January 2025

Dental Digital X-Ray Market (By Product: Digital X-Ray Systems, Analog X-Ray Systems; By Type: Extraoral X-ray Systems, Intraoral X-ray Systems, Hybrid X-ray Systems; By Application: Diagnostic, Therapeutic, Cosmetic, Others; By End Use: Dental Hospitals & Clinics, Dental Academic & Research Institution, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

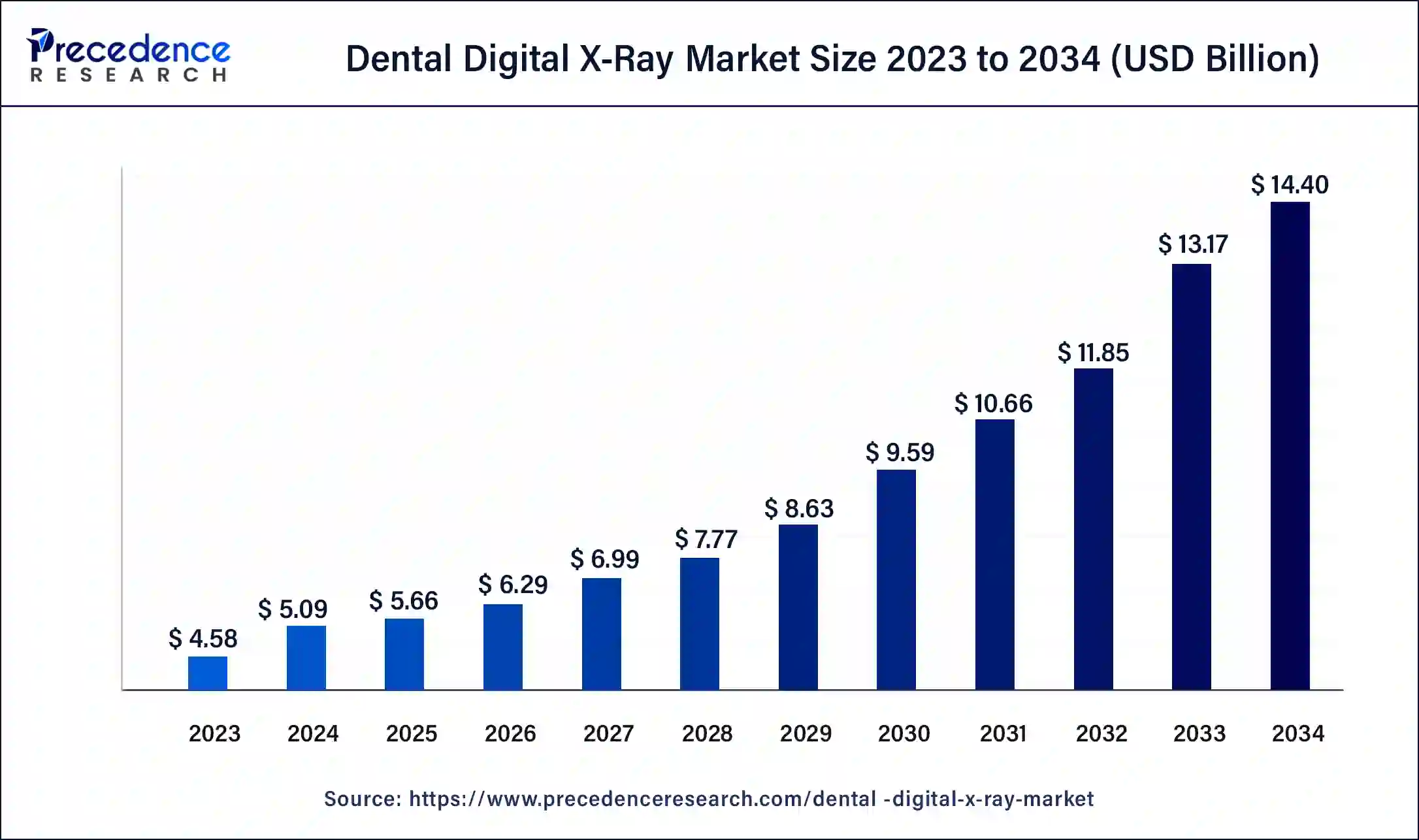

The global dental digital x-ray market size was USD 4.58 billion in 2023, calculated at USD 5.09 billion in 2024 and is expected to reach around USD 14.40 billion by 2034, expanding at a CAGR of 11% from 2024 to 2034. The dental digital x-ray market size reached USD 2.06 billion in 2023. The global rise in dental disorders and the growing consciousness of oral health have led to a surge in the need for sophisticated diagnostic instruments such as digital X-ray machines.

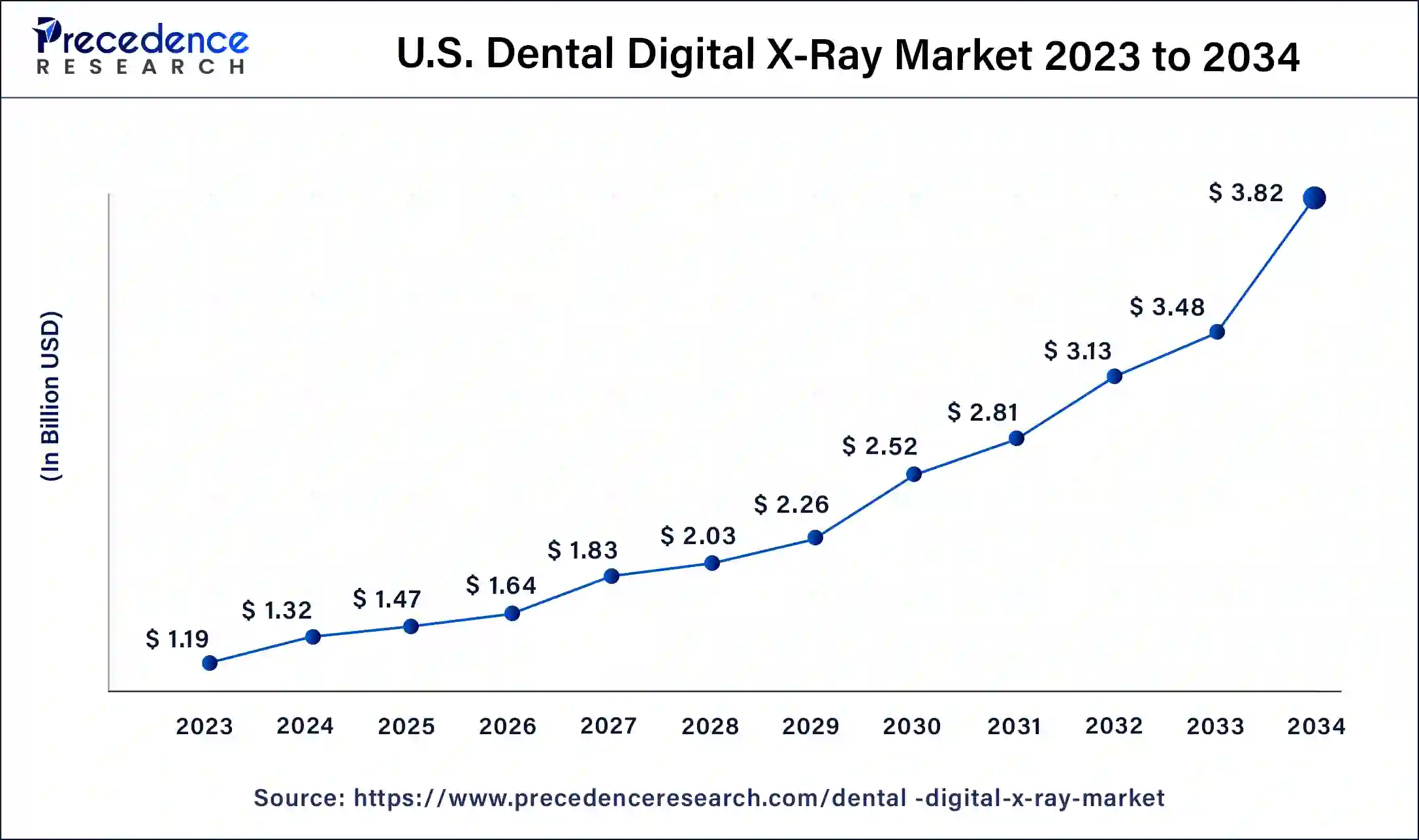

The U.S. dental digital x-ray market size reached USD 1.19 billion in 2023 and is expected to be worth around USD 3.82 billion by 2034 at a CAGR of 11.19% from 2024 to 2034.

