February 2025

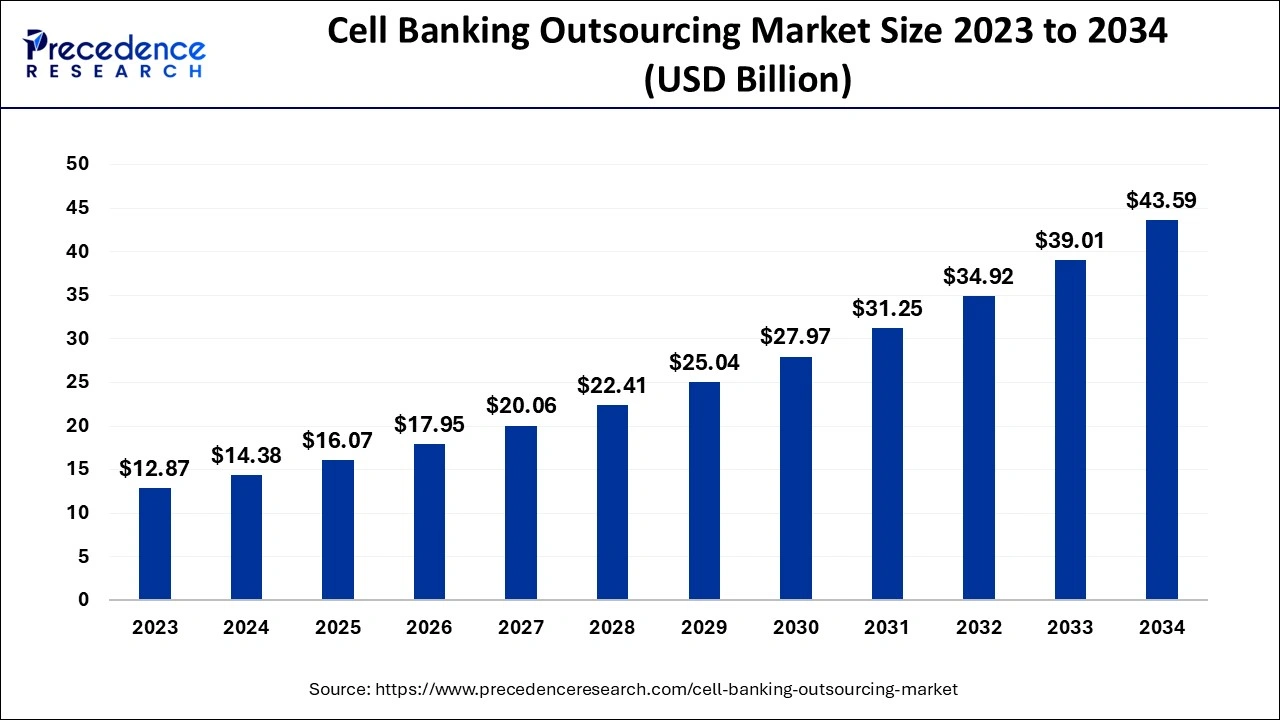

The global cell banking outsourcing market size accounted for USD 14.38 billion in 2024, grew to USD 16.07 billion in 2025 and is expected to be worth around USD 43.59 billion by 2034, registering a solid CAGR of 11.72% between 2024 and 2034. The North America cell banking outsourcing market size is calculated at USD 5.90 billion in 2024 and is estimated to grow at a fastest CAGR of 11.86% during the forecast period.

The global cell banking outsourcing market size is calculated at USD 14.38 billion in 2024 and is projected to surpass around USD 43.59 billion by 2034, expanding at a CAGR of 11.72% from 2024 to 2034. The rising advancement of cryopreservation and cell bank preparation methodologies is the key factor to drive the cell banking outsourcing market growth.

North America dominated the global cell banking outsourcing market in 2023. North America, particularly the United States, is the focal point of the biopharmaceutical sector. The regulatory landscape in the U.S. fosters biopharmaceutical research and development by providing clear and established guidelines from regulatory bodies like the Food and Drug Administration (FDA). Moreover, this regulatory framework ensures a predictable and supportive environment for businesses involved in cell banking and related services by improving confidence among stakeholders and consumers.

