January 2025

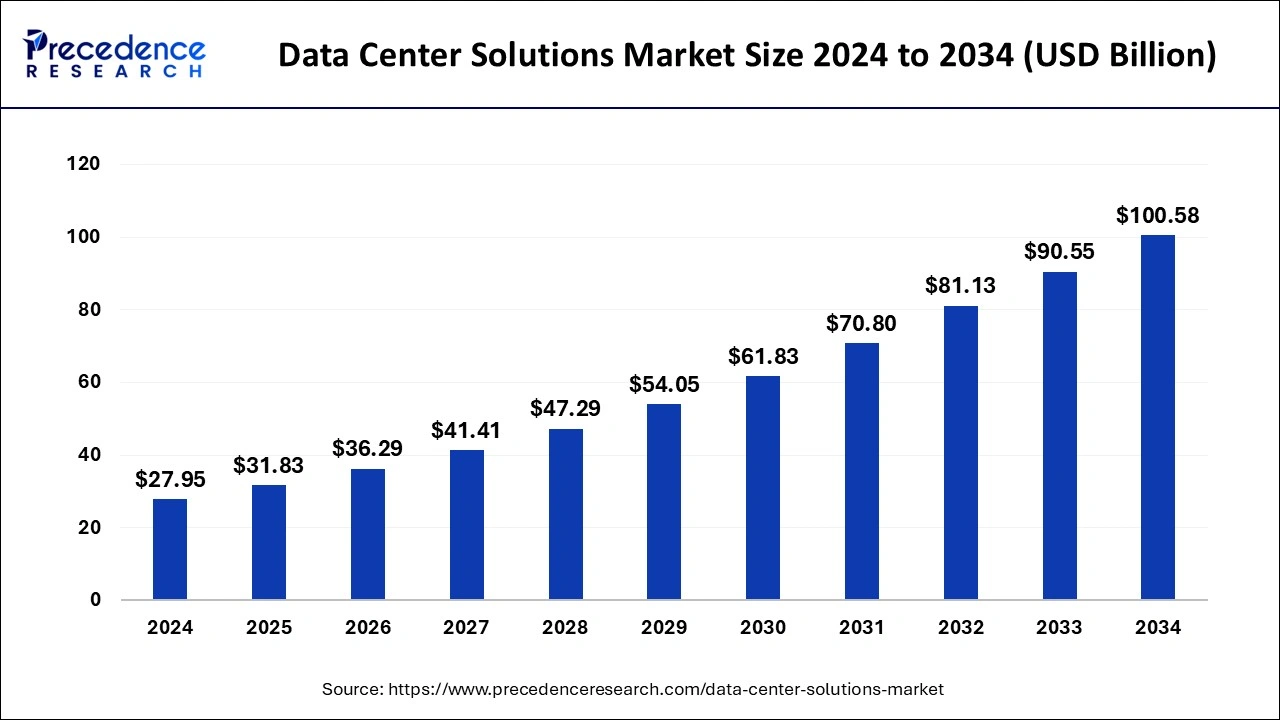

The global data center solutions market size is accounted at USD 31.83 billion in 2025 and is forecasted to hit around USD 100.58 billion by 2034, representing a CAGR of 13.66% from 2025 to 2034. The North America market size was estimated at USD 10.90 billion in 2024 and is expanding at a CAGR of 13.81% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global data center solutions market size accounted for USD 27.95 billion in 2024 and is predicted to increase from USD 31.83 billion in 2025 to approximately USD 100.58 billion by 2034, expanding at a CAGR of 13.66% from 2025 to 2034.

