November 2024

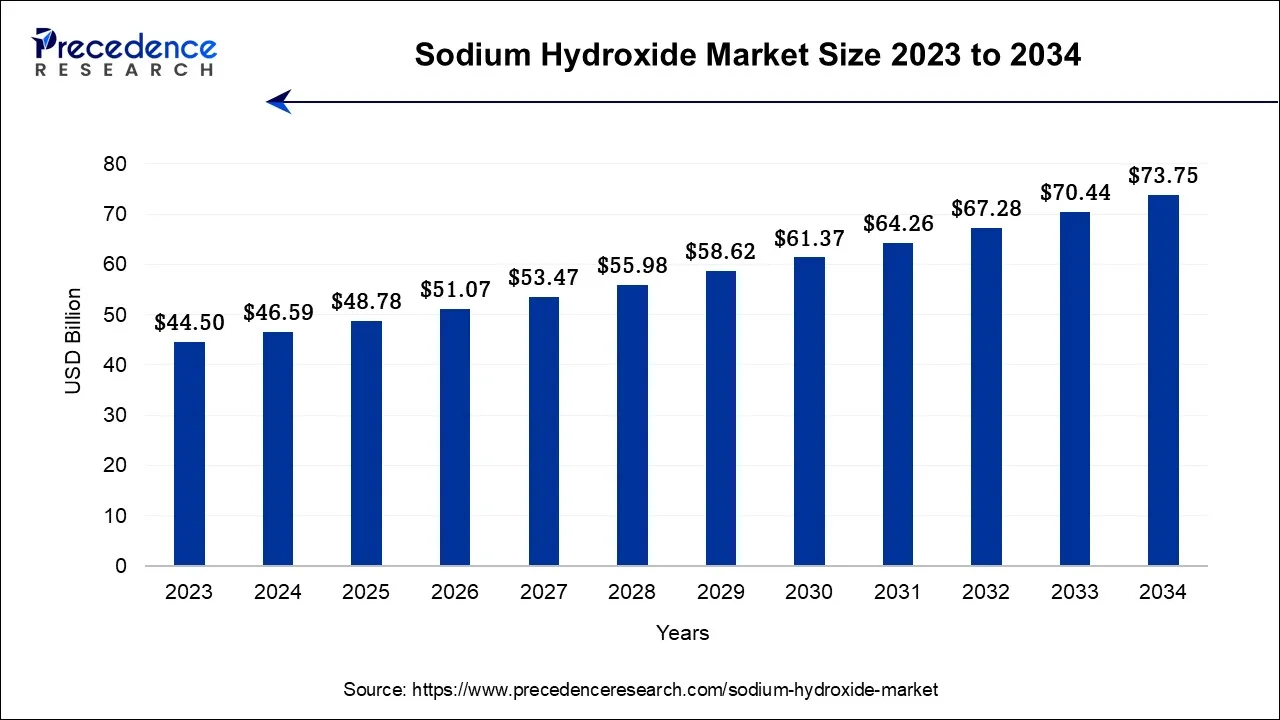

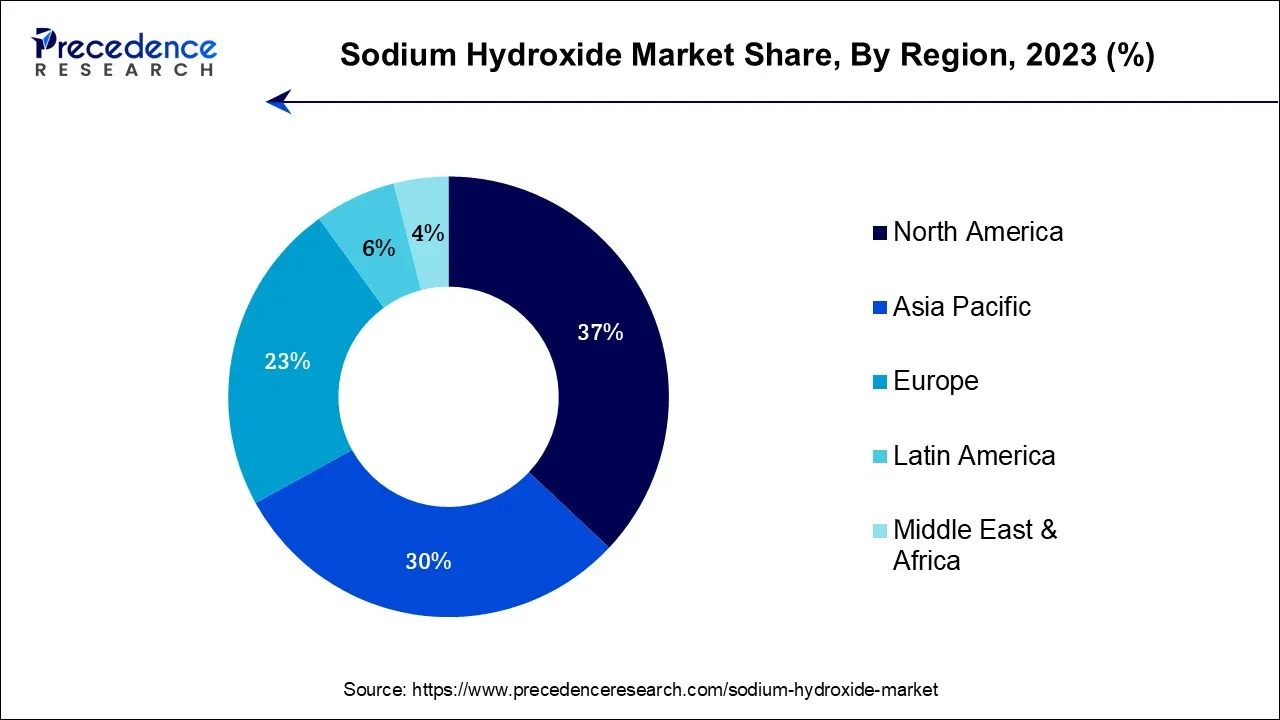

The global sodium hydroxide market size is calculated at USD 46.59 billion in 2024, grew to USD 48.78 billion in 2025, and is predicted to hit around USD 73.75 billion by 2034, poised to grow at a CAGR of 4.7% between 2024 and 2034. The North America sodium hydroxide market size accounted for USD 17.24 billion in 2024 and is anticipated to grow at the fastest CAGR of 4.84% during the forecast year.

