What is the Data Center Liquid Cooling Market Size?

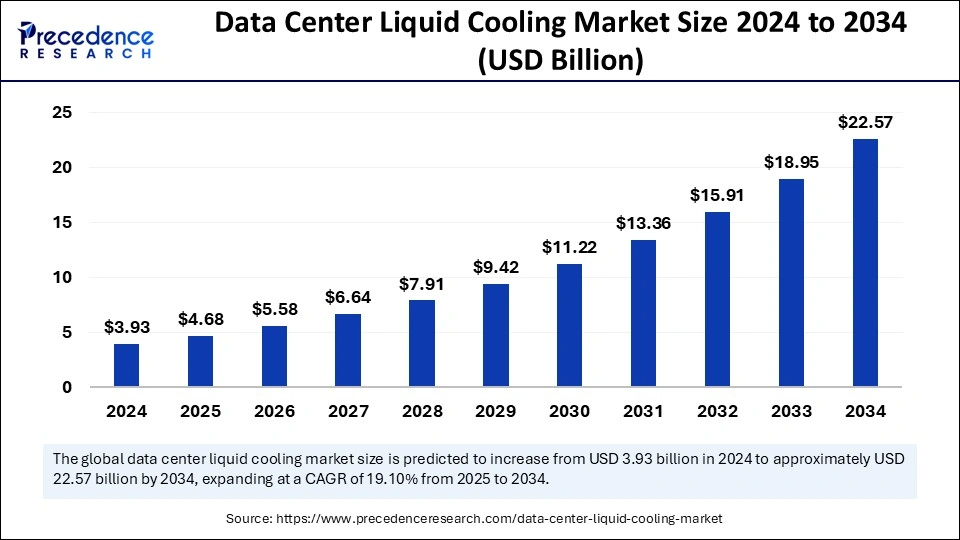

The global data center liquid cooling market size was estimated at USD 4.68 billion in 2025 and is predicted to increase from USD 5.58 billion in 2026 to approximately USD 25.80 billion by 2035, expanding at a CAGR of 18.61% from 2026 to 2035. The growth of the data center liquid cooling market is driven by the increasing data generation and extensive use of cloud computing, edge computing, and AI technologies in various sectors.

Data Center Liquid Cooling Market Key Takeaways

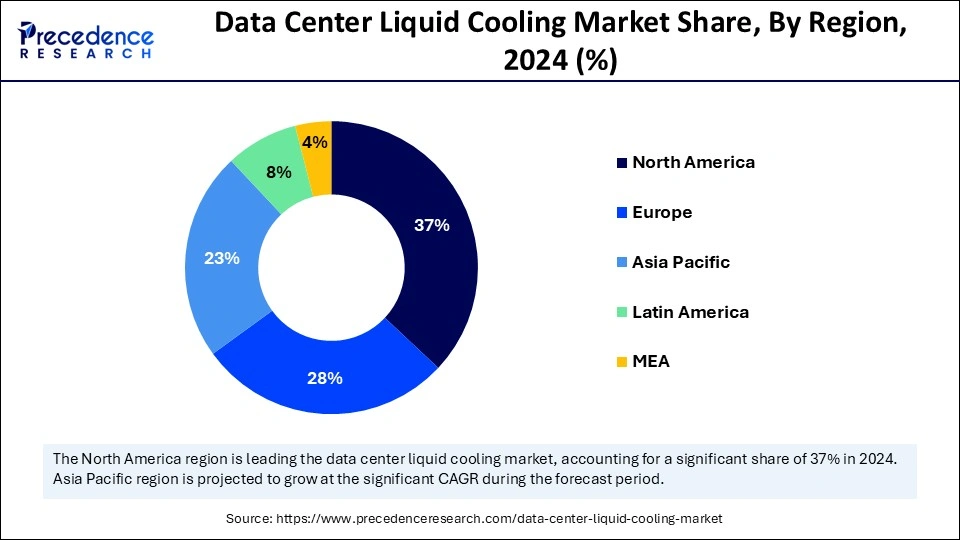

- North America dominated the global market with the largest market share of 37% in 2025.

