February 2025

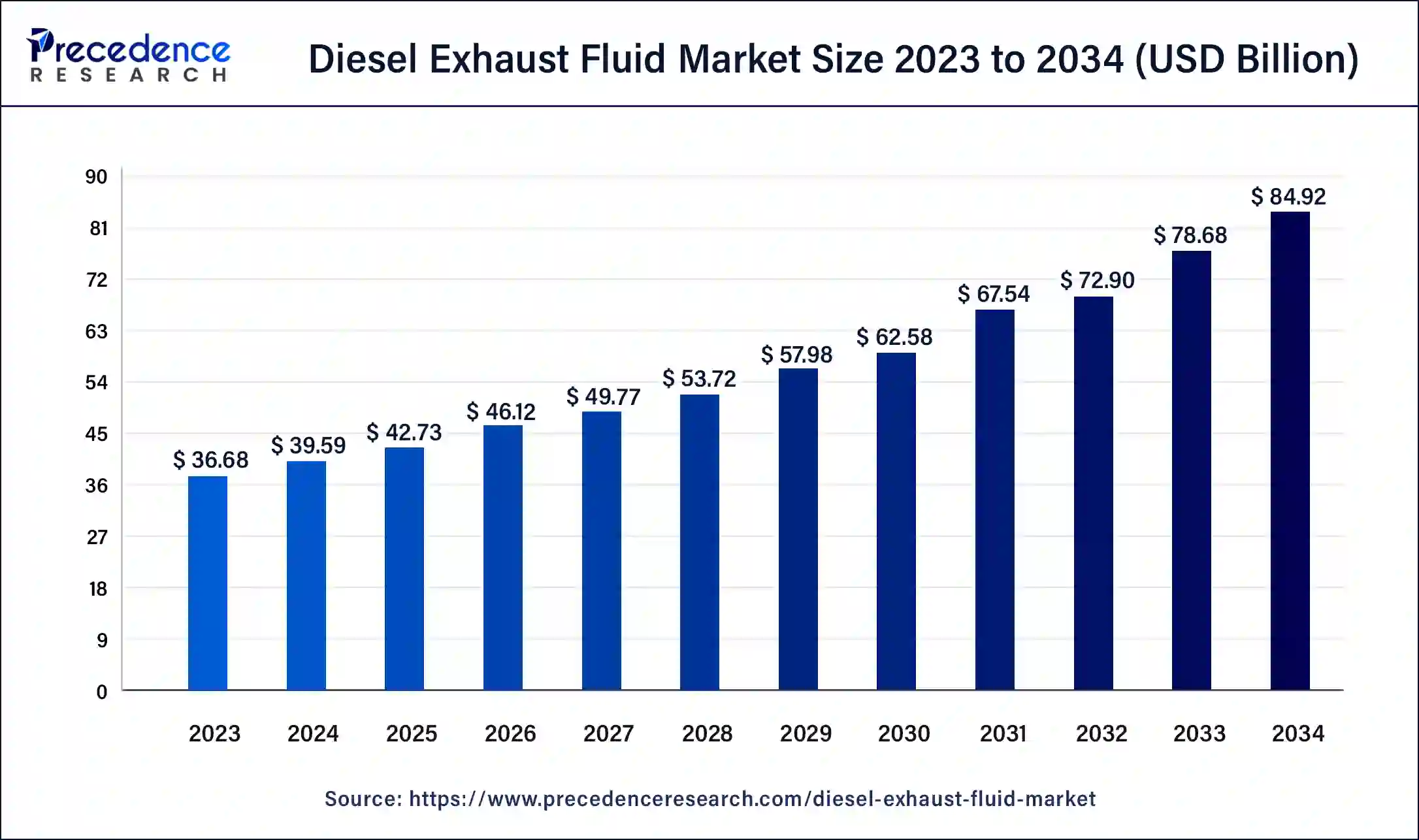

The global diesel exhaust fluid market size was USD 36.68 billion in 2023, calculated at USD 39.59 billion in 2024 and is expected to be worth around USD 84.92 billion by 2034. The market is slated to expand at 7.93% CAGR from 2024 to 2034.

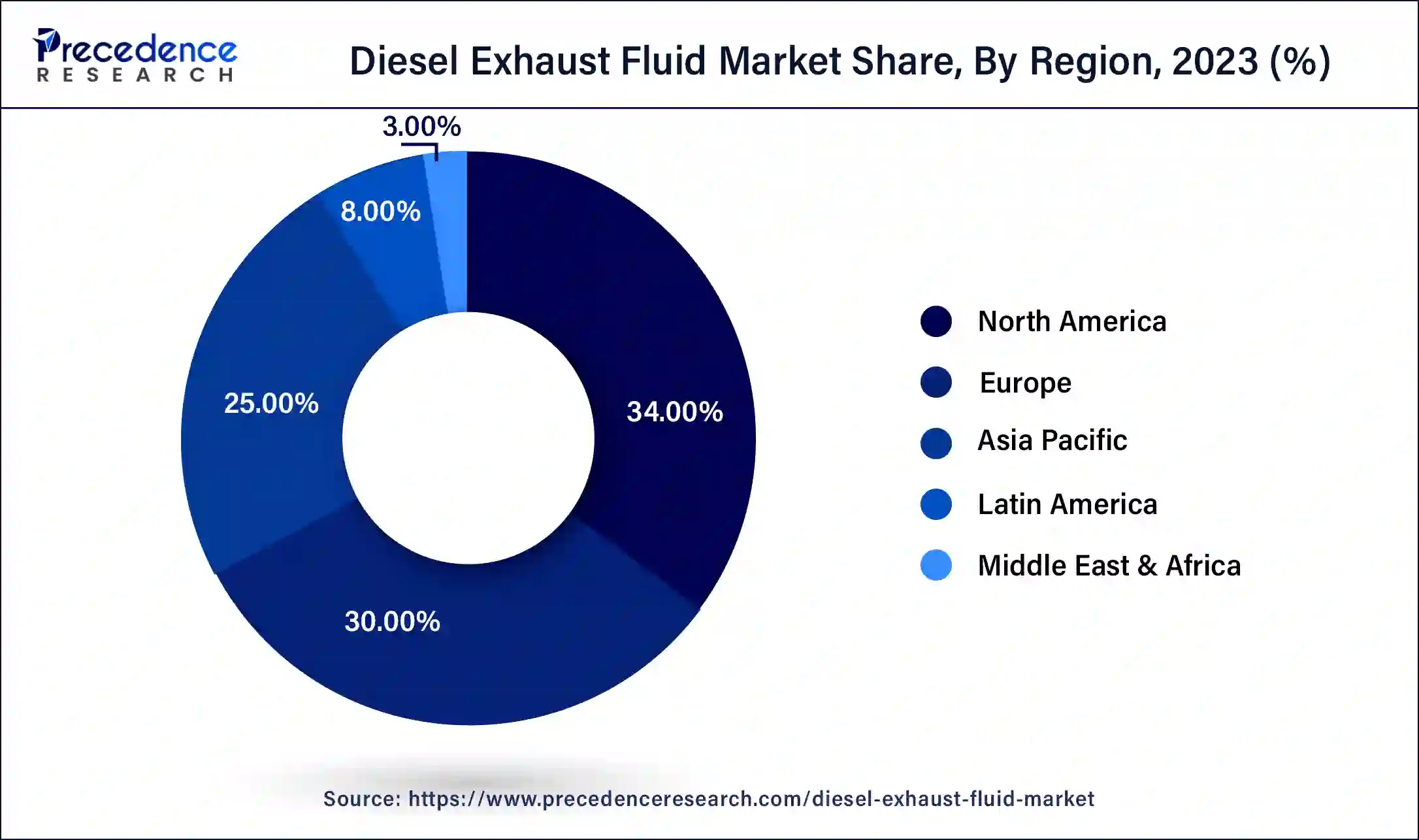

The global diesel exhaust fluid market size is expected to be worth USD 39.59 billion in 2024 and is anticipated to reach around USD 84.92 billion by 2034, growing at a solid CAGR of 7.93% over the forecast period 2024 to 2034. The North America diesel exhaust fluid market size reached USD 12.47 billion in 2023. The rising application of diesel exhaust fluid in construction and agricultural equipment is a key diesel exhaust fluid market driver.

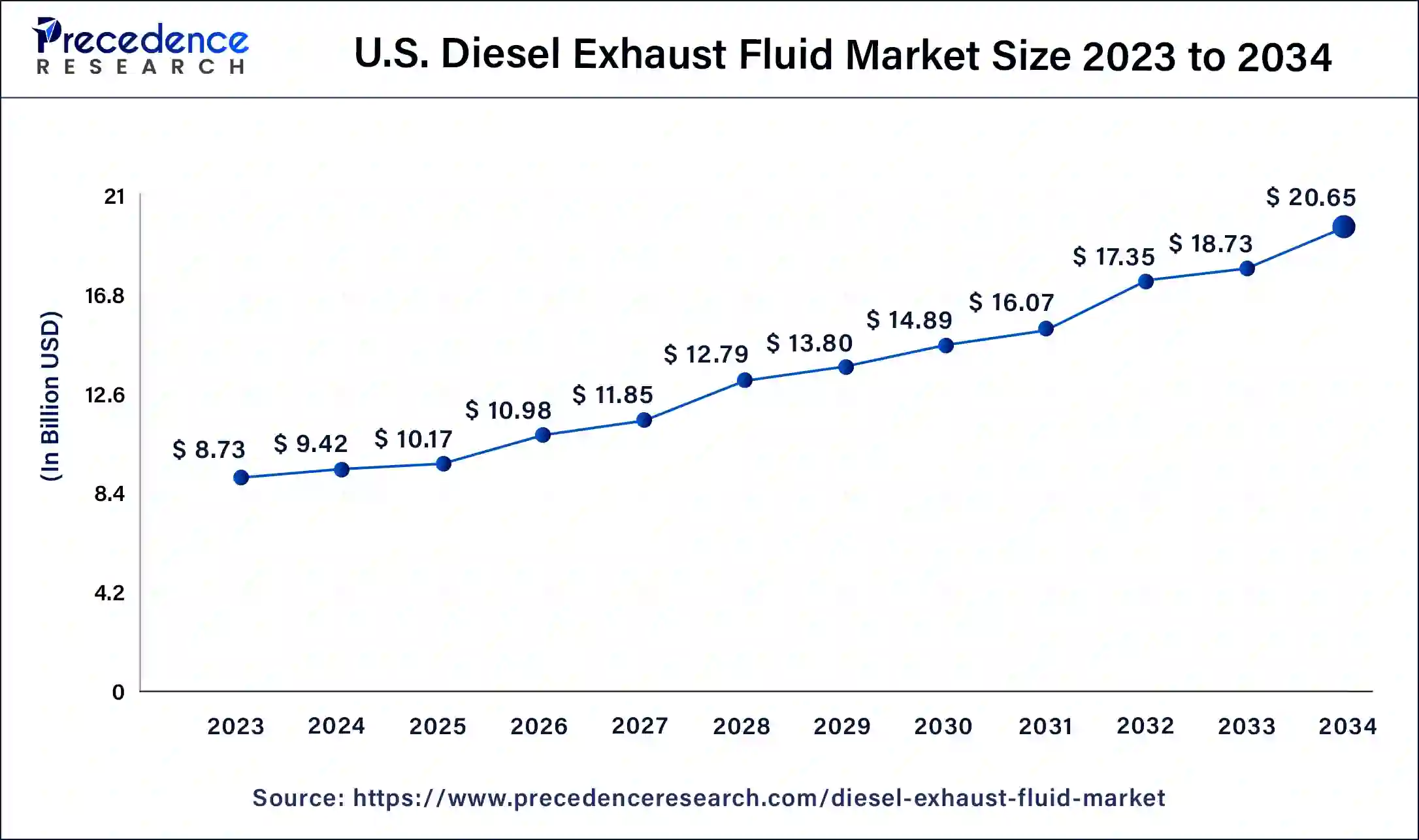

The U.S. diesel exhaust fluid market size was exhibited at USD 8.73 billion in 2023 and is projected to be worth around USD 20.65 billion by 2034, poised to grow at a CAGR of 8.14% from 2024 to 2034.

North America dominated the diesel exhaust fluid market in 2023. The dominance of the segment can be attributed to the significant growth of the construction industry in the region coupled with the rising demand for non-residential construction projects like commercial buildings, hospitals, and colleges. Furthermore, the market in the U.S. is expanding at a substantial rate because of positive market fundamentals for real estate and a strong economy.

Asia Pacific is expected to grow significantly in the diesel exhaust fluid market over the projected period. The growth of the region can be linked to the urbanization and swift industrialization occurring in nations like China and India, along with the stricter emission standards to counteract air pollution.

List of countries by motor vehicle production

| Country | Year 2023 |

| China | 30,160,966 |

| United States | 10,611,555 |

| Japan | 8,997,440 |

| India | 5,851,507 |

| South Korea | 4,244,000 |

| Germany | 4,109,371 |

| Mexico | 4,002,047 |

| Spain | 2,451,221 |

| Brazil | 2,324,838 |

| Thailand | 1,841,663 |

Diesel exhaust fluid (DEF) is a mixture of 67.5% deionized water and 32.5% urea. It is colorless, odorless, and non-flammable. DEF's quality is preserved in special storage tanks made of stainless steel or polyethylene plastic because the shelf life of the substance depends on the temperature at which it is stored. To reduce diesel exhaust emissions, selective catalytic reduction (SCR) uses AUS 32 as a consumable to lower nitrous oxide (NOx) levels in engines.

Impact of AI on the Diesel Exhaust Fluid Market

Artificial Intelligence (AI) is substantially influencing market-driven analytics, and ML algorithms are improving the accuracy of diesel exhaust fluid dosage and enhancing the efficiency of exhaust systems. Furthermore, automation in the diesel exhaust fluid market technology has led to reduced operational costs and higher production rates. As AI and automation evolve, their integration into diesel exhaust fluid systems is anticipated to further stimulate fuel consumption and emission control.

| Report Coverage | Details |

| Market Size by 2034 | USD 84.92 Billion |

| Market Size in 2024 | USD 39.59 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.93% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle Type, Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Innovations in selective catalytic reduction technology

Innovations in SCR technology improved the performance and efficiency of the diesel exhaust fluid market by extensively gaining its usage in many sectors. Additionally, the demand for more innovative SCR systems from the automotive industry rises because products have strict emission regulations and want to enhance their fuel efficiency. The utilization of advanced SCR systems in agriculture and construction has helped fulfill environmental standards and boost the performance of diesel-based equipment.

Fluctuating cost of raw materials

The growth of the market can be hampered by the fluctuating cost of raw materials such as urea, along with the increasing demand for electric vehicles worldwide. Also, the overall growth of the global diesel exhaust fluid market can be constrained by adulteration, which has a negative effect on the quality of diesel exhaust fluid.

Opportunity

Rise of renewable diesel fuels

The advent of renewable diesel fuels presents a crucial opportunity to integrate the diesel exhaust fluid market into a wide platform. Renewable diesel products are cleaner options than traditional diesel and can be created from bio-based feedstocks, which in turn reduces carbon emissions compared to their conventional counterparts. Furthermore, the increase in renewable diesel development builds a complementary relationship with diesel exhaust fluid and impacts.

The light commercial vehicles segment held a significant share of the diesel exhaust fluid market in 2023. The dominance of the segment can be attributed to the increasing use of diesel exhaust fluid in light commercial vehicles to meet strict emissions regulations and improve environmental performance. Additionally, the segment's dominance indicated its crucial role in the diesel exhaust fluid market and influenced the overall demand for this product in the transportation sector.

The passenger car segment will show notable growth in the diesel exhaust fluid market during the projected period. The growth of the segment is driven mainly by the rising popularity of diesel-engine cars. Diesel exhaust fluid is a most common feature in passenger cars. It can be used in combination with selective catalytic reduction technology to clear exhaust gas before it's emitted into the atmosphere. The DEF is utilized in a variety of passenger vehicles, such as pickups, SUVs, and cars.

The catalysts segment led the global diesel exhaust fluid market in 2023. This is because the catalyst component of the product is important for the efficient operation of selective catalytic reduction systems in diesel engines. DEF is mainly composed of deionized water and urea which acts as a reductant in the SCR process. Moreover, catalytic reaction is essential for decreasing NOx emissions and fulfilling stringent environmental regulations.

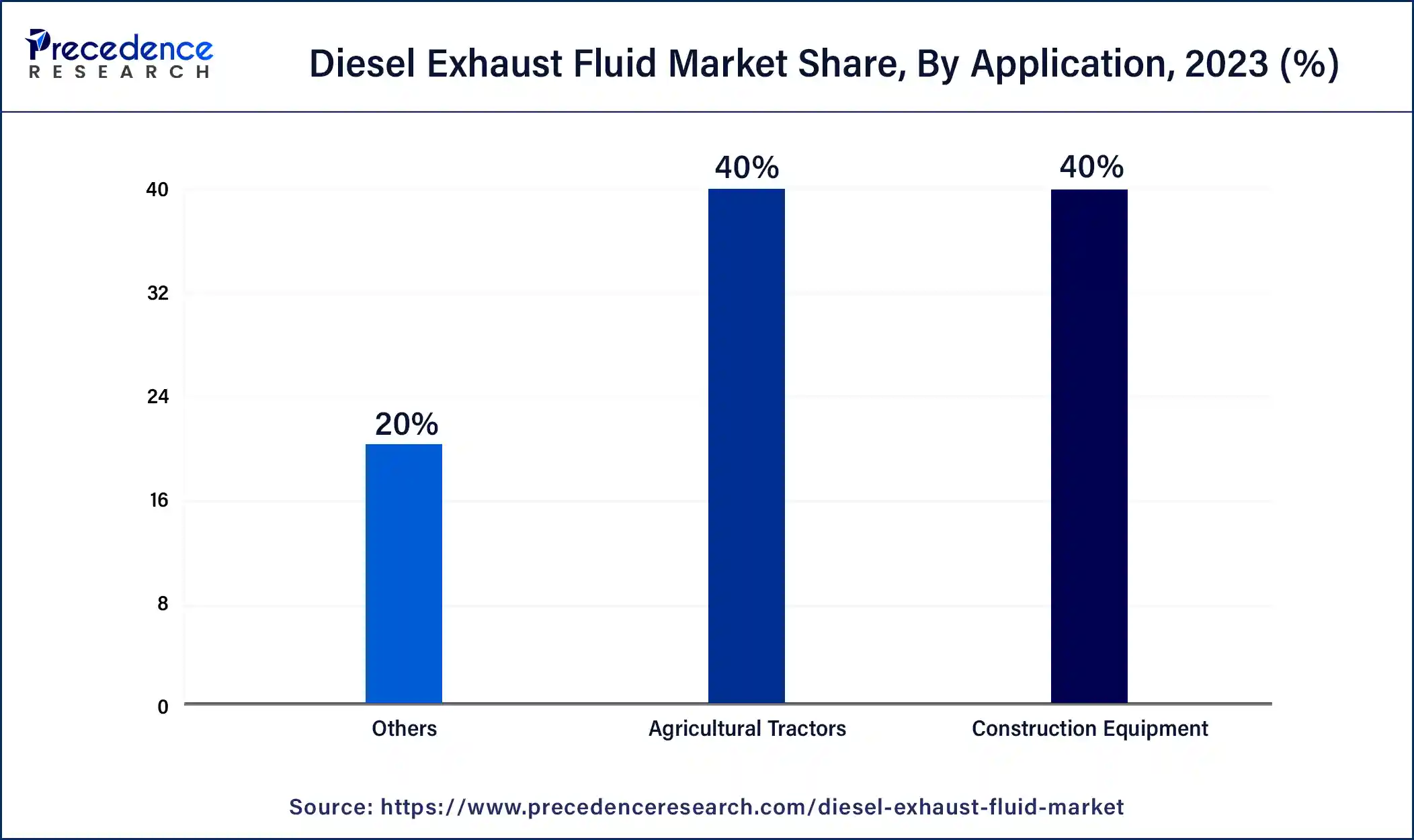

The construction equipment segment dominated the global diesel exhaust fluid market. The dominance of the segment can be credited to the increased utilization of Construction equipment like bulldozers, excavators, and loaders in the construction industry as they operate smoothly under demanding conditions. Furthermore, diesel exhaust fluid is crucial for construction equipment to match with modern emissions regulations and support environmental sustainability.

The agricultural tractors segment will witness the fastest growth in the diesel exhaust fluid market over the forecast period. This is due to DEF helping tractors fulfill the EPA’s Tier 4 Final emissions standards by ensuring a substantial decrease in air pollution. This application can enhance engine efficiency and longevity by stimulating combustion and decreasing toxic emissions. Also, regular refilling of DEF and Proper storage are necessary for regulating tractor performance and sustainability during tedious agricultural operations.

Segments Covered in the Report

By Vehicle Type

By Component

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025