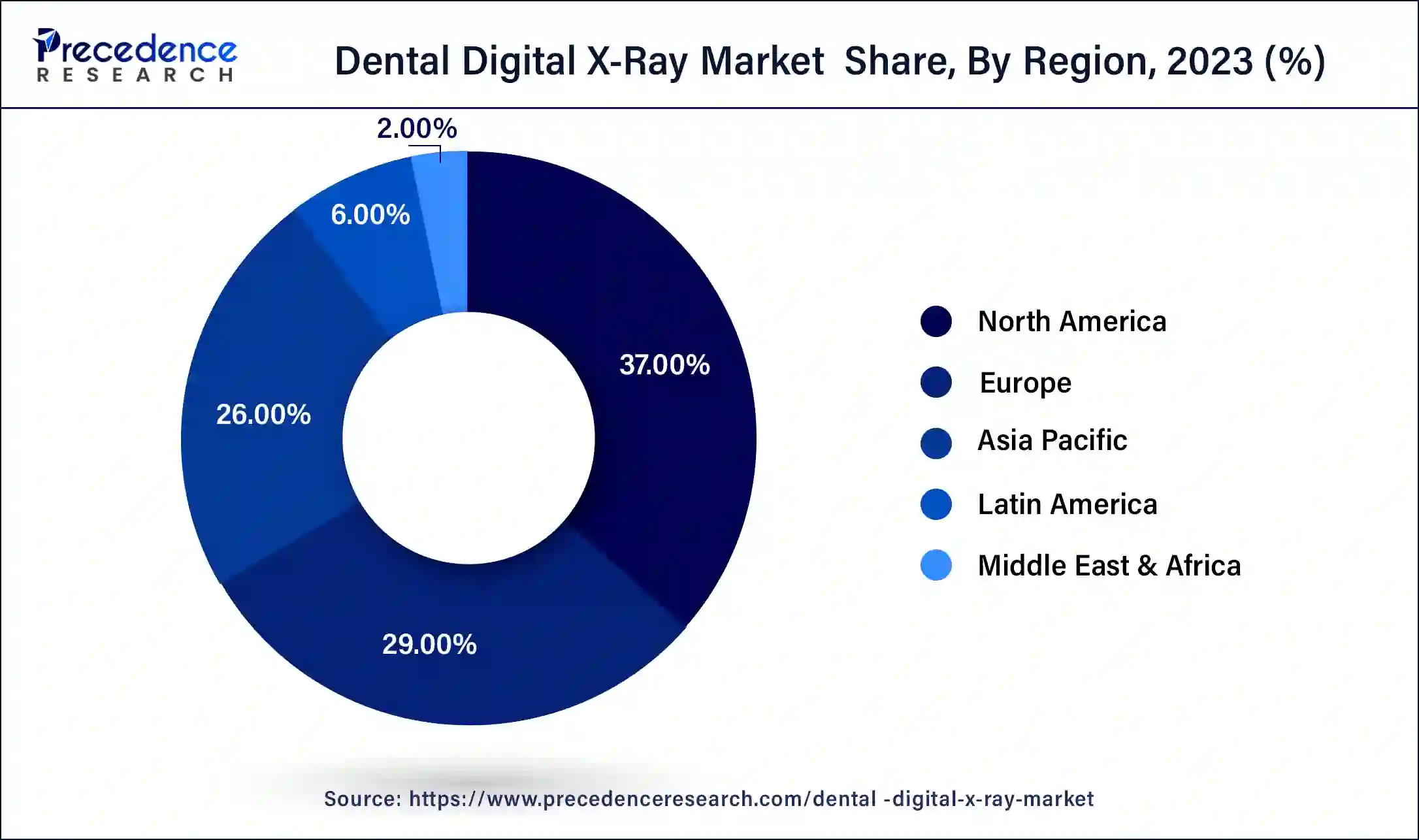

North America holds the largest share of the dental digital X-ray market. The demand for more effective diagnostic tools in dental practices, growing awareness of oral health, and technical improvements have all contributed to the steady growth of the market in North America. Compared to conventional film-based X-rays, digital X-ray systems include advantages such as quicker image acquisition, less radiation exposure for patients, and simpler image sharing and storage.

The dental digital X-ray market is known for its ongoing innovation, as businesses launch new features and technology all the time in an effort to enhance patient comfort, workflow effectiveness, and image quality. The actions and rules of the government also influence the dynamics of the market. For example, laws governing radiation safety and picture quality requirements affect the use of digital X-ray equipment in dental offices.

Europe is expected to grow notably during the forecast period. The rising prevalence of dental problems, growing awareness of oral healthcare, and technical improvements have all contributed to the continuous expansion of the dental digital X-ray market in Europe. Compared to conventional film-based X-rays, digital X-ray systems have the advantage of quicker image processing, less radiation exposure, and simpler image sharing and storage.

The dental digital X-ray market has grown as a result of government initiatives to improve access to dental treatments and to promote the digitalization of healthcare. The market is expanding due to the increasing use of cone beam computed tomography (CBCT) technology, which provides more detailed imaging for dental diagnosis and treatment planning.

The dental digital X-ray market used in dentistry has been rising rapidly and is expected to do so in the years to come. This expansion is attributed to various factors, including the growing demand for precise and efficient diagnostic instruments, the increasing acceptance of digital imaging systems by dental practitioners, and the rise in investments in healthcare infrastructure.

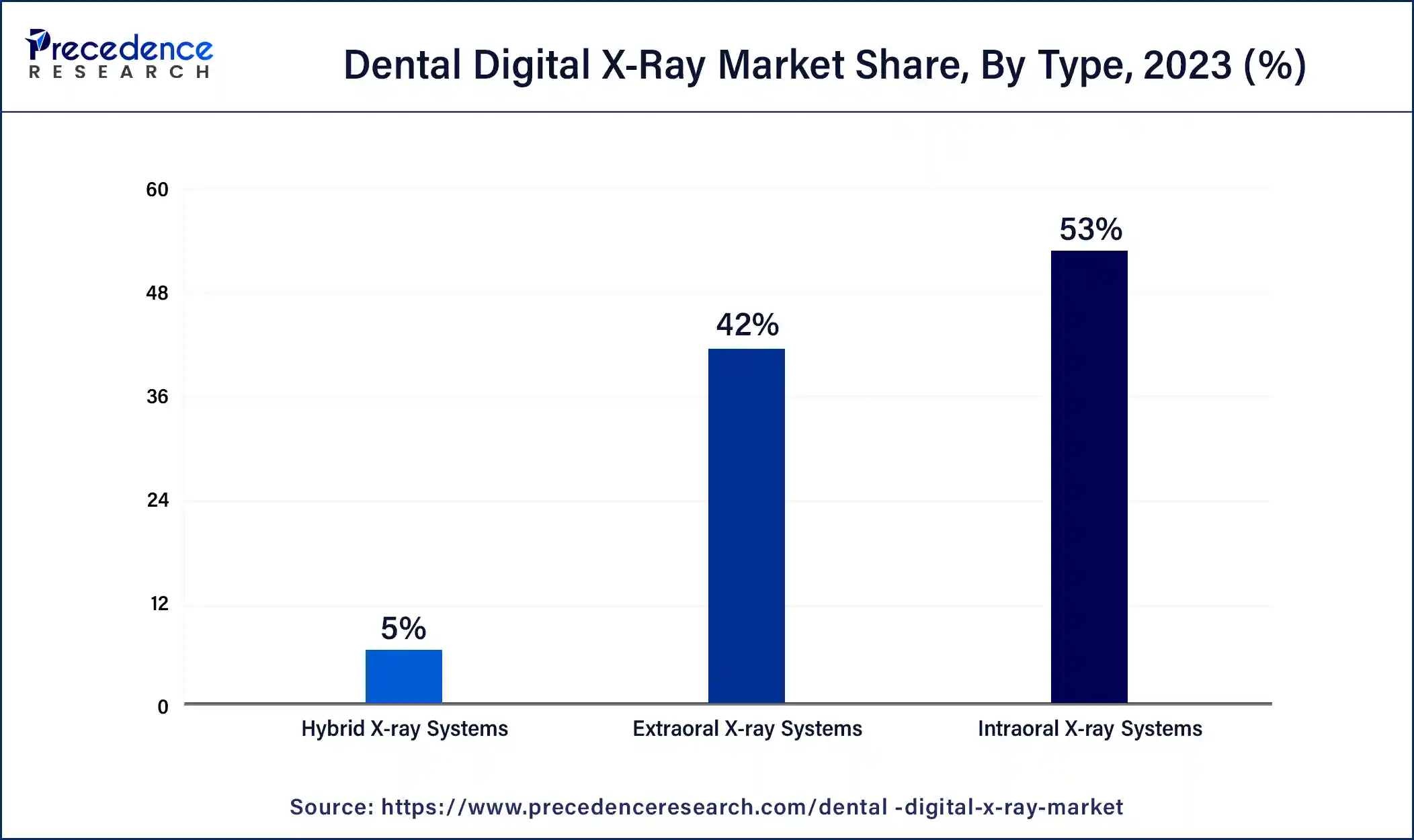

There are several ways to divide the dental digital X-ray market, including by product type, application, end user, and geography. CBCT systems, extraoral X-ray systems, and intraoral X-ray systems are examples of product kinds. The market is developing due to factors such as the aging population, rising rates of periodontal and dental caries, rising demand for cosmetic dentistry operations, and improvements in dental imaging technology.

However, a number of issues, including the high upfront costs of digital X-ray systems, difficulties with reimbursement, and radiation exposure concerns, might potentially impede market expansion. It is anticipated that the demand for preventative and cosmetic dental procedures, the growing use of digital dentistry techniques, and continuous technological advancements will drive the growth of the dental digital X-ray market.

Furthermore, it is anticipated that the addition of machine learning and artificial intelligence (AI) to dental imaging systems will improve patient outcomes and significantly increase diagnostic capabilities. Regional variations exist in the industry's growth trajectory, with developed regions like North America and Europe exhibiting the highest adoption and market share.