- Asia pacific is expected to witness the fastest growth during the forecast years.

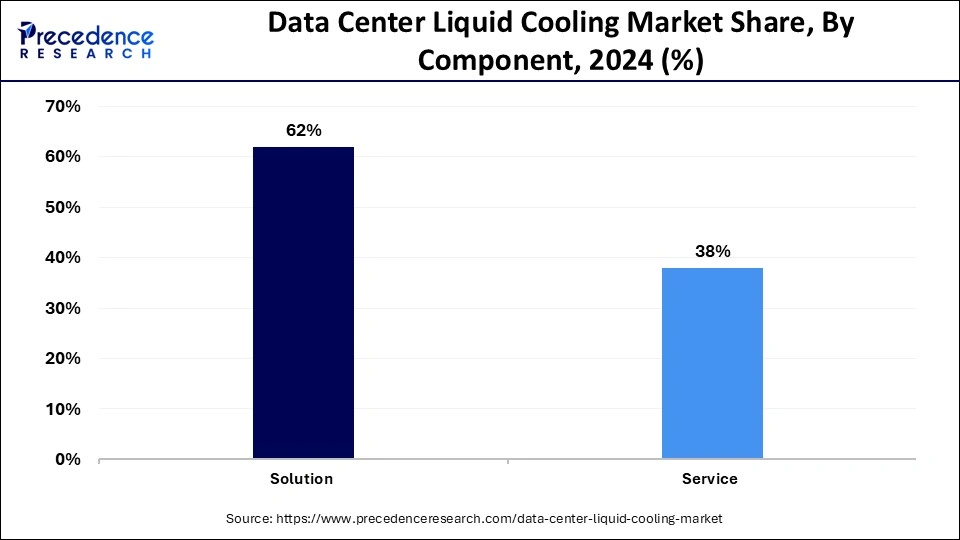

- By component, the solution segment accounted for the highest market share of 62% in 2025.

- By component, the service segment is expected to witness the fastest growth in the upcoming period.

- By data center size, the large size data centers segment held the largest market share in 2025.

- By data center size, the small and medium size data centers segment is projected to grow rapidly during the forecast period.

- By application, the server cooling segment led the market in 2025.

- By application, the storage cooling segment is anticipated to witness the fastest growth in the foreseeable future.

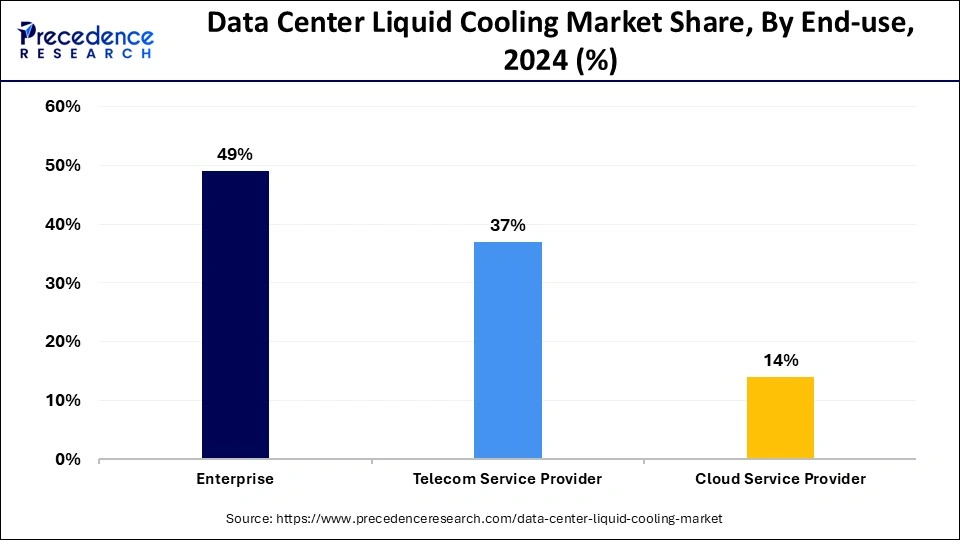

- By end-use, the enterprise segment has held the major market share of 49% in 2025.

