January 2025

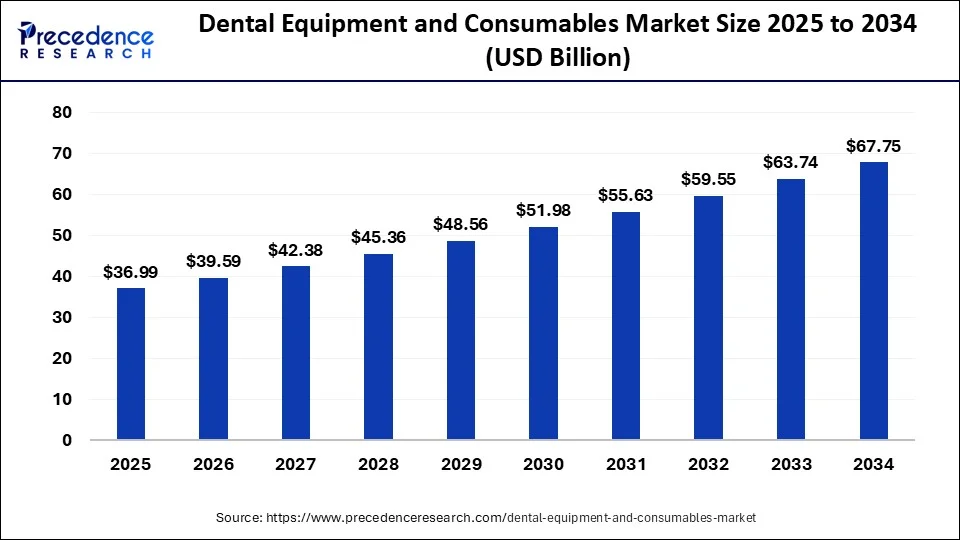

The global dental equipment and consumables market size accounted for USD 36.99 billion in 2025 and is forecasted to hit around USD 67.75 billion by 2034, representing a CAGR of 6.96% from 2025 to 2034. The North America market size was estimated at USD 14.17 billion in 2024 and is expanding at a CAGR of 7.09% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental equipment and consumables market size was calculated at USD 34.56 billion in 2024 and is predicted to increase from USD 36.99 billion in 2025 to approximately USD 67.75 billion by 2034, expanding at a CAGR of 6.96%. The rising prevalence of dental problems in the geriatric population and the changing eating habits are driving the growth of the market.

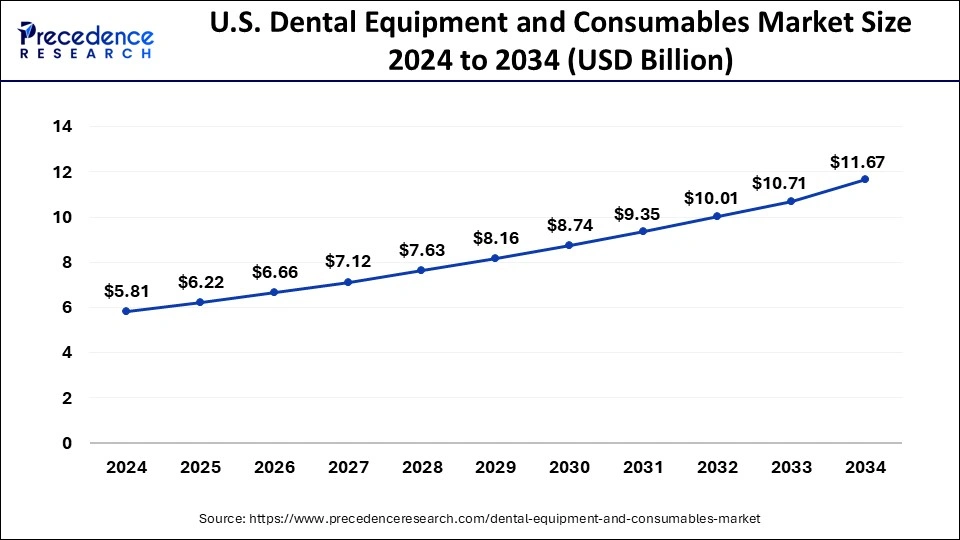

The U.S. dental equipment and consumables market size was exhibited at USD 5.81 billion in 2024 and is projected to be worth around USD 11.67 billion by 2034, growing at a CAGR of 7.22%.

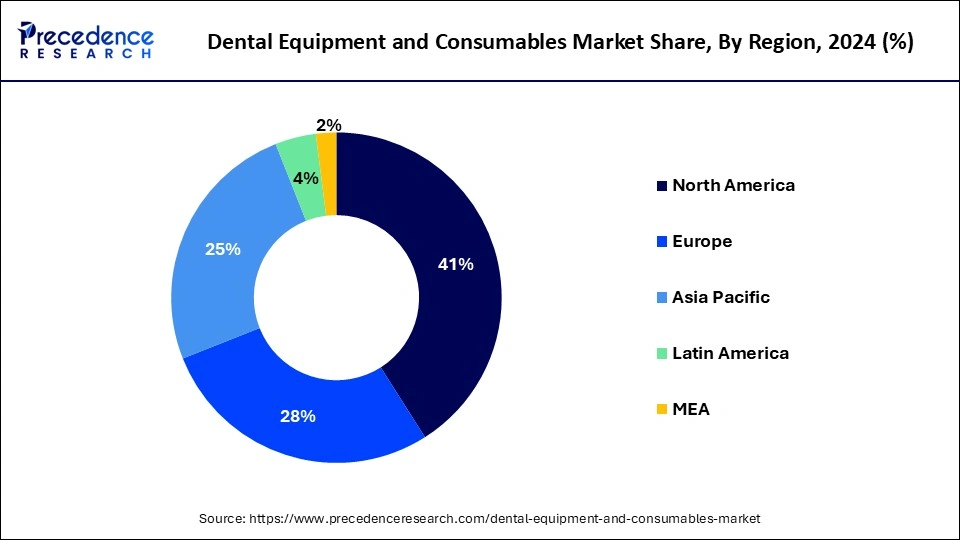

North America led the market with the biggest market share of 41% in 2024. The growth of the market in the region is increasing due to the increasing healthcare infrastructure and the higher presence of healthcare equipment manufacturing firms in the United States and Canada. The rising per capita income in the economically developed countries of the region results in a shift in the lifestyle of the people, changing eating habits, and excess consumption of sugary and junk foods that are prone to higher chances of dental and oral problems. Thus, the rising rate of dental problems in the younger population in the region and the increasing spending on healthcare by individuals are driving the growth of the dental equipment and consumables market in the region.

Asia Pacific is projected to experience significant growth in the dental equipment & consumables market during the forecast period. The growth of the market in the region is growing due to the increasing investments in the healthcare and pharmaceutical sectors in countries like China, India, and Japan, which is boosting the growth of the market. The growing population of the region, mainly the geriatric population, is more likely to get infected with dental problems due to the aging factor and the rising consumption of sugar and junk foods by the younger population of the region due to the rising urbanization and trend for dine-out is boosting the number of dental diseases in the people and contributed in the growth of dental equipment and consumables market in the region.

The instruments, supplies, and equipment used by dental hygienists, dentists, and laboratories are referred to as dental consumables and equipment. Plaster, drills, amalgams, cements, dental hand instruments, and other devices are examples of specific items. Increasing government spending on dental care, higher median personal income, structural reforms in important markets, more access to education at all levels, and an increase in the use of health insurance drive the growth of the dental equipment & consumables market.

Expanding dental insurance coverage encourages more people to seek dental care, which fuels the expansion of the dental equipment & consumables market. The development of novel materials and processes, in conjunction with technological advancements like the incorporation of artificial intelligence (AI) and the Internet of Things (IoT) into dental equipment, are propelling market expansion.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.96% |

| Market Size in 2025 | USD 36.99 Billion |

| Market Size by 2034 | USD 67.75 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increasing prevalence of dental problems

The increasing prevalence of oral and dental diseases in the population due to changing eating habits and increasing consumption of sugary and starchy foods leads to a higher chance of dental problems that drive the demand for dental equipment and consumables products and accelerate the growth of the dental equipment & consumables market.

The increasing geriatric population also contributes to the growth of the market. With the rising geriatric population, age-related dental issues are also increasing simultaneously, driving the demand for dental consumables and dental treatment. Additionally, the rising demand for aesthetic dental procedures boosts the demand for specialized equipment and consumables. Aesthetic dental procedures like tooth whitening treatment drive the sales of laser equipment and whitening agents, which creates future opportunities for growth in the dental equipment & consumables market.

Higher cost

The development and production processes of dental equipment involve the contribution of highly skilled personnel who use sophisticated equipment and technology to produce the best quality equipment. This forces companies to increase the retail prices of their products and services. This increased cost of dental equipment and consumables due to technological advancements leads to the increased cost of dental treatment that restraints the growth of the dental equipment & consumables market.

Regularity support

The increasing government support for oral healthcare drives the growth of the dental equipment & consumables market. The rising investments in the technological advancement of dental equipment are propelling the growth of the dental equipment and consumables market. Furthermore, supportive government policies and the rising number of subsidies in the oral healthcare program further support the expansion of the market.

The ongoing campaign by the government for dental care awareness, regular dental check-ups, and preventive dental care is boosting the growth of the market. The initiatives for the inclusion of dental treatment coverage in healthcare policies are to encourage more people to get dental treatment, which will result in the expansion of the dental equipment & consumables market.

The equipment segment dominated the dental equipment & consumables market in 2024. The growth of the segment is attributed to the increase in cases of dental problems, which is driving the growth of the segment. Dental professionals can provide high-quality oral health care with accuracy and speed due to the advancements in dental equipment. The oral health treatments, which include diagnosis, restorations, surgeries, and more, have a variety of equipment available.

Dental instruments fall into a few general types, each of which is designed to be used for a particular dental treatment. Instruments for endodontics, periodontics, orthodontics, prosthodontia, restorative dentistry, surgery, and diagnostics are among these fields. The importance of dental instruments endures despite the field's constant change, bearing witness to the diligence, creativity, and precision that characterize contemporary dentistry.

The consumables segment is expected to grow in the dental equipment & consumables market during the forecast period. Dental consumables are one-time-use items. This area includes an extensive range of tools, materials, chemicals, and goods. The wide variety of dental consumables available has varying purposes depending on the type of procedure and area of dentistry.

Dental consumables are widely used in dental practices for ease of use and the dispensing of dental products. There is a wide range of consumables, such as cotton rolls, cannulas, saliva aspirators, impression trays, aspirator tips, prostheses, restorative items, cellulose, and mouth rinse covers. To protect patients and workers as much as possible, these dental consumables ensure that there is no cross-contamination.

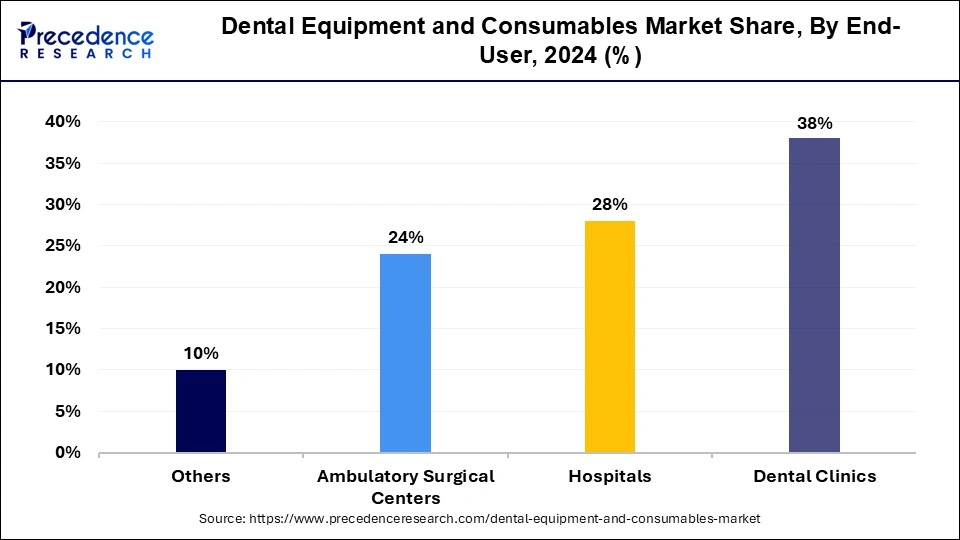

The dental clinics segment led the market with the largest share of 38% in 2024. Dental clinics are staffed with trained professionals, including dentists and oral surgeons, who have the expertise to perform implant procedures safely and effectively. Dental clinics typically have access to specialized equipment and technology required for implant procedures, such as imaging devices for diagnostics and surgical tools for placement.

The hospitals segment is observed to remain the second largest segment in the dental equipment and consumables market during the predicted timeframe. The growth of the segment is attributed to the higher availability of dental clinics or hospitals for the treatment. Furthermore, hospitals play a more significant role in the dental equipment and consumables market landscape due to the growing tendency toward preventative dental care.

In particular, hospitals play a major role when it comes to intricate dental surgeries and procedures that need specialized resources and knowledge. Oral surgery and emergency dental treatment are among the many dental services provided by hospitals, which are outfitted with cutting-edge resources and infrastructure. The availability of skilled, trained professionals and specialized equipment for surgical procedures is driving the growth of the segment.

By Product

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023