January 2025

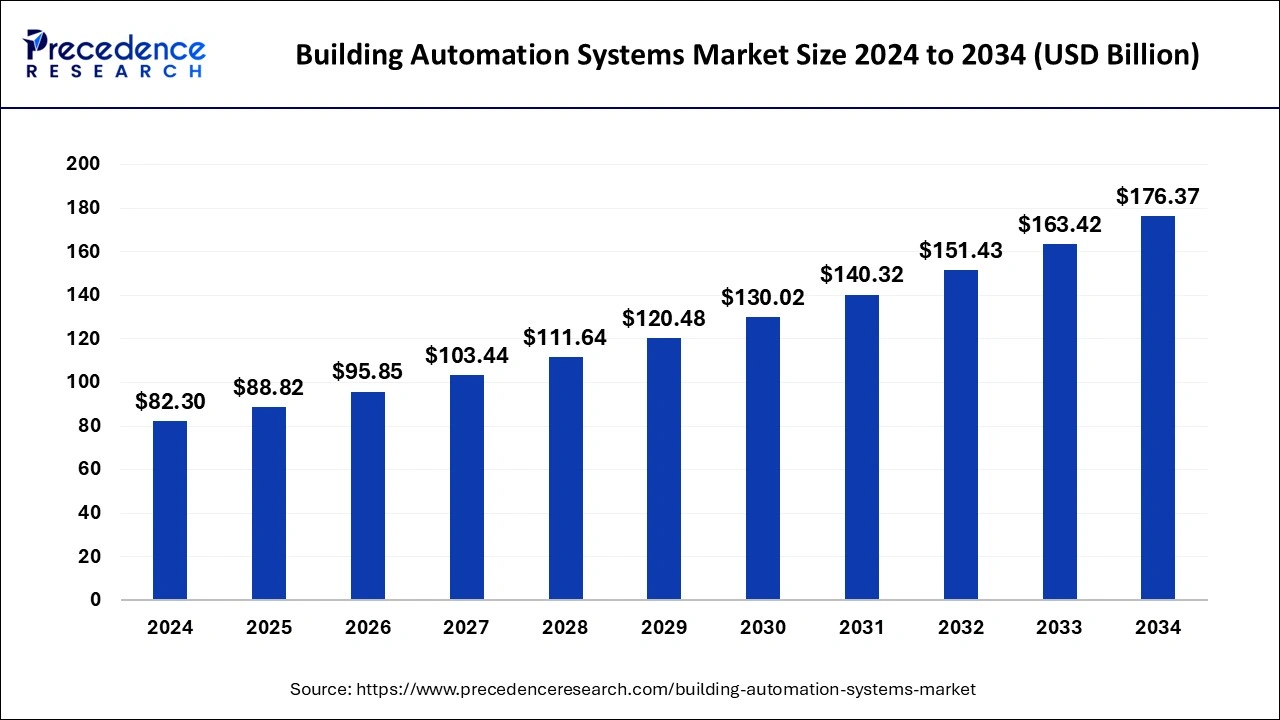

The global building automation systems market size is calculated at USD 88.82 billion in 2025 and is forecasted to reach around USD 176.37 billion by 2034, accelerating at a CAGR of 7.92% from 2025 to 2034. The North America building automation systems market size surpassed USD 29.63 billion in 2024 and is expanding at a CAGR of 8.06% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global building automation systems market size was accounted for USD 82.30 billion in 2024 and is anticipated to reach around USD 176.37 billion by 2034, growing at a CAGR of 7.92% from 2025 to 2034. Control over lighting, chillers, boilers, air-handling units, roof-top units, etc., and the controlled benefits over power monitoring, close circuit video, security, fire alarm systems, etc. contribute to the growth of the building automation systems market.

Artificial intelligence helps in the analysis of data from several building systems and the prediction of equipment failures before breakdown occurs. This predictive maintenance through AI algorithms offers proactive servicing, reduces downtime, extends equipment lifespan, and lowers maintenance costs. AI helps in the detection of faults in real-time and analysis of sensor data which enables faster identification and resolution of issues. AI improves system performance and efficiency by ensuring the smooth running of building operations. AI is involved in the analysis of energy consumption data which identifies inefficiency and improves building operations. It helps to forecast the future needs of consumers and enables informed decisions.