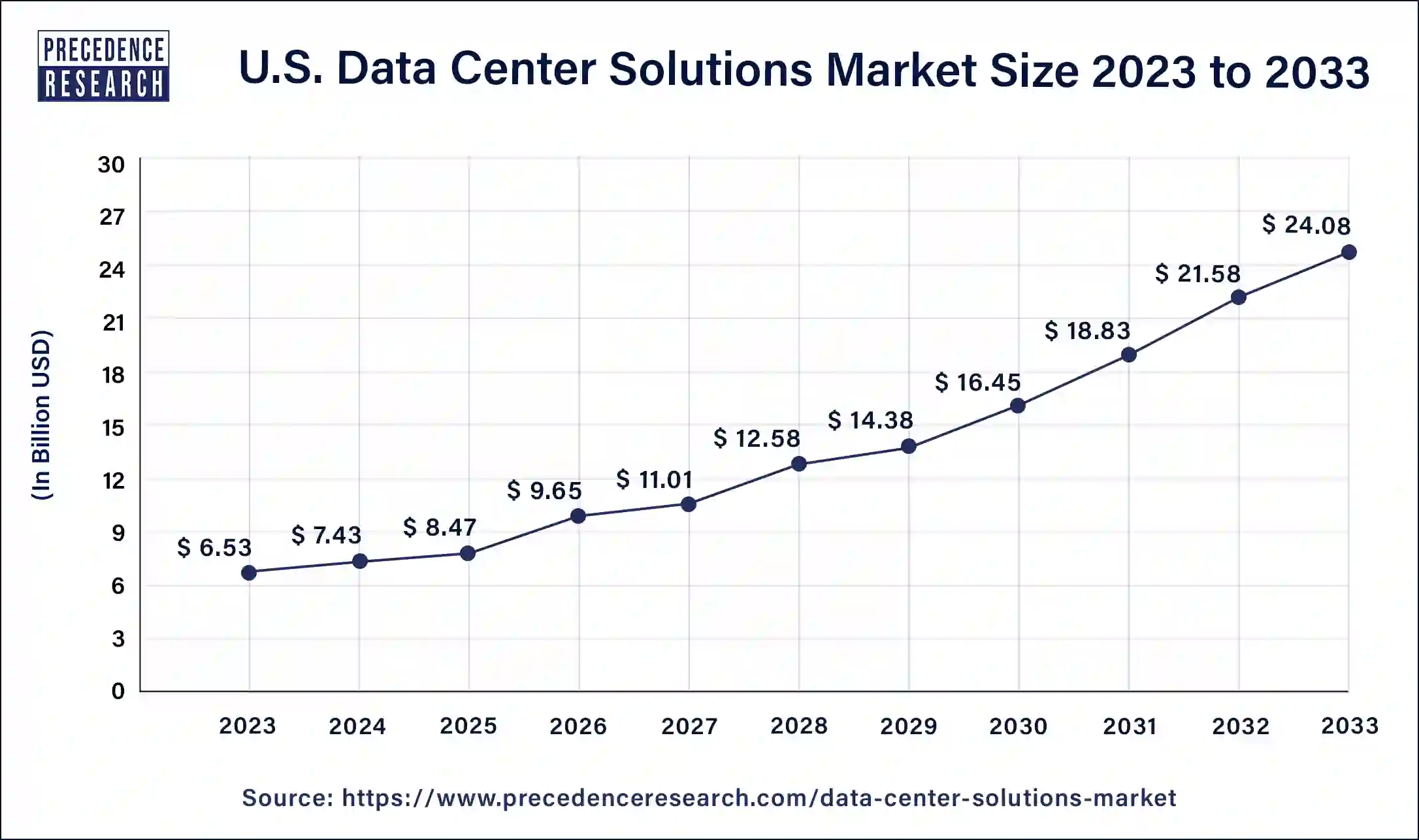

The U.S. data center solutions market size was evaluated at USD 7.63 billion in 2024 and is projected to be worth around USD 28.01 billion by 2034, growing at a CAGR of 13.89% from 2025 to 2034.

