September 2024

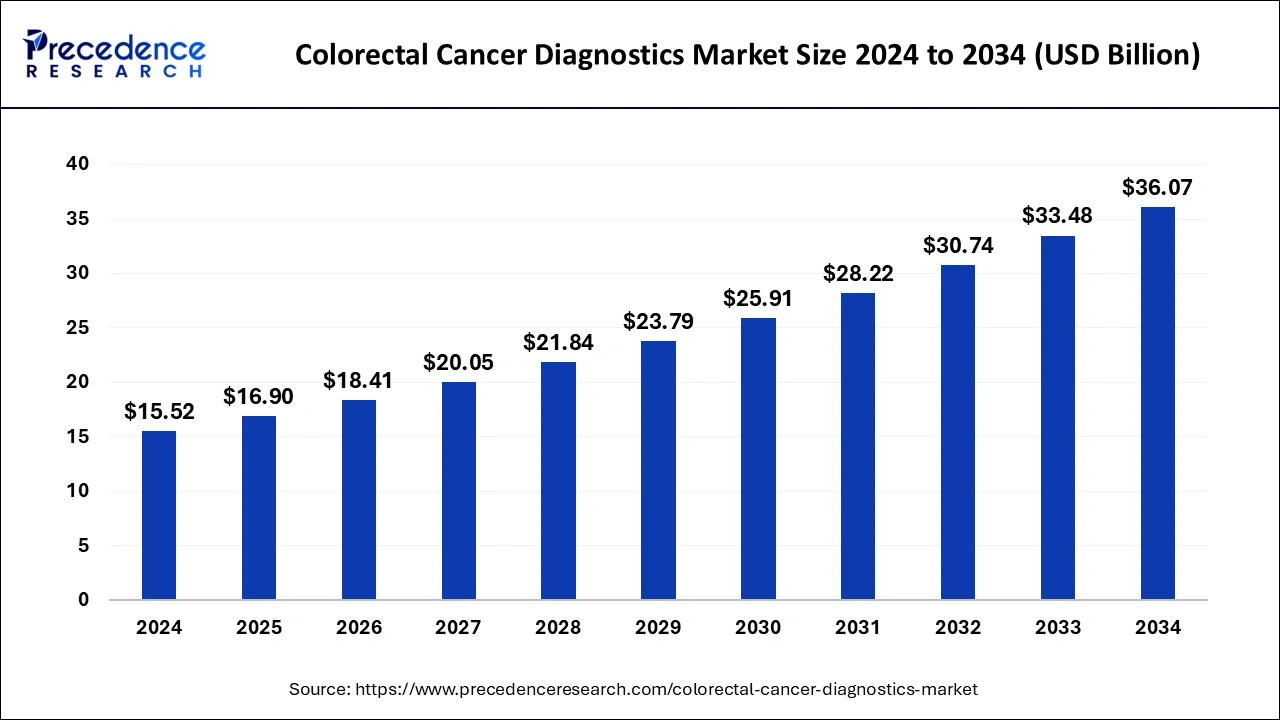

The global colorectal cancer diagnostics market size is calculated at USD 16.90 billion in 2025 and is forecasted to reach around USD 36.07 billion by 2034, accelerating at a CAGR of 8.80% from 2025 to 2034. The North America colorectal cancer diagnostics market size surpassed USD 6.21 billion in 2024 and is expanding at a CAGR of 8.82% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global colorectal cancer diagnostics market size was estimated at USD 15.52 billion in 2024 and is predicted to increase from USD 16.90 billion in 2025 to approximately USD 36.07 billion by 2034, expanding at a CAGR of 8.80% from 2025 to 2034. The colorectal cancer diagnostics market is driven by the increasing focus on screening and early detection initiatives.

