September 2024

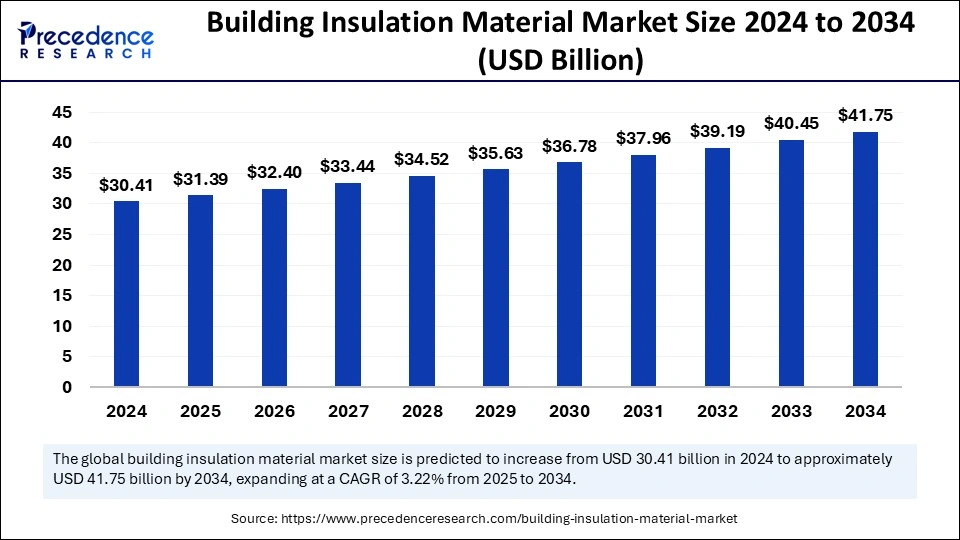

The global building insulation material market size is calculated at USD 31.39 billion in 2025 and is forecasted to reach around USD 41.75 billion by 2034, accelerating at a CAGR of 3.22% from 2025 to 2034. The Europe market size surpassed USD 13.99 billion in 2024 and is expanding at a CAGR of 3.32% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global building insulation material market size accounted for USD 30.41 billion in 2024 and is predicted to increase from USD 31.39 billion in 2025 to approximately USD 41.75 billion by 2034, expanding at a CAGR of 3.22% from 2025 to 2034. The building insulation material market is growing rapidly due to factors like increasing construction of commercial and residential buildings, rapid urbanization, and rising environmental regulations.

In the near future, more sustainable construction with Artificial Intelligence is possible. AI helps in the development of innovative construction materials with enhanced properties. AI can be used as a tool to increase energy efficiency and materials production and reduce carbon footprints by analyzing vast datasets such as environmental impact and material properties to provide a holistic approach to available materials that can be used for building insulation.

Manufacturers are striving for solutions to optimize large-scale production, support the circular economy, and reduce material wastage. Integrating AI technologies in manufacturing processes significantly optimizes production volumes and reduces waste by automating various tasks and minimizing errors. AI can also predict material degradation and enhance the quality of building insulation materials. AI can also detect when materials need replacement or maintenance, helping extend the building's lifespan.

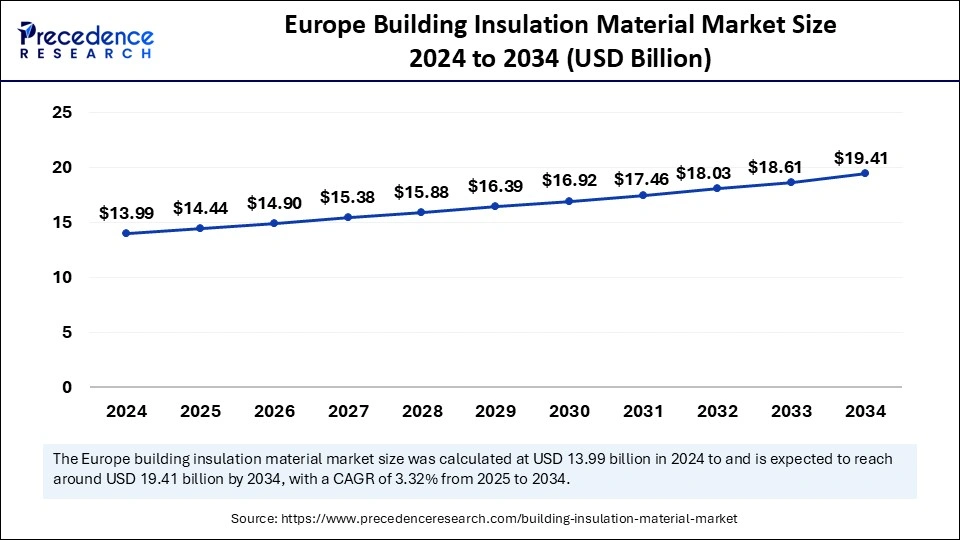

The Europe building insulation material market size was exhibited at USD 13.99 billion in 2024 and is projected to be worth around USD 19.41 billion by 2034, growing at a CAGR of 3.32% from 2025 to 2034.

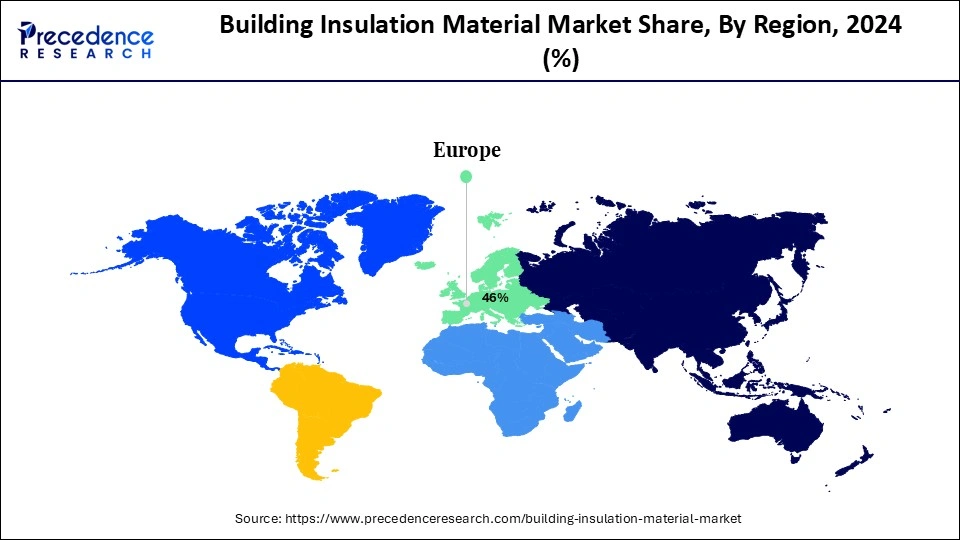

Europe dominated the building insulation material market with the largest share in 2024. This is mainly due to the increased building renovation activities under the European Commission’s Renovation Wave project that aims to improve energy efficiency in buildings. This project aims to renovate around 35 million buildings, including both public and private, by 2030, which is nearly double the current annual rate. Moreover, the European Union has imposed stringent regulations regarding energy efficiency and GHG emissions, encouraging the construction industry to shift toward sustainable materials.

Germany is a major contributor to the European building insulation material market. Leading construction companies in Germany are offering sustainable and energy-efficient construction materials like glass, steel, bricks, and other insulation materials to meet stringent regulations set by the European government for environmental protection to reduce carbon footprints. These enterprises are popular for their sustainability and eco-friendly approach, and they invest substantially in research and development to find new materials.

North America was the second-largest shareholder of the market in 2024 and is expected to grow at a steady growth rate in the coming years. The increasing energy process and stringent regulations regarding energy usage are boosting the adoption of insulation materials in building construction. The U.S. and Canada play a major role in the North American building insulation material market. The increasing awareness about the benefits of insulation materials and the rising construction of green buildings are likely to boost the market growth. According to the report published by the U.S. Environmental Protection Agency, insulation used in a building saves up to 20% on heating and cooling costs.

Asia Pacific is expected to witness the fastest growth in the foreseeable period. The increasing housing construction, especially in countries like India and China, is expected to boost the market growth in the region. With the rapid pace of urbanization, construction activities are on the rise in the region, supporting market growth. Governments around the region are also investing heavily in construction projects, contributing to market growth. In addition, there is a high demand for sustainable construction materials due to the strong emphasis on minimizing carbon emissions from the construction sector and achieving sustainability goals.

Building insulation materials include a range of products to minimize heat transfer and improve building energy efficiency. Such innovative materials are crucial in improving thermal conductivity and minimizing energy consumption to reduce environmental impact. The rising demand for energy-efficient buildings and the increasing construction activities are expected to drive the growth of the building insulation material market during the forecast period. Governments around the world are offering incentives to promote sustainable construction, which further supports market expansion.

