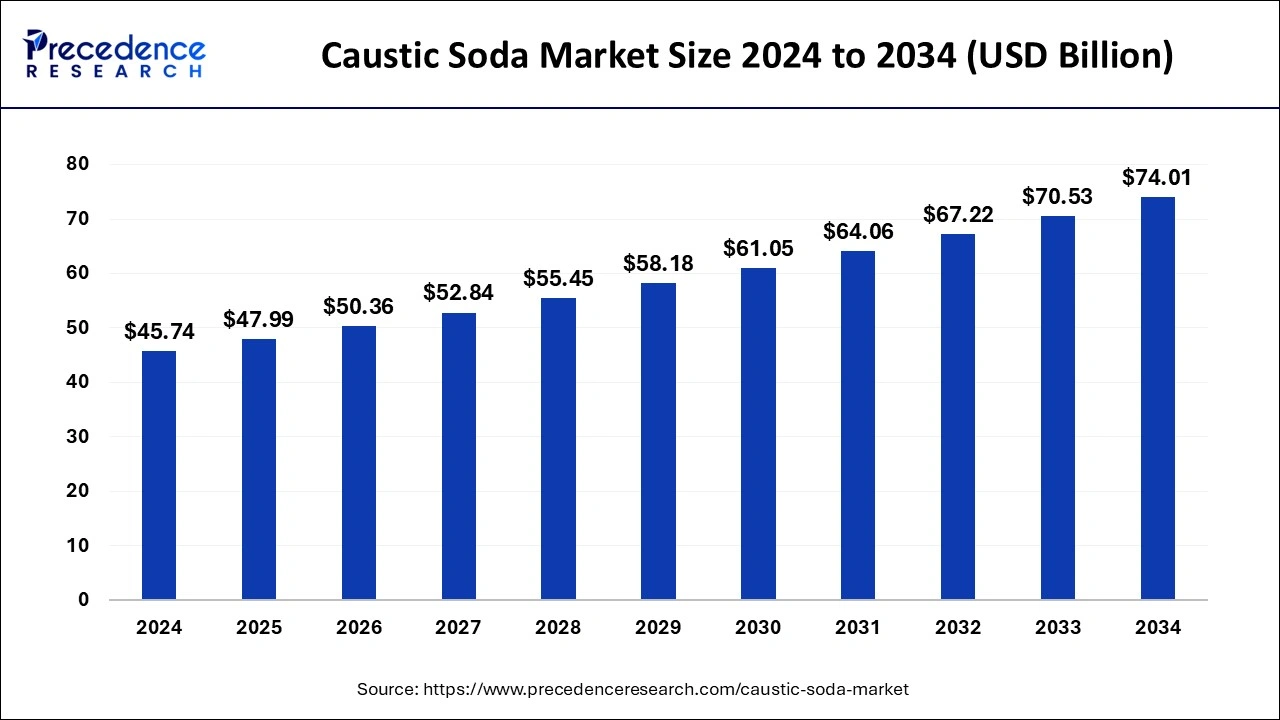

The global caustic soda market size is accounted at USD 47.99 billion in 2025 and is forecasted to hit around USD 74.01 billion by 2034, representing a CAGR of 4.93% from 2025 to 2034. The North America market size was estimated at USD 24.33 billion in 2024 and is expanding at a CAGR of 4.97% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global caustic soda market size was calculated at USD 45.74 billion in 2024 and is predicted to reach around USD 74.01 billion by 2034, expanding at a CAGR of 4.93% from 2025 to 2034. The caustic soda market growth is attributed to the increasing demand for caustic soda in diverse applications, such as aluminum production, water treatment, and chemical manufacturing.

In the caustic soda market, some organizations use artificial intelligence (AI) systems in manufacturing, energy management, and increasing safety measures. Sophisticated digital programs process big data instantly to offer producers the ability to forecast equipment maintenance schedules, increase output, and reduce losses. AI also facilitates market forecasting by recognizing patterns and changes in demand, enabling stakeholders as well. Furthermore, integrating it into supply chain management also makes inventory needs and delivery more efficient, thereby enhancing customer relationships.

