July 2024

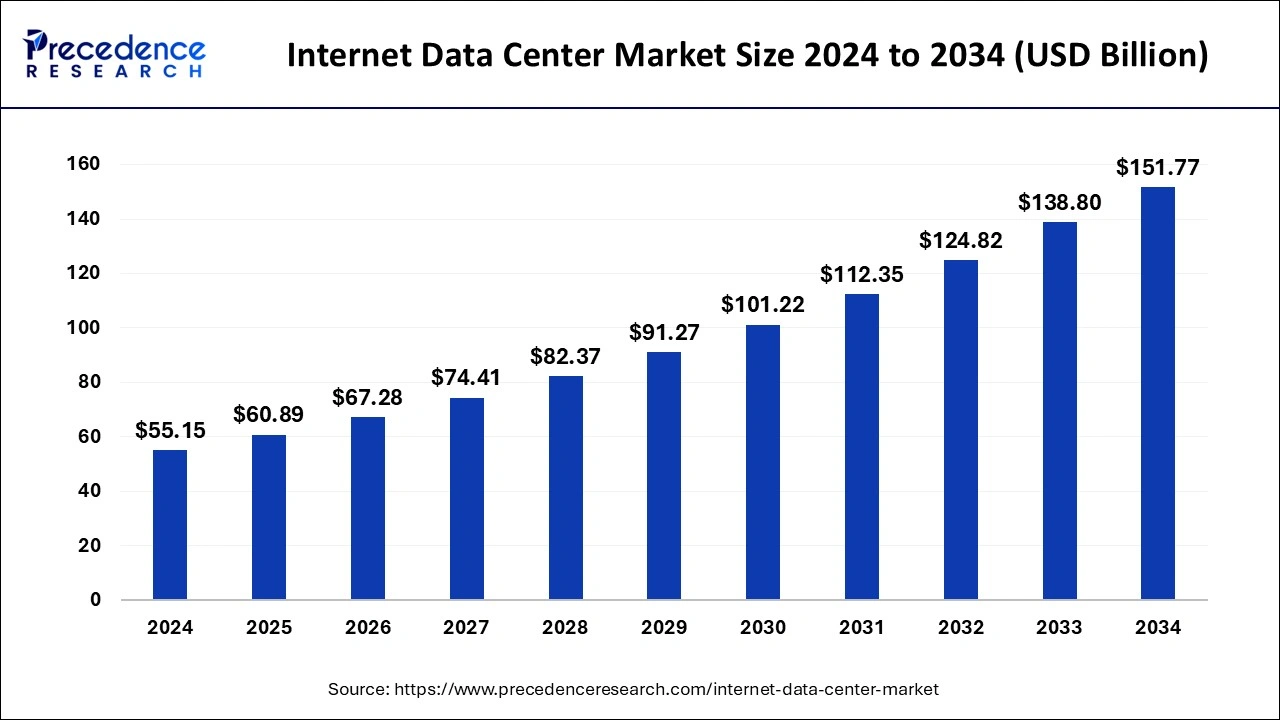

The global internet data center market size is calculated at USD 60.89 billion in 2025 and is forecasted to reach around USD 151.77 billion by 2034, accelerating at a CAGR of 10.65% from 2025 to 2034. The North America internet data center market size surpassed USD 23.71 billion in 2024 and is expanding at a CAGR of 10.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global internet data center market size was estimated at USD 55.15 billion in 2024 and is predicted to increase from USD 60.89 billion in 2025 to approximately USD 151.77 billion by 2034, expanding at a CAGR of 10.65% from 2025 to 2034.