Building insulation materials can withstand harsh environmental conditions, optimizing the energy efficiency and lifespan of the building. Phase change materials (PCM) can release and absorb heat as per requirement and phase changes. Indoor temperatures can be regulated with the help of phase change materials, further optimizing energy efficiency. The rising concerns regarding climate change further support market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 41.75 Billion |

| Market Size in 2025 | USD 31.39 Billion |

| Market Size in 2024 | USD 30.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.22% |

| Dominated Region | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing Construction of Green Buildings

The growing construction of green buildings is a key factor driving the growth of the building insulation material market. This approach has emerged in recent years due to increased concerns regarding environmental sustainability. Consumers are becoming aware of the environmental impact of traditional building materials, which heavily affect the climatic cycle and impact the healthy lifestyle of masses across the globe. To avoid this, many governments have imposed stringent regulations for major sectors responsible for greenhouse gas emissions. Thus, consumers and business owners are seeking eco-friendly solutions, which are offered by building insulation materials, expanding its reach in the global market. This further encourages the development of advanced materials with high thermal efficiency that can comply with strict regulations as well.

Another major factor for the market's growth includes growing construction activities due to rapid urbanization across the globe. The need for residential buildings is increasing due to population growth, requiring sustainable and cost-effective solutions. Insulation materials with different types can be utilized to fulfill this growing demand for building construction, further augmenting the market’s reach.

Supply Chain Barrier with High Upfront Investment

Supply chain disruptions caused by geopolitical tension hampers the growth of the building insulation material market. Supply chain disruptions limit the availability of raw materials, leading to high production costs. This, in turn, discourages building contractors from adopting building insulation materials. Moreover, the high costs of insulation materials affect the growth of the market. The volatile nature of the market due to geopolitical tension among several countries like the U.S., Russia, and China limits market growth by disturbing the supply chain and continuously changing the rate of raw materials. Also, transportation barriers may worsen this situation.

Innovation in Materials and Smart Technology

The major opportunities that the building insulation market holds are increasing innovations in sustainable materials and the rising development of smart insulation materials. To create materials with improved performance, investing in research and development is a significant move for the leading players. Developing and using smart insulation technologies for construction presents a substantial opportunity for market growth. Smart insulation materials having automation capabilities can provide real-time data for thermal management, fuelling the tech driven solutions for building insulation. Moreover, governments across the globe are offering incentives and subsidies to adopt construction practices that are eco-friendly, energy-efficient, and able to comply with regulatory standards.

The Expanded Polystyrene segment held the largest share of the building insulation material market in 2024. This is mainly due to the high demand for energy-efficient building materials. Expanded Polystyrene (EPS) is a type of plastic material derived from rigid polystyrene pellets. Its high tensile strength and lightweight make it an ideal material for building insulation. EPS offers excellent thermal insulation and helps minimize energy consumption in building construction. EPS also prevents water absorption and is highly resistant to humidity.

The glass wool segment is expected to grow at a significant rate during the forecast period. Glass wool exhibits excellent thermal resistance properties, making it an ideal option for building insulation materials. It optimizes energy efficiency in buildings. Glass wool insulation can be applied in both residential and commercial buildings, highlighting its versatility. It offers easy installation and lightweight properties, and it is eco-friendly as well. The rising focus on developing energy-efficient buildings is likely to support segmental growth.

The roofs segment dominated the building insulation material market with the largest share in 2024. The segment growth is driven by the growing demand for efficient solutions to reduce heat penetration through roof surfaces. Proper insulation for roofs enhances indoor comfort by providing a shield from heat waves and reducing the cost of cooling methods. The need for advanced insulation solutions has also increased due to an inclination toward green building and thermally resistive roofing systems, which bolstered the segment’s growth.

The walls segment is projected to grow at a rapid pace during the assessment year. The growth of the segment can be attributed to the increasing use of insulation for external and internal walls of the buildings to protect them from excessive heat absorption that may reduce the lifespan of construction. The comfort of occupants is a prime focus for contractors while ensuring heat transfer should be less even through walls of residential and commercial buildings. Insulation of walls is a prominent factor in making buildings energy-efficient and sustainable.

The residential segment dominated the building insulation material market in 2024. This is mainly due to the increased construction of residential buildings, especially in emerging countries. Stringent regulations regarding GHG emissions have mandated the use of insulation materials in residential constructions to reduce energy consumption. Moreover, rapid urbanization in countries like India and China is boosting the demand for residential buildings, sustaining segment’s position in the market. According to a report, more than 40% of the Indian population is expected to live in urban areas by 2030, which creates a need for 25 million extra housing units that are affordable.

The commercial segment is anticipated to witness the fastest growth during the projection period. The segment is expanding due to the growing construction of office spaces, hypermarkets, supermarkets, universities, departmental stores, hospitals, and resorts. Many countries have imposed strict building codes that require commercial buildings to meet specific energy efficiency standards. Moreover, businesses are prioritizing sustainable practices and focusing on reducing carbon emissions, supporting segmental growth.

By Material

By Application

By End-user

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

February 2025

November 2024