| Report Coverage | Details |

| Global Market Size by 2034 | USD 14.40 Billion |

| Global Market Size in 2023 | USD 4.58 Billion |

| Global Market Size in 2024 | USD 5.09 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Type, Application, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Enhanced diagnostic capabilities

Producers are always improving their imaging technologies in order to generate photos with greater clarity and resolution. Thanks to this advancement, dentists can now identify dental problems more precisely and accurately. Comprehensive CBCT provides finely detailed three-dimensional views of the oral and maxillofacial tissues, facilitating more accurate evaluation of intricate dental problems such as impacted teeth, morphology of root canals, and disorders of the temporomandibular joint.

Dental technologies and software, including practice management software and electronic health information, are smoothly integrated with modern digital X-ray systems. Comparing digital X-rays to traditional film-based X-rays, radiation exposure has been significantly reduced because of advancements in this technology. This benefit enables more frequent imaging as needed while simultaneously enhancing patient safety.

Data security concerns

Sensitive patient data, such as personal identification numbers and medical histories, can be found in digital X-ray pictures. Regulations may be broken, and patient privacy may be violated if this data is accessed without authorization. For data security, access control to digital X-ray equipment and patient records is essential. Unauthorized access can be avoided by putting robust authentication measures in place, such as multi-factor authentication, biometrics, and passwords. Dental offices are subject to data privacy laws, such as the General Data Privacy Regulation (GDPR) in the European Union and the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Dental offices must consider the security protocols put in place by suppliers to safeguard patient information when selecting digital X-ray equipment or service providers.

Tele-dentistry and remote consultations

Patients in remote or underserved locations can more easily receive dental care because of tele-dentistry. Digital X-ray pictures can be taken on-site and safely sent to specialists or dentists off-site for diagnosis, planning, and consultation. Dental experts can collaborate more easily thanks to tele-dentistry. X-ray pictures are easily shared by dentists with colleagues for consultations or second opinions, which promotes better patient outcomes and more informed decision-making. Patients can benefit from increased convenience with tele-dentistry, particularly those with hectic schedules or limited mobility. The inconvenience of making regular clinic visits is diminished since they can consult with their dentists or other professionals from the comfort of their homes.

