consistency, and extensive distribution networks. Macro brewery also tends to have a wide range of beer styles in their portfolio, including specialty brews, ales, and larger popular beers. The cost of a macro brewery is much less than that of a craft brewery.

The craft brewery segment is estimated to be the fastest-growing during the forecast period. The health benefits of craft breweries include it helps to lower cholesterol levels, reduced risks of Alzheimer’s Disease, enhanced cognitive function, lowered risk of kidney stones, boosted immune systems, improved gut health, decreased risk of type-2 diabetes, reduced stress, and boosted mood, strengthen bones, reduces inflammation, and protects against cardiovascular disease (CVD).

The business benefits of craft breweries include advantages from the passionate and dedicated customer base, participation in an experience-based economy, growing tourism, potential for high-profit margins, encourage brand identity and creative expression, support sustainability appeal and local sourcing, capitalizing on rising craft brewery demand, offer high quality, unique artisanal products, encouraging strong community ties and loyalty, etc. contribute to the growth of the brewing ingredients market.

The dry segment dominated the brewing ingredients market in 2023 and is expected to grow at the fastest rate during the forecast period. Dry brewing ingredients, including dry yeast, are generally more affordable than liquid strains. Dry yeast has a higher number of cells in each package than liquid yeast. Dry yeast also has a longer shelf life at room temperature. The need for wort oxygenation is eliminated or reduced. Dry yeast is user-friendly and very convenient, and very few strains are available.

The liquid segment is anticipated to grow significantly during the forecast period. Liquid forms of brewing ingredients include liquid yeast, which is a live yeast cell culture suspended in a liquid form. It comes in smack packs or vials and needs refrigeration to maintain viability. The liquid yeast shines and offers brewers an exceptional level of complexity and diversity. The liquid yeast strains are available in unique flavor profiles, and they open the exploration world of possibilities for brewers. These factors help to the growth of the brewing ingredients market.

Asia Pacific dominated the brewing ingredients market in 2023. India and China are the leading countries for the growth of the market in the Asia Pacific region. The rising population’s drinking preference is constantly shifting towards an alcoholic culture. The growing market and increasing population demand for brewing ingredients. There is demand for various beers with different ABVs and different flavors, which is driving the growth of the market in the Asia Pacific region.

North America is estimated to be significantly growing during the forecast period of 2024-2033. The increase in brewery development and the unique beer introduction contribute to the growth of the brewing ingredients market in the North American region. The North American region’s increasing demand for flavored beers, cutting-edge brewing practices, and increasing craft beer industries are driving the market’s growth.

Popular Canadian Beer Brands

Segments Covered in the Report

By Source

By Brewery Size

By Form

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

December 2024

October 2024

February 2025