January 2025

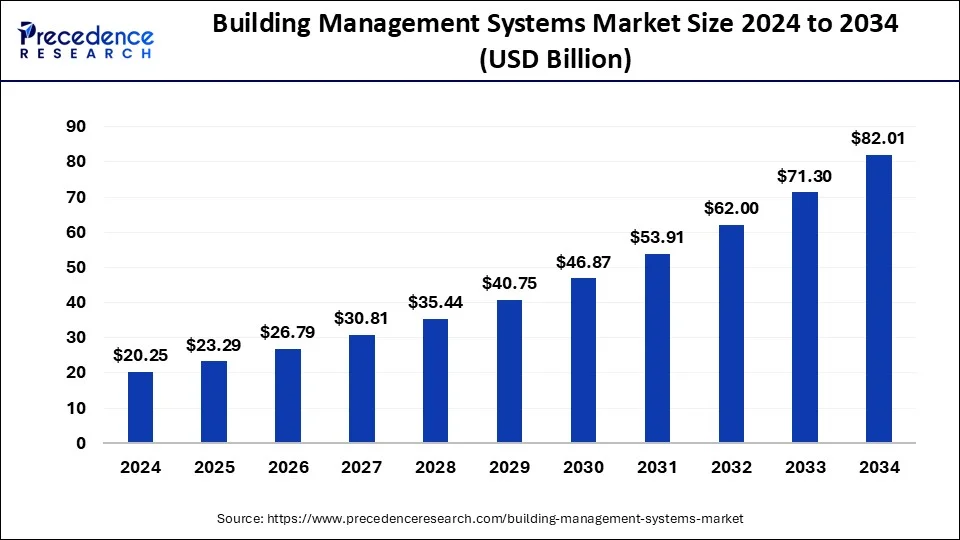

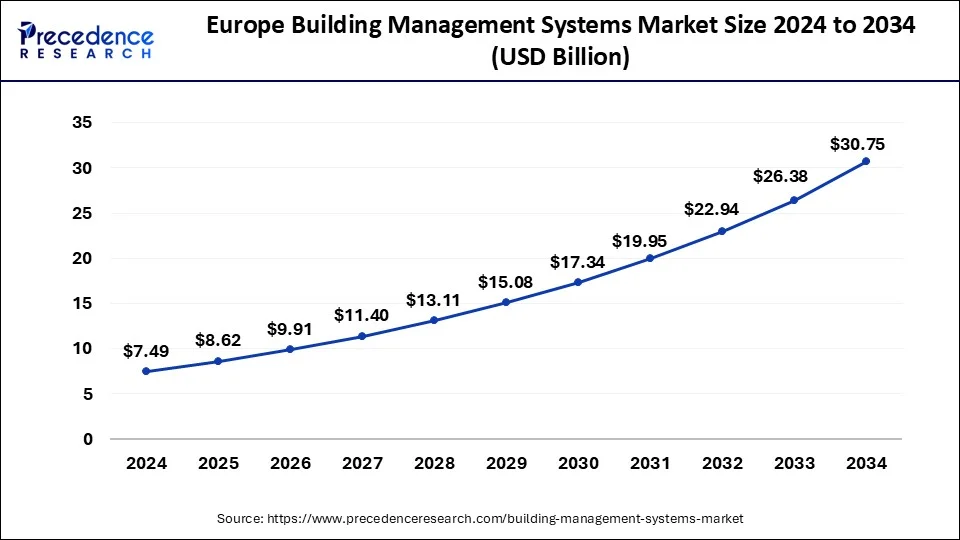

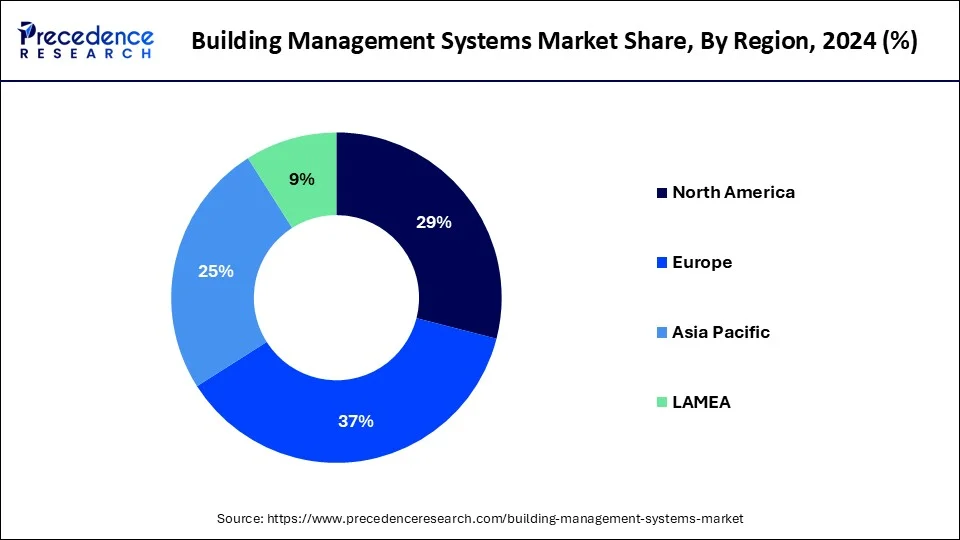

The global building management systems market size is calculated at USD 23.29 billion in 2025 and is predicted to reach around USD 82.01 billion by 2034, accelerating at a CAGR of 15.01% from 2025 to 2034. The Europe building management systems market size surpassed USD 8.62 billion in 2025 and is expanding at a CAGR of 15.17% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global building management systems market size was estimated at USD 20.25 billion in 2024 and is predicted to increase from USD 23.29 billion in 2025 to approximately USD 82.01 billion by 2034, expanding at a CAGR of 15.01% from 2025 to 2034. The rising use of smart sensors and IoT devices is observed to promote the building management systems market growth in the coming years.

As technology continues to evolve, the integration of cloud computing technologies, the Internet of Things (IoT), and artificial intelligence (AI) in the building management systems market provide efficient solutions, such as extending the equipment life, water conservation, improving grid reliability, reducing energy consumption, lowing carbon emissions, and enhancing the overall occupant comfort. With technological advancements, the monitoring and controlling of various systems, such as HVAC, lighting, and security, provide a comprehensive view of building operations.

Cloud computing is integral to building management systems BMS as it offers remote monitoring and control capabilities. The cloud-based platform brings about scalability, better data storage, and accessibility from anywhere. Internet of Things (IoT) devices provide a broad range of data points for analysis and optimization. Artificial intelligence (AI) can analyze data efficiently and automatically adjust settings for maximum efficiency, resulting in reduced operational costs. Machine learning (ML) algorithms assist in predicting equipment failures before they occur, which leads to lowering downtime and ensuring a seamless and reliable experience.

The Europe building management systems market size was exhibited at USD 7.49 billion in 2024 and is projected to be worth around USD 30.75 billion by 2034, poised to grow at a CAGR of 15.17% from 2025 to 2034.

Europe held the dominant share of the software building management systems market in 2023 and is observed to witness prolific growth in the during the forecast period. The region’s growth is attributed to the rapid infrastructure development, growing adoption of smart building solutions, increasing demand for energy-efficient and eco-friendly buildings, supportive regulatory frameworks, rise in R&D expenses, presence of prominent market participants, and increasing investment in smart city projects. In addition, there is a rising demand for innovative safety and security solutions in building facilities.

Furthermore, there is a rapid adoption of advanced technologies such as artificial intelligence, IoT, analytics, and cloud computing in building management systems. These integrations of advanced technologies enable predictive maintenance and improve control over building operations and real-time data analysis.

North America is anticipated to grow at the fastest rate in the building management systems market during the forecast period owing to the increasing popularity of demand for energy-efficient infrastructure, rising investments in smart city projects, the presence of its stringent regulations on greenhouse gas emissions, expansion of construction industry, increase in the number of technology companies, rapid adoption of advanced in smart buildings, and increasing awareness about energy conservation.