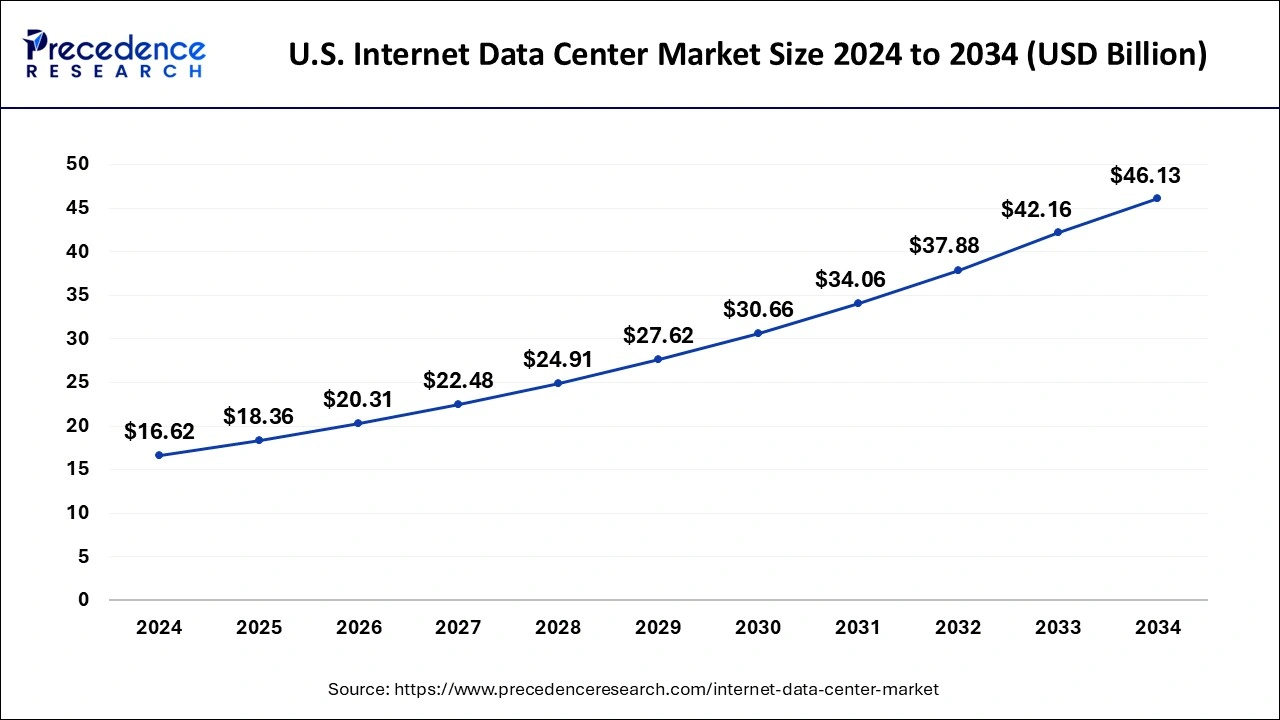

The U.S. internet data center market size was estimated at USD 16.62 billion in 2024 and is anticipated to reach around USD 46.13 billion by 2034, poised to grow at a CAGR of 10.75% from 2025 to 2034.

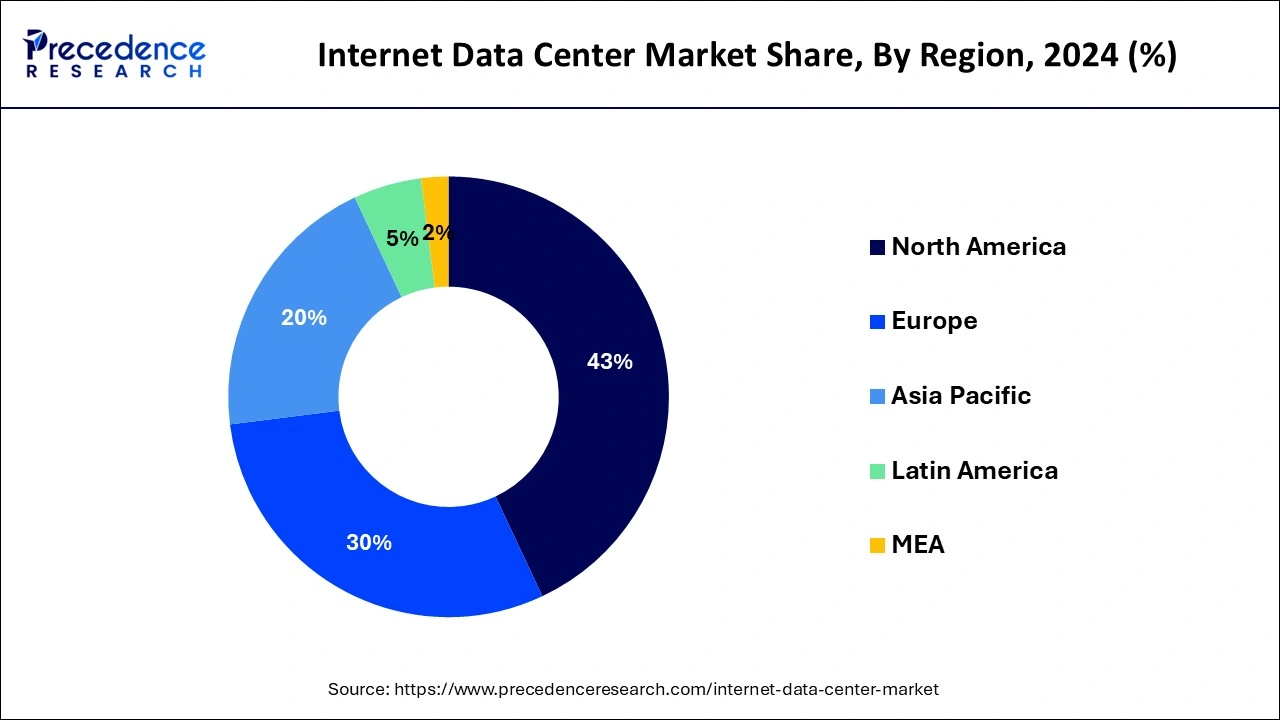

North America dominated the internet data center market with the largest market share of 43% in 2024. The region's thriving business climate and growing economy contribute to the market's upward trajectory. Businesses across various industries in North America, including e-commerce, entertainment, finance, and healthcare, rely on IDC services to access networking and data storage tools for developing and deploying cutting-edge digital solutions.

The growth of IDC in North America is significantly influenced by the region's status as a global financial center. Given the financial sector's stringent data security and compliance standards, IDC services have become a popular choice for storing crucial financial data and applications. The increasing popularity of FinTech solutions and the provision of online banking services contribute to sustained high demand for secure and reliable data center services in the region. North America's leadership in the IDC market reflects its pivotal role in driving technological advancements and meeting the evolving needs of diverse industries.

Asia-Pacific is expected to exhibit the fastest CAGR of 14.2% over the forecast period. The rapid urbanization and economic expansion in the region are instrumental in driving the widespread adoption of digital technology. This surge in digitalization is creating a heightened demand for innovative data center services, catering to the diverse needs of companies, both large and small, as they strive to enhance and support their operations.

The growth of Internet Data Centers (IDCs) in the Asia-Pacific region is further fueled by the tremendous digital transformation occurring in emerging markets such as China and India. These markets are experiencing a significant uptick in demand for IDC services to meet the escalating requirements for data storage and computing capabilities.

Asia-Pacific, with its substantial population and the development of a growing middle class, represents a sizable consumer base. This demographic shift is a key driver contributing to the expansion of the IDC market in the region. IDCs play a crucial role in enabling digital experiences as more consumers in the region embrace activities such as internet streaming, online purchasing, and digital payments. The increasing reliance on digital services is propelling the need for robust and scalable data center solutions, making the Asia Pacific region a focal point for the growth of the IDC market.

The internet data center market offers a facility that encompasses networked computers, servers, and storage systems for the storage, processing, management, and distribution of large volumes of data over the internet. These centers are equipped with high-speed internet connections and advanced security measures to ensure the efficient operation of internet-based services and applications. The future outlook for the IDC market is highly optimistic.

The increasing reliance on cloud-based services, Internet of Things (IoT) devices, and big data analytics is expected to drive the demand for data storage and processing facilities in the coming years. The growing popularity of e-commerce, social media, streaming services, and online gaming necessitates the establishment of more IDCs to cater to the expanding user base and their requirements.

Ongoing digital transformation initiatives by businesses across various sectors further contribute to the need for IDCs to manage and process vast amounts of data. Moreover, technological advancements, including edge computing, artificial intelligence (AI), and machine learning (ML), are key drivers of the IDC market's growth. These technologies require computing resources closer to end-users to minimize latency and enhance performance, thereby fueling the demand for edge data centers.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.65% |

| Market Size in 2025 | USD 60.89 Billion |

| Market Size by 2034 | USD 151.77 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service, By Deployment, By Enterprise Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for data storage and processing

The global internet data center market is experiencing notable trends, including the swift adoption of cloud and edge computing solutions, driven by the escalating demands for data storage and processing.

The growth of the Internet of Things (IoT), artificial intelligence (AI), and big data analytics is contributing to the development of highly efficient and sustainable data centers. Companies are placing increased emphasis on green initiatives, prioritizing energy efficiency, the use of renewable power sources, and the reduction of carbon footprints. Furthermore, there is a growing demand for hyperscale data centers, driven by the requirements for enhanced computing performance, speed, scalability, and connectivity. Additionally, the market is witnessing a shift towards modular and containerized data centers, aiming to achieve greater flexibility and cost-effectiveness in deployment.

Technological upgradations

In the internet data center market, the rapid evolution of technology necessitates continuous upgrades and investments to remain competitive. Staying current with the latest advancements is crucial, and companies face challenges in adapting to dynamic technological changes, including integrating new hardware, software, and infrastructure solutions. This ongoing need for innovation can strain resources and budgets, making it imperative for companies to proactively embrace and invest in cutting-edge technologies.

Rapid growth of edge computing solutions and cloud services

Organizations are increasingly embracing edge computing solutions, strategically positioning data centers closer to the point of data generation. This shift is driven by the escalating need for real-time data processing and heightened sensitivity to latency. Edge data centers within internet data centers (IDCs) ensure faster response times, enhancing the efficiency of applications such as IoT, autonomous driving, and augmented reality. The emergence of edge computing is generating new opportunities and requirements, contributing to the expansion of the Internet data center market.

Similarly, rapid growth of cloud services is creating more opportunities for the IDC market expansion. Cloud service Providers (CSPs) are actively investing in and expanding their data center infrastructures to meet the surging demand for cloud-based services. This ongoing commitment to enhancing cloud capabilities underscores the dynamic nature of the IDC market, aligning with evolving technological trends and the increasing reliance on cloud computing resources.

The cloud service provider (CSP) segment dominated the market with the highest market share of 38% in 2024. CSPs play a pivotal role in driving the revolution in cloud computing by offering a diverse array of essential cloud services. These services, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), are integral to modern corporate operations. The escalating demand for on-demand, scalable, and cost-effective cloud solutions has fueled the growth of CSPs, whose services heavily rely on internet data center (IDC) infrastructure.

The e-commerce & retail segment is anticipated to achieve the fastest CAGR of 15.2% over the forecast period in the internet data center market. The remarkable growth of the e-commerce sector has spurred an increased demand for internet data center (IDC) services. E-commerce and retail enterprises, in their pursuit to uphold online storefronts, manage extensive product catalogs, and deliver seamless consumer experiences, require resilient and scalable digital infrastructure. IDCs play a pivotal role by providing the essential network, processing, and storage resources necessary for high-performance, secure, and reliable e-commerce operations.

The colocation segment dominated the internet data center market, holding the highest market share of 43% in 2024. The growing popularity of colocation services is primarily attributed to their cost-effectiveness. Constructing and maintaining a private data center entail significant upfront capital costs and ongoing operational expenses, making it a potentially expensive endeavor. Colocation offers a more affordable alternative, allowing businesses to utilize shared infrastructure and facilities, resulting in substantial cost savings. The pay-as-you-use business model of colocation is particularly advantageous for companies aiming to optimize their IT budgets, eliminating the need for significant investments in separate data center hardware.

The Content Delivery Network (CDN) segment is projected to experience the fastest CAGR of 10.3% over the forecast period. This growth is driven by the increasing importance of effective content delivery, given the surge in digital content and online services, leading to a substantial rise in data usage. CDNs play a crucial role by distributing content across a network of strategically placed servers, improving performance, enhancing user experience, and reducing latency. The rapid expansion of streaming video, online gaming, and e-commerce has significantly fueled the growth of the CDN segment. In the realm of e-commerce, CDNs are indispensable for swiftly delivering web pages, graphics, and product content to customers, thereby enhancing user experience and boosting conversion rates.

The public segment dominated the internet data center market with 56% in 2024. The significant growth of the public segment is driven by the increasing demand for scalable and cost-effective cloud computing services. Major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have expanded their global network of data centers to deliver public cloud services. These services liberate organizations from the complexities of managing on-premises data centers and hefty upfront investments in infrastructure. Public cloud services allow businesses to scale their infrastructure up or down according to their requirements.

