January 2025

Cloud Managed Services Market (By Service Type: Business, Network, Security, Datacenter, Mobility; By Deployment: Public, Private; By End-user: SMEs, Large Enterprises; By Verticals: Telecom & ITes, Government, BFSI, Retail & Consumer, Healthcare, Manufacturing & Automotive, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

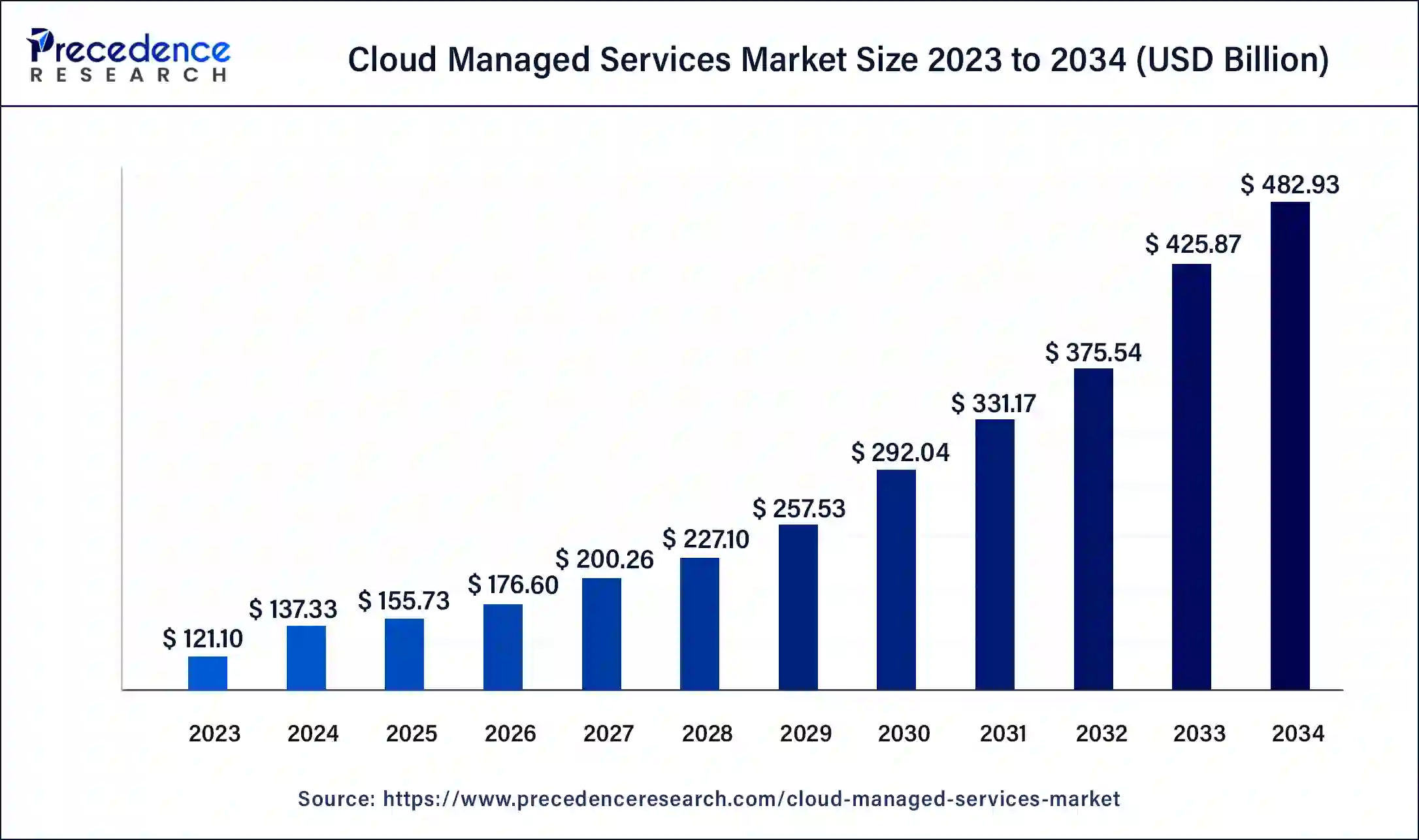

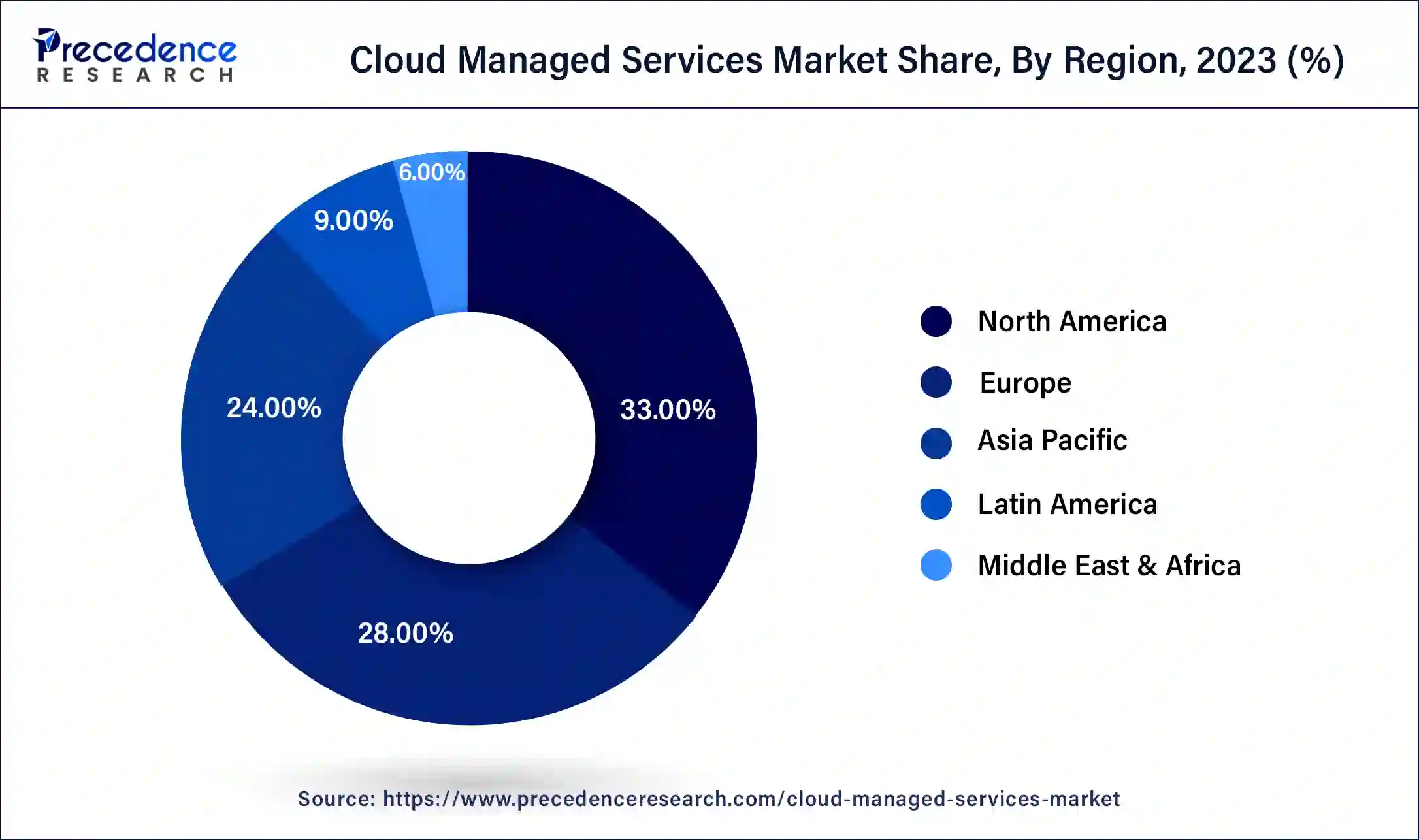

The global cloud managed services market size accounted for USD 137.33 billion in 2024 and is expected to reach around USD 482.93 billion by 2034, expanding at a CAGR of 13.4% from 2024 to 2034. The North America cloud managed services market size reached USD 39.96 billion in 2023. The growing emphasis on mobility and the requirement to focus on core business functions will drive cloud managed services market growth.