Several building management systems market players in North America are expanding their operations and adopting marketing strategies such as new product launches, partnerships or collaborations, and acquisitions to strengthen their positions. Moreover, the rising spending capacity of consumers for digitalizing building facilities is observed.

Building management systems (BMS) are computer-based systems installed to monitor and control the building's electrical and mechanical equipment, including lighting, HVAC, heat pumps, air handling units, condensing units, fire systems, energy, and security systems. Building management systems is a central control point for all facilities within a building. BMS can easily remotely control ventilation and heating systems from a mobile device and computer or laptop.

The physical presence of facility management staff is not required to go to each building, room, or floor to switch on, shut down, or manually adjust mechanical devices. Almost every equipment used in the building feeds data to one single system. The building management systems market enables well-informed decision-making, boosts efficiency, and reduces energy consumption, which leads to cost savings.

| Report Coverage | Details |

| Market Size by 2034 | USD 82.01 Billion |

| Market Size in 2025 | USD 23.29 Billion |

| Market Size in 2024 | USD 20.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.01% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Software, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for energy-efficient and eco-friendly buildings

Energy-efficient and eco-friendly buildings are expected to boost the growth of the building management systems market during the forecast period. As smart technology evolves, energy efficiency becomes a top priority for building owners. Building management systems (BMS) are increasingly becoming a crucial role in both new construction and retrofit projects. BMS can optimize energy usage within buildings, which will result in reducing energy consumption, promoting sustainable building practices, and adopting renewable energy sources. BMS systems are highly effective in energy management as they continuously monitor and analyze data from several building systems, including lighting and HVAC, to optimize energy usage.

High initial cost

The high initial cost is projected to hamper the growth of the market. The deployment of AI sensors requires significant investment as advanced technology and infrastructure are required. In addition, several lower and middle-income countries lack adequate internet connection infrastructure that provides the desired performance and is also likely to limit the expansion of the global building management systems market during the forecast period.

Rise in cybersecurity measures

The rising cybersecurity measures are expected to boost the growth of the building management systems market during the forecast period. BMS integrates a wider range of building functions, including lighting, heating, ventilation, air conditioning (HVAC), security, access control, and more, into a single unified system. As building management systems have become more sophisticated and increasingly connected. Cybersecurity has become a growing concern in safeguarding building systems from cyber threats and unauthorized access. More robust measures are widely adopted, including advanced encryption, secure communication protocols, and regular software updates necessary for data integrity.

The energy management segment held the largest share of the building management systems market in 2024 and is expected to sustain its position throughout the forecast period. The growth of the segment is majorly driven by the increasing energy costs, rising government initiatives towards sustainability, and increasing adoption of renewable energy. In energy management, BMS enables the comprehensive control of lighting systems and HVAC to optimize energy consumption. BMS allows buildings to automate functions and reduce energy costs. It also enables real-time monitoring and control of the building facility.

The security management segment is expected to witness considerable growth in the building management systems market over the forecast period. The significant rise in security concerns over the years led to an increasing adoption of BMS. The use of security surveillance devices such as CCTV cameras and biometric systems assists in ensuring the safety of the residents.

The commercial segment dominated the global building management systems market in 2024. BMS are computer-based systems widely installed in commercial buildings to monitor, supervise, and control the building's mechanical and electrical equipment. These systems include access control, fire alarms, programmable lighting, video surveillance, HVAC control, electric power management, and others. Moreover, the use of these systems helps to increase operating efficiency, improve indoor air quality, lower operating and maintenance costs, and enhance occupant experience.

The residential segment is projected to expand rapidly in the building management systems market in the coming years, owing to the increasing demand for smart and connected homes. Building management systems are designed to control, monitor, and optimize various building functions and services in residential buildings. These systems are extensively deployed in residential buildings to reduce energy consumption, boost operational efficiency, deliver occupant comfort, and improve overall building performance. Residents can easily personalize temperature and lighting settings through mobile apps, which creates a comfortable environment. It also allows the tracking of real-time data on air quality.

By Software

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

August 2024

August 2024