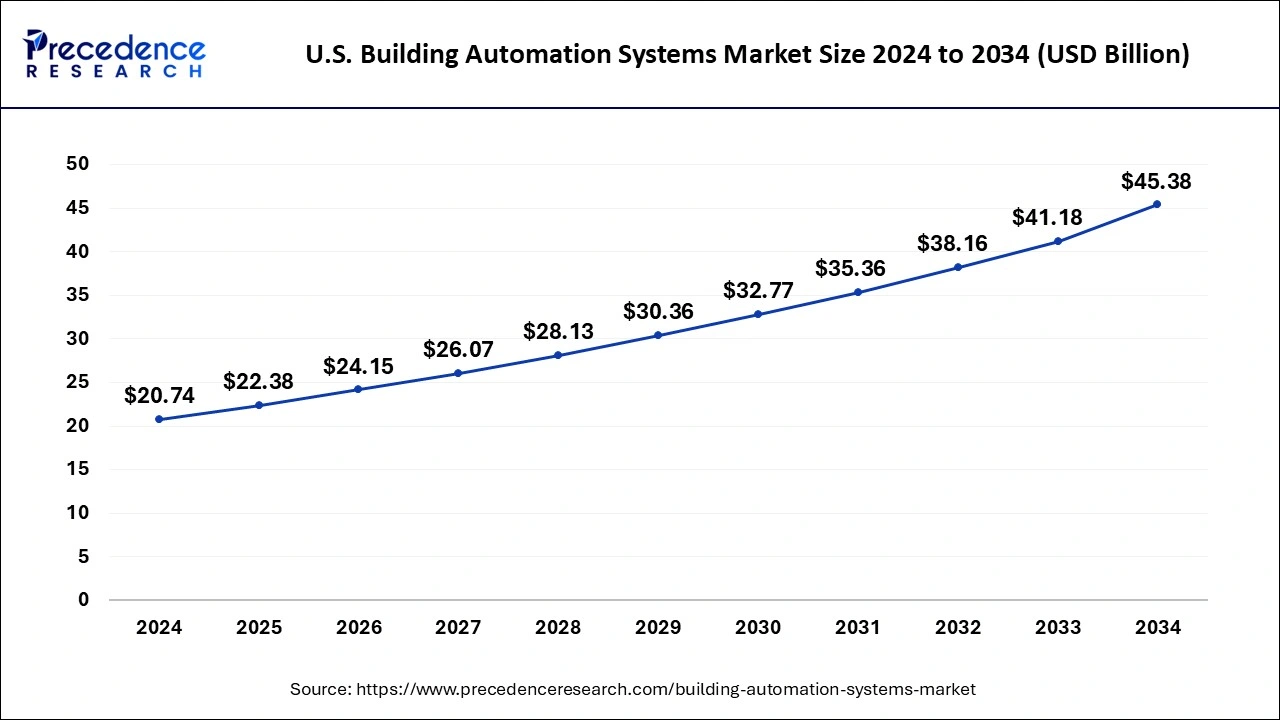

The U.S. building automation systems market size was evaluated at USD 20.74 billion in 2024 and is predicted to be worth around USD 45.38 billion by 2034, rising at a CAGR of 8.14% from 2025 to 2034.

