November 2024

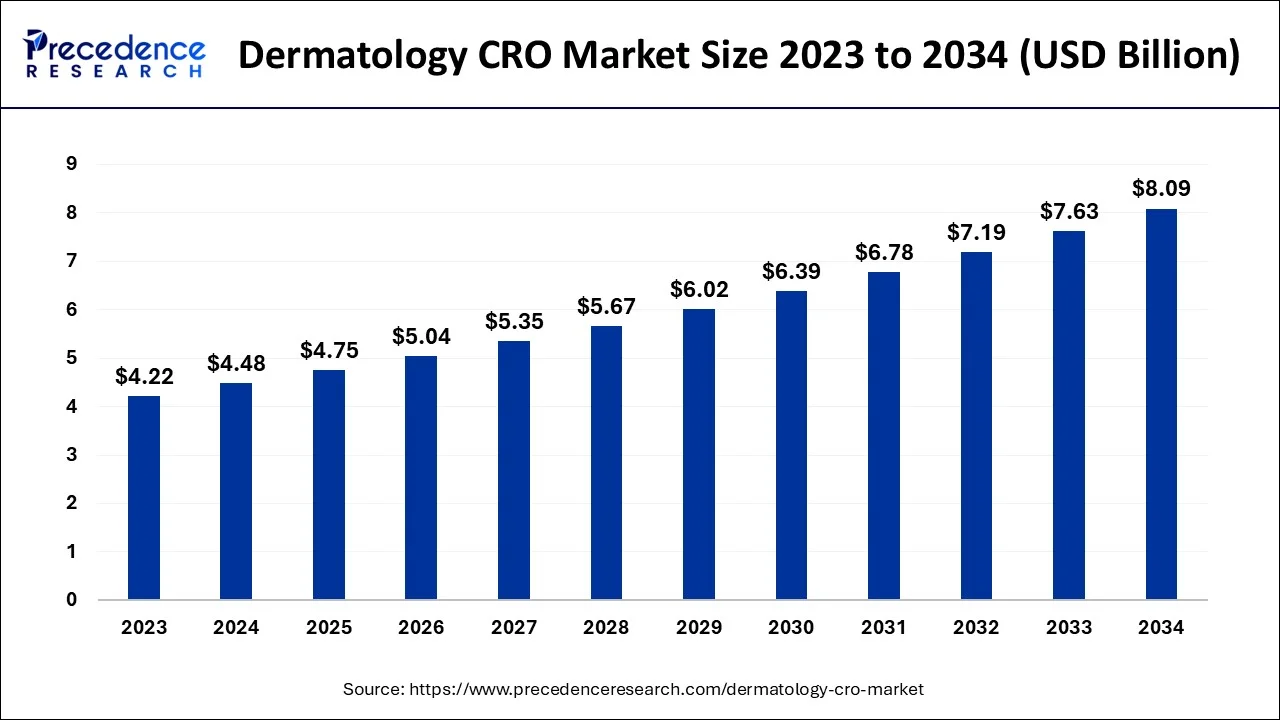

The global dermatology CRO market size accounted for USD 4.48 billion in 2024, grew to USD 4.75 billion in 2025 and is predicted to surpass around USD 8.09 billion by 2034, representing a healthy CAGR of 6.10% between 2024 and 2034.

The global dermatology CRO market size is estimated at USD 4.48 billion in 2024 and is anticipated to reach around USD 8.09 billion by 2034, expanding at a CAGR of 6.10% from 2024 to 2034.