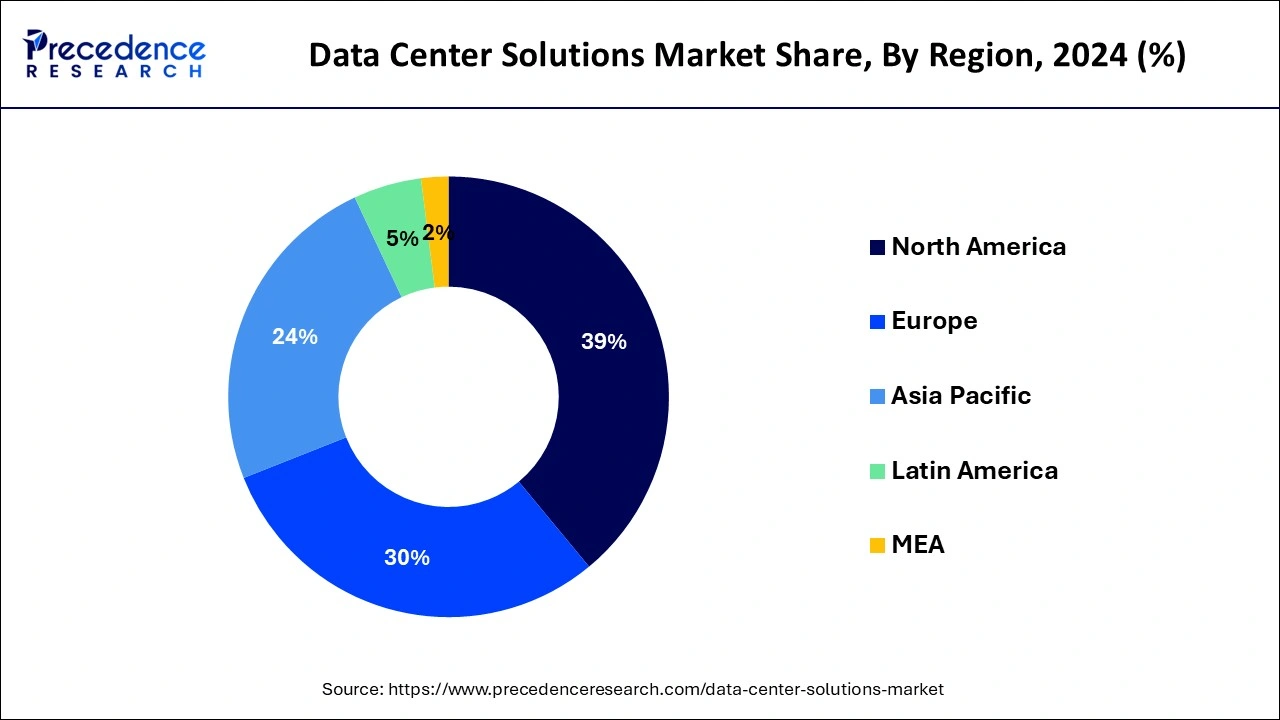

North America has held the largest revenue share of 39% in 2024. North America's data center solutions market is witnessing a notable uptick in demand for hyperscale data centers, spurred by the rapid growth of cloud computing and the imperative for digital transformation. A trend toward edge data centers is emerging to cater to low-latency applications. Sustainability is a key focal point in the region, with numerous data centers embracing green initiatives to mitigate their environmental footprint.

Asia Pacific is estimated to observe the fastest expansion. In Asia Pacific, the data center solutions market is experiencing substantial growth due to increasing internet penetration and the expansion of the e-commerce sector. Edge computing and 5G deployments are driving demand for localized data centers. Moreover, there is a strong emphasis on energy efficiency and renewable energy adoption, reflecting the region's commitment to sustainability in data center operations.

In the European data center solutions market, there's a strong emphasis on innovation and sustainability. The region's data centers are adopting advanced technologies for increased efficiency while also focusing on reducing their environmental impact. As data privacy regulations become more stringent, data security and compliance are critical considerations. Europe's market exhibits a commitment to sustainability, technological advancement, and ensuring data integrity, making it a dynamic and progressive segment within the global data center solutions industry.