- By end-use, the telecom service providers segment is likely to grow at the fastest rate in the upcoming period.

What is the Data Center Liquid Cooling?

The data center liquid cooling system uses liquid-based solutions, which absorb heat from hardware components to improve thermal conductivity. A major advantage of liquid cooling includes its ability to increase the lifespan of data center equipment while minimizing the thermal load on components. This approach leads to a minimum failure rate while ensuring consistent operating temperature to function at an optimum level. The data center liquid cooling market is expanding rapidly due to factors like low power consumption, which leads to energy efficiency and minimizes reliance on air conditioning systems that are energy intensive. This further decreased carbon emissions.

Traditional cooling systems cannot work properly with large-sized data centers, boosting the demand for liquid cooling systems as they offer enhanced performance stability, and lower failure rates, minimizing downtime and increasing productivity. Liquid cooling is a more efficient and eco-friendly method for cooling hardware systems in data centers. Liquid cooling systems consume less power than conventional cooling systems, making them suitable for high-performance computing environments. The rising demand for cloud computing and data centers to support data storage and processing further boosts market growth.

How is AI contributing to the Data Center Liquid Cooling Process?

AI allows for predictive thermal management by processing sensor data, controlling coolant flow automatically, eliminating hotspots, fine-tuning CDUs, cutting down on energy wastage, increasing hardware trustworthiness, prolonging the life of the equipment, catering to the needs of AI that requires huge computational power, and thereby reducing operational costs through the smart, instantaneous cooling decisions.

Data Center Liquid Cooling Market Growth Factors

- The increasing investment in hyperscale data centers boosts the growth of the market.

- The rising adoption of cloud computing and edge computing is expected to boost market growth in the coming years.

- The increasing need to improve the power density of IT equipment contributes to market expansion. Liquid cooling systems provide efficient solutions to manage higher thermal loads.

- The strong emphasis on minimizing energy consumption and lower operation costs encourages data center operators to adopt liquid cooling methods.

- Technological advancements like direct-to-chip and immersion cooling further bolster the market's growth.

- Stringent regulations regarding energy efficiency and environmental sustainability boost the adoption of liquid cooling systems in data centers.

Market Outlook

- Industry Growth Overview: Liquid cooling keeps up with the heat, and thus, the artificial intelligence workloads push the adoption of liquid cooling in the areas where high thermal efficiency is required.

- Sustainability Trends: Liquid cooling brings along the trifecta of energy savings, heat reuse, and water conservation in the plants.

- Global Expansion: North America is the forerunner in liquid cooling adoption, whereas Asia-Pacific is making quick strides in scaling liquid cooling investment.

- Major Investors: The likes of Blackstone, KKR, Macquarie, Microsoft, and NVIDIA are in the forefront and play a significant role in the funding of the liquid cooling expansion.

- Startup Ecosystem: The likes of Iceotope and LiquidStack are proving to be the harbingers of innovation through immersion and advanced liquid cooling designs, driving it.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 25.80Billion |

| Market Size in 2025 | USD 4.68Billion |

| Market Size in 2026 | USD 5.58 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 18.61% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Data Center Size, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for High-performance and Energy-efficient Data Centers

There is a heightened need to improve the performance and energy efficiency of data centers, which is a major factor driving the growth of the data center liquid cooling market. Liquid cooling systems reduce energy consumption in data centers, leading to reduced carbon emissions and potential failures due to temperature. The usage of data centers has increased among businesses as they provide reliable infrastructure to store, process, and manage large amounts of data. As per the recent data, nearly 11,800 data centers were registered across the globe, highlighting the need for data center liquid cooling for their upkeep. By adopting liquid cooling systems, energy efficiency in data centers can be achieved. These systems also ensure compliance with stringent regulations for carbon emissions. Liquid cooling systems reduce greenhouse gas (GHG) emissions from data centers.

