April 2025

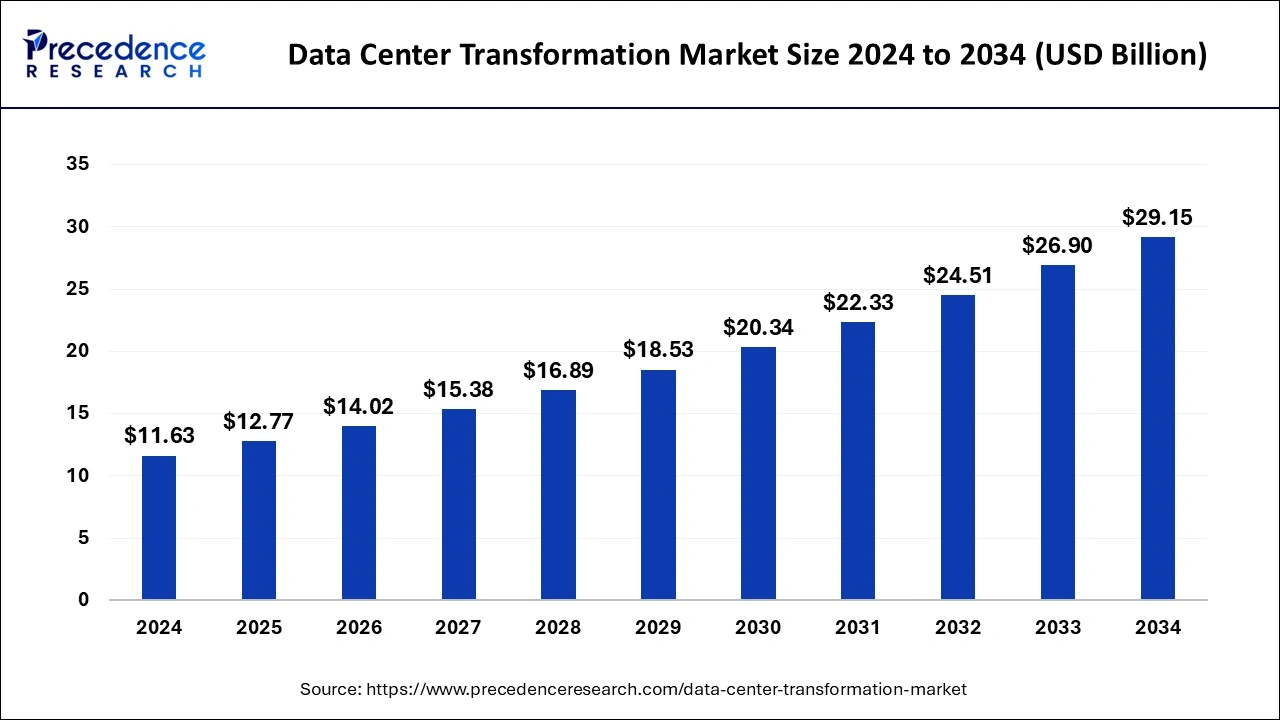

The global data center transformation market size is calculated at USD 12.77 billion in 2025 and is forecasted to reach around USD 29.15 billion by 2034, accelerating at a CAGR of 9.62% from 2025 to 2034. The North America data center transformation market size surpassed USD 5.93 billion in 2024 and is expanding at a CAGR of 9.63% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global data center transformation market size was valued at USD 11.63 billion in 2024 and is anticipated to reach around USD 29.15 billion by 2034, growing at a CAGR of 9.62% from 2025 to 2034. The data center transformation market is experiencing significant growth due to the rising usage of cloud computing.

The landscape of data center operations is undergoing a significant transformation, majorly due to the increasing adoption of artificial intelligence (AI) technologies. One of the key benefits of AI in this sector is its ability to allocate power resources intelligently. By analyzing the workloads of various servers, AI can prioritize power to those handling the most demanding tasks while simultaneously reducing energy supply to underutilized servers. In some cases, AI can even power down hardware that is not in use, thereby optimizing energy consumption. Furthermore, many data centers are integrating renewable energy sources into their power infrastructure. AI can manage the seamless integration of these green energy sources, enhancing sustainability and reducing overall operational costs.

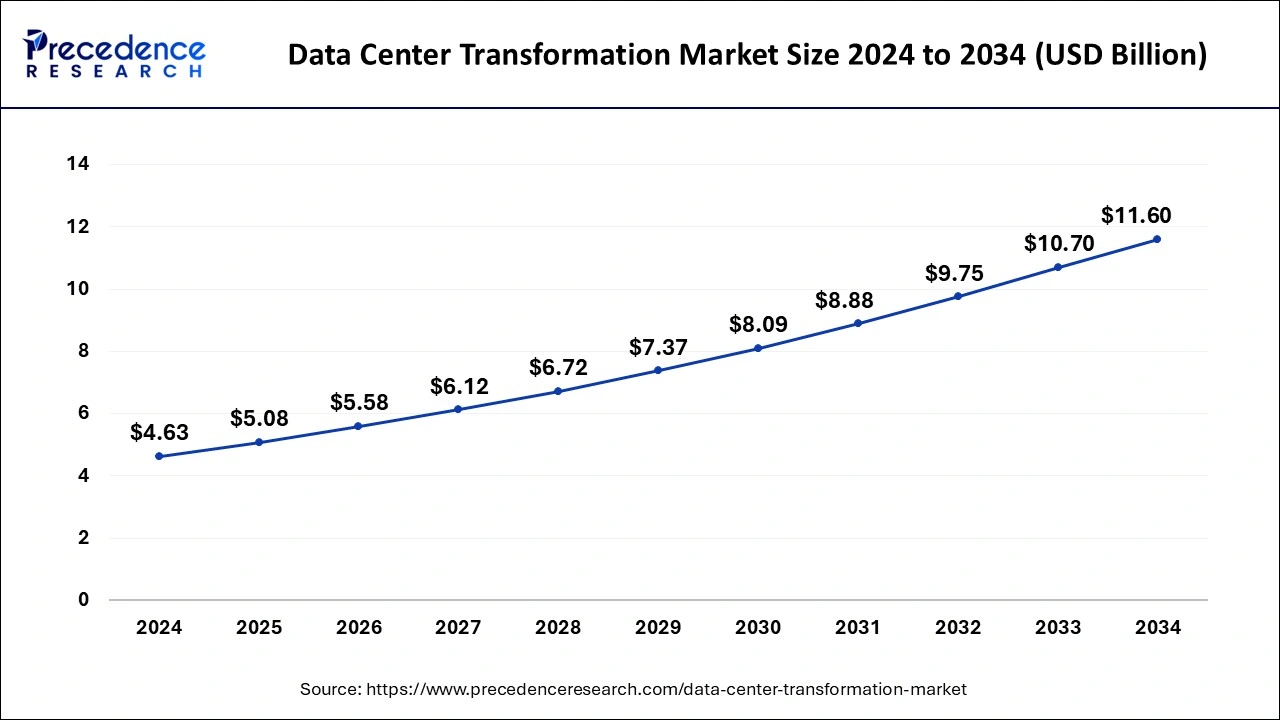

The U.S. data center transformation market size was estimated at USD 4.63 billion in 2024 and is projected to surpass around USD 11.60 billion by 2034 at a CAGR of 9.62% from 2025 to 2034.

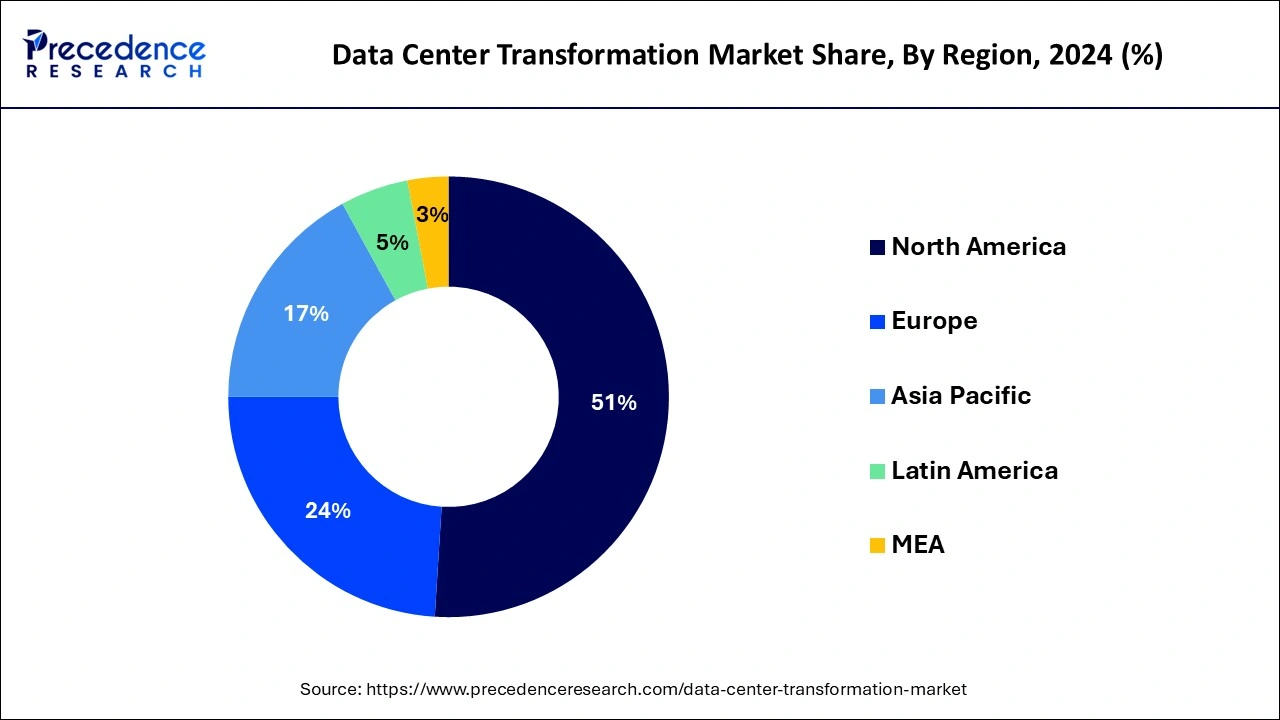

North America had the largest market share in 2024 in the data center transformation market throughout the predicted timeframe. The area has a robust digital economy, with sectors including IT, finance, e-commerce, and entertainment leading the way. These industries' heavy reliance on data centers for processing, storing, and analyzing enormous volumes of data fuels the need for updated and effective data center infrastructures. North America boasts a highly skilled workforce in fields such as information technology, engineering, and data science. This pool of talent contributes to the development and deployment of advanced data center solutions, including virtualization, automation, and artificial intelligence-driven optimizations.

North America has made significant investments in telecommunications and internet infrastructure, laying the foundation for robust data center networks. This infrastructure supports the expansion of data center facilities and enables high-speed connectivity, which is essential for efficient data processing and storage. Many of the leading data center service providers and technology vendors based in North America have a global presence. Their expertise, coupled with extensive networks of data centers worldwide, allows them to cater to the needs of clients across different regions, further consolidating North America's dominance in the data center transformation market.

Asia-Pacific is observed to be the fastest growing in the data center transformation market during the forecast period. Adequate data privacy and security precautions are required as digital activities increase. Modern data centers with cutting-edge security features like encryption, biometric access controls, and threat detection systems are becoming increasingly expensive for businesses and government organizations. Several regional governments are promoting the construction of data center infrastructure through financial contributions, tax breaks, and legislative initiatives. These programs seek to guarantee data security and compliance, encourage digital innovation, and draw in foreign investment.

The data center transformation market offers services for altering an organization's IT infrastructure to enhance its functionality, effectiveness, and efficiency. Some examples of this process are data center migration, significant hardware modifications, the addition of virtualization and software-defined components, and the automation of business procedures. Integrating virtualization and cloud computing into an existing data center is a common step in transformation. The data center must be upgraded or redesigned to accommodate remote access, network virtualization, and other cloud computing characteristics because traditional data centers are not designed to use cloud computing.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.62% |

| Global Market Size in 2025 | USD 12.77 Billion |

| Global Market Size by 2034 | USD 29.15 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service, By End-user, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A vast pool of skilled labor

Adopting new technologies like software-defined networking (SDN), cloud computing, edge computing, and hyper-converged infrastructure (HCI) is a standard part of data center transformation. To properly examine these technologies, determine whether they are appropriate for the organization's objectives, and install them in a data center setting, skilled manpower is required. Within data centers, skilled personnel fosters innovation by investigating new technologies, trends, and industry best practices. They pinpoint areas where data center infrastructures can be made more resilient, scalable, and optimized for the future. In the quickly changing digital landscape, this proactive strategy aids firms in maintaining their agility and competitiveness.