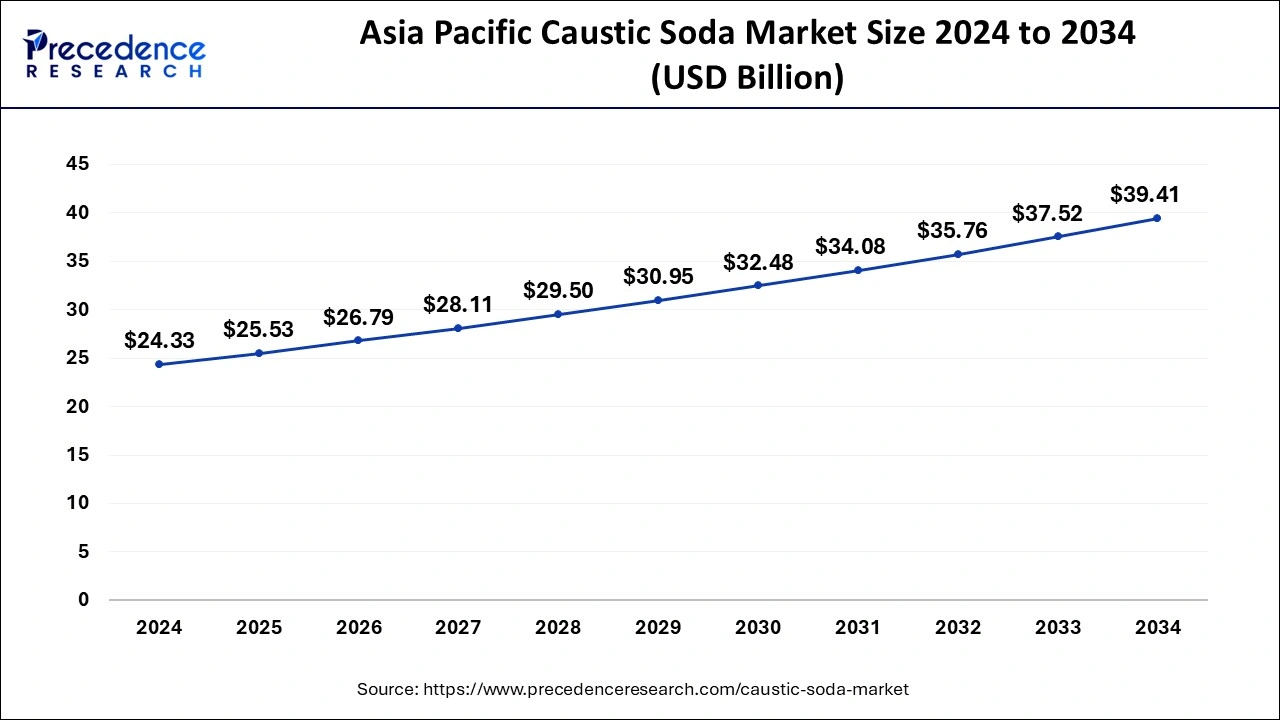

The Asia Pacific caustic soda market size was exhibited at USD 24.33 billion in 2024 and is projected to be worth around USD 39.41 billion by 2034, growing at a CAGR of 4.97% from 2025 to 2034.