The data center solutions market is a fast-growing industry that includes hardware, software, and services tailored to enhance the functionality of data centers. These facilities play a pivotal role in storing, processing, and managing vast amounts of digital data that are essential for diverse industries.

The growth of data center solutions is propelled by the surging volumes of data, a growing reliance on cloud computing, and the demand for energy-efficient and secure data storage facilities. Furthermore, trends in edge computing, artificial intelligence, and the emphasis on data center sustainability play a significant role in shaping this market.

Oracle's robust revenue growth demonstrates the increasing demand for cloud services and data management. In 2023 was $50.962B, a 15.41% increase year-over-year. Oracle's annual revenue for 2023 was $49.954B. This success supports the data center solutions market by driving investment in advanced data infrastructure, ensuring the continued expansion and innovation of data centers.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.66% |

| Market Size in 2025 | USD 31.83 Billion |

| Market Size by 2034 | USD 100.58 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Electrical Solution, Mechanical Solution, User Type, and Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Edge computing, remote work, and cloud adoption

With the increasing use of IoT devices and real-time applications, edge computing has emerged as a transformative trend. Edge data centers are positioned closer to data sources, reducing latency and enabling faster processing. This shift demands a network of distributed data centers, amplifying the need for data center solutions that cater to localized computing requirements. These solutions support the efficient deployment, management, and security of edge data centers, catering to the evolving landscape of IoT and real-time data processing.

The accelerated adoption of remote work, cloud services, and virtualization has necessitated robust data center infrastructure. To support a remote workforce, data center solutions are vital for ensuring connectivity, accessibility, and data security. Cloud adoption, both for public and private clouds, leads to increased demand for data center services that facilitate seamless integration with cloud platforms. This requires agile, scalable, and efficient data center solutions to meet the demands of an increasingly distributed and digital workforce.

Energy consumption and high operational costs

One significant restraint in the data center solutions market is the substantial energy consumption associated with data centers. These facilities demand massive electrical power to operate servers, cooling systems, and other infrastructure. This high energy consumption increases operational costs and has environmental implications, contributing to a significant carbon footprint. As sustainability concerns continue to grow, data center operators are under pressure to reduce their energy consumption and environmental impact. This can pose a challenge, as optimizing energy efficiency often requires significant upfront investments in technologies such as advanced cooling systems, efficient hardware, and renewable energy sources.

High operational costs are another key restraint. Building, maintaining, and upgrading data centers involves substantial investments in infrastructure, skilled personnel, and ongoing operational expenses. These costs can strain the budgets of organizations, particularly smaller businesses. Moreover, the swift progression of technological advancements requires continual upgrades and adaptations to maintain data centers' competitiveness and security. This makes it vital for businesses to carefully manage and optimize their operational expenses to remain competitive in the data center solutions market.

Data center services and energy-efficient solutions

Data center services play a pivotal role in surging market demand for data center solutions. With the ever-increasing complexity of data center operations, organizations are seeking efficient ways to manage their data infrastructure. Colocation services, cloud-related services, and managed data center solutions are in high demand. Colocation services enable businesses to leverage shared data center facilities, reducing the need for in-house data centers and offering cost-effective, scalable solutions. Managed services ensure smooth data center operations, from maintenance to security and compliance, allowing businesses to focus on their core activities. These services are especially appealing to organizations seeking to cut capital expenditures and enhance operational efficiency.

Energy-efficient solutions are another crucial factor driving demand in the data center solutions market. Innovations in cooling systems, power distribution, and server technologies have led to significant reductions in energy consumption. Data center operators are adopting renewable energy sources and power management technologies, optimizing energy usage while minimizing the environmental impact. The emphasis on sustainability and the rising costs of energy have made energy-efficient data center solutions more attractive to businesses, leading to increased market demand as organizations seek to reduce their carbon footprint and operational costs.