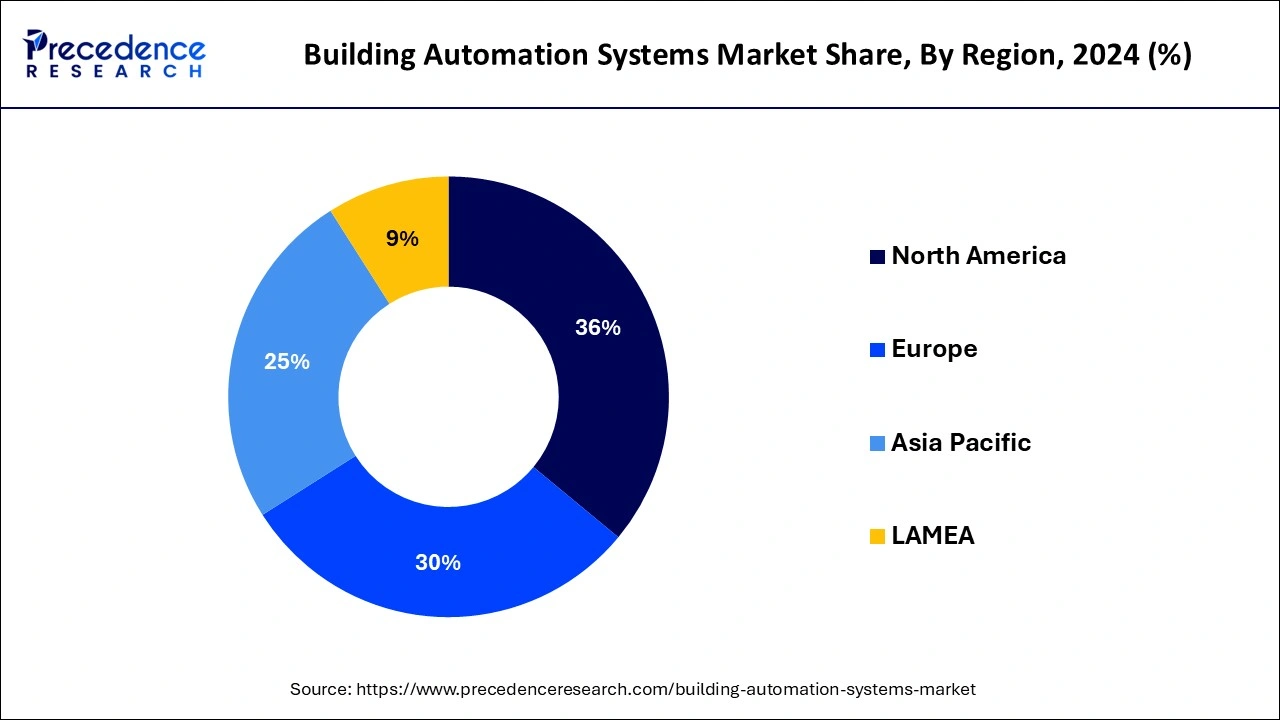

North America led the building automation systems market with the biggest market share of 36% in 2024. In North America, the market trends showcase a strong emphasis on energy efficiency and sustainability. With a focus on green building initiatives and smart city development, there's a surge in demand for advanced BAS solutions. The region witnesses increased adoption of IoT-integrated systems, predictive maintenance, and cloud-based BAS applications, reflecting a commitment to environmentally conscious and technologically advanced building management practices.

North America is renowned for the prominent presence of technology companies, research institutions, and start-ups involved in advancing intelligent building automation technologies. Technological leadership contributes to the development and adoption of cutting-edge solutions in this region. The growing use of renewable energy sources and the rising awareness of consumers about environmental protection drive the market’s expansion in this region. Wireless sensor network technology is integrated into building automation systems, which drives the growth of this market.

Asia Pacific is estimated to observe the fastest expansion. The market trends highlight a rapid adoption of smart building solutions and BAS technologies. As urbanization accelerates, countries in the region prioritize infrastructure development, incorporating advanced BAS for efficient energy use, occupant comfort, and intelligent building operations. Additionally, the region demonstrates a growing inclination towards customized BAS solutions tailored for specific industry verticals, contributing to the market's dynamic evolution.

In Asia Pacific, the huge adoption of intelligent building automation technology in developing economies such as India, China, Japan, and Singapore drives the growth of the building automation systems market. The governments of India, China, and South Korea are investing in developing smart cities. The Middle East and Africa are anticipated to achieve significant growth in this market due to developments in huge public infrastructure and related investments. The implementation of security systems fuels the market’s growth significantly.

In Europe, the building automation systems market reflects a keen focus on sustainable building practices and stringent energy efficiency standards. The region witnesses a robust adoption of BAS technologies, emphasizing smart city integration and eco-friendly building solutions. With a proactive approach to green initiatives and digital transformation, Europe's BAS trends align with the continent's commitment to creating intelligent and environmentally responsible urban spaces.

The EU directive including the Energy performance of Buildings Directive aims to optimize the energy performance of a building. The rising implementation of security systems by homeowners is expected to drive the market’s growth in this region. The growing demand for energy-efficient products and smart-grid services in France and Germany is anticipated to boost the market’s growth in this region in the coming years.

The building automation systems market encompasses the global industry focused on implementing centralized control systems to monitor and manage a building's various mechanical, electrical, and security components. These systems enhance operational efficiency, reduce energy consumption, and improve occupant comfort by automating functions such as lighting, heating, ventilation, and security.

The market is driven by the increasing demand for smart building solutions, energy efficiency measures, and the integration of IoT technologies. Key players in the market provide solutions that optimize building performance and sustainability, catering to the evolving needs of modern infrastructure.