Restraint

High Upfront Investment

One of the major restraining factors for the data center liquid cooling market is the substantial investment required for procuring a liquid cooling system. These systems require regular maintenance, which further increases operational costs. This cost factor created challenges for small and medium-sized businesses, limiting the adoption of liquid cooling systems. Moreover, these systems are made up of rare components like metals and alloys such as titanium and bronze, which are subject to price fluctuations. Specialized tools like cold plates and heat sinks are also needed to produce liquid cooling systems to properly dissipate heat from electronic components. Moreover, the limited availability of skilled workers limits the adoption of these systems as they require detailed knowledge for proper installation, operation, and maintenance.

Opportunity

Expanding Use of Blockchain and High-frequency Trading Systems

The rising usage of blockchain technology and high-frequency trading systems is expected to create immense opportunities in the data center liquid cooling market. Such technologies require high-performance processing units like graphics processing units and tensor processing units. These units increase heat loads, which need to be dissipated properly to reduce downtime and the possibility of hardware malfunction. Therefore, enterprises that use blockchain technology are increasingly investing in data center liquid cooling to ensure smooth operations of data centers.

Segment Insights

Component Insights

The solution segment held the largest share of the data center liquid cooling market in 2024. The rise in demand for advanced and precise cooling solutions to dissipate heat generated by data centers bolstered the segment. Conventional methods to dissipate heat are replaced by innovative liquid cooling solutions where densely packed parts of systems are submerged in liquid to dissipate heat effectively. Liquid cooling solutions lower operational costs and reduce additional need for cooling infrastructure.

The service segment is expected to witness the fastest growth during the forecast period. The segment growth can be attributed to factors like increased demand for managed services. With the rising adoption of data centers, the demand for managed services is increasing among businesses. Services providers provide managed or professional services to implement liquid cooling systems.

Data Center Size Insights

The large size data centers segment accounted for the largest market share in 2024. The growth of the segment is driven by the increasing demand for hyperscale data centers among large enterprises. Hyperscale and large cloud service providers like Google, AWS, and Microsoft often invest in liquid cooling systems as large-scale operations require efficient energy management solutions to comply with regulatory standards of carbon reduction. Furthermore, the integration of Artificial Intelligence (AI), Internet of Things (IoT), and 5G technologies with hyperscale and enterprise data centers creates excessive heat due to dense circuitry and performance. To tackle this, these data centers require liquid cooling systems for effective results.

The small and medium-sized data centers segment is projected to grow rapidly over the studied period. The segment growth is attributed to the growing need to meet energy efficiency and sustainability in operations. The adoption of small and medium-sized data centers is increasing, especially among SMEs, due to their enhanced scalability, efficiency, security, and lower cost. As the adoption of these data centers increases, so does the need for effective cooling systems. Immersion cooling methods and new modular setups are becoming cheaper in the market, which are leveraged by SMEs to expand their roots. Unlike an air cooling system, SMEs operate in compact spaces, where liquid cooling provides the best option without occupying much space.

Application Insights

The server cooling segment led the market with the largest share in 2024. Excessive heat generation by the servers of hyperscale data centers often requires an efficient cooling system to tackle heat generation during operations. Such data centers have more servers on one rack, increasing their density and requiring robust cooling solutions for thermal management. Additionally, maintaining optimum heat levels is necessary to increase processing speeds, lower downtime, and enhance the lifespan of hardware.

The storage cooling segment is anticipated to witness the fastest growth in the foreseeable future. The segment growth is attributed to factors like the growing need for sustainability and longevity, which are crucial for enterprises' ability to handle huge volumes of data. Increasing data generation boosts the need for energy-efficient solutions. Advanced storage systems require efficient cooling systems as they create more heat while working.

End-user Insights

The enterprise segment accounted for the largest market share in 2024. Enterprises are looking for solutions to lower power consumption and minimize carbon generation to comply with regulations set by governments of various countries. Large enterprises are actively expanding their IT infrastructure, in which liquid cooling plays a crucial role in providing cost-effective solutions. Large structures generated significant heat, depending on AI, big data analytics, and other applications, which require efficient cooling methods, supporting the segment's growth.

