February 2025

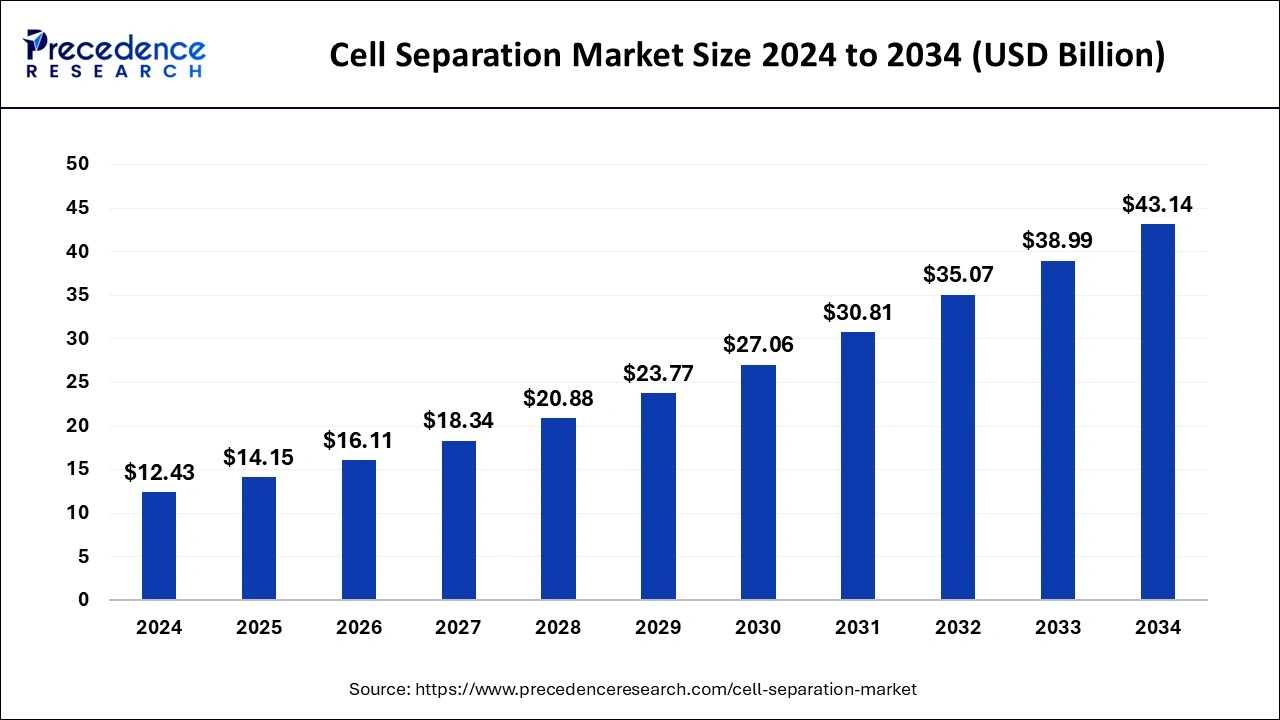

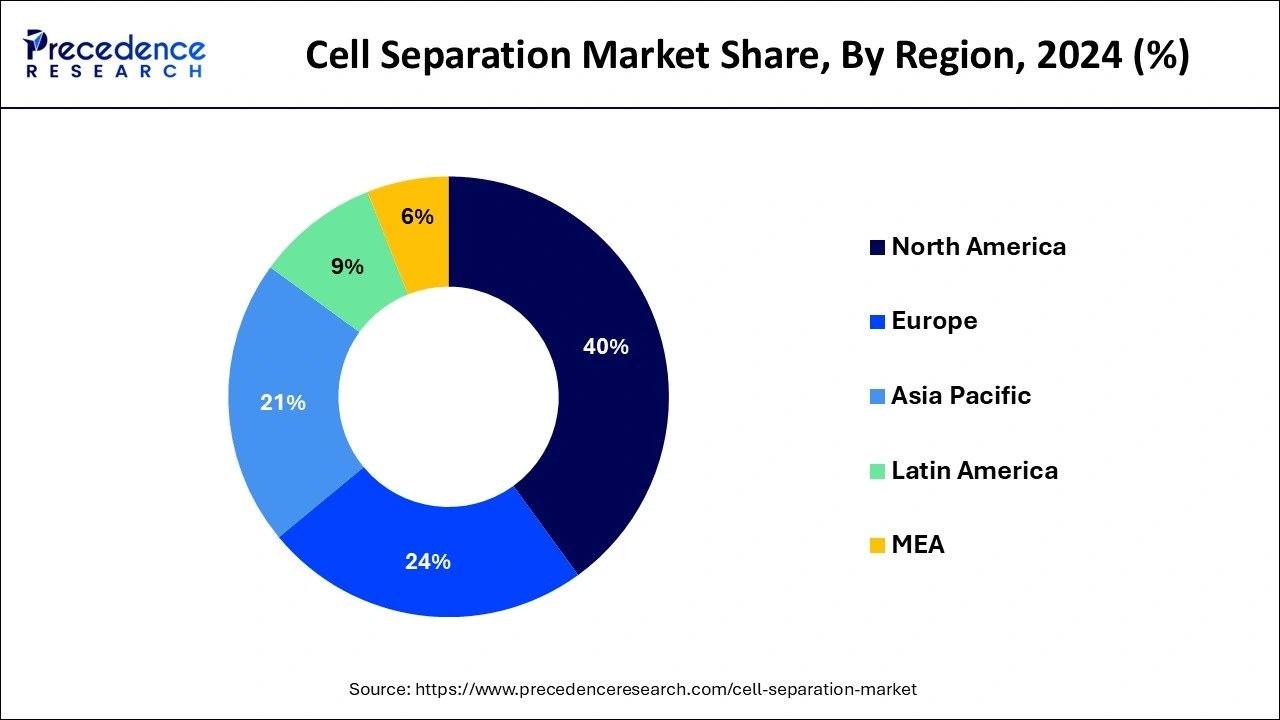

The global cell separation market size is calculated at USD 14.15 billion in 2025 and is forecasted to reach around USD 43.14 billion by 2034, accelerating at a CAGR of 13.25% from 2025 to 2034. The North America cell separation market size surpassed USD 4.97 billion in 2024 and is expanding at a CAGR of 13.28% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cell separation market size was exhibited at USD 12.43 billion in 2024 and is projected to attain around USD 43.14 billion by 2034, growing at a CAGR of 13.25% during the forecast period 2025 to 2034.