Asia Pacific is expected to grow at the fastest rate in the cell banking outsourcing market during the period studied. The biopharmaceutical and biotechnology sectors in Asia Pacific are experiencing notable growth, which results in a rising demand for cell banking services to bolster research and development efforts. Also, the region’s vast population and varied genetic diversity offer extensive opportunities for stem cell research and personalized medicine, which intensifies the need for effective cell banking and storage solutions.

The preparation of cell banks involves precise cryopreservation techniques, with three crucial factors affecting the process's quality: the cell line's biological properties, the type of freezing media utilized, and the selected freezing method or profile. Moreover, the scale of the cell bank significantly affects cryopreservation quality, as both small and large banks experience notable vial-to-vial variability. This variability is influenced by temperature differences, variations in handling procedures, and timing inconsistencies. The cell banking outsourcing market is instrumental in the collection, testing, storage, and characterization of cells and tissues. Through stringent cryopreservation practices, this industry seeks to ensure the preservation of cell and cell line integrity and viability throughout storage and usage.

The Benefits of AI in the Cell Banking Outsourcing Market

Artificial Intelligence (AI) is advancing the life sciences in numerous ways, including enhancing clinical trial outcomes and increasing accessibility for both researchers and patients. In the cell banking outsourcing market, the process of preserving cells and tissues, AI offers substantial advantages. This complex procedure is prone to challenges, but AI technology can alleviate some of these difficulties. The benefits of incorporating artificial intelligence in this field are extensive. They cover improvements in safety, optimal storage of biological materials, and advancements in bioinformatics.

| Report Coverage | Details |

| Market Size by 2034 | USD 43.59 Billion |

| Market Size in 2024 | USD 14.38 Billion |

| Market Size in 2025 | USD 16.07 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.72% |

| Largest MarketNorth America | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Cell Type, Phase, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing adoption of stem cell therapies

The global cell banking outsourcing market is significantly driven by the rising adoption of stem cell therapies. Stem cell therapy, an expanding area within regenerative medicine, holds promise for addressing a broad spectrum of diseases and disorders. As the need for stem cell treatments increases, so does the demand for stable and high-quality cell lines, which fuels the growth of cell banking services. Moreover, Biopharmaceutical companies and contract research organizations (CROs) are seeking efficient and cost-effective solutions for the production and storage of these essential cell lines, which propel the market forward.

Ethical issues related to the donation of cells

Challenges related to the procedures for obtaining informed consent from prospective cord blood donors and concerns about the disclosure of significant clinical information identified during the donor screening process are impeding the growth of the cell banking outsourcing market. Additionally, the high costs associated with cell banking services may restrict their adoption, particularly in developing regions where healthcare budgets are constrained.

Development of cell banks in developing countries

Cell banks play an important role in characterizing cell lines and help lower the costs associated with cell culture processes, which enable the storage and retrieval of cell lines as needed. The growing emphasis on regenerative and personalized medicine presents a promising opportunity for the expansion of the cell banking outsourcing market. Furthermore, many leading companies are focusing on providing products and services to the American and European markets, owing to their advanced healthcare infrastructure, large patient populations, and substantial healthcare spending.

The master cell banking segment dominated the cell banking outsourcing market in 2023. Master cell banks are important for the creation and utilization of functional cell banks, as they are preserved for extended periods and require the use of advanced cryopreservation techniques and equipment. This increased demand contributes to the growth of revenue in this sector. Additionally, master cell banks are crucial for various research and development applications, particularly in stem cell and gene therapies. The rising prevalence of autoimmune diseases and cancers, which can be addressed through these therapies combined with regenerative medicine, can drive market growth further.