The global sodium hydroxide market size is expected to be valued at USD 46.59 billion in 2024 and is anticipated to reach around USD 73.75 billion by 2034, expanding at a CAGR of 4.7% over the forecast period from 2024 to 2034.

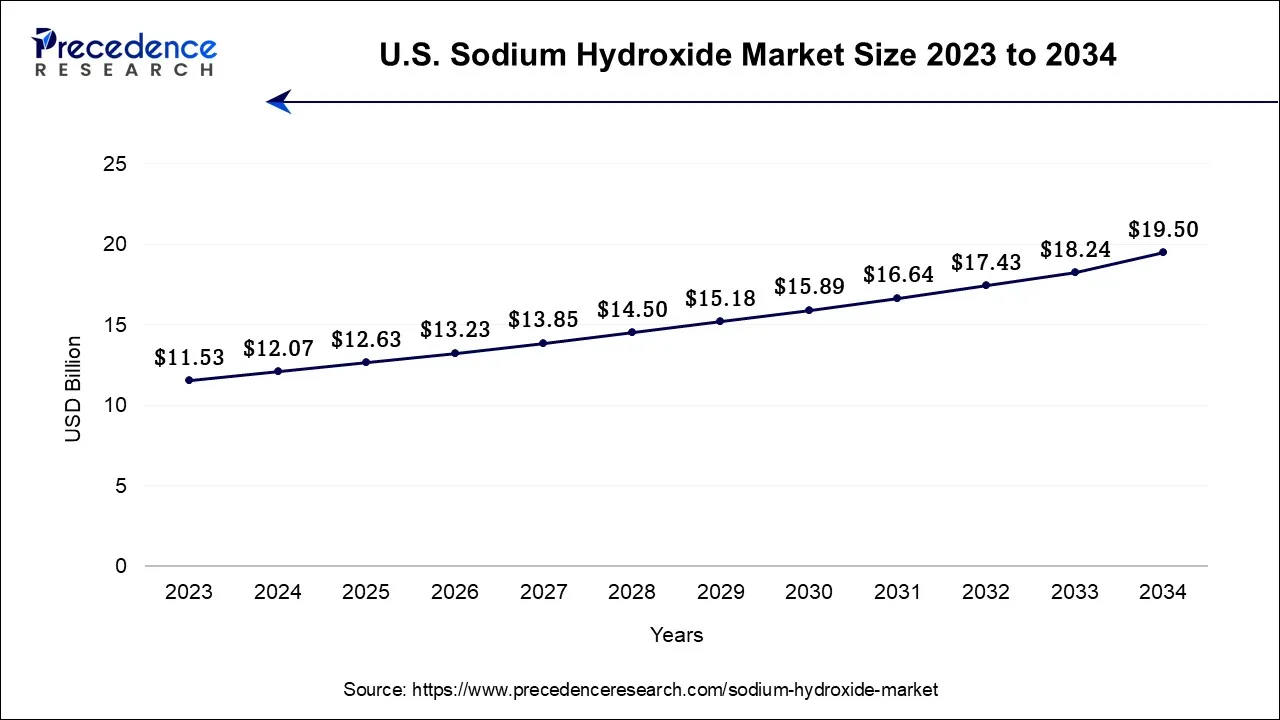

The U.S. sodium hydroxide market size is accounted for USD 12.07 billion in 2024 and is projected to be worth around USD 19.50 billion by 2034, poised to grow at a CAGR of 4.92% from 2024 to 2034.

North America has held the largest revenue share 37% in 2023. One key trend is the increasing emphasis on sustainable production methods and environmentally friendly processes, driven by stringent environmental regulations. Additionally, the market has seen growth in applications related to water treatment, as concerns over water quality and purification continue to rise. The region's expanding chemical and manufacturing sectors also contribute to the steady demand for sodium hydroxide. These trends reflect North America's commitment to both environmental responsibility and industrial growth in the sodium hydroxide market.

Asia-Pacific is Estimated to Observe the Fastest Expansion

In the Asia-Pacific region, the sodium hydroxide market is witnessing significant growth driven by expanding industrial sectors and infrastructure development. Countries like China and India are experiencing robust demand due to increased manufacturing activities and water treatment needs. Additionally, rising environmental awareness is encouraging the adoption of sodium hydroxide for wastewater treatment. As the region continues to urbanize and industrialize, the sodium hydroxide market in Asia-Pacific is poised for sustained expansion, making it a key player in the global sodium hydroxide landscape.

Several industry trends and growth drivers are shaping the sodium hydroxide market, including the expanding chemicals sector, driven by increased demand for raw materials and intermediate products, which continues to boost sodium hydroxide consumption. Moreover, the rising awareness of water treatment and environmental concerns prompts the adoption of caustic soda for effective wastewater management.

Additionally, technological advancements in manufacturing processes enhance sodium hydroxide production efficiency, further propelling market growth. The market also benefits from its integral role in the pulp and paper industry, which is experiencing growth due to e-commerce packaging demands and increased paper recycling.

Moreover, the sodium hydroxide market growth is underpinned by several key factors. The increasing demand for caustic soda as a key ingredient in the manufacturing of various chemicals, including soaps, detergents, and textiles, presents lucrative business opportunities. Furthermore, the growing need for water purification and treatment, driven by urbanization and environmental regulations, creates a stable market demand for sodium hydroxide.

Technological innovations that optimize production processes and reduce energy consumption are likely to enhance market competitiveness. Additionally, the market can explore opportunities in emerging economies where industrialization and infrastructure development are on the rise, fostering greater demand for sodium hydroxide across various applications.

| Report Coverage | Details |

| Market Size in 2024 | USD 46.59 Billion |

| Market Size by 2034 | USD 73.75 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.7% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Grade, By Production Process, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The surge in chemical manufacturing significantly boosts the demand for the sodium hydroxide market. As a fundamental ingredient in the production of various chemicals, including detergents, soaps, and synthetic materials, sodium hydroxide is indispensable to this sector. With chemical manufacturing expanding to meet growing consumer and industrial needs, the reliance on caustic soda as a crucial raw material escalates. This heightened demand underscores sodium hydroxide's pivotal role in the chemical industry, making it an essential and steadily sought-after commodity in the market. Moreover, Industrial demand is a primary driver for the surge in market demand for the market.

Moreover, the growth and expansion of these industries, coupled with the development of new products and applications, continuously increase the need for caustic soda. This sustained industrial demand creates a steady and robust market for sodium hydroxide, making it a fundamental and sought-after commodity in the global market.

Environmental regulations impose constraints on the sodium hydroxide market by mandating stringent compliance measures and sustainability practices. The disposal of byproducts, notably chlorine gas, requires costly, eco-friendly solutions, increasing production costs. Additionally, regulations demand reduced emissions and responsible waste management, adding operational complexities and expenses. As a result, manufacturers face challenges in maintaining competitive pricing while adhering to these environmental mandates. This can potentially limit market demand for sodium hydroxide as industries seek more environmentally friendly alternatives to meet their chemical needs.

Moreover, Safety concerns pose a significant restraint on market demand for the market. The highly corrosive nature of sodium hydroxide necessitates stringent safety measures in handling, storage, and transportation, increasing operational complexity and costs. Mishandling can result in accidents, injuries, and environmental hazards, making businesses cautious about its usage. Compliance with safety regulations further adds to operational expenses. These safety-related challenges can discourage some industries from using sodium hydroxide or prompt them to explore safer alternatives, thereby impacting market demand.

Energy storage technologies, such as flow batteries, are surging in popularity due to their role in renewable energy integration and grid stability as it is essential for batteries as an electrolyte solution as renewable energy sources expand, so does the need for large-scale energy storage solutions, consequently increasing the demand for sodium hydroxide. This demand surge positions sodium hydroxide as a critical component in the growing energy storage sector, offering substantial growth potential for manufacturers and suppliers within the market.

Moreover, water treatment processes drive market demand for sodium hydroxide. As stringent environmental regulations and increased urbanization heighten the need for effective wastewater management, sodium hydroxide is essential for pH control and neutralizing acidic or alkaline contaminants in water treatment facilities. Its versatile and reliable performance in water purification positions it as a fundamental component in addressing growing global concerns about water quality and sustainability. Hence, the escalating demand for clean water and compliance with environmental standards significantly bolster the market demand for sodium hydroxide in the water treatment sector.

According to the grade, the 50% Aqueous Solution segment has held 43% revenue share in 2023. A 50% Aqueous Solution of sodium hydroxide is a chemical mixture consisting of 50% sodium hydroxide and 50% water. It finds widespread application across industries due to its adaptability in regulating pH, counteracting acidic substances, and supporting various chemical operations. In the sodium hydroxide market, there is a growing trend toward the demand for 50% Aqueous Solution due to its convenience and safety compared to handling solid sodium hydroxide. Industries like water treatment, pulp and paper, and textiles increasingly favor this solution for its ease of use and precise dosing capabilities, reflecting a shift towards safer and more efficient chemical handling practices.

The hardware sector is anticipated to expand at a significant CAGR of 5.8% during the projected period solid sodium hydroxide, available in various grades, is a key chemical compound extensively used across industries. In the Sodium Hydroxide Market, trends indicate a shift towards higher-purity grades to meet stringent quality requirements, especially in the food, pharmaceutical, and electronics sectors. Additionally, advancements in production processes have led to improved solid sodium hydroxide quality and reduced impurities. Growing awareness of environmental sustainability is also prompting the development of eco-friendly solid sodium hydroxide formulations, reflecting the market's commitment to meet evolving industry demands while adhering to stringent quality standards.

Based on the production process, membrane cell segment is anticipated to hold the largest market share of 29% in 2023. Membrane cell, a production process in the sodium hydroxide industry, utilizes an ion-exchange membrane to separate chlorine gas and sodium hydroxide during electrolysis. This method offers several advantages, including improved energy efficiency and reduced environmental impact compared to the older mercury cell process. In recent trends, there's a notable shift toward membrane cell technology due to its eco-friendliness and compliance with stringent environmental regulations. This transition reflects the market's commitment to sustainability and energy-efficient manufacturing processes in the sodium hydroxide production landscape.

On the other hand, the Diaphragm Cell segment is projected to grow at the fastest rate over the projected period. A Diaphragm Cell is a production process used in the sodium hydroxide market to manufacture this essential chemical compound. This process yields sodium hydroxide, chlorine gas, and hydrogen gas, all while preserving a physical diaphragm barrier between the anode and cathode compartments. This technology is evolving to meet environmentally friendly production standards, reduce energy consumption, and enhance overall operational efficiency, reflecting the industry's growing commitment to sustainability and resource optimization.

In recent sodium hydroxide market trends, there is a growing emphasis on environmentally friendly production methods and sustainability. Diaphragm cell technology is evolving to minimize environmental impacts, reduce energy consumption, and improve overall efficiency, aligning with the industry's increasing focus on eco-friendly practices and resource optimization.

In 2023, the biodiesel segment had the highest market share of 36.8% on the basis of the installation. Biodiesel, a sustainable alternative to traditional fossil fuels, is produced through a chemical process called transesterification, where sodium hydroxide (caustic soda) serves as a catalyst. In the sodium hydroxide market, biodiesel production has emerged as a notable application trend. A notable trend in this sector involves the increasing global demand for biodiesel due to its lower carbon footprint and compliance with stringent emissions standards. As governments and industries worldwide prioritize sustainability, the biodiesel market continues to grow, driving the demand for sodium hydroxide as a crucial catalyst in this eco-friendly fuel production process.

The alumina is anticipated to expand at the fastest rate over the projected period. Alumina, derived from bauxite ore, is a primary application of sodium hydroxide. In the sodium hydroxide market, the alumina industry is witnessing significant growth trends. As global demand for aluminum continues to rise, alumina production, which relies on sodium hydroxide for refining bauxite, is increasing. The market is also impacted by technological advancements aimed at optimizing the alumina extraction process, enhancing efficiency, and reducing environmental impact. Additionally, sustainability concerns are driving efforts to recycle sodium hydroxide used in alumina refining, aligning with the broader industry shift towards eco-friendly practices.

Market Segmentation

By Grade

By Production Process

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

February 2025

February 2023