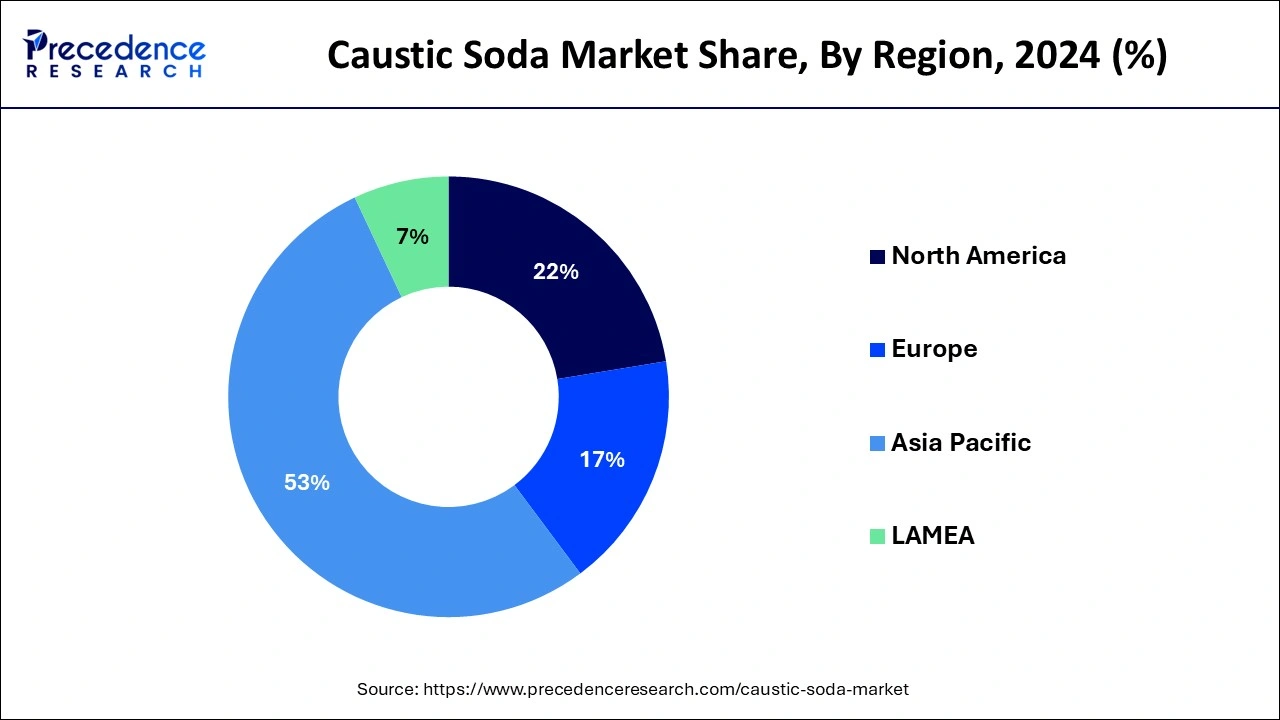

Asia Pacific dominated the global caustic soda market in 2024. It remains evident that key consuming countries, including China, India, and Japan, are instrumental to the growth in end-use markets, such as aluminum production and chemicals, water treatment chemicals, and textiles. The region’s domination is supported by the fact that China is the largest producer of aluminum in the world, and it uses large amounts of caustic soda in the Bayer process of alumina extraction. Furthermore, with the rising industrialization and urbanization in India, the use of chemicals in water treatment and other chemical manufacturing.

North America is anticipated to grow at the fastest rate in the caustic soda market during the forecast period due to the research and development of new technologies in chemical industries, rising demand for aluminum products, and growing attention to infrastructure development. The United States remains an important market in North America where sustainability still remains a focus point; caustic soda has numerous uses, such as water treatment, production of organic and inorganic chemicals, and pulp and paper industries.

The EPA has specifically pointed to increasing stringency of water quality regulation, which compels industries to seek out and buy water treatment, in turn driving demand for caustic soda. Furthermore, the increasing demand for green technologies and the relatively recent upturn of the American manufacturing industry is expected to facilitate an increased demand for caustic soda.