The prominent industrial players contributing to the growth of the building automation systems market are ABB Ltd, Siemens AG, Honeywell International Inc., Delta Electronics Inc., Cisco Systems Inc., etc. In September 2024, ABB India launched ABB – free@home in India which is a Smart Home Automation System with enhanced interoperability. This is a cutting-edge and comprehensive wireless home automation solution that offers comfort, energy efficiency, and security for the residential segment.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.92% |

| Market Size in 2025 | USD 88.82 Billion |

| Market Size by 2034 | USD 176.37 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Application, and By Offering |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Smart building adoption and internet of things (IoT) integration

The surge in market demand for building automation systems is significantly propelled by the widespread adoption of smart buildings. Organizations and property owners increasingly recognize the benefits of smart building solutions in optimizing operational efficiency, reducing energy consumption, and enhancing overall building performance. Smart buildings leverage BAS to automate and integrate various systems, such as lighting, HVAC, security, and more, providing a holistic and interconnected approach to building management. This demand is further intensified by the growing focus on creating intelligent and sustainable structures that cater to the evolving needs of occupants and align with modern environmental standards.

The integration of internet of things (IoT) technologies plays a pivotal role in surging the market demand for building automation systems. IoT enables advanced connectivity and real-time data exchange, allowing BAS to operate with heightened efficiency. The ability to remotely monitor and control building systems, coupled with the seamless communication between devices, enhances the overall functionality of BAS.

This surge is driven by the desire for data-driven decision-making, predictive analytics, and the capability to create agile, responsive building environments. As IoT continues to evolve, its integration with BAS becomes integral in meeting the demands for intelligent, connected, and adaptable building infrastructures.

The complexity of implementation and interoperability challenges

The building automation systems market faces significant restraints due to the complexity of implementation and interoperability challenges. Implementing BAS involves integrating diverse components like sensors, controllers, and software, which can lead to intricate deployment processes. The complexity arises from the need to customize solutions based on specific building requirements, resulting in longer implementation timelines and increased costs. This complexity can deter potential adopters, especially smaller enterprises with limited resources, impacting the overall market demand.

Interoperability challenges pose another constraint on the building automation systems market. The lack of standardized communication protocols among different BAS components can hinder seamless integration, leading to system inefficiencies and compatibility issues. This challenge becomes more pronounced as organizations seek to expand or upgrade existing systems, facing difficulties in integrating new technologies with legacy infrastructure. Addressing these complexities and enhancing interoperability are crucial for overcoming market restraints and fostering widespread adoption of BAS across diverse industries.

Smart city integration and customized solutions for verticals

The surge in market demand for the building automation systems market is prominently fueled by the integration of building automation systems (BAS) into the broader framework of smart cities. As urban centers strive to become more interconnected and intelligent, BAS plays a pivotal role in optimizing the operational efficiency of diverse infrastructure components. From intelligent street lighting to efficient waste management, smart city initiatives leverage BAS to create interconnected systems that enhance sustainability, reduce energy consumption, and improve overall urban living conditions. The demand for BAS as a key component in shaping the future of smart urban environments intensifies as cities globally prioritize digital transformation for enhanced citizen services and resource optimization.

The market demand for BAS experiences a significant upswing through the provision of customized solutions tailored for specific industry verticals. As organizations in sectors such as healthcare, education, and retail recognize the unique requirements of their built environments, BAS providers seize the opportunity to develop specialized solutions. These customized offerings address sector-specific challenges, enhance operational efficiency, and contribute to a more adaptive and responsive building ecosystem. The customization trend not only meets the distinct needs of different verticals but also drives innovation within the BAS market, fostering a landscape where tailored solutions lead to increased adoption and sustained market growth.