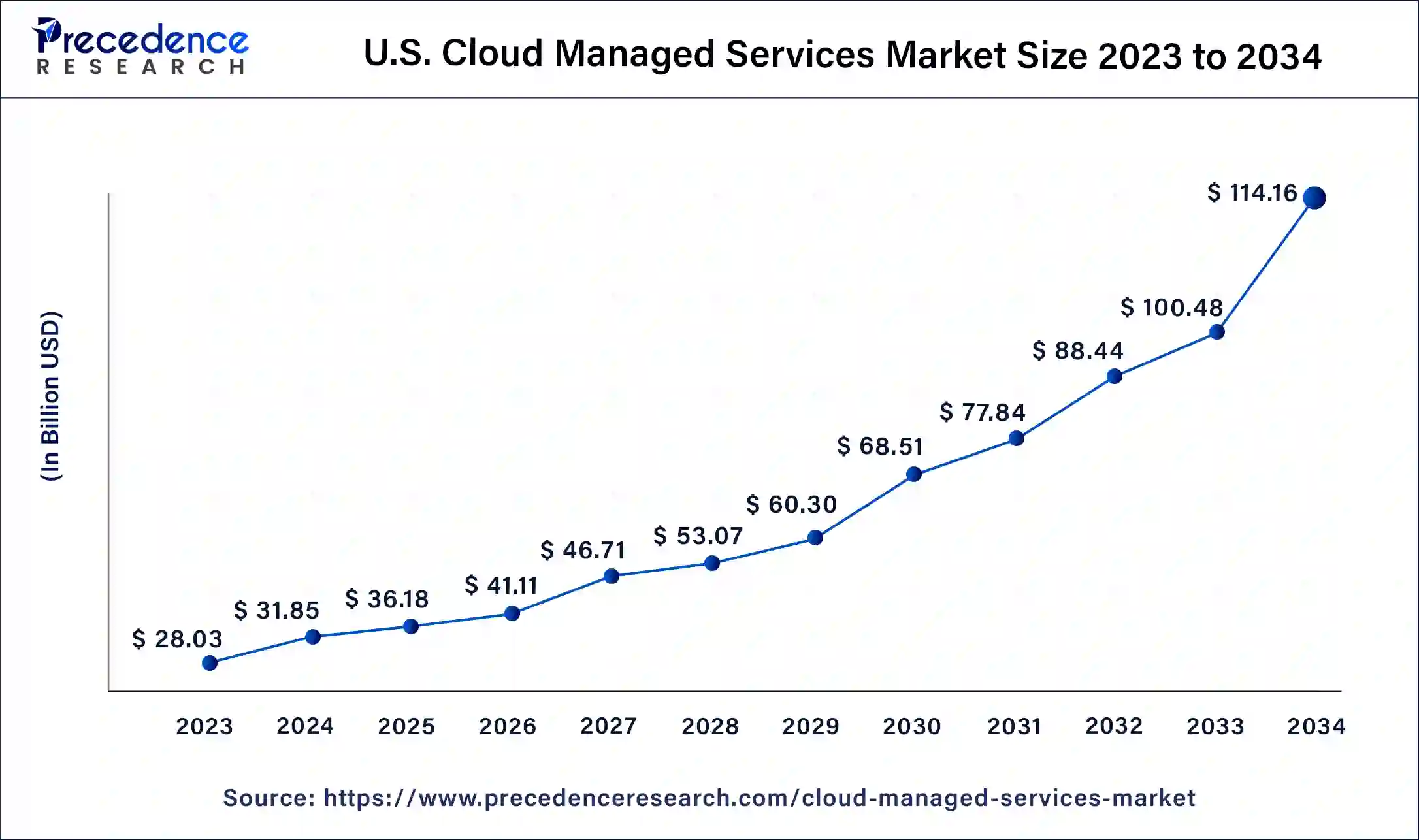

The U.S. cloud managed services market size was estimated at USD 28.03 billion in 2023 and is predicted to be worth around USD 114.16 billion by 2034, at a CAGR of 13.6% from 2024 to 2034.

North America held the largest share of the global cloud-managed service market in 2023 and is poised for rapid expansion in the coming years. This growth is driven by the region's widespread adoption of cloud computing technologies and the increasing deployment of data centers. Furthermore, North America benefits from a thriving IT industry, which has led to the development of advanced cloud-managed services. The presence of numerous established suppliers in the region has also contributed to the growth of the cloud-managed services market.

Asia Pacific has captured a 26% revenue share in 2023 and is expected to experience significant growth in the coming years. This growth is driven by improvements in the IT industry and government initiatives to promote cloud computing technologies. The expansion of data centers, particularly driven by the high activity of BPOs and data centers, further fuels the demand for cloud-managed services in the region. Countries like China and India play a crucial role as leading suppliers of advanced cloud-managed services to their clients.

The cloud managed services market involves outsourcing various IT functions to external service providers, who oversee and manage a client's cloud-based platforms, applications, and infrastructure. These services encompass tasks such as cloud security, optimization, troubleshooting, resource monitoring, and maintenance. By leveraging cloud-managed services, businesses can ensure scalability, cost-effectiveness, and optimal performance while allowing internal IT teams to focus on strategic initiatives and core business objectives.

Additionally, businesses benefit from professional support and guidance in navigating complex cloud environments. Cloud-managed services offer a comprehensive solution for organizations seeking to optimize operations, enhance efficiency, and bolster security in today's digital landscape. This includes services such as data analytics, cybersecurity, infrastructure management, and application support, all delivered through the cloud managed services market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 13.4% |

| Global Market Size in 2023 | USD 121.10 Billion |

| Global Market Size in 2024 | USD 137.33 Billion |

| Global Market Size by 2034 | USD 482.93 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Service Type, By Deployment, By End-user, and By Verticals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing need to manage critical business applications and IT systems

As companies seek to enhance their security, operations, and organizational capabilities, they are increasingly turning to managed services. Cloud-managed services offer valuable benefits, including the ability to streamline complex system integration and ensure scalability and cost-effectiveness in the cloud.

In the cloud managed services market, many small- and medium-sized enterprises maintain full-time IT professionals to handle cloud services is prohibitively expensive. By outsourcing these services, businesses can reduce network maintenance expenses without compromising productivity or security.

Security and privacy concerns

One of the main drawbacks of relying on multiple third-party providers for cloud-managed services is the concern surrounding security and privacy. This comprises various aspects such as web network security, endpoint protection, application infrastructures, virtualization, database security, and mobility.

For many businesses, the primary obstacle to adopting cloud-managed services is apprehension regarding security and privacy risks. To address this concern, managed service providers (MSPs) have implemented robust privacy and security measures to safeguard data stored and transmitted over the cloud, such as encryption and end-to-end network protection, which offer clients enhanced security options.

Rise in demand for cloud-based solutions via MSP

Managed cloud services will surpass all other technologies as businesses create plans and follow strategies to satisfy their IT and network requirements. Effective IT system management is vital for any organization, and managed service providers can help address IT issues. Most MSPs offer 24/7 monitoring to attract clients. They use security solutions to monitor IT systems and detect potential threats or disturbances.

Many businesses have shifted their IT applications to cloud servers for various functions such as accounting, finance, customer relationship management, and others. The global adoption of cloud solutions is on the rise due to the widespread use of cloud technology for managing corporate operations.

The mobility segment dominated the cloud managed services market in 2023. This is because businesses are using the cloud for data protection because of its inherent advantages like flexibility and cost savings. Moreover, the rising adoption of portable and mobile devices in the industry can drive the segment growth further.

The network services segment is anticipated to grow at the fastest CAGR over the forecast period. This is attributed to the adoption of cloud computing and the expansion of cloud-based applications and services, which are increasing the demand for network services. Furthermore, enterprises seek more secure, highly efficient networks to connect with their own infrastructure with cloud services.

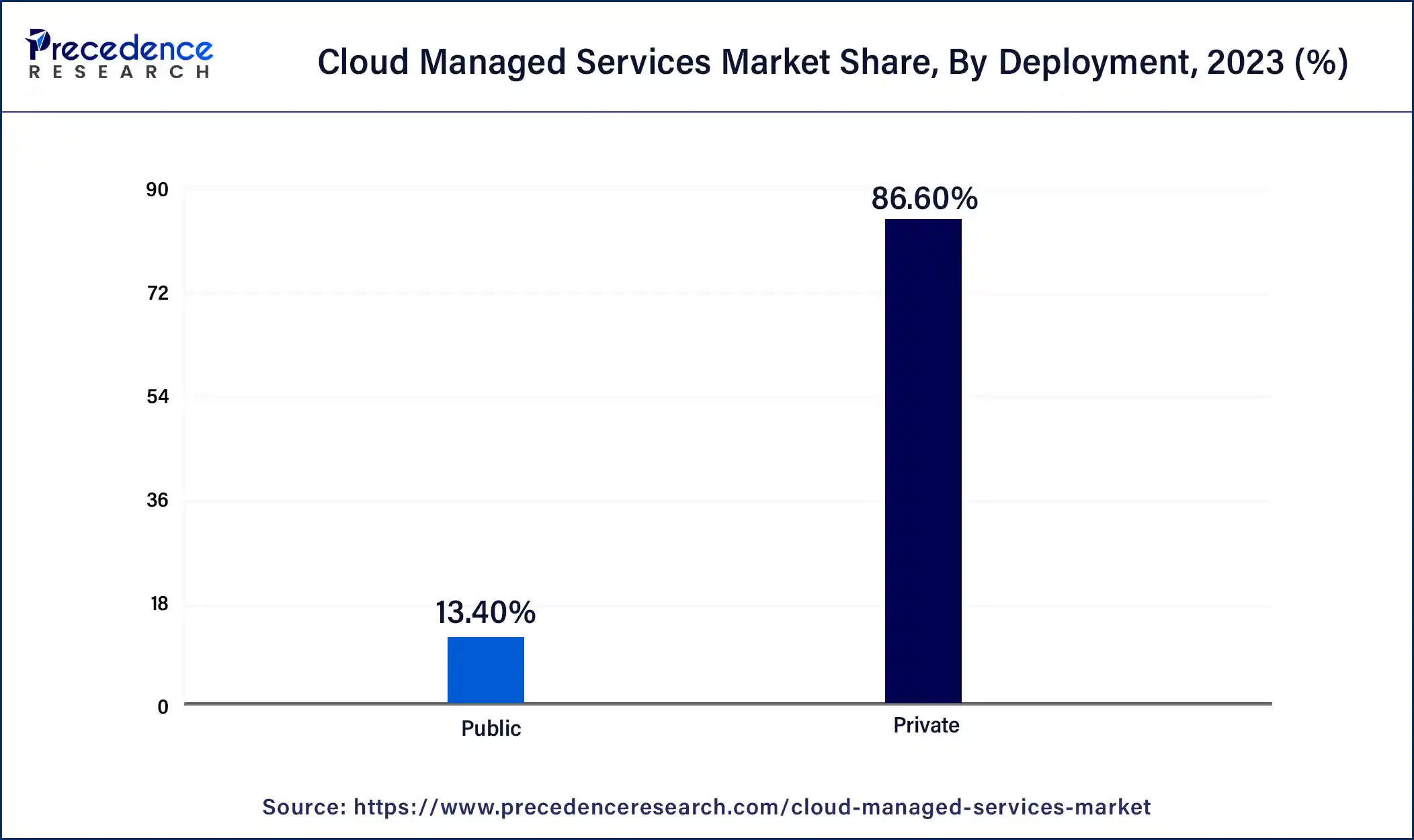

The private segment held the largest share of the cloud managed services market in 2023. The private cloud offers enterprises various advantages, including enhanced data security and control over access. Additionally, it brings benefits like cost efficiency and reliability. However, the expenses involved in implementing and maintaining a private cloud can be substantial.

The public segment has captured 13.4% revenue share in 2023 and is estimated to grow at the fastest CAGR. Public clouds assist commercial organizations in reducing their investment requirements for building independent IT infrastructure. This enables businesses to better fulfill customer needs and preferences while enhancing the scalability of their operations.

The telecom & ITes segment dominated the cloud managed services market in 2023. This is linked to the rapid digital transformation in the telecommunication and IT industry that is driving the segment's growth. Various organizations in this sector strive to optimize and modernize their infrastructure and service delivery. Cloud solutions also offer flexibility and cost-efficiency.

The government segment is anticipated to experience the fastest growth in the upcoming years. Governments at different levels are progressively embracing cloud technologies to improve operations, enhance service delivery, and propel digital transformation efforts. Cloud technologies enable governments to optimize their IT infrastructure, streamline processes, and cut costs. By utilizing cloud-managed services, government agencies can prioritize their core functions while entrusting the management of cloud infrastructure to skilled service providers.

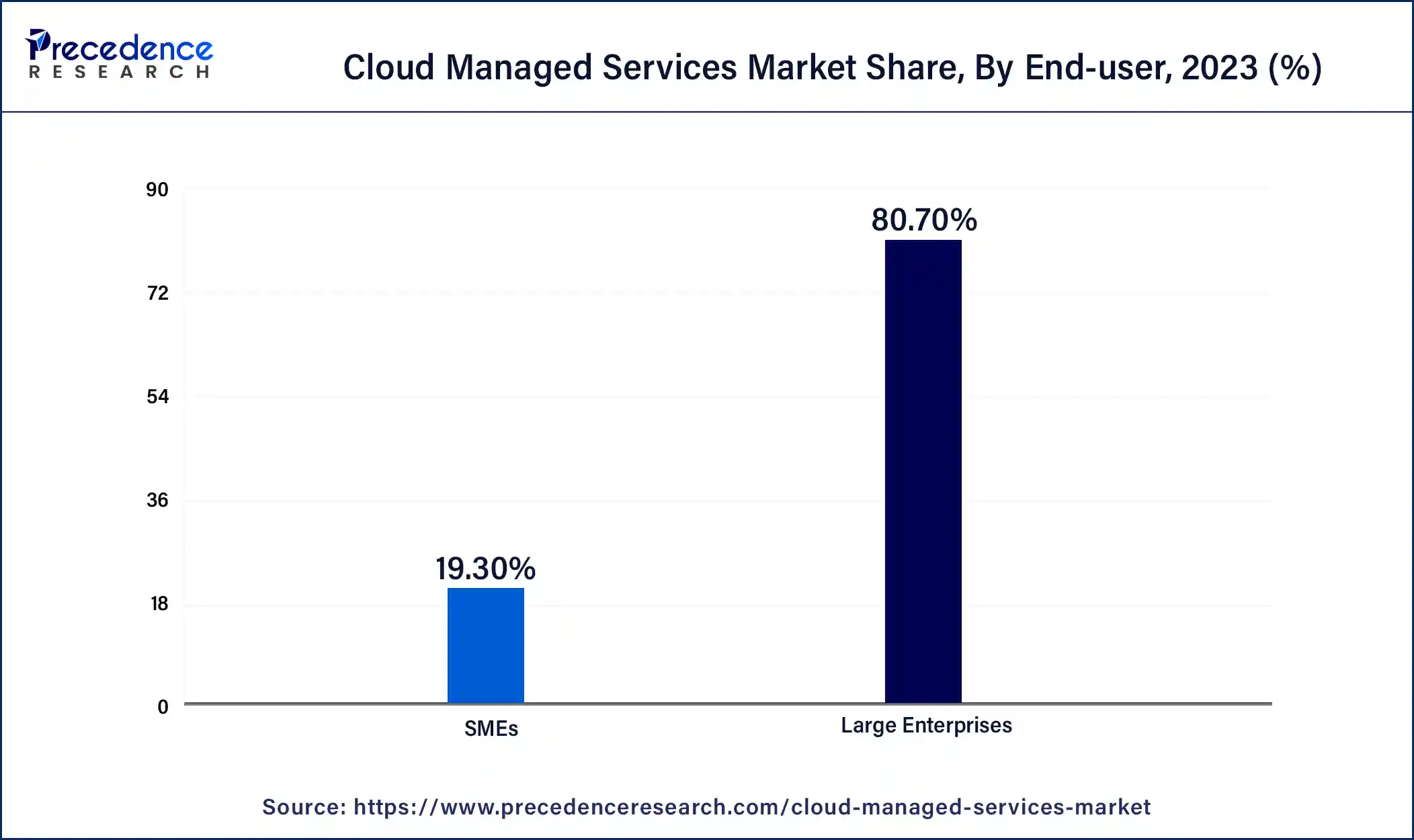

The large enterprise segment dominated the cloud managed services market. Large enterprises, known for their extensive operations and complex IT setups, have increasingly turned to cloud-managed services. This move aims to boost operational efficiency, scale up easily, and optimize IT investments. Cloud-managed services have also helped small- and medium-sized organizations by handling their IT infrastructure, allowing them to concentrate on core business activities and improve productivity.

The SME segment has captured a 19.3% revenue share in 2023 and is projected to experience the highest growth rate during the forecast period. Service providers offering customizations give organizations the flexibility they need, which is expected to fuel the adoption of cloud-managed services among SMEs.

Segments Covered in the Report

By Service Type

By Deployment

By End-user

By Verticals

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

May 2025

January 2025