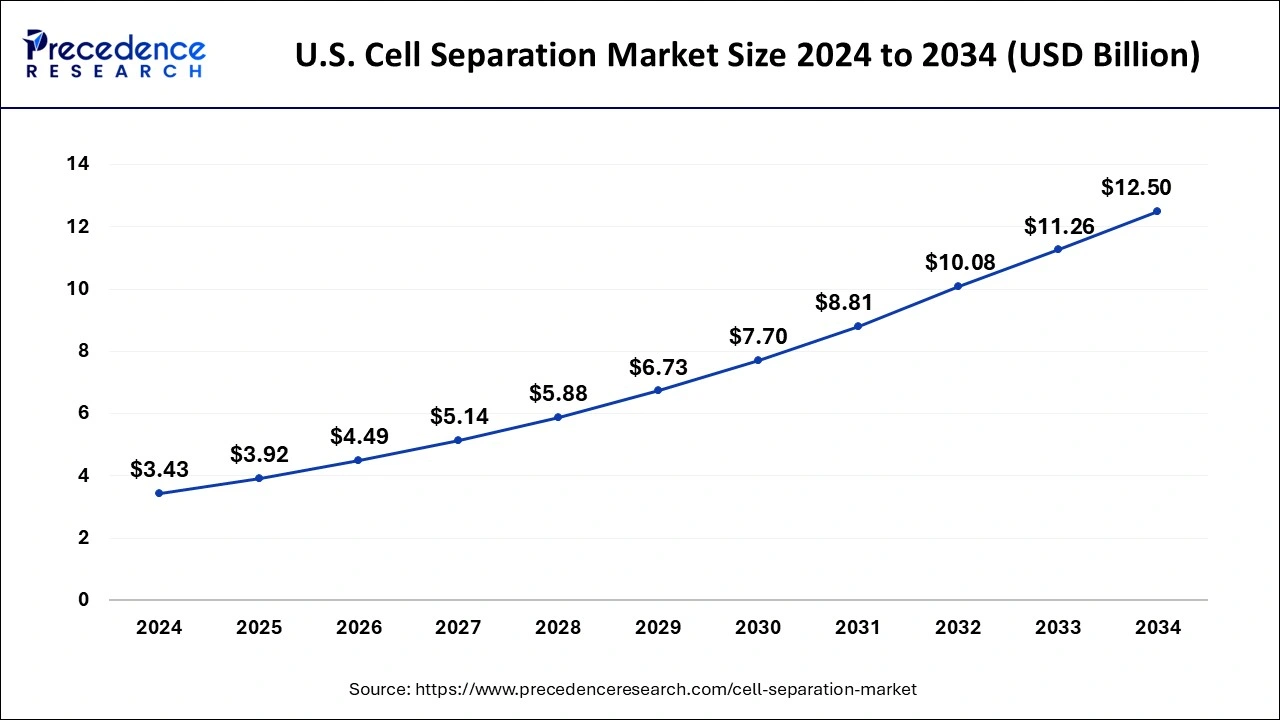

The U.S. cell separation market size was estimated at USD 3.43 billion in 2024 and is projected to surpass around USD 12.50 billion by 2034 at a CAGR of 13.81% from 2025 to 2034.

North America contributes significantly to global revenue and is anticipated to expand at a CAGR of 13.93% over the projection period and generate more than 40% of revenue share in 2024. Due to its highly developed healthcare industry, significant R&D investments, rising product approval rates, and a large number of cell separation technology manufacturers in the region, North America is anticipated to hold a dominant share of the global cell separation technology market during the forecast period. For instance, the Corning X-SERIES cell processing platform was introduced in July 2020 by the U.S. business Corning Incorporated.

Asia-Pacific is the region with the fastest growth in the global cell separation market. Asian countries are investing in the creation of a healthcare infrastructure to support ongoing stem cell and cancer research that will result in innovative treatments for patients and medical professionals. Government programs to support the biotechnology sector are providing possibilities for rivals. New competitors get an advantage by incorporating innovative breakthrough technologies into their product lines.

Concentrating financial resources on stem cell and cancer research advancements could spur further industry expansion. The market for cell separation technology can expand because of rising healthcare knowledge regarding cell separation as well as rising per-capita healthcare spending in developing nations.

The development of regenerative medicines or tissue engineering is projected to be boosted by the rise in the occurrence of chronic diseases around the world, which is anticipated to accelerate the use of cell separation technologies by academics. The global market is anticipated to grow during the projected period due to technological developments in cell separation solutions and an increase in government initiatives to promote the cell separation process. In contrast, the global market would be constrained by a shortage of financing for the development of cell separation technologies during the forecast period.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.25% |

| Market Size in 2025 | USD 14.15 Billion |

| Market Size by 2034 | USD 43.14 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Cell Type, By Technique, By Application and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

The prevalence of chronic diseases has increased - Increased sedentary lifestyle, aging of the global population, and increase in cigarette smoking and alcohol drinking are all contributing factors to the growth in chronic diseases like diabetes, obesity, arthritis, heart disorders, and cancer. According to Imperial College London, seven out of ten fatalities worldwide were expected to be due to chronic illnesses in 2020, accounting for over 41 million deaths annually. Nearly 17 million of these deaths are considered premature, with the average person passing away at a younger age than anticipated.

As a result, the need for cellular therapies to treat chronic diseases is growing along with the burden of chronic diseases. This in turn is directing attention and funding into research to create efficient remedies. Therefore, the global market for cell separation technologies is being driven by an increase in cellular research activities.

Demand for clinical trials and research is increasing as the geriatric population grows - The senior population is more likely than the younger population to experience chronic illnesses like cancer and neurological disorders. Furthermore, compared to the younger population, the geriatric population is growing quickly. Alzheimer's, dementia, cancer, and immunological illnesses are predicted to become more prevalent as the population ages 65 and over increases.

This is expected to raise the need for corrective treatment for these conditions. This is probably going to increase the demand for cell separation products used in clinical trials and other types of research. These factors are anticipated to drive the market for cell separation technologies worldwide.

Cell separation techniques are being used more and more in biotech and pharmaceutical companies - There are several global biotechnology companies entering in the market, particularly in underdeveloped nations. Cell separation techniques will probably be used by pharmaceutical corporations to create new medications and contribute to innovation. Companies have purchased sizable independent units to support the burgeoning stem cell research.

As a result, the biotechnology & pharmaceutical firms’ section is projected to be driven by the developments of medications and treatments, such as CAR-T through cell separation technologies. 449 public biotech companies are currently operating in the U.S., which is projected to drive the biotechnology & pharmaceutical companies market.

Lack of technically skilled individuals - The shortage of technically competent workers and the rise in concerns about the existence of tight rules and compliances for cell separation are projected to restrain market expansion, while the high cost of cell separation technology implant treatment can pose a threat to market growth.

Technological advancement - In the forecast period of 2021 to 2030, it is anticipated that the cell separation technology market will experience significant growth opportunities due to the rapid technological advancements in cell-based technology, including higher purity yield, cell isolations time, rise in government initiatives to improve cell-based technology and cost-effectiveness, and the well-developed healthcare infrastructure in developing countries.

Cell separation was led by the consumables segment in 2024 and generated around 63.60% revenue share. Due to frequent purchases of consumables, this market segment held the largest market share. Increased R&D spending by biotechnology and biopharmaceutical companies for the development of complex biologics, such as monoclonal antibodies and vaccines, is another factor driving the business. As a result, it is anticipated that there will still be a significant demand for consumables during the projection period.

Due to product innovations, the instruments segment is anticipated to grow at a profitable rate throughout the forecast period. Effective cell separation is made possible by technological advancements in devices for use in research, diagnostics, and therapies. The exorbitant cost of the instruments, however, is anticipated to impede market expansion.

In 2024, the human cell category, which also had the biggest revenue share of around 45.50%, led the market for cell separation. The increasing focus on cancer and human research, as well as the multiple applications of isolated human cells in biopharmaceutical development, clinical trials, and research, are some of the primary factors resulting into the largest market share.

The attractive payment policies for personalized medicine in industrialized countries have an additional impact on the demand for human cell isolation. It is anticipated that the animal cells section would increase at a profitable rate during the forecast period. The creation of novel drugs is increasingly receiving attention from the government, the commercial sector, and healthcare organizations, which is a major driver of the segment's growth. Animal cells are used in the discovery and development of novel drugs to assess toxicity, pharmacokinetics, and effectiveness.

The segment of centrifugation, which had the biggest revenue share 43% in 2024, dominated the market for cell separation. This is due to the widespread usage of this technique by academic institutions, research centers, and companies that produce biotechnology and biopharmaceuticals. Centrifugation is one of the most important steps in cell isolation. Differential centrifugation and density gradient centrifugation are frequently used in cell separation. Density gradient centrifugation employs the molecular weights of the particles to be separated, whereas differential centrifugation uses a lysate to rip open cell membranes.

In the near future, it's anticipated that surface marking and filtration segments will both experience significant growth. The expansion of this market is primarily driven by product development and rising corporate investments in manufacturing infrastructure. Innovative surface markers for filtration systems are used by manufacturers in their manufacturing and research processes to increase the quality of the final product.

The market for cell separation was driven by the biomolecule isolation category, which in 2024 had the greatest revenue share of 31%. The primary factor for the biggest share is the increased attention being paid to the manufacture of biopharmaceuticals, such as monoclonal antibodies, recombinant proteins, and biosimilars. Additionally, expanding government financing for the discovery of new drugs fuels market expansion.

The study period is expected to see profitable expansion in the stem cell and cancer research sectors. Growing corporate and academic investment in cell-based research is a significant factor in the segment's expansion. Due to the rising incidence of cancer worldwide, several public-private groups are making significant investments in cancer research, which is fueling the demand for creative separation solutions.

By Product

By Cell Type

By Technique

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

January 2025