January 2025

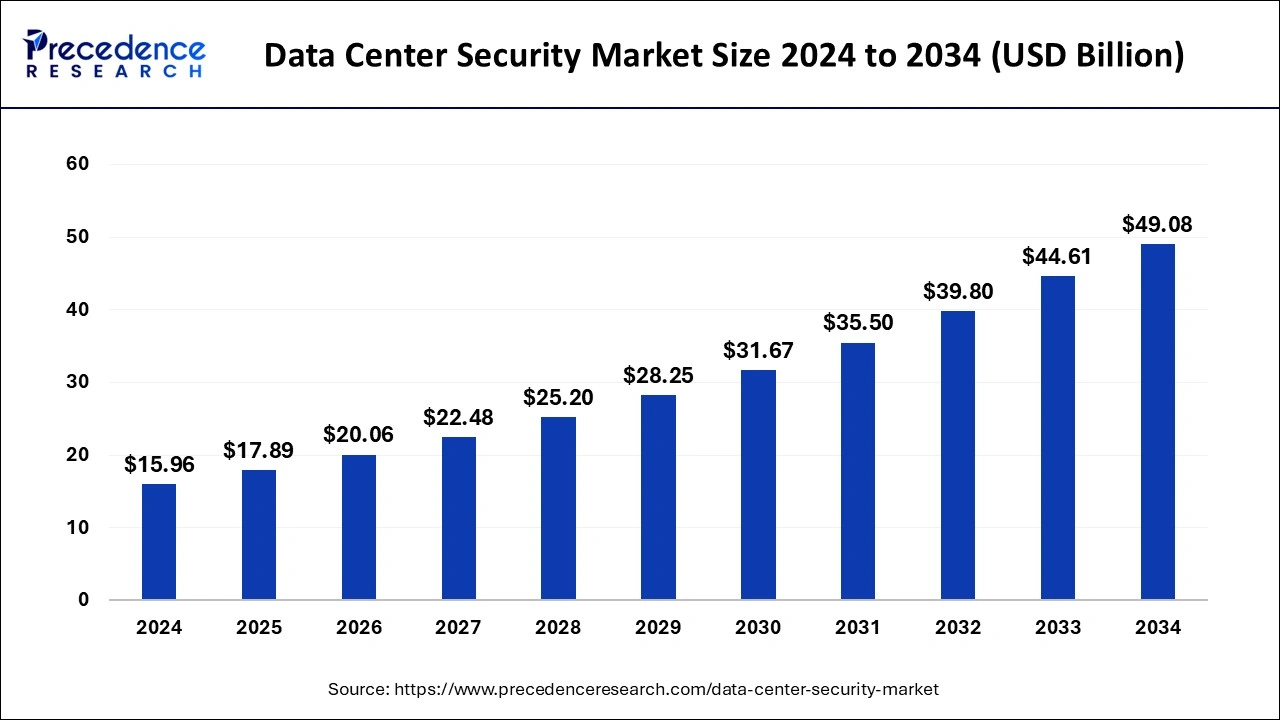

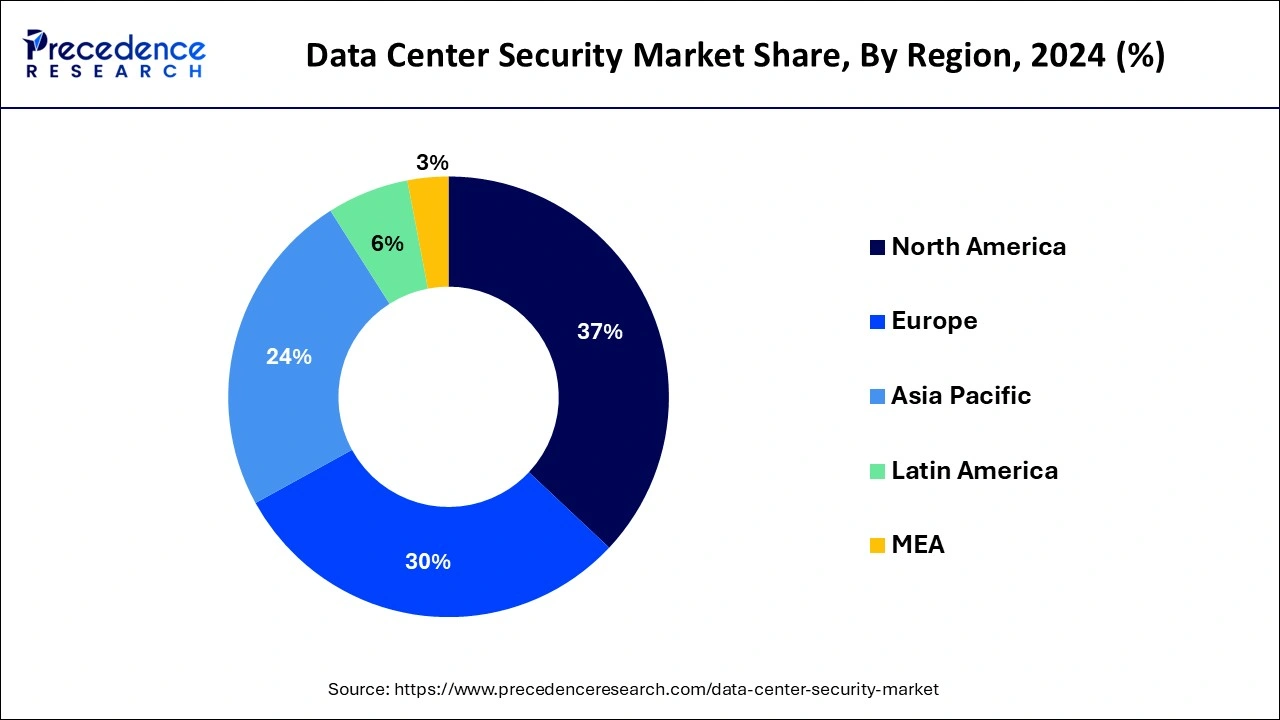

The global data center security market size is calculated at USD 17.89 billion in 2025 and is forecasted to reach around USD 49.08 billion by 2034, accelerating at a CAGR of 11.89% from 2025 to 2034. The North America data center security market size surpassed USD 5.91 billion in 2024 and is expanding at a CAGR of 12.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global data center security market size was estimated at USD 15.96 billion in 2024 and is predicted to increase from USD 17.89 billion in 2025 to approximately USD 49.08 billion by 2034, expanding at a CAGR of 11.89% from 2025 to 2034.

