September 2024

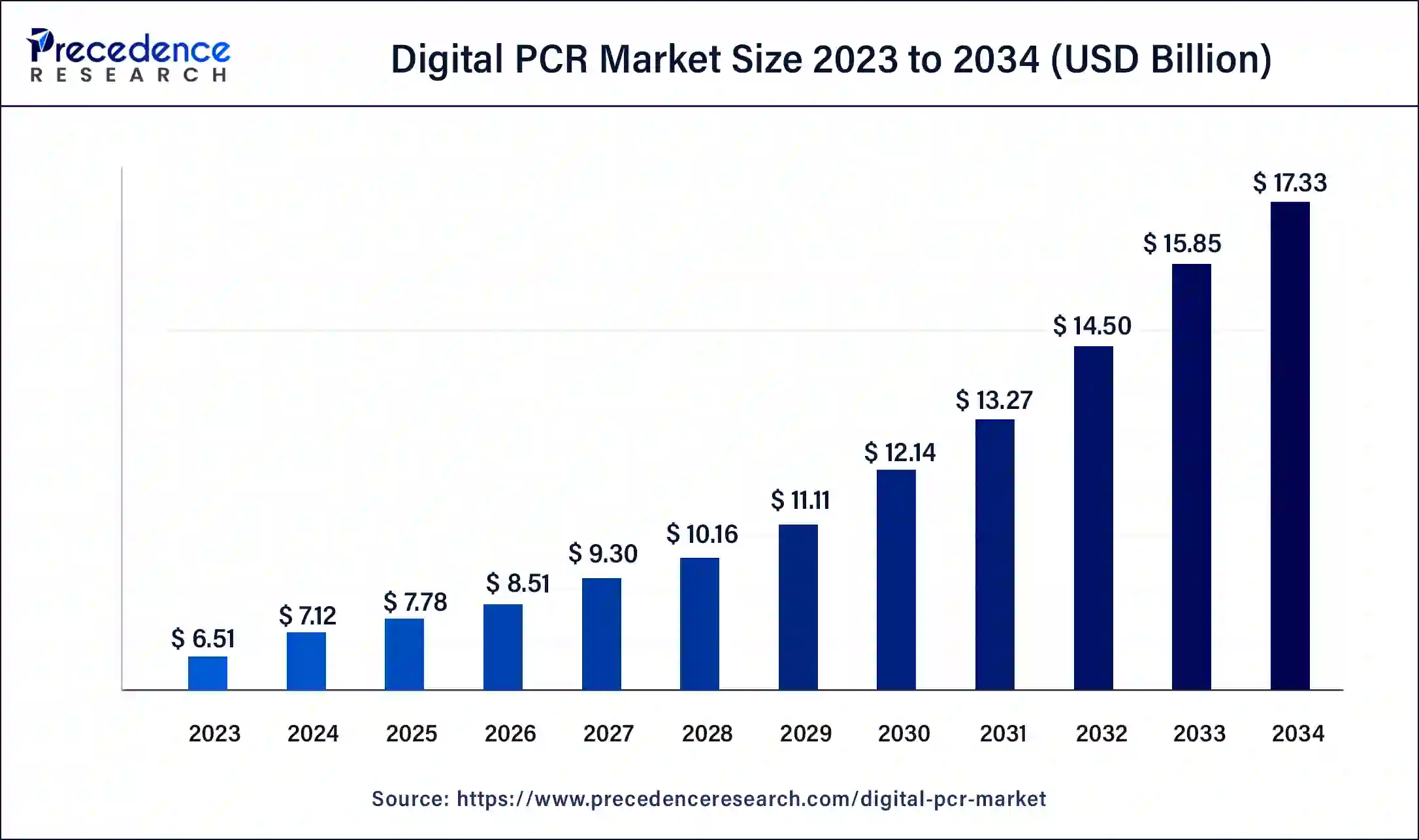

The global digital PCR market size was USD 6.51 billion in 2023, calculated at USD 7.12 billion in 2024 and is projected to surpass around USD 17.33 billion by 2034, expanding at a CAGR of 9.3% from 2024 to 2034.

The global digital PCR market size accounted for USD 7.12 billion in 2024 and is expected to be worth around USD 17.33 billion by 2034, at a CAGR of 9.3% from 2024 to 2034.

Digital PCR (dPCR) is a technology used to quantify and precisely analyze nucleic acids, particularly DNA. It is a form of polymerase chain reaction (PCR) that partitions a sample into thousands or millions of individual reactions, allowing for absolute quantification of target molecules with high sensitivity and specificity.

The digital PCR market is a rapidly growing sector of the molecular diagnostics industry, driven by increasing demand for accurate and reliable nucleic acid testing in areas such as clinical diagnostics, research and development, and biopharmaceuticals. Furthermore, the increasing prevalence of infectious diseases and genetic disorders, rising demand for personalized medicine, and the need for accurate and reliable detection of cancer biomarkers. Additionally, the emergence of new technologies and advancements in the field of genomics are expected to propel market growth in the coming years further are the major factors driving the growth of the Digital PCR market.

The increasing prevalence of genetic disorders is expected to propel the market. Additionally, the market expansion is anticipated to be fueled by increased health consciousness, an improving standard of life, and rising disposable income. The prevalence of viral infections and airborne infectious diseases is increasing, which has increased consumer awareness of health issues. The rise of numerous deadly epidemics, including swine flu and avian influenza, has also spurred the expansion of the global digital PCR industry during the past few decades.

However, regulatory and sample preparation challenges are anticipated to impede market growth over the forecast period. Digital PCR requires high-quality nucleic acid samples for accurate and reliable testing. Sample preparation can be time-consuming and challenging, particularly for difficult-to-extract samples such as formalin-fixed paraffin-embedded tissue.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have led to a surge in demand for nucleic acid testing, as PCR-based tests are the gold standard for diagnosing COVID-19. Digital PCR has played an important role in COVID-19 testing, as it provides highly accurate and sensitive detection of SARS-CoV-2, the virus that causes COVID-19.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.51 Billion |

| Market Size in 2024 | USD 7.12 Billion |

| Market Size by 2034 | USD 17.33 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.3% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Technology, By Product, By Type, By Indication and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing advancements in digital PCR technology to brighten the market prospect:

The digital PCR market benefits from technological advancements, including instrumentation, software, and assay design improvements. For instance, digital droplet PCR is a newer form of digital PCR that enables higher-throughput testing and more precise quantification.

In addition, researchers at the University of California, Berkeley, have developed a next-generation digital PCR system that uses microfluidic technology to enable ultra-high-throughput testing. The system can process up to 10,000 samples per run and offers improved sensitivity and precision compared to traditional digital PCR. Furthermore, the University of Bristol has developed a digital PCR-based method for gene expression analysis that is faster, more sensitive, and more accurate than traditional qPCR. The method, called droplet digital PCR gene expression analysis (ddGEA), uses droplet-based microfluidics to enable high-throughput testing. These advancements in digital PCR technology are driving innovation and expanding the range of applications for the technology, from gene expression analysis to liquid biopsy to infectious disease testing.

Increasing demand for accurