January 2025

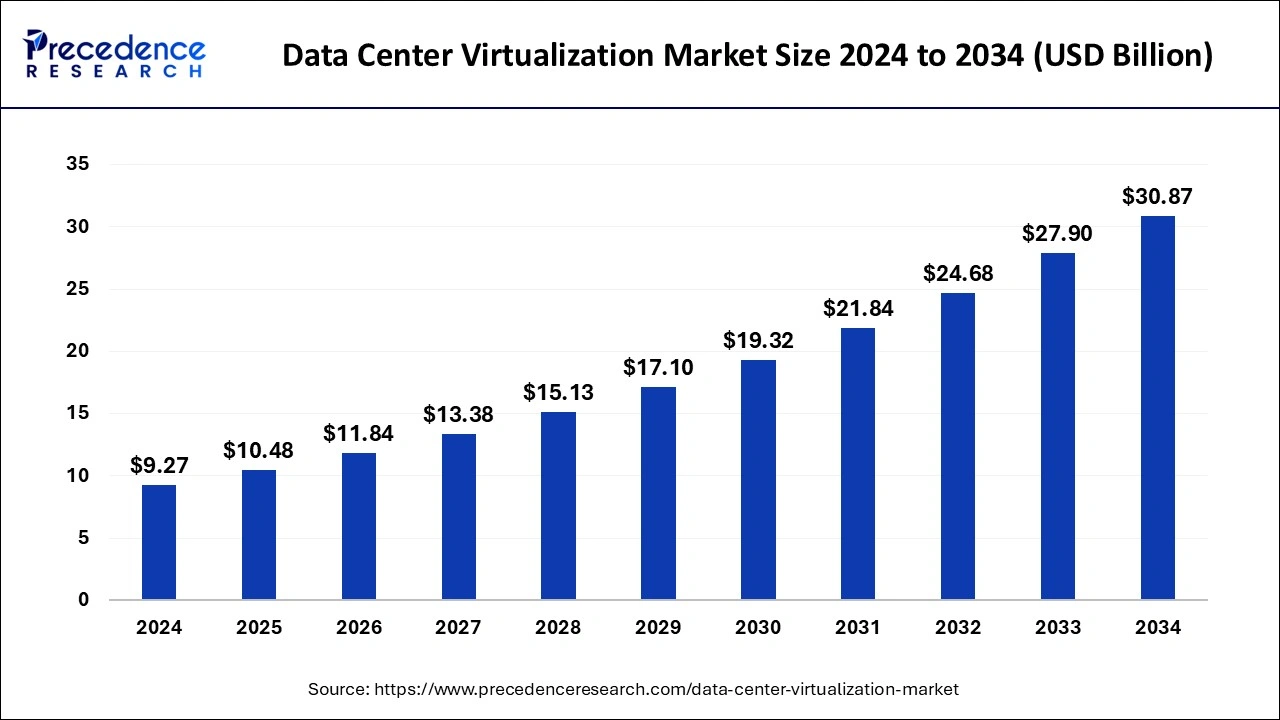

The global data center virtualization market size is calculated at USD 10.48 billion in 2025 and is forecasted to reach around USD 30.87 billion by 2034, accelerating at a CAGR of ccc% from 2025 to 2034. The North America data center virtualization market size surpassed USD 3.80 billion in 2024 and is expanding at a CAGR of 12.92% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global data center virtualization market size was estimated at USD 9.27 billion in 2024 and is predicted to increase from USD 10.48 billion in 2025 to approximately USD 30.87 billion by 2034, expanding at a CAGR of 12.78% from 2025 to 2034.

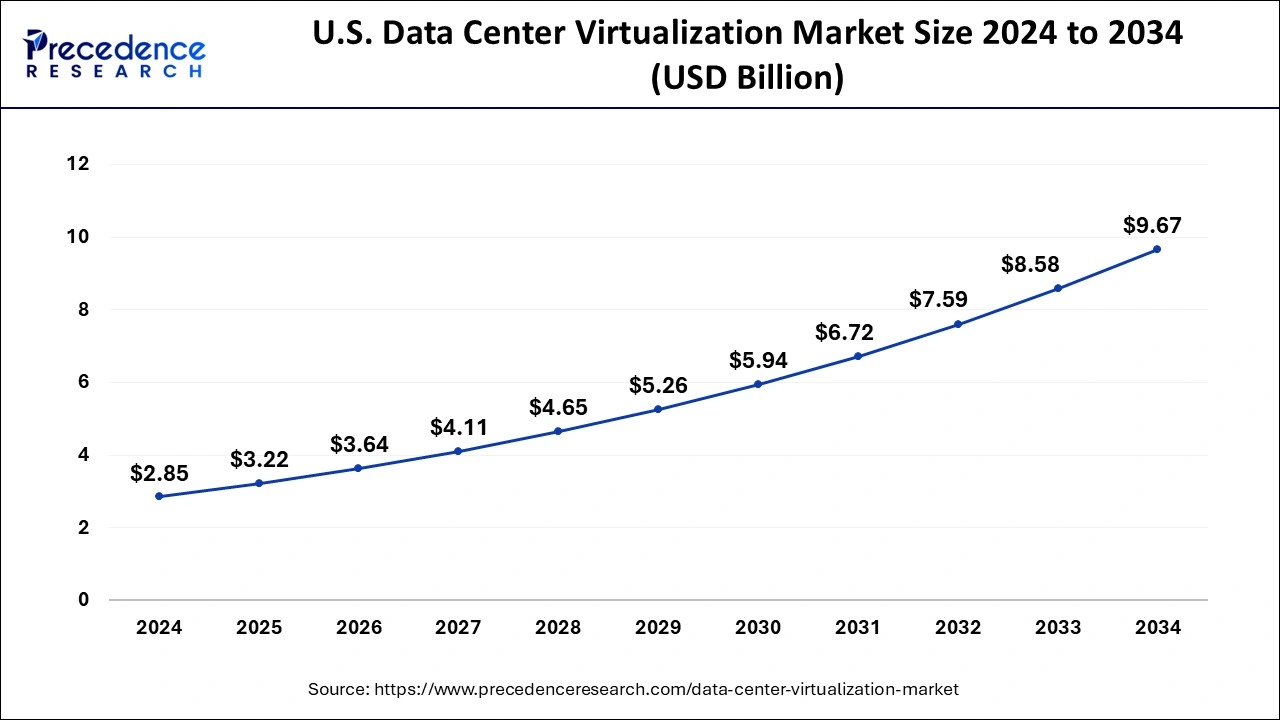

The U.S. data center virtualization market size reached USD 2.85 billion in 2024 and is projected to surpass around USD 9.67 billion by 2034 at a CAGR of 12.99% from 2025 to 2034.

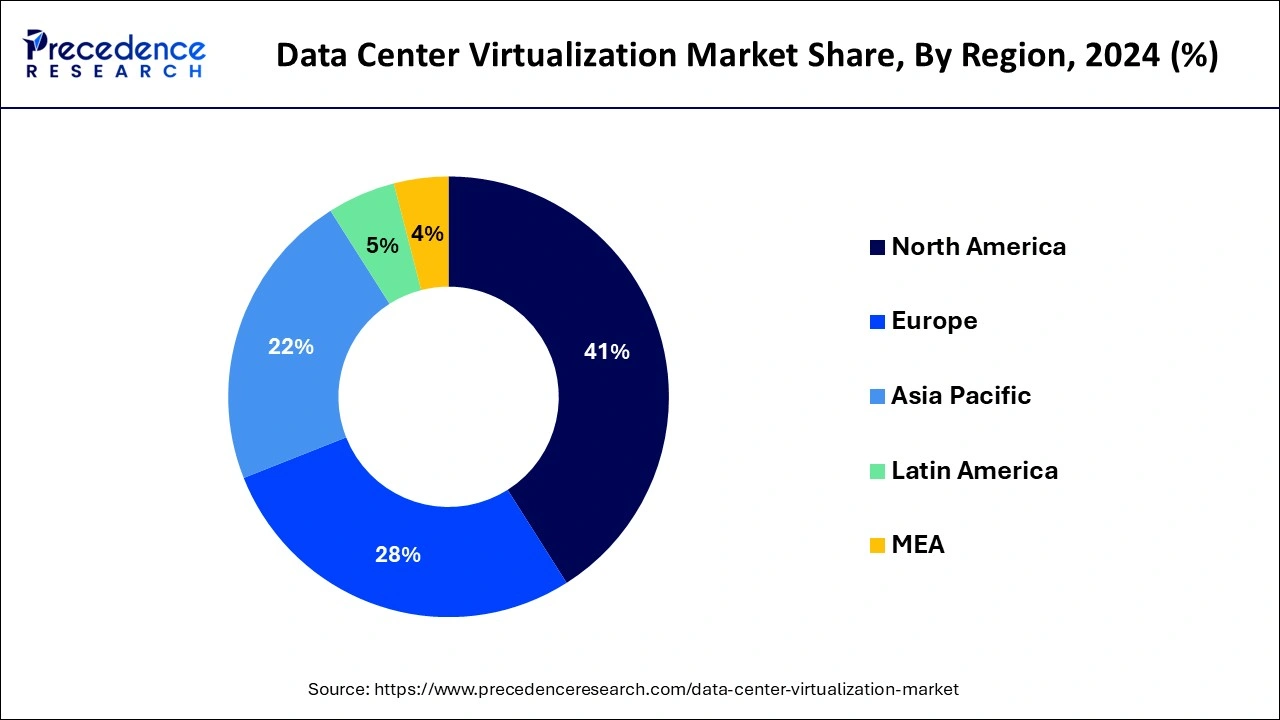

North America has held the largest market share of around 41% in 2024. These areas' companies have years of experience implementing and maintaining virtualized infrastructures, so they have a thorough understanding of the advantages and difficulties associated with data center virtualization. The market's maturity and businesses' increased knowledge of cost savings, agility, and efficiency improvements provided by virtualization encourage more investment in these solutions.

Asia-Pacific has accounted for 22% of revenue share in 2024 and it is the fastest growing data center virtualization market during the forecast period. The Asia-Pacific area has seen a sharp rise in internet penetration rates due to the widespread use of smartphones and the accessibility of affordable internet connectivity. Due to this increase in internet users, a huge amount of data has been generated from many sources, including social media, mobile apps, and e-commerce platforms. Data center virtualization is driving the need for virtualized infrastructure solutions, which help businesses effectively manage and handle this massive amount of data.

IT operations are a significant component of most organizational operations. Among the primary objectives is company continuity. IT departments are now fighting to be more cost-effective and responsive to the business during the global economic downturn. Costs continuously rise due to power, cooling, real estate, and the growing need for processing, storage, and application resources. Here, data center virtualization plays a significant role.

To significantly impact the market, businesses require constant availability and rapid Internet connectivity. For many smaller firms, it was not financially feasible or acceptable to install IT&C technology for this reason. As a result, several significant service providers began constructing enormous buildings known as data centers (DCs) or Internet data centers (IDCs), which offer companies various options for deploying and managing systems. Data centers must provide a secure environment to reduce the likelihood of a security breach because information security is also a concern.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.78% |

| Market Size in 2025 | USD 10.48 Billion |

| Market Size by 2034 | USD 30.87 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Component, By Service, By Organization Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased pressure to provide more secure and robust IT environments

Organizations are pressured to defend their IT infrastructure due to the increasing cyber threats and data breaches. Data centers' overall security posture is strengthened by virtualization's improved security features, which include network segmentation, virtual machine (VM) isolation, and centralized security administration. Better use of IT resources is made possible by virtualization, which allocates processing, storage, and networking resources dynamically in response to demand. Better business outcomes are ultimately the result of this optimization, which also increases performance and agility and optimizes resource use overall.

Need for efficient data management

By combining several physical servers into virtual computers, data center virtualization improves resource use, including processing power, storage, and network bandwidth. This optimization contributes to the decrease in expenses linked to idle hardware. Virtualization solutions facilitate administrative chores like provisioning, monitoring, and maintenance by providing centralized administration tools and automation capabilities. As a result, managing data center infrastructure takes less time and effort and simplifies operations.

Security Concerns

Cyberattacks target the hypervisor, a crucial part of virtualization software that assigns and manages computing resources. If they can penetrate the hypervisor effectively, attackers may be able to take over all virtual machines operating on that host. This might result in broad data theft, interrupted services, or even system sabotage. Tight regulations on data protection and privacy compliance apply to businesses in regulated sectors like finance, healthcare, and government. These legal requirements, which frequently call for implementing extra security measures, frequent audits, and data segregation to thwart unwanted access or data leakage, must be followed by virtualized environments.

Establishment of local data centers throughout the regions

Since they are closer to end users, local data centers can reduce latency, which enhances the functionality of virtualized services and applications. In the event of localized outages or disasters, distributed data centers' redundancy and disaster recovery capabilities guarantee business continuity. It enables edge computing initiatives for real-time applications like IoT and AI, which enable processing closer to the source of data generation.

The server segment dominated the data center virtualization market in 2024. Server hardware has advanced dramatically, offering increased processor, memory, and storage capacities. These improvements have enabled servers to manage workloads associated with virtualization effectively, making them the foundation of virtualized data centers.

Server virtualization separates software from hardware, increasing IT agility and flexibility. Due to this decoupling, IT managers can now flexibly provision, relocate, and manage virtualized workloads without being restricted to a specific set of physical servers. Consequently, enterprises may adapt swiftly to evolving business requirements, distribute resources more effectively, and enhance efficiency throughout their virtualized systems.

The desktop segment is the fastest growing in the data center virtualization market during the forecast period. Data security is vital for businesses that handle sensitive data, particularly in healthcare, banking, and government sectors. Desktop virtualization offers improved security measures, including access controls, encryption, and centralized data storage. Storing data and apps inside the data center helps organizations defend against viruses, breaches, and unwanted access.

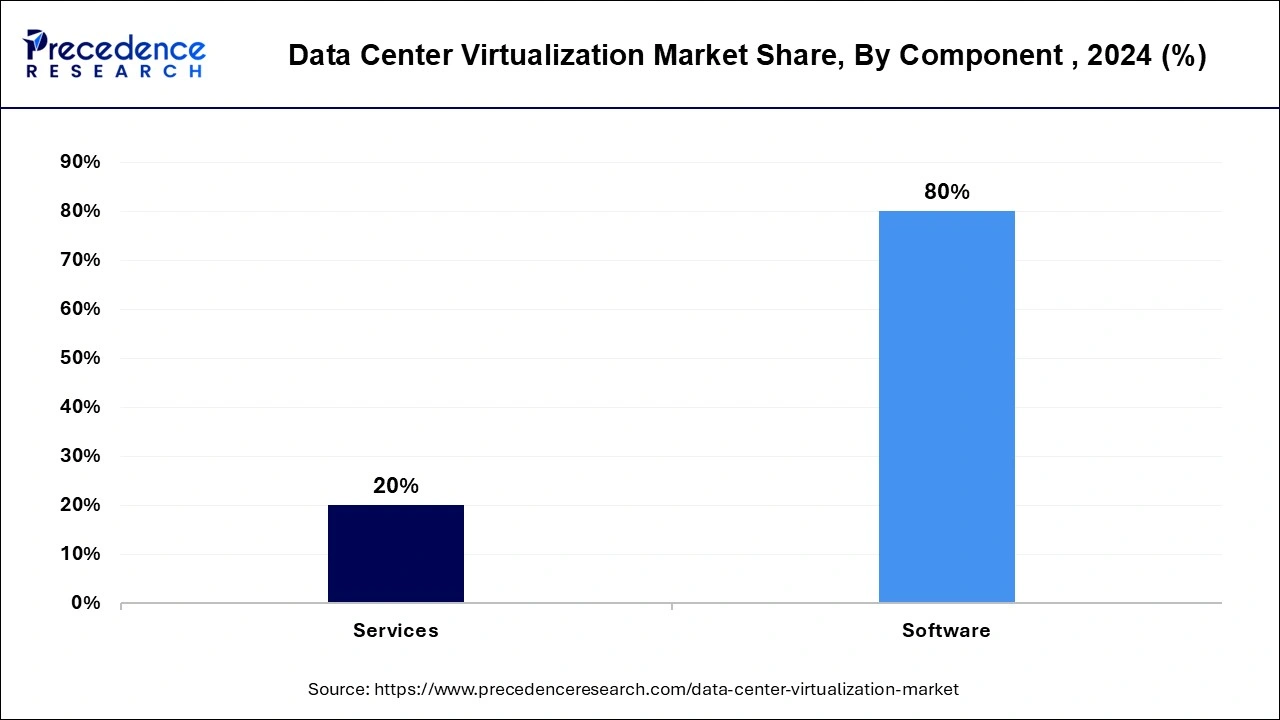

The software segment has accounted for 80% market share in 2024. Virtualization solutions based on software provide unmatched flexibility and versatility. They separate physical hardware from the underlying infrastructure and allow data center operators to construct virtual instances of servers, storage, networking, and other resources. Because of its adaptability, computer resources may be allocated dynamically in response to demand and used efficiently.

The services segment shows significant growth in the data center virtualization market during the forecast period. Businesses' growing use of virtualization and cloud computing is driving increased demand for implementation, consulting, and support services. Professional services are in high demand since virtualized environments are complicated and require specialized deployment, management, and optimization knowledge.

Moreover, enterprises' pursuit of increased operational effectiveness, lower expenses, and greater scalability depends on service providers to deliver customized solutions and continuous support for their virtualized infrastructure. The increasing demand for knowledge and assistance in setting up and maintaining virtualized data center infrastructures drives the services sector's growth.

The optimization services segment dominated the data center virtualization market in 2024. Optimization services are essential in data centers for cutting expenses and increasing resource efficiency. Organizations can save a reasonable amount of money by optimizing workloads, balancing resource allocation, and implementing effective virtualization techniques while maintaining ideal performance levels.

The advisory & implementation services segment shows significant growth in the data center virtualization market during the forecast period. IT infrastructures are growing more complex as cloud computing, edge computing, Internet of Things (IoT) gadgets, and other technologies increase. Because it offers centralized control and automation capabilities, data center virtualization is fundamental to managing this complexity. Advisory services facilitate the smooth integration and operation of virtualized systems by assisting enterprises in navigating the complexities of contemporary IT architectures.