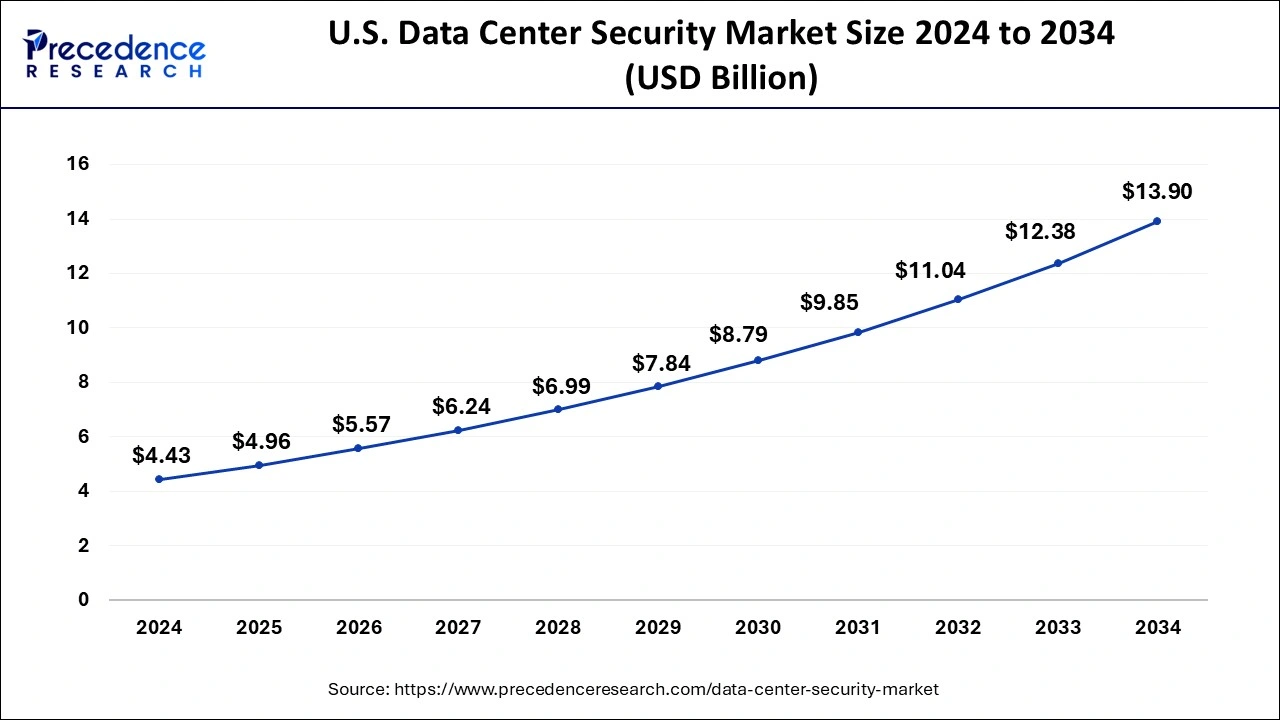

The U.S. data center security market size was estimated at USD 4.43 billion in 2024 and is projected to surpass around USD 13.90 billion by 2034 at a CAGR of 12.11% from 2025 to 2034.

North America held a share of 37% in the data center security market in 2024 due to several factors. The region boasts a high concentration of large enterprises, technology companies, and financial institutions that heavily rely on data center infrastructure. Moreover, North America has stringent regulatory requirements for data protection and security, driving the adoption of advanced security solutions. Additionally, the region's strong cybersecurity ecosystem, coupled with significant investments in research and development, further reinforces its dominance in the data center security market.

Asia-Pacific is experiencing rapid growth in the data center security market due to several factors. This growth is driven by the increasing adoption of cloud computing, digital transformation initiatives, and the proliferation of data-driven technologies across various industries. Additionally, rising cyber threats and stringent regulatory requirements are compelling organizations in the region to prioritize data center security investments. The expanding digital infrastructure and growing awareness about cybersecurity risks further contribute to the surge in demand for robust security solutions in Asia-Pacific.

Meanwhile, Europe is experiencing notable growth in the data center security market due to several factors. Stricter data protection regulations, such as GDPR, have compelled organizations to bolster their security measures to safeguard sensitive information. Additionally, the increasing adoption of cloud computing and digital transformation initiatives has fueled the demand for robust data center security solutions. Moreover, the region's proactive approach towards cybersecurity and rising awareness of cyber threats has further stimulated investments in advanced security technologies, contributing to the market's growth trajectory.

Data center security involves implementing measures to protect the physical and digital assets housed within data centers. It encompasses a range of technologies, processes, and protocols designed to safeguard against unauthorized access, data breaches, and cyber threats. These security measures include physical security controls such as access controls, surveillance systems, and environmental monitoring to protect against physical threats like theft, vandalism, and natural disasters.