The working cell segment is expected to grow at a fast rate in the cell banking outsourcing market over the forecast period. Working cell banking focuses on the storage and upkeep of cells intended for producing specific products. The segment's expansion is boosted by the rising use of stem cell therapies and advancements in cell line storage and characterization technologies. Also, the incorporation of cryoprotective agents to maintain tissue stability during cryopreservation is expected to propel the growth of the working cell banking sector.

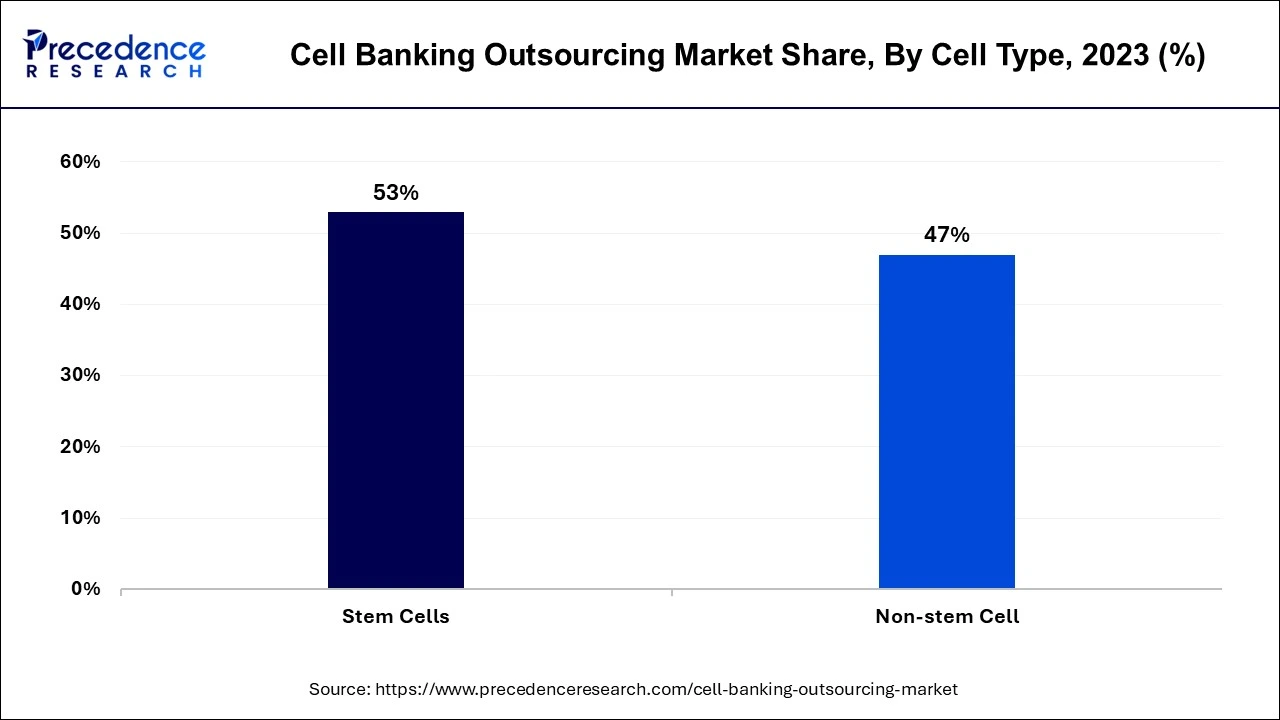

The stem cells segment dominated the global cell banking outsourcing market. This can be attributed to their vast therapeutic potential and their applications in regenerative medicine, cell therapy, and drug development. Their unique capability to transform into various specialized cell types makes them crucial for addressing numerous diseases and injuries. Furthermore, as the demand for therapies based on stem cells grows, there is an increasing tendency for companies to outsource the banking of these specialized cells to experienced providers who excel in their handling and preservation. This trend is anticipated to drive substantial growth in the stem cell segment of the cell banking outsourcing market.

The cord cell banking segment is expected to grow at a significant rate in the cell banking outsourcing market during the forecast period. The substantial share of this market is largely due to the increasing number of cord blood banks and banking services worldwide. Cord blood provides considerable benefits, such as being a rich source of hematopoietic stem cells and ensuring donor convenience by reducing the risk of graft-versus-host disease, minimizing the likelihood of viral contamination, and providing immediate availability.