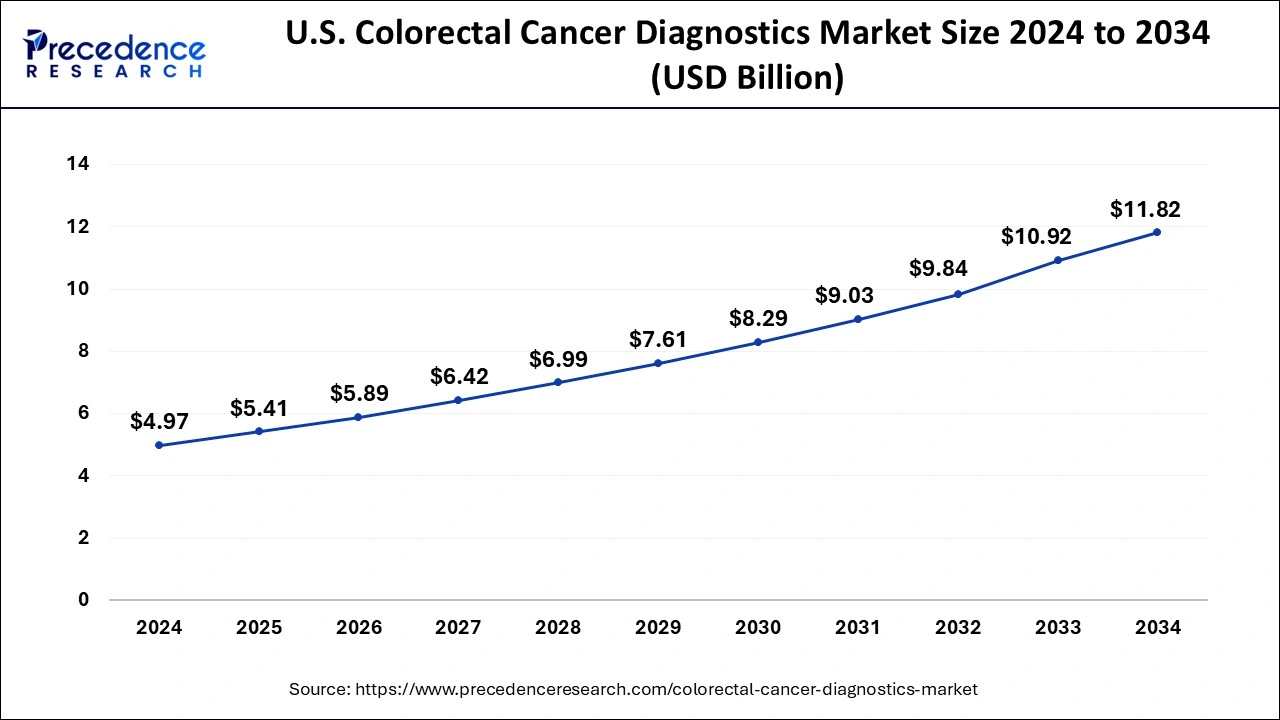

The U.S. colorectal cancer diagnostics market size was estimated at USD 4.97 billion in 2024 and is predicted to be worth around USD 11.82 billion by 2034 at a CAGR of 9.05% from 2025 to 2034.

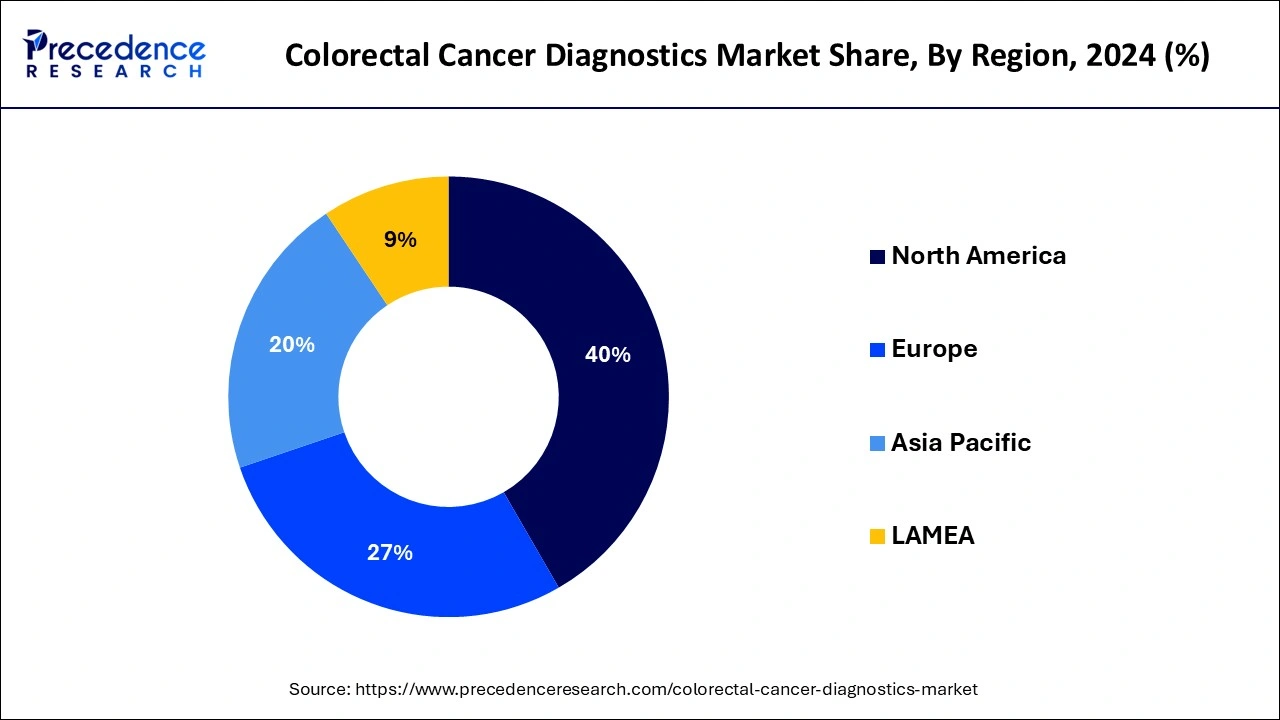

North America had the largest market share in 2024 in the colorectal cancer diagnostics market. In North America, both the public and healthcare professionals are becoming more aware of colorectal cancer and the value of routine screening. Governments, healthcare organizations, and advocacy groups aggressively promote screening programs. This results in a rise in diagnostic procedures such as colonoscopies, fecal occult blood tests (FOBT), and fecal immunochemical tests (FIT). Research institutes, pharmaceutical companies, and diagnostic businesses frequently work together in this region on R&D projects to enhance colorectal cancer detection. These partnerships increase market penetration, promote innovation, and quicken the creation of new diagnostic instruments.

Asia-Pacific is observed to be the fastest growing colorectal cancer diagnostics market during the forecast period. The incidence of colorectal cancer in the region is rising, mainly due to aging populations, altered eating patterns and changing lifestyles. Several factors, including sedentary lifestyles, a high intake of processed foods, and little physical activity, are linked to the rising incidence of colorectal cancer in Asia-Pacific nations. Healthcare spending is rising in line with the continued growth of the economies in the Asia-Pacific region. Spending on preventive healthcare measures, such as routine colorectal cancer screenings, is increasing among individuals. The region's colorectal cancer diagnostics market is also growing due to government programs and insurance coverage for cancer screening and treatment.

The area of the healthcare business dedicated to creating, manufacturing, and distributing diagnostic instruments and tests to identify and track colorectal cancer is known as the colorectal cancer diagnostics market. One of the most common and dangerous types of cancer in the world is colorectal cancer, which also encompasses tumors of the colon and the rectum. Patient outcomes and survival rates are greatly enhanced by early identification of colorectal cancer. Colonoscopies, stool DNA testing, fecal occult blood tests (FOBT), imaging methods, and other diagnostic procedures are vital in detecting colorectal cancer in its early stages when therapy is most successful.

The colorectal cancer diagnostics market comprises a sizeable portion of the more significant oncology diagnostics industry. Market expansion is facilitated by ongoing technology developments, such as creating non-invasive and more accurate diagnostic techniques. Furthermore, the accuracy and dependability of colorectal cancer diagnostics are improved by introducing innovative biomarkers and molecular diagnostic methods.

Colorectal Cancer Diagnostics Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.80% |

| Market Size in 2025 | USD 16.90 Billion |

| Market Size by 2034 | USD 36.07 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Test Type and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of colorectal cancer

Spending more on healthcare, especially in industrialized nations, makes modern colorectal cancer diagnostics and therapies more accessible. Patients gain better access to screening programs and diagnostic centers as governments and healthcare institutions devote resources to cancer prevention, detection, and management. The growing expenditure on healthcare infrastructure is driving the growth of the market for colorectal cancer diagnostics. Thereby, the rising prevalence of colorectal cancer is observed to act as a driver for the colorectal cancer diagnostics market.

Growing preference for non-invasive diagnostic methods

The market for colorectal cancer diagnostics is driven by consumers' increasing demand for non-invasive diagnostic techniques, altering how this common cancer is identified and treated. One of the most common malignancies detected worldwide, colorectal cancer, has historically been linked to invasive diagnostic procedures, including sigmoidoscopies and colonoscopies. However, the development of non-invasive diagnostic methods has changed how medical practitioners approach this disease's detection and surveillance.

Lack of awareness among the general population regarding the importance of colorectal cancer screening

Despite the availability of efficient screening techniques, including sigmoidoscopy, colonoscopy, and fecal occult blood tests (FOBT), many people do not regularly engage in screening programs because they are unaware of their significance. This hesitation could be brought on by false beliefs about the difficulty of screening tests, anxiety over being diagnosed with cancer, or ignorance of the possible advantages of early detection. Despite people's awareness of the significance of colorectal cancer screening, several obstacles may keep them from utilizing screening services.

These obstacles include the absence of health insurance, budgetary limitations, travel time to screening locations, and linguistic or cultural hurdles. Insufficient knowledge worsens these obstacles by making impacted populations feel that screening is not as important or urgent.

Limitations in the accuracy and reliability of certain tests

Sampling errors can occur in certain diagnostic tests, especially tissue or stool samples. The diagnostic process's reliability can be threatened by erroneous test results resulting from inadequate sampling or inappropriate sample handling. Due to various genetic alterations and molecular subtypes, colorectal cancer is heterogeneous. The biological variability among tumors might impact diagnostic tests' performance to target specific biomarkers or molecular signatures, resulting in inconsistent test results and diagnostic accuracy.

Growing opportunity for personalized medicine approaches

Personalized medicine empowers Patients to participate more actively in their healthcare journeys. A patient-centric style of care that puts efficacy, safety, and quality of life first is fostered by personalized medicine, which customizes diagnostic and therapeutic techniques to everyone's distinct biology and preferences. Individualized strategies help patients with colorectal cancer not only increase their chances of survival but also improve their general health and level of satisfaction with their medical care.

Innovations in imaging technologies

High-resolution images of the colon and rectum are provided by imaging technologies like CT, MRI, and PET scans, which enable medical practitioners to spot abnormal growths like polyps or cancers early on. To allow timely intervention and increase the chance of effective treatment, early identification is essential in the management of colorectal cancer. The potential for enhancing colorectal cancer diagnosis by integrating artificial intelligence (AI) and machine learning algorithms with imaging technology is enormous. AI-based image analysis can help radiologists analyze imaging data more effectively and precisely, resulting in quicker diagnosis and more targeted therapy suggestions.

The imaging test segment dominated in the colorectal cancer diagnostics market in 2024. Unmatched ability to identify anomalies in the colon and rectum is provided by imaging procedures, including computed tomography (CT), magnetic resonance imaging (MRI), and positron emission tomography (PET). By detecting worrisome growths, polyps, or tumors in their early stages, these tests can significantly enhance patient outcomes by facilitating early management. A thorough evaluation of the degree and dissemination of colorectal cancer is possible with imaging testing.

They include comprehensive details regarding the size, location, invasion of surrounding tissues, and involvement of distant organs or neighboring lymph nodes. Accurately diagnosing the disease and choosing the best course of treatment depends on this thorough evaluation.

The blood test segment is observed to be the fastest growing in the colorectal cancer diagnostics market during the forecast period. Both people and medical professionals find blood tests to be a non-invasive way to diagnose colorectal cancer. Blood testing offers a relatively easy and practical alternative to more intrusive and uncomfortable traditional screening techniques like colonoscopies. Because it is non-invasive, more people are encouraged to get screened, raising market demand. One of the main reasons why blood tests are so popular with patients is their ease. Unlike colonoscopies, blood tests are usually quick and require little preparation, which may involve intestinal preparation and downtime.

More people follow screening recommendations due to this convenience, especially those who might not otherwise want to have intrusive procedures done. Consequently, blood test recommendations from healthcare professionals as part of standard screening procedures are more likely, which propels market expansion.

The hospitals segment dominated the colorectal cancer diagnostics market in 2024. A multidisciplinary team of oncologists, surgeons, radiologists, pathologists, and other experts is frequently involved in treating colorectal cancer. Hospitals give these specialists a place to work together, resulting in more precise diagnoses and individualized treatment regimens catered to each patient's requirements. Hospitals employ skilled medical personnel with a focus on the diagnosis and treatment of colorectal cancer. These experts have received substantial training and experience in interpreting diagnostic tests and identifying subtle indicators of colorectal cancer, which enables prompt intervention and better patient outcomes.

The diagnostic imaging centers segment is observed to be the fastest growing in the colorectal cancer diagnostics market during the forecast period. One of the most common diseases in the world, colorectal cancer is becoming more common, especially in affluent nations. There's a growing need for better diagnostic services to control the disease burden as the world's population ages, and lifestyle factors, including poor diet and sedentary behavior, contribute to the rising incidence of colorectal cancer. With their cutting-edge imaging equipment, diagnostic imaging facilities can provide prompt and precise diagnosis, which makes them essential in the fight against colorectal cancer.

By Test Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

January 2025

September 2024