On the digital front, data center security involves deploying firewalls, intrusion detection and prevention systems, encryption technologies, and endpoint security solutions to defend against cyber-attacks, malware, and data exfiltration attempts.

Additionally, comprehensive security policies, regular audits, and employee training are essential components of data center security to ensure compliance with regulatory requirements and maintain the integrity and confidentiality of sensitive data. Overall, data center security is crucial for ensuring the reliability, availability, and confidentiality of data and applications housed within data centers.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 11.89% |

| Market Size in 2025 | USD 17.89 Billion |

| Market Size by 2034 | USD 49.08 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Data Center Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing frequency and sophistication of cyber threats

The rise in cyber threats, such as malware, ransomware, and hacking attempts, has created a pressing need for robust data center security solutions. As cybercriminals become more sophisticated in their techniques, organizations face higher risks of data breaches and system compromises. This heightened threat landscape has compelled businesses to invest significantly in enhancing the security of their data centers to protect sensitive information and critical infrastructure from unauthorized access and malicious attacks. To mitigate the risks posed by cyber threats, companies are deploying advanced security measures, including intrusion detection systems, firewalls, encryption technologies, and security analytics tools within their data centers.

These solutions help organizations detect and respond to threats in real-time, fortifying their defenses against evolving cyber-attacks. As the frequency and complexity of cyber threats continue to escalate, the demand for data center security solutions is expected to surge further, driving market growth as businesses prioritize safeguarding their digital assets and maintaining the integrity of their operations.

Compliance requirements leading to resource constraints

Compliance requirements, such as GDPR, HIPAA, and PCI-DSS, impose strict guidelines on data protection and security measures within data centers. While these regulations are essential for safeguarding sensitive information, they often result in resource constraints for businesses. Meeting compliance standards demands significant investments in security technologies, personnel training, and audit procedures, diverting resources away from other critical areas of operation. This allocation of resources can strain budgets and limit the capacity of organizations to invest in comprehensive data center security solutions.

