January 2025

Conductive Coatings Market (By Application: Automotive, Electronics, Aerospace, Energy, Others; By Type: Silver-based, Carbon-based, Copper-based, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

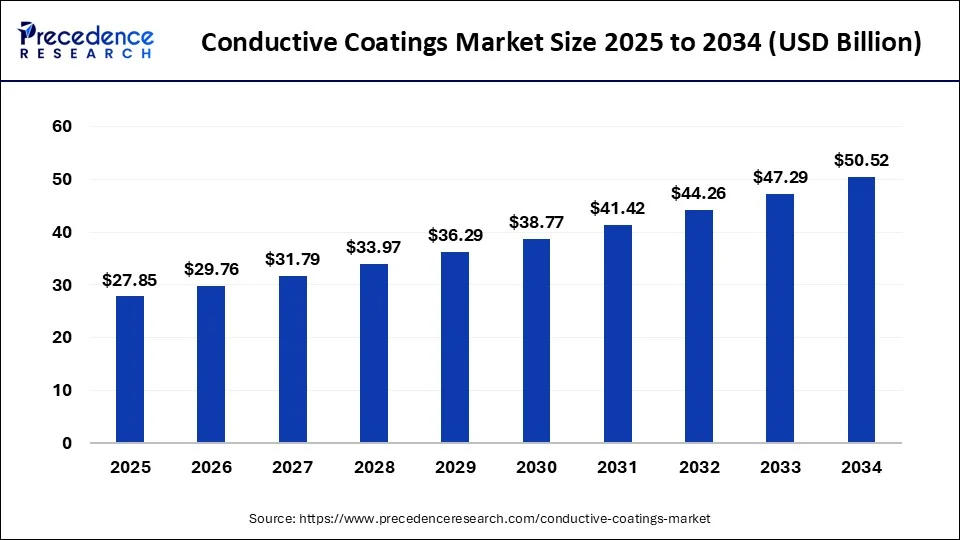

The global conductive coatings market size was USD 24.40 billion in 2023, calculated at USD 26.07 billion in 2024 and is expected to reach around USD 50.52 billion by 2034, expanding at a CAGR of 6.84% from 2024 to 2034. The rising demand for high-performance coatings from several end-user industries across the world is driving the growth of the conductive coatings market.

The conductive coatings market is one of the important industries in the chemical sector. This industry mainly deals in the manufacturing and distribution of conductive coatings around the globe. This industry consists of several types of conductive coatings that mainly include acrylics, epoxy, polyesters, polyurethane, and some others. There are several materials that are used in the manufacturing of conductive coatings, such as silver-based, carbon-based, copper-based, and some others. Conductive coatings mainly find applications in several end-user industries, such as automotive, electronics, aerospace, energy, and others. This industry is expected to grow exponentially with the growth in the automotive and electronics industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 50.52 Billion |

| Market Size in 2023 | USD 24.40 Billion |

| Market Size in 2024 | USD 26.07 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.84% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Application, Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for autonomous vehicles around the world

The trend of autonomous vehicles (AVs) has grown significantly across the world in recent times with growing advancements in the automotive industry. The transition towards AVs is mainly due to various factors such as improved safety, assistance from drivers, reduced traffic congestion, high fuel efficiency, and others. Thus, with the increasing demand for autonomous vehicles around the world, the demand for conductive coatings from automotive companies has increased rapidly in recent times.

Conductive coatings have several applications in the automotive industry for manufacturing autonomous vehicles, including electromagnetic interference (EMI) shielding, corrosion resistance, enhancing aesthetics, and prevention of electrostatic discharge. This, in turn, drives the growth of the conductive coatings market during the forecast period.

Safety concerns and high maintenance cost

The use of conductive coatings is very prominent for several applications across the world. Although the application of silicone material in the electronics and automotive industry is worth mentioning, there are several problems associated with it. Firstly, the conductive coatings may not provide high insulation properties, which can cause safety concerns and act as a hindrance in this industry. Secondly, the cost of maintaining conductive paints for a longer duration comes with a high price tag that, in turn, forbids industrial growth. Thus, safety-related issues, along with increased maintenance costs, are expected to restrain the growth of the conductive coatings market during the forecast period.