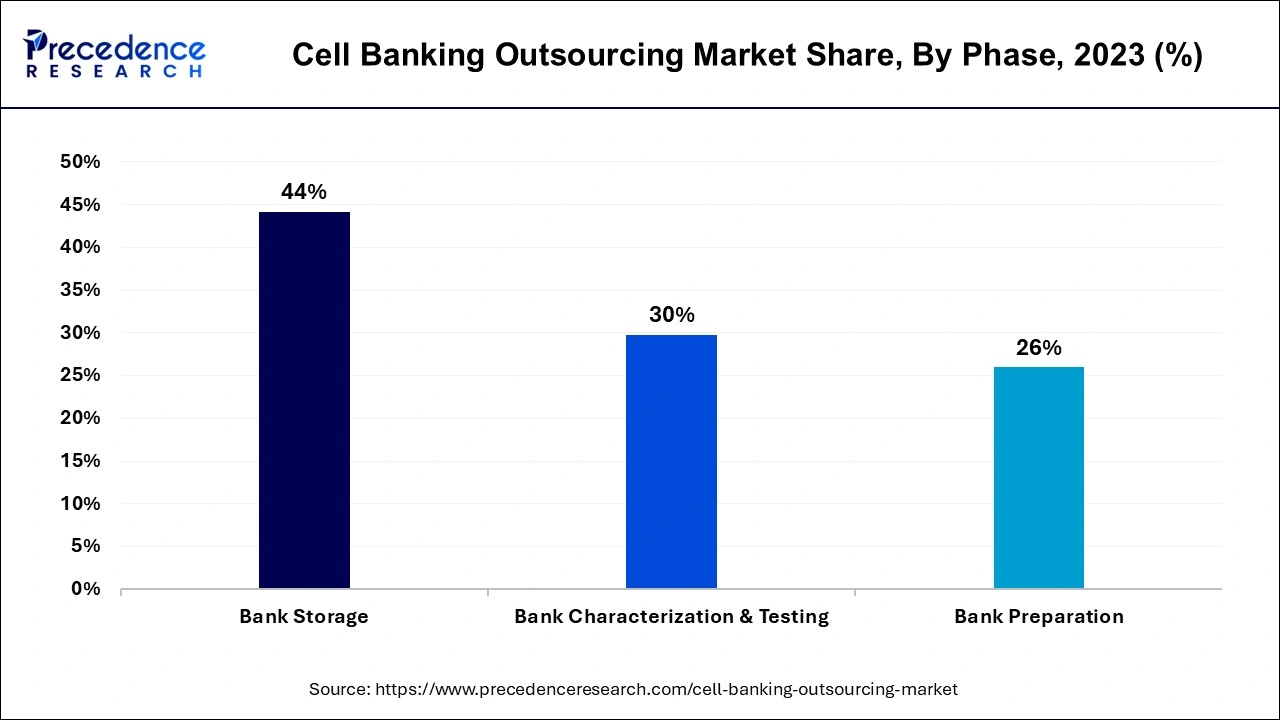

The bank storage segment led the cell banking outsourcing market in 2023. The biological products are preserved at extremely low temperatures using liquid nitrogen in cell banks. Typically, master cell banks (MCB) and working cell banks (WCB) are kept at temperatures ranging from -70°C to -150°C. Storage facilities for Master Cell Banks are often divided and maintained at two separate locations. Additionally, cell banks store cord blood and stem cells from newborns for potential future applications.

The bank characterization & testing segment is expected to show the fastest growth in the cell banking outsourcing market over the projected period. The involvement of various market players providing outsourcing services for bank characterization and testing to hospitals and clinical research organizations is a key factor. For example, Creative Biogen delivers comprehensive bank characterization services to ensure the biosafety and quality control of biotechnological and biological products for its clients.

Segments Covered in the Report

By Type

By Cell Type

By Phase

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

January 2025