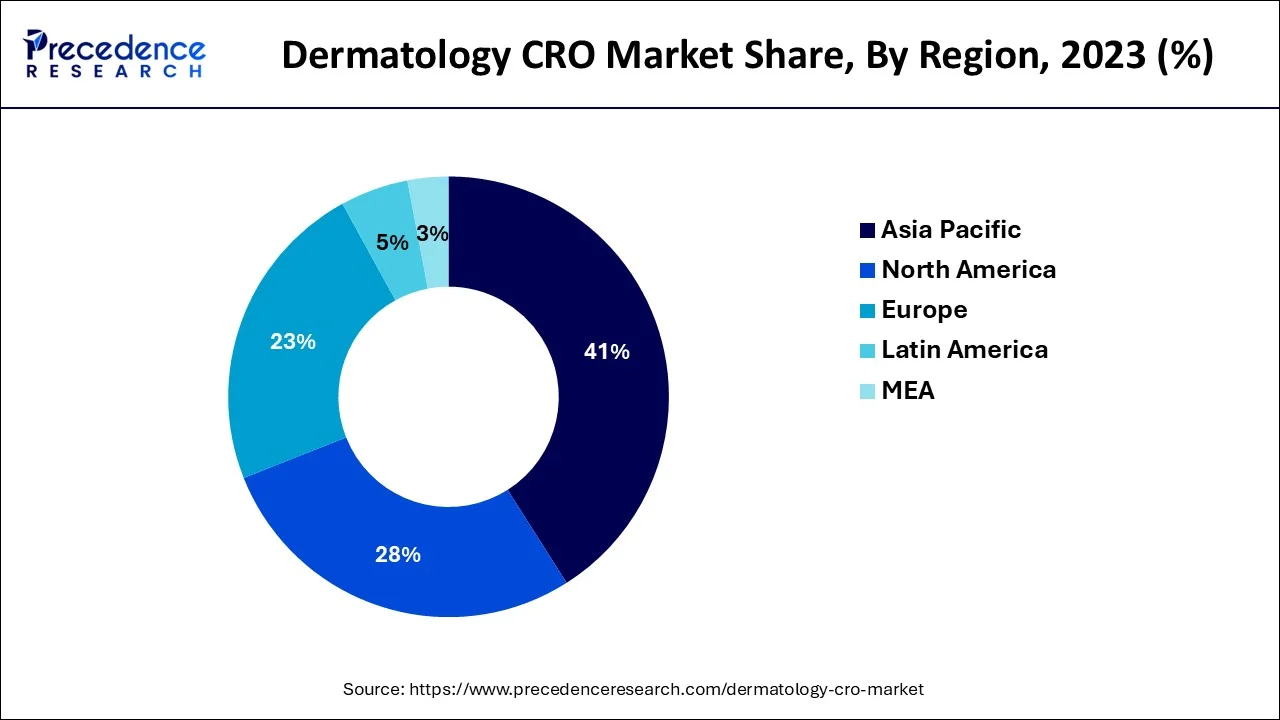

The Asia Pacific dermatology CRO market size is estimated at USD 1.84 billion in 2024 and is expected to be worth around USD 3.36 billion by 2034, rising at a CAGR of 6.22% from 2024 to 2034.

Asia Pacific led the market in 2023 with a revenue share of over 41% and is predicted to expand quickly going forward. This is brought on by the high frequency of chronic diseases, the accessibility of various populations, the simplicity of enlisting and keeping patients, and the adoption of legislation that passes muster. Additionally, supportive government actions are promoting market expansion. For instance, the Central Drugs Standard Control Organization (CDSCO) released new regulations in February 2018 that are anticipated to reduce the clearance process' duration to around 30 to 60 days.

The market for dermatological CROs in North America will account for a sizeable revenue share in 2023 due to the region's highest number of trials that are carried out and outsourced. The expansion of this regional market has also been aided by the government's growing funding of R&D initiatives through grants and loans to businesses and research institutions.

Institutions that help pharmaceutical or biotechnology corporations with their contracted research activities are known as dermatology contract research organizations. Both pharmaceuticals and medical equipment are produced by CROs. CROs provide all of the essential research for pharma and biotech businesses, including project planning and clinical trial administration

One of the main factors propelling the market is the need for topical dermatological medications including anti-infective, anti-inflammatory, emollients, local anesthetics, and cleansers to treat acne. The dermatology contract research organization (CRO) industry is also being driven ahead by the increased public awareness of skin illnesses, the critical need for quick detection, and the rising incidence of skin cancer and other skin conditions.

The COVID-19 outbreak had a negative impact on the global economy in 2020 and is still having an impact now. The market for dermatological CRO was largely spared by the effects of the pandemic because of the development of online clinical trials and government initiatives to preserve faulty healthcare supply chains. Additionally, due to ongoing immunization campaigns and the repeal of the shelter-in-place rules, the backlog of clinical studies is decreasing. The market, therefore, seems to have a promising future.

Over the projection period, it is predicted that the prevalence of skin diseases would increase globally. Up to 50 million North Americans have acne each year, making it the most prevalent skin condition in the country, according to the American Academy of Dermatology Association. One in ten people will experience atopic dermatitis at some time in their lives. In the United States, 7.5 million individuals suffer from psoriasis. In the United States, rosacea is a common skin disorder that affects 16 million individuals. In the United States, more than 9,500 people receive a skin cancer diagnosis each day.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.48 Billion |

| Market Size by 2034 | USD 8.09 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.10% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

An increasing number of clinical trials

Several issues associated with dermatology clinical research

The growing investment by biopharmaceutical, pharmaceutical, and medical device companies

With a revenue share of more than 75.30%, the clinical segment led the dermatological contract research organizations market in 2023. The desire for novel technologies, the rising demand for orphan medications and customized medicine, and the rising number of biologics are all factors in the segment's growth. Technology developments, the requirement for CROs to perform dermatological clinical trials, and the globalization of clinical trials are some of the drivers that are predicted to fuel the rise.

Outsourcing phase III clinical trials to dermatological CROs helped the clinical segment obtain the greatest revenue share in 2022 since phase III clinical trials are one of the most expensive stages of a clinical trial. Over the projected period, the preclinical segment is anticipated to grow at the highest CAGR of 8.5%. The need for dermatological CROs is going to be driven by the increase in preclinical studies using big molecules and the growing need to lower R&D costs, which will lead to market growth.

Clinical monitoring had the greatest revenue share of more than 20.60% in 2023, and it is anticipated that it will keep that position throughout the projection. This could be brought on by an increase in clinical studies and the need to monitor them, which is raising service demand.

Dermatology clinical research has been contracted out to CROs during the past ten years for a variety of factors, including cost-effectiveness and technical expertise. Clinical monitoring data is anticipated to improve with the usage of smart analytics and real-time data-capturing technology in the healthcare industry. The category is growing because real-time data collecting on drug safety and toxicity enables early discovery of trial defects and fast adjustments, such as trial re-design or cancellation.

Phase III clinical trials are the most expensive and include the most participants, therefore in 2023, they led the market with a revenue share of over 50.40%. The typical price of a single phase III clinical investigation is around USD 19.0 million, with 59 innovative therapeutic drugs being authorized by the FDA between 2015 and 2016.

Phase III also requires more patients and, frequently, longer treatment durations. In 2021, the phase II segment's revenue share was the second-largest. There are two sections to this study. The first stage is reviewing various dosages and efficacy studies, while the second portion entails selecting a dose.

By Service

By Type

By Phase Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

December 2024

November 2024

August 2024