Integration of modern technologies in coating industries for aerospace applications

The conductive coatings industry is growing rapidly with the development of modern science and technology. There are several advancements in technologies, such as AI and ML technologies, for developing new conductive coatings for aerospace applications. The aerospace applications of conductive coatings include lightning strike protection (LSP), wiring systems, aircraft doors, avionics, printed circuit boards (PCB), propulsion systems, landing gear, and some others. Thus, growing advancements in AI and ML technologies for developing high-grade conductive coatings for aerospace applications are expected to create ample growth opportunities for the conductive coatings market players in the future.

The electronics segment held the largest market share in 2023. The growing demand for conductive coatings in electronics and electricals for anti-static applications is driving the market growth. Also, the rising demand for acrylics, epoxy, polyester, and some others from the electronics industry due to their properties, such as high chemical resistance, abrasion, and impact resistance, along with superior durability, has driven the market growth. Moreover, the increasing trend of smartphones, tablets, televisions, laptops, and other gadgets has increased the demand for conductive coatings as they provide shielding of electronic components from electromagnetic interference (EMI), which in turn is driving the growth of the conductive coatings market.

The automotive segment is expected to grow with the highest compound annual growth rate during the forecast period. The growing demand for EVs among people has increased the demand for conductive coatings, thereby driving the market growth. For instance, in November 2023, Mitsubishi Motors Corporation launched a new Minicab EV. This vehicle comes with enhanced safety features and a powerful driving experience with a driving range of around 180 km. Also, the growing application of conductive coatings in the automotive industry to protect car components such as electronics, battery systems, sensors, GPS, infotainment systems, and others has boosted the market growth. For instance, in January 2023, AkzoNobel launched Resicoat EV powder coatings. These coatings protect the battery system and electronic components of electric vehicles (EVs).

The silver-based segment held the dominant share of the conductive coatings market in 2023. The growing application of silver-based conductive coatings due to several properties such as anti-galling, good lubricity, high corrosion resistance, temperature-withstanding capacity, superior conductivity, and some others has driven the market growth. Moreover, the rising use of silver coatings in several end-user industries, such as electronics, medicine, telecommunications, automotive, and others, is driving the growth of the conductive coatings market.

The copper-based segment is expected to grow with the highest CAGR during the forecast period. The growing number of construction programs across the world has increased the demand for copper-based conductive coatings, thereby driving market growth. According to the Associated General Contractors of America, the estimated number of construction establishments was 919,000 in the U.S. during the first quarter of 2023. Moreover, the conductive coating companies are developing high-grade copper-based coatings with superior features such as great conductivity, malleability and adhesiveness, corrosion protection, antibacterial properties, cost-effectiveness, and some others for use in aerospace, telecommunication, automotive, and electronics is driving the growth of the conductive coatings market.

Asia-Pacific held the largest conductive coatings market share in 2023. The growth of the market in the Asia-Pacific region is mainly driven by the rising demand for luxurious vehicles among people in countries such as Japan, India, China, and others, which increases the demand for conductive coatings, thereby driving the market growth. The growing developments in the electronics industry, along with the rising government initiatives in countries such as China, South Korea, Japan, India, and others to strengthen the energy industry, have boosted market growth. According to the India Brand Equity Foundation (IBEF), the government of India announced an investment of Rs. 74,000 crores (US$ 8.90 billion) to increase renewable energy capacity across the country.

Moreover, presence of several local market players in conductive coatings, such as Asian Paints, Nippon Paint, Kansai Paint, and some others, are constantly engaged in developing high-grade conductive coating products for end-user industries and adopting several strategies such as product launches, collaborations, and business expansions, which in turn drives the growth of the conductive coatings market in this region.

North America is expected to be the fastest-growing region during the forecast period. The rising demand for electric vehicles among the people of this region increases the demand for conductive coatings, thereby driving market growth. Also, the rising government initiatives for strengthening the healthcare industry increase the demand for conductive coatings in medical products, thereby driving market growth. Moreover, there are several aerospace companies such as Boeing, Lockheed Martin, Northrop Grumman, L3Harris, SpaceX, and some others that have increased the demand for conductive coatings for several aerospace applications, which in turn is driving the market growth.

Additionally, the presence of various local companies of conductive coatings, such as PPG Industries, Axalta Coating Systems Ltd, Sherwin-Williams Company, and some others, are developing superior quality conductive coatings to fulfill the demand from end-users such as aerospace and automotive industries across the North American region, that in turn is expected to drive the growth of the conductive coatings market.

Segments Covered in the Report

By Application

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

February 2025

October 2024