The growth of caustic soda products with its high demand is going to increase across all sectors, which will further facilitate the caustic soda market. There is an increasing desire for alumina manufacturing, in which caustic soda is used to extract aluminum from bauxite. The aluminum industry and other related products are constantly growing, especially in China, India, and the rest of the world. It is anticipated that the increasing application of caustic soda in water treatment processes further drives market growth. The technological breakthroughs in caustic soda manufacturing include improved energy-efficient and eco-friendly processes that are expected to have high production capacity and quality.

| Report Coverage | Details |

| Market Size by 2024 | USD 45.74 Billion |

| Market Size in 2025 | USD 47.99 Billion |

| Market Size in 2034 | USD 74.01 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.93% |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising alumina production

Increasing demand for alumina production is expected to boost the caustic soda market growth in the coming years. The Alumina industry uses caustic soda for the Bayer process through which aluminum is obtained from bauxite using the chemical as a reagent. This dependence is due to caustic soda solubilizing power, which makes the output to be very pure. Since aluminum is used increasingly in automobiles, aerospace industries, construction, and other segments, as it is lighter and lasts longer, the demand for caustic soda increases consequently. Furthermore, these tendencies prove the role of caustic soda as the key intermediate product in the aluminum industry’s value chain, together with constantly rising requirements for ecologically friendly and energy-saving production processes.

Environmental challenge

Hamper environmental concerns surrounding caustic soda production are anticipated to limit caustic soda market expansion in the coming years. The process of production causes relative emissions of carbon dioxide and other greenhouse gases, hence contributing to climate change. The governments of countries around the world continue to put enhanced standards on pollution emissions, which has negative impacts on the cost of operations for the producers.

The most important category of production methods in the caustic soda market is also potentially problematic, as it uses mercury and asbestos in some plants, which has health and environmental consequences. Furthermore, there are global bodies like the United Nations Environment Programme (UNEP) that champion cleaner production technologies for industries that are forcing change or improvement. Such factors lead stakeholders to search for other chemicals or processes to apply.

Rising investments in advanced production technologies

Rising investments in advanced production technologies are likely to unlock new potential in the caustic soda market. Manufacturers prioritize the development of energy-efficient and environmentally friendly caustic soda production methods to comply with stringent regulations and reduce operational costs. Further capital expenditure on superior production technologies is opening up new opportunities in the caustic soda industry. Industry players strive to achieve efficient and sustainable production processes to meet legal requirements and cut expenses.

Membrane cell technology remains more efficient and emits less as the adoption of the technology spreads worldwide. Such innovations enhance the ability of firms to scale up production and quality standards and meet the increasing demand and need for the caustic soda market across different sectors while considering sustainability. Furthermore, the rising use of electric evaporation plants, as Nobian in 2024, has put its bet on electricity-powered evaporation plants to produce caustic soda. The facility under construction in Delfzijl decreases COâ‚‚ emissions by 25,000 tonnes per year and saves 85% of the energy consumed.

The alumina segment held a significant presence in the caustic soda market in 2024 due to the strong demand for aluminum, particularly in the automotive, aerospace, and construction sectors. Bauxite processing involves the use of caustic soda in the Bayer process, which is essential for the extraction of alumina. The global aluminum production summary of 2023 reveals that China and India have recently ramped up their capacity to produce this metal to meet the internal and export markets. Furthermore, the rising capital spending on aluminum pot lining and chromizing technologies will help drive the demand for the product further as China, India, and Brazil continue to invest in alumina refineries for higher aluminum production.

The water treatment segment is expected to grow at the fastest rate in the caustic soda market during the forecast period of 2025 to 2034, owing to the growing interest in water and wastewater management as a necessity for growing industries and municipal needs. Sodium hydroxide is also used effectively in water treatment companies as a neutralizer of acids and for the removal of heavy metals from water. The increasing global awareness of water pollution in industrial and agricultural processes is projected to drive water treatment applications. The growth of cities in developing countries requires effluent, safe, and clean water treatment systems confined to nations such as India and sub-Saharan Africa, where water scarcity is fast becoming a cause of concern, which further boosts the demand for caustic soda in the water treatment sector.

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client