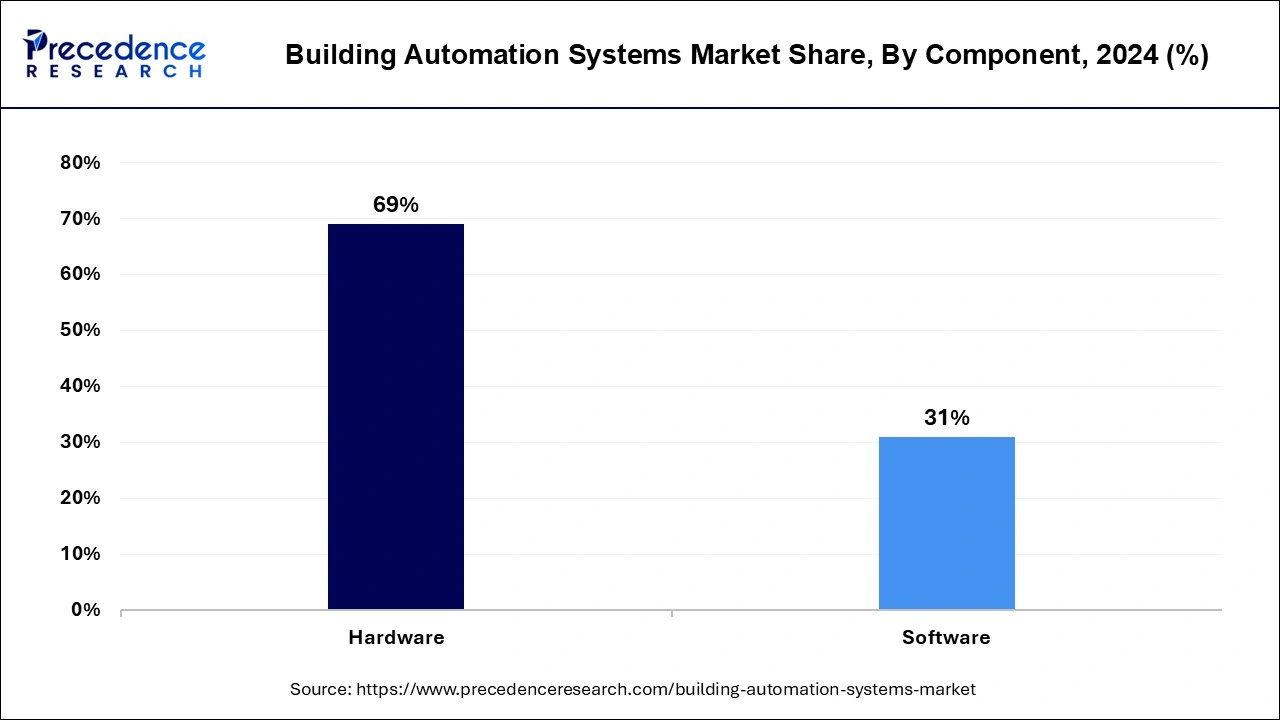

The hardware segment has held the largest market share of 69% in 2024. In the building automation systems market, hardware components encompass the physical devices integral to system functionality. This includes sensors, actuators, controllers, and communication modules. Trends in BAS hardware involve the integration of advanced sensors for real-time data collection, energy-efficient actuators for precise control, and robust controllers capable of handling complex automation tasks. The shift towards open-source hardware and modular architectures further enhances flexibility and interoperability, meeting the evolving needs of smart buildings.

The software segment is anticipated to expand at a significant CAGR of 12.5% during the projected period. BAS software constitutes the digital intelligence orchestrating the various hardware components for seamless building automation. Trends in BAS software include the adoption of cloud-based platforms for remote monitoring, analytics-driven solutions for data-driven decision-making, and the integration of artificial intelligence (AI) for predictive maintenance. User-friendly interfaces and the development of scalable software architectures are key trends, facilitating efficient building management and contributing to the overall adaptability of building automation systems to diverse environments.

The commercial segment accounted for a major market share of 49% in 2024. The commercial application of BAS involves the implementation of automation systems in non-residential buildings such as offices, retail spaces, and hotels. Commercial BAS trends emphasize energy management, space optimization, and occupant well-being. Smart lighting, climate control, and occupancy sensors contribute to energy efficiency, while advanced analytics enable data-driven decision-making for building operations. As businesses prioritize sustainability and occupant comfort, commercial BAS trends align with creating intelligent and adaptive environments that enhance operational efficiency and overall business performance.

On the other hand, the residential segment is projected to grow at the fastest rate over the projected period. In the building automation systems market, residential applications refer to the integration of smart technologies within homes. The trend in residential BAS focuses on enhancing comfort, energy efficiency, and security. Home automation systems enable homeowners to control lighting, HVAC, security, and entertainment systems remotely. With the growing demand for smart homes, residential BAS trends lean towards user-friendly interfaces, voice-activated controls, and energy-saving features, creating a more connected and automated living experience.

The security and access controls segment contributed the highest market share of 56% in 2024. In the building automation systems market, security & access control offerings involve the integration of advanced solutions to ensure the safety and security of buildings. This includes technologies such as access control systems, video surveillance, and intrusion detection. Trends in this segment revolve around the convergence of physical and cybersecurity measures, leveraging biometrics, AI, and cloud-based solutions for comprehensive building security.

The facility management systems segment is anticipated to expand at the fastest rate over the projected period. facility management systems within the market encompass tools and technologies for efficiently managing building operations. This includes solutions for HVAC control, lighting systems, and space utilization. Trends in facility management systems emphasize predictive maintenance, IoT integration for real-time monitoring, and the adoption of cloud-based platforms for centralized control and data analytics, enhancing overall operational efficiency and sustainability.

By Component

By Application

By Offering

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

August 2024

January 2025