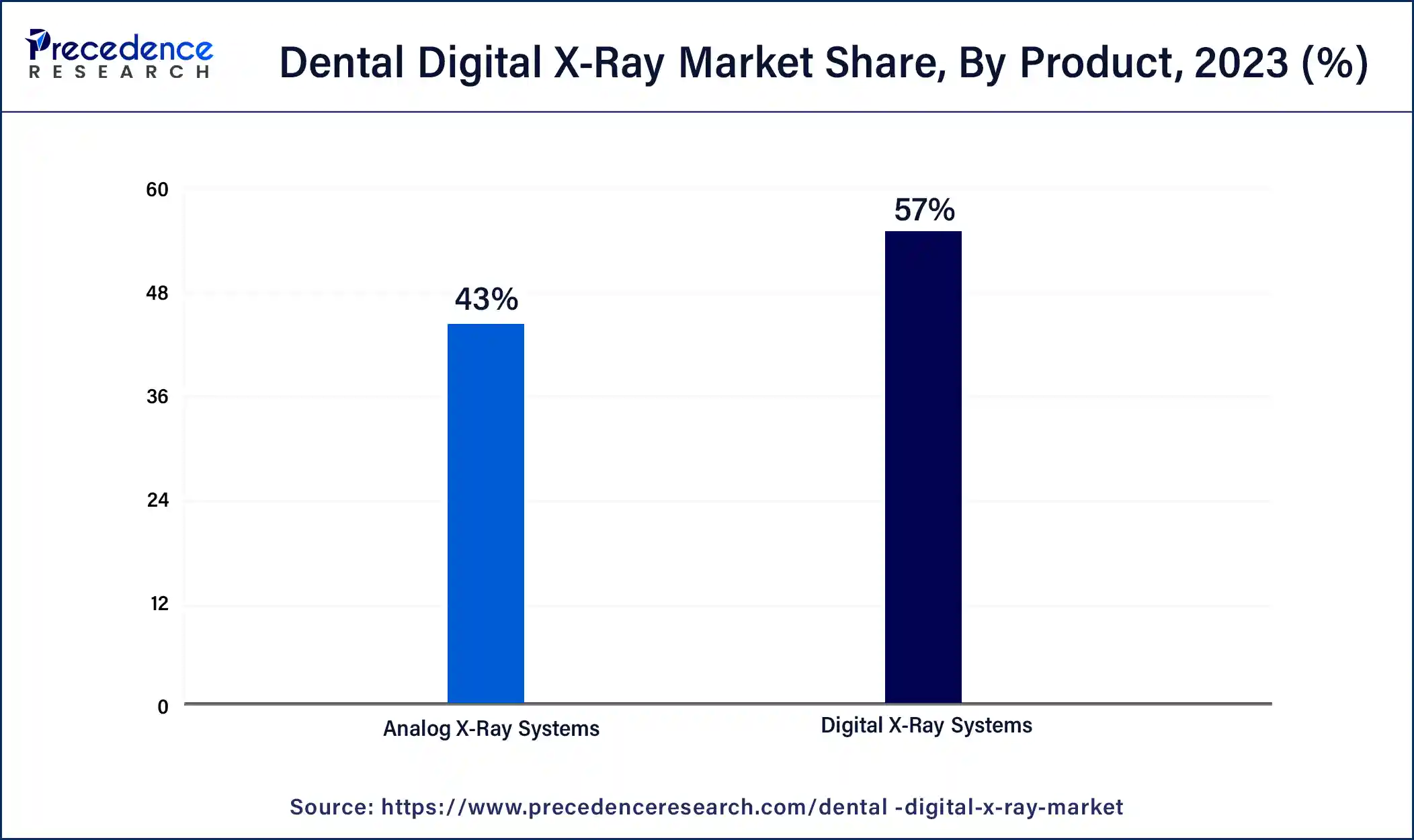

The analog X-ray systems segment held the largest share in the dental digital X-ray market in 2023 and is expected to maintain this dominance during the forecast period. Images from analog X-ray machines are created on X-ray film, which must then be processed in a darkroom. Because of all the benefits that digital technology has to offer, these systems have been mainly superseded by digital X-ray equipment. Traditional X-ray equipment that uses film to collect images is referred to as analog X-ray systems. Analog X-ray equipment has been in widespread use for many years in the dental business. However, as technology has advanced, digital X-ray devices have grown in popularity.