Moreover, compliance requirements may introduce complexities in the implementation and management of security measures, further exacerbating resource constraints. The need to continually adapt to evolving regulatory frameworks adds to the operational burden, potentially hindering the adoption of advanced security technologies. Consequently, while compliance is vital for maintaining trust and regulatory adherence, the associated resource constraints may impede organizations' ability to fully address the complex and dynamic security challenges within data centers, thereby restraining demand for comprehensive data center security solutions.

Expansion of hyper-scale data centers

The expansion of hyperscale data centers presents significant opportunities for the data center security market. As hyperscale data centers grow in size and capacity to accommodate vast amounts of data and processing power, the need for robust security measures becomes paramount. These large-scale facilities house critical information for numerous organizations, making them lucrative targets for cyber-attacks. Consequently, there is a heightened demand for advanced security solutions tailored to the unique requirements of hyperscale environments.

Moreover, the expansion of hyperscale data centers often involves the deployment of cutting-edge technologies and architectures, such as cloud-native applications and distributed computing platforms. This creates opportunities for security vendors to develop innovative solutions that can seamlessly integrate with these infrastructures to provide comprehensive protection against evolving cyber threats. By addressing the security challenges specific to hyperscale environments, vendors can capitalize on the growing demand for data center security solutions and establish themselves as key players in this rapidly expanding market segment.

The solution segment held the highest market share of 75% in 2024. In the data center security market, the solution segment comprises various offerings aimed at safeguarding data center infrastructure and assets. This includes firewall and intrusion detection systems, encryption solutions, access control systems, and security management software. A notable trend in this segment is the increasing adoption of integrated security platforms that offer comprehensive protection against a wide range of cyber threats. Additionally, there is a growing emphasis on solutions incorporating advanced technologies like artificial intelligence and machine learning for real-time threat detection and response.

The service segment is anticipated to witness rapid growth at a significant CAGR during the projected period. In the data center security market, the service segment encompasses offerings such as consulting, implementation, training, and support services. Service providers assist organizations in designing, deploying, and managing effective security solutions tailored to their specific needs. An emerging trend in this segment is the increasing demand for managed security services, where third-party providers offer continuous monitoring, threat detection, and incident response capabilities. This trend reflects a growing preference among organizations to outsource security operations to experts, enabling them to focus on their core business activities.

The small data center segment held a 46% market share in 2024. Small data centers typically serve the needs of small to medium-sized businesses or specific departments within larger organizations. These facilities house a limited number of servers and networking equipment, often with less than 100 racks. Despite their size, small data centers face similar security concerns as larger facilities, including cyber threats and regulatory compliance. Trends in the Data Center Security market for small data centers include the adoption of integrated security solutions, cloud-based security services, and the use of automation to streamline security operations.

The large data center segment is anticipated to witness rapid growth over the projected period. Large data centers are facilities that typically span tens of thousands of square feet and house extensive computing and storage infrastructure. In the data center security market, trends indicate a heightened focus on advanced threat detection and prevention measures, encryption technologies, and robust access controls within large data centers. As these facilities store vast amounts of sensitive data, securing them against cyber threats and unauthorized access is paramount, driving the adoption of sophisticated security solutions tailored to their scale and complexity.

The BFSI segment has held a 21% market share in 2024. The BFSI (Banking, Financial Services, and Insurance) segment encompasses institutions involved in financial transactions, including banks, credit unions, insurance companies, and investment firms. In the Data Center Security market, BFSI organizations prioritize safeguarding sensitive financial data, customer information, and transactional records from cyber threats and data breaches. Key trends in this segment include the adoption of advanced encryption techniques, real-time threat detection systems, and regulatory compliance measures to ensure the security and integrity of financial operations.

The healthcare segment is anticipated to witness rapid growth over the projected period in the data center security market. In the healthcare industry vertical, data center security refers to safeguarding electronic health records (EHRs), patient information, and critical medical systems from cyber threats. Trends in this segment include the adoption of advanced encryption techniques, robust access controls, and stringent compliance measures such as HIPAA. Healthcare organizations are increasingly investing in data center security solutions to protect sensitive data from breaches and ensure regulatory compliance, given the growing frequency of cyber-attacks targeting the healthcare sector.

By Component

By Data Center Type

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

January 2025

October 2024