According to the electrical solution, the power distribution segment has held a 48% revenue share in 2024. In the data center solutions market, power distribution involves the efficient management and delivery of electrical power to various IT equipment. This includes uninterruptible power supplies (UPS), power distribution units (PDUs), and smart power management systems. Trends in power distribution include the implementation of intelligent PDUs that provide real-time monitoring and control, ensuring efficient energy usage. Additionally, advancements in power distribution are focused on redundancy and fault tolerance to enhance data center reliability.

The power backup segment is anticipated to expand at a significant CAGR of 12.8% during the projected period. In power backup in data centers refers to backup systems, like generators and energy storage solutions, that ensure uninterrupted operations in case of power disruptions. The data center solutions market is witnessing a shift towards sustainable power backup options. This includes the integration of renewable energy sources to reduce the environmental footprint while ensuring uninterrupted operations.

Moreover, the adoption of compact and longer-lasting lithium-ion batteries is on the rise, replacing traditional lead-acid batteries for energy storage in data centers. These trends reflect a growing focus on both environmental responsibility and reliability in data center power backup solutions.

Based on the mechanical solutions, the air conditioning segment held the largest market share of 43% in 2024. In the data center solutions market, mechanical solutions such as air conditioning are essential for maintaining optimal operating conditions. These systems manage temperature and humidity, preventing overheating and ensuring stable performance. A key trend is the adoption of energy-efficient cooling technologies, including precision cooling and free cooling systems, to reduce power consumption and environmental impact. Moreover, modern air conditioning systems integrate with advanced monitoring and control systems for more efficient and proactive management of data center environmental conditions.

On the other hand, the management system segment is projected to grow at the fastest rate over the projected period. Data center management systems are pivotal for streamlined data center operations. These systems encompass both software and hardware tools, allowing for the monitoring, control, and optimization of various facets within data centers. A prominent trend is the transition to integrated, cloud-based management systems.

These cloud-based systems provide real-time visibility and control over data center resources, thereby boosting scalability, reliability, and energy efficiency. These systems facilitate proactive monitoring, predictive maintenance, and dynamic resource allocation, aligning perfectly with the growing demand for agile and sustainable data center solutions.

In 2024, the enterprise data centers segment had the highest market share of 52% based on the user type. Enterprise data centers serve large organizations with extensive data processing and storage needs. The trends in enterprise data centers involve a transition towards hybrid and multi-cloud strategies, incorporating high-performance computing, edge computing infrastructure, and a strong emphasis on data security and compliance. These centers often require advanced data center solutions that can seamlessly integrate with various cloud platforms and support the demands of complex, mission-critical applications.

The mid-size data centers segment is anticipated to expand at the fastest rate over the projected period. Mid-size data centers cater to businesses that require moderate IT infrastructure. These are often organizations with data needs beyond small-scale solutions but not at the scale of large enterprises. Trends in mid-size data centers include a growing reliance on cloud services, edge computing solutions, and a focus on energy efficiency and cost optimization. These data centers need flexible and scalable solutions to accommodate changing IT requirements while maintaining a balance between performance and operational costs.

Based on the vertical, the BFSI segment held the largest market share of 33% in 2024. In the data center solutions market, the BFSI sector demands highly secure and robust data storage and processing. A key trend is the increasing adoption of hybrid cloud solutions to enhance agility and data management. BFSI organizations are also investing in disaster recovery solutions to ensure business continuity and cybersecurity measures to protect sensitive financial data.

On the other hand, the telecom & IT segment is projected to grow at the fastest rate over the projected period. The Telecom & IT vertical requires data center solutions to support the growing demand for digital services. A notable trend is the deployment of edge data centers to reduce latency for real-time applications. Furthermore, the sector is focused on implementing energy-efficient data centers to reduce operational costs and environmental impact while supporting the expanding digital infrastructure.

By Electrical Solution

By Mechanical Solution

By User Type

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

January 2025

October 2024