The hybrid deployment segment is anticipated to exhibit the fastest CAGR of 16.2% over the forecast period. The emergence of hybrid deployments is attributed to the recognition that not all workloads are uniform. While some data and applications benefit from the scalability and cost-effectiveness of the public cloud, others require the security, management, and compliance features provided by private data centers. The hybrid approach enables businesses to strategically allocate tasks to the most suitable environment, maximizing resource utilization and financial efficiency. This flexibility in deployment options addresses diverse workload requirements and aligns with the varying needs of organizations across different industries.

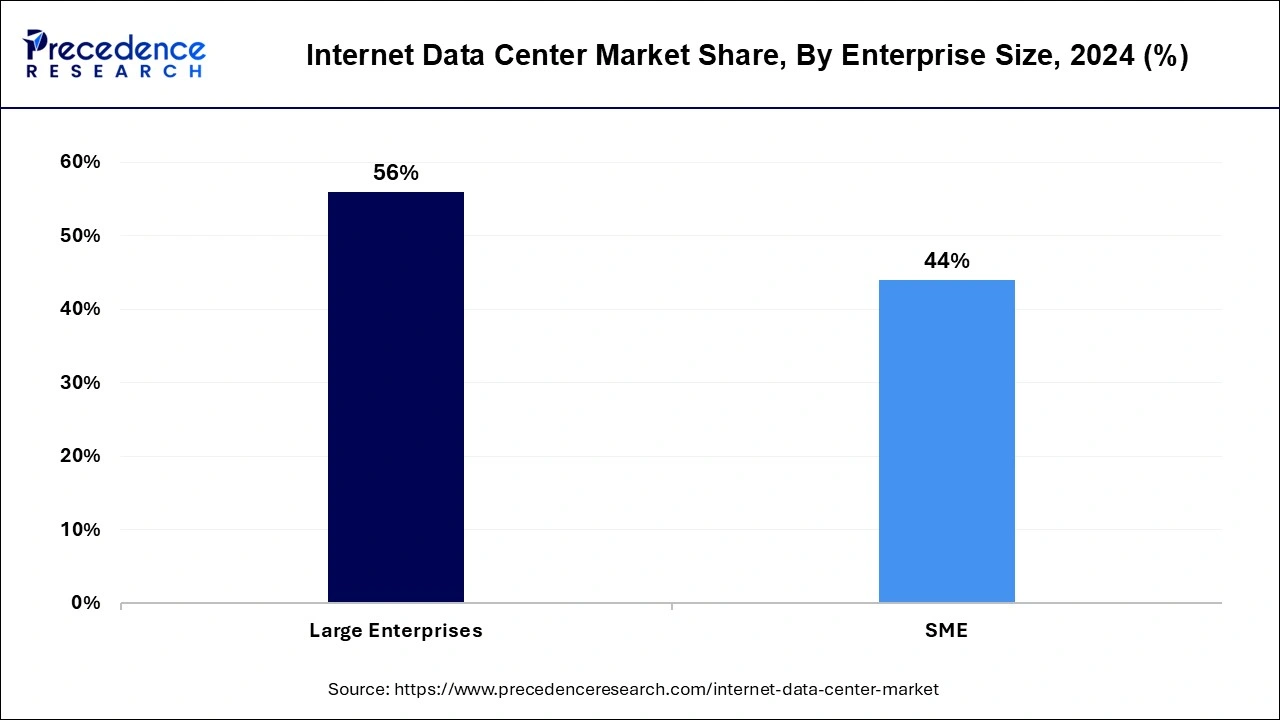

The large enterprises segment held the largest share of 56% in 2024. The prevalence of data-intensive applications in the IT operations of major businesses is a key factor contributing to the dominance of large enterprises in the market. These companies manage vast amounts of data, necessitating sophisticated network infrastructure, computing power, and storage. The demand from large enterprises for IDC services is driven by the continuous growth of data needs, particularly with the rise of big data analytics and machine learning applications.

The small and medium-sized enterprises (SME) segment is projected to register the fastest CAGR of 18.3% over the forecast period. SMEs are rapidly adopting cloud computing and undergoing digital transformation. As awareness of the benefits of digital technology spreads among small and medium-sized businesses, there is an increasing need for scalable and cost-effective IT infrastructure to support their operations, contributing to their overall growth and competitiveness.

By Service

By Deployment

By Enterprise Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

January 2025

December 2024

December 2024