The telecom service providers segment registers the fastest growth rate in the upcoming period. The segment's growth can be attributed to factors such as increasing data traffic in the telecom sector, space constraints, and the growing need for energy-efficient performance. Telecom networks need high performance with low latency infrastructure, which further creates excessive heat. Thus, liquid cooling systems offer best solution for telecom providers to meet the requirements of energy efficiency.

Regional Insights

What is the U.S. Data Center Liquid Cooling Market Size?

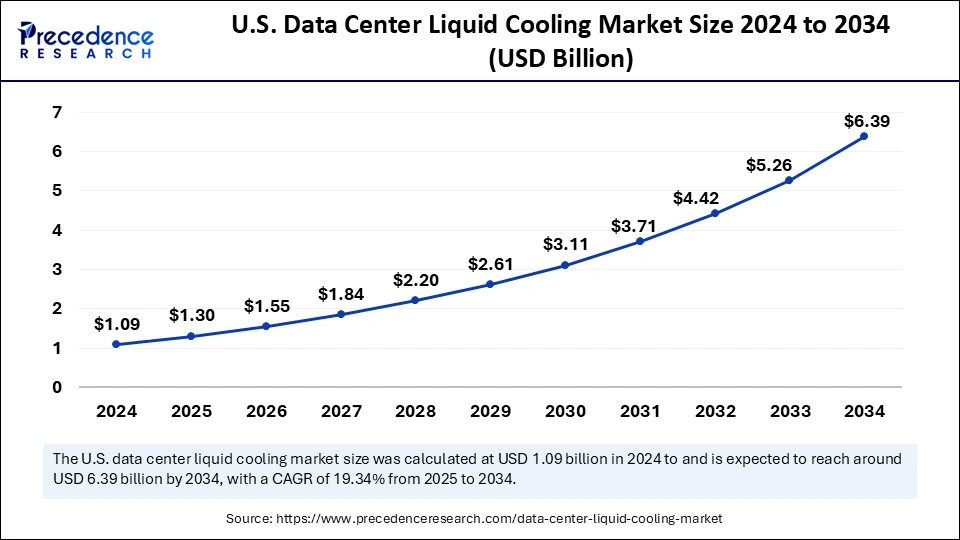

The U.S. data center liquid cooling market size was exhibited at USD 1.30 billion in 2025 and is projected to be worth around USD 7.33 billion by 2035, growing at a CAGR of 18.88% from 2026 to 2035.

North America's Sustained Dominance

North America held the largest share of the data center liquid cooling market in 2024. The region is presenting several opportunities to expand the data center liquid cooling market due to the presence of major tech giants like Microsoft, AWS, and Google that are heavily investing in innovative technologies like liquid cooling systems. Integration of artificial intelligence AI,machine learning, and high-performance computing among businesses boosts the need for robust structure for thermal management. North America has the highest number of data centers across the globe, which is a key driving factor for the market's expansion. Increasing deployment of 5G and edge computing is also fueling the market growth in the region as it requires robust cooling solutions like liquid cooling.

Market Trends in the U.S.

The U.S. is the major contributor to the market for data center liquid cooling in North America. Innovations such as immersion cooling and direct-to-chip are increasing the broader adoption in several end-use industries. Nearly 40% of energy can be saved due to a liquid cooling system in the data center, showcasing its ability to align with sustainability goals. The rising adoption of data centers further supports market expansion.

- In October 2024, Schneider Electric agreed to pay about USD 850 million for a controlling stake in Motivair Corp, a specialist in liquid cooling for high-performance computing.

Asia Pacific: The Fastest-Growing Region

Asia Pacific is expected to witness the fastest growth during the forecast period. Countries like India, China, and Japan are investing heavily in hyperscale data centers to support cutting-edge technologies. The increasing adoption of AI and cloud computing also supports market expansion. The rising adoption of high-performance data centers further contributes to market expansion. For instance, in February 2025, a new module has been added to China's underwater data center at Lingshui to support more high-performance workloads. The use of such hyperscale technologies creates excessive heat that can be dissipated efficiently by the liquid cooling method. Hence, the region is witnessing a surge in the liquid cooling demand. Moreover, the rapid expansion of IT infrastructure is expected to boost market growth.