Surging data storage demands

Big data has completely changed how businesses function and make choices. Companies in various sectors use big data analytics to spur innovation, increase operational effectiveness, and obtain insightful knowledge. Data storage designs are now more complicated due to the emergence of edge computing, which places data processing closer to the point of data generation. Edge sites need storage solutions that can manage sporadic connectivity, low-latency access, and data synchronization across dispersed settings. Efficient storage solutions support real-time applications and services at the network's edge in data centers and computing infrastructure.

Difficulty in managing the Complex infrastructure

Complexity raises the possibility of service interruptions, downtime, and performance bottlenecks. Ensuring fault tolerance, disaster recovery, and high availability in a complex infrastructure calls for proactive maintenance plans, strong architecture designs, and monitoring systems. Because managing sophisticated infrastructure requires specialized tools, software licenses, maintenance, and employee training, operating expenses may rise. Managing costs and optimizing performance through resource allocation is a persistent challenge for the data center transformation market.

Progressive government policies

Governments prioritizing digital infrastructure development can create opportunities for the data center industry. This includes initiatives to expand high-speed internet access, promote cloud computing adoption, and support emerging technologies like Internet of Things (IoT) and artificial intelligence (AI). As businesses and consumers increasingly rely on digital services, a growing demand for robust data center infrastructure to support these services creates a favorable market environment.

Service Insights

The consolidation services segment dominated the data center transformation market in 2024. Data center consolidation helps companies reduce the number of physical data centers by reducing or merging servers, storage systems, networking systems, and locations. The aim is to build a more centralized and adequate infrastructure. To reduce inefficiencies and increase efficiency, businesses combine several data centers into fewer, larger spaces.

As a result, companies that decide to move workloads to more productive virtual platforms, made possible by the growing acceptance of virtualization and cloud computing, resort to data center consolidation services. Presently, vendors of data center consolidation services include hybrid and multi-cloud services. These manuals assist businesses with cloud platform selection, migration management, and seamless integration upkeep.

The cloud service providers services segment dominated the data center transformation market in 2024. Data centers have undergone substantial evolution from conventional on-premises facilities to contemporary, incredibly efficient, and scalable infrastructures. In the past, businesses were responsible for maintaining on-site networking, storage, and physical servers. However, as digital technologies and data volumes increased, maintaining this infrastructure became more difficult and expensive.

The colocation providers segment is observed to be the fastest growing segment in the data center transformation market during the forecast period. Data centers are essential to organizations running in our increasingly interconnected society. These cutting-edge facilities manage, process, and safeguard the enormous volumes of data that businesses produce and depend on. Due to the growth of big data analytics, cloud computing, and digital transformation, data centers are now an essential component of IT plans. However, data centers have played a crucial role in company operations since the early days of computers; thus, their position is not new.

They have changed and evolved to satisfy the increasing need for effective and safe data management and storage. Colocation data centers provide efficient data handling and seamless connection and have emerged as significant players in this growth. India has become a notable market in this fast-paced global business, significantly increasing colocation services.

The IT & telecommunications segment dominated the data center transformation market in 2024. With the introduction of various technologies such as 5G, IoT, virtual reality & augmented reality, and AI/ML, the telecommunications sector is adapting to meet the demands of extensive data processing and low latency.

The telecom data centers are undergoing change to meet the demands of low latency and high data volume. With the arrival of the data revolution and the emergence of smart cities, automation in homes and businesses, over-the-top (OTT) services, and intelligent transportation, consumer and corporate landscapes are changing quickly. A recurring motif emerges as data is pervasive and rapidly expanding. First-generation networks were analog and limited to voice; digital communication was introduced by 2G; mobile data and video were added by 3G; high-speed access was made possible by 4G; and vast bandwidth and low latency were brought about by 5G.

The BFSI segment is observed to witness a notable rate of growth during the forecast period in the data center transformation market. BFSI companies are undergoing digital transformation initiatives to improve customer experience, streamline operations, and stay competitive in the market. This involves the adoption of cloud computing, mobile banking, digital payment systems, and other innovative technologies that require agile and scalable data center infrastructure. Data center transformation enables BFSI organizations to modernize legacy systems, migrate to cloud-based platforms, and deploy hybrid IT architectures to support digital initiatives effectively.

By Service

By End-user

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

March 2025

January 2025