The digital X-ray systems segment is expected to gain a substantial share during the forecast period. Dental diagnostics and treatment planning have seen a dramatic change because of digital X-ray technologies. These systems are very important in the dental digital X-ray market since they have so many benefits over traditional film-based X-rays. When comparing digital X-ray equipment to classic film X-rays, greater-resolution images are provided. Improved image quality makes it possible to identify dental problems, including infections, fractures, and cavities, more accurately. Digital X-ray devices streamline the imaging process because they do not require film development. Digital picture capture, viewing, and storage allow dentists to diagnose and arrange treatments more quickly. In order to facilitate the effective storage, retrieval, and exchange of patient pictures and records, many digital X-ray systems are made to interact smoothly with practice management software.

The intraoral segment held the largest share of the dental digital X-ray market in 2023. These devices are made expressly to take pictures within the mouth, giving dentists a close-up look at the gums, teeth, and other oral structures. Dental professionals may precisely diagnose dental issues like cavities, gum disease, and anomalies thanks to the high-resolution images produced by intraoral X-ray devices. Patient safety and comfort are top priorities in the design of intraoral X-ray equipment. Generally speaking, they employ less radiation than conventional X-ray machines, which lowers the hazards to the patients. Varied configurations of intraoral X-ray devices are available to accommodate varied clinical needs and practice sizes. This covers portable systems, wall-mounted devices, and handheld gadgets.

The hybrid X-ray system is expected to establish a notable presence in the upcoming years. In the dental digital x-ray market, sophisticated imaging technologies that combine the advantages of two or more imaging modalities are commonly referred to as hybrid X-ray systems. These systems combine more modern digital technology with conventional X-ray imaging in dentistry to provide better patient care and more advanced diagnostic capabilities.

In order to provide a thorough diagnostic solution, hybrid X-ray systems in the dental digital X-ray market may incorporate components of digital imaging sensors, CBCT technology, panoramic imaging, and classic X-ray machines. For many years, traditional X-ray equipment has been used extensively in dentistry. They offer important details about cavities, bone health, and tooth structure. Usually, film-based or analog sensors are used in these systems to take pictures.

The diagnostics segment held a significant share of the dental digital X-ray market in 2023. Because digital X-ray equipment provides so many benefits over analog ones, dental offices are switching over to them on a regular basis. Workflow is streamlined, productivity is increased, and patient record storage and retrieval is made simpler with digital X-ray equipment. The importance of oral health is becoming more widely recognized, which is driving up demand for dental operations and diagnostic imaging services. In dental offices, there is an increasing need for 3D imaging technologies like cone-beam computed tomography (CBCT) in addition to conventional 2D digital X-ray machines. The market for dental digital X-rays is expanding due to the expansion of healthcare infrastructure in developing nations and increased healthcare spending.

The cosmetic segment is expected to grow substantially during the forecast period. High-resolution images from digital X-ray devices enable dentists to examine teeth and surrounding structures in remarkable detail. This is especially important in cosmetic dentistry, as operations like veneers, implants, and teeth whitening require precise imaging. Patients are safer using digital X-ray devices since they release a great deal less radiation than film X-rays do. This is especially crucial in the field of cosmetic dentistry, as patients may need regular imaging sessions for operations like smile makeovers. Since they don't require awkward film positioning and take less time to image, digital X-ray devices are frequently more comfortable for patients.

The dental hospital & clinics segment holds a significant share of the dental digital X-ray market. In order to deliver high-quality dental care, the dental departments at Mayo Clinic frequently use cutting-edge technologies, such as digital X-ray equipment. Modern digital X-ray technology is probably available in Cleveland Clinic's dental offices, which are renowned for their creative approaches to healthcare. Many colleges that provide dental studies also have their own clinics or hospitals where they treat patients from the general public. For educational and therapeutic objectives, these institutions frequently invest in cutting-edge imaging equipment like digital X-rays. Dental Associates, one of the biggest dental groups in the US, has multiple locations throughout several states, many of which include digital X-ray machines.

The dental academics & research institutions segment is expected to notably expand during forecast period. You would have a thorough understanding of the hardware, software, and imaging methods of digital X-ray imaging systems used in dentistry. It's possible that you work on creating training manuals and instructional materials to teach dental professionals how to properly operate digital X-ray equipment and analyze digital images. You would be knowledgeable about the rules and regulations pertaining to the use of digital X-ray equipment in dental offices, making sure that all applicable policies and procedures are followed. Your job would entail presenting at conferences, publishing research findings in peer-reviewed publications, and writing for textbooks and other teaching materials on digital dental radiography.

Segment Covered in the Report

By Product

By Type

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023