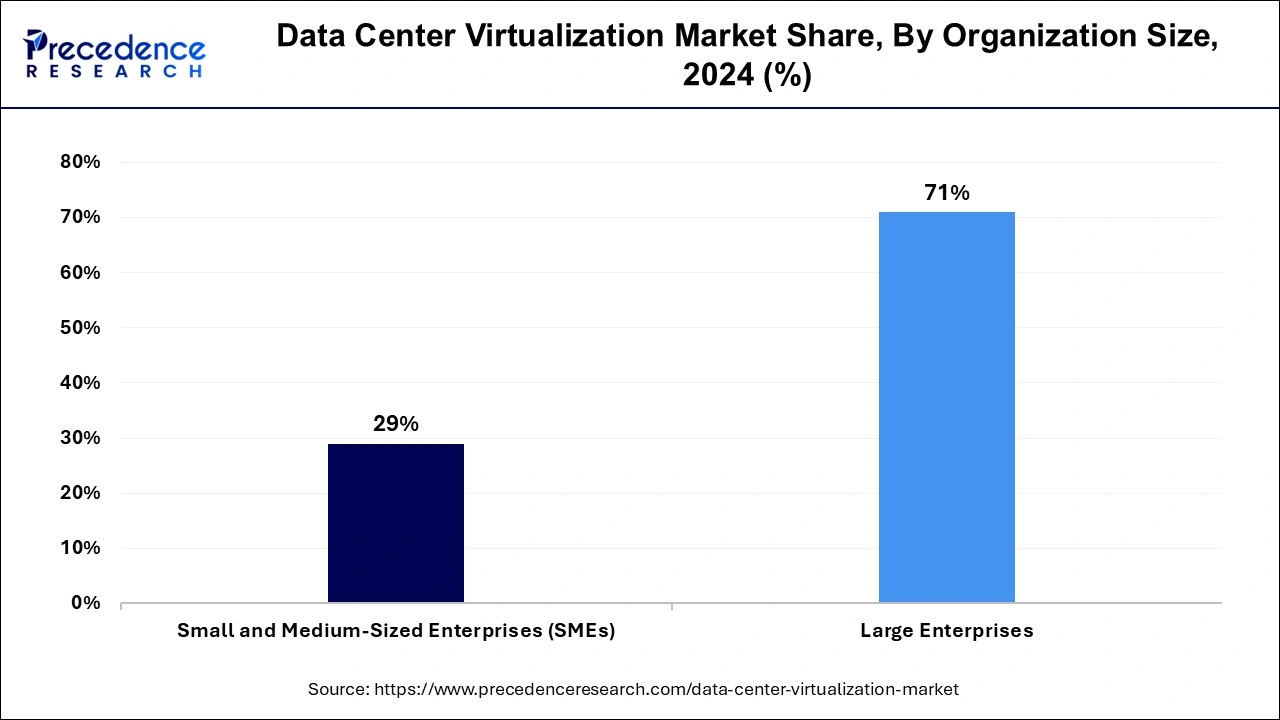

The large enterprises segment accounted for 71% of revenue share in 2024. Large businesses' IT infrastructures must be scalable to meet their expanding business needs. Due to physical space, electricity, and cooling restrictions, traditional physical data centers frequently have difficulty scaling effectively. Because virtualization enables dynamic resource allocation, businesses can scale up or down without making significant hardware investments.

Virtualization vendors frequently offer cutting-edge features and functionalities designed to meet the demands of big businesses. These may include features like automatic provisioning, live migration, high availability, and disaster recovery. Large companies place a high importance on these aspects to ensure optimal application operation, meet compliance standards, and maintain business continuity.

The small and medium-sized enterprises (SMEs) segment show significant growth in the data center virtualization market during the forecast period. For small and medium-sized enterprises (SMEs), data center visualization offers several benefits, including lower hardware costs, better resource usage, more flexibility, enhanced business continuity, decreased downtime, and enhanced security. These benefits can aid SMEs in overcoming the difficulties they encounter and achieving increased effectiveness and cost reductions. Businesses can improve their whole IT infrastructure and reap significant benefits by meticulously organizing and executing the deployment of a virtualized environment.

The IT & telecommunication segment has accounted revenue share of 59% in 2024. Virtualized systems, which offer automatic fault tolerance, load balancing, and disaster recovery capabilities, make improved performance and dependability possible. This is crucial for IT and telecom businesses that offer vital services like cloud computing, communication networks, and data storage. Reliability and availability must be maintained at high levels to guarantee customer satisfaction and reduce service interruptions, both of which are critical in this industry.

The BFSI segment is the fastest growing in the data center virtualization market during the forecast period. BFSI institutions need to be flexible and nimble to be relevant amid swift technological breakthroughs and evolving consumer demands. Data center virtualization allows BFSI businesses to simplify software updates, roll out new services more quickly, and test them in a safe setting. Virtualization encourages creativity and agility by separating applications from underlying hardware dependencies, allowing BFSI businesses to launch cutting-edge goods and services faster.

By Type

By Component

By Service

By Organization Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

January 2025

October 2024