Europe

The European data center liquid cooling market is expanding due to various factors, including increasing demand from many end-use sectors for high-performance computing, targets for energy efficiency and sustainability, and regulatory support to minimize carbon emissions. Initiatives in the European region, like the European Green Deal and the Digital Strategy, foster the transition to highly efficient and sustainable data center practices.

The region presents several opportunities for the expansion of the data center liquid cooling market. The integration of various technologies like IoT, cloud computing, and AI requires heat load management on an efficient scale. This can be achieved by the European Union's robust commitment to environmentally friendly methods and sustainability targets.

- In January 2025, Carrier made an investment in Zutacore, who are leading provider of thermal solutions for data centers. This initiative will help the market to adopt next-generation and highly efficient solutions for data center cooling systems.

Data Center Liquid Cooling Market Companies

- 3M Company: 3M Company introduces not only the advanced thermal materials but also the connectivity solutions that are tightly integrated with the efficient liquid cooling methods in the contemporary high-density data center surroundings.

- Alfa Laval AB: Alfa Laval AB provides a diverse range of heat exchangers and modular liquid cooling systems, which improve heat transfer efficiency in different data center setups.

- CoolIT Systems Inc.: CoolIT Systems Inc. manufactures liquid cooling systems such as cold plates and CDUs that are specifically tailored for artificial intelligence and high-performance computing clusters, among others.

Other Major Key Players

- IBM Corporation

- Mitsubishi Electric Corporation

- Rittal GmbH & Co. KG

- Schneider Electric SE

- STULZ GmbH

- Submer Technologies

- Vertiv Group

Recent Developments

- In January 2026, Vertiv launched MegaMod HDX modular power and liquid cooling systems for high-density computing, targeting AI and high-performance computing. The hybrid design combines direct-to-chip liquid cooling with air cooling for GPU heat management.

(Source: https://itbrief.co.uk ) - In January 2026, AISPEX launched Kryonix™, a liquid cooling and thermal infrastructure company for AI data centers at CES 2026. Kryonix offers scalable, modular solutions designed for high-density energy systems, addressing the limitations of traditional air cooling with innovative, prefabricated designs. (Source: https://www.heraldtribune.com )

- In February 2025, Motivair Corporation was acquired by Schneider Electric to deliver top-tier cooling solutions for the data center liquid cooling market across the globe. The acquisition aims to offer an end-to-end cooling portfolio for the Schneider Electric enterprise, which is customized to meet the growing demand for high-density computing.

- In February 2025, Cisco and Asperitas made a partnership with the Cisco Engineering Alliance Program. The partnership leverages Asperitas immersion cooling technologies like direct forced convection and perpetual natural convection with a Cisco unified computing system. The collaboration aims to solve the increasing demand for effective cooling methods for high-performance computing environments owing to the arrival of technologies like blockchain, IoT, and big data analytics.

- In May 2024, three leading enterprises, namely, UNICOM Engineering, Dell Technologies, and Submer, have made a collaboration to adopt next-gen immersion cooling solutions, customized for data centers as per their requirements. The three collaboratively offer immersion-ready servers to enhance data center performance and their efficiency.

- In January 2024, a tech giant, Google, announced its plan to develop a 33-acre Data Center Campus at Hertfordshire, where the Humber Tech Park will be able to host multiple hyperscale data centers.

- In November 2023,Microsoft revealed a plan to spend USD 500 million to build its data center infrastructure in Eastern Canada, where multiple data centers will be built in Quebec.

Segments Covered in the Report

By Component

- Solution

- Direct to Chip

- Immersive

- IT Chassis

- Tub/Open Bath

- Service

- Managed Service

- Professional Service

By Data Center Size

- Small Data Center

- Medium Data Center

- Large Data Center

By Application

- Server Cooling

- Storage Cooling

- Networking Cooling

- Others

By End-use

- Enterprise

- BFSI

- Retail & E-commerce

- Government

- Healthcare

- Manufacturing

- IT-enabled Services (ITeS)

- Others

- Telecom Service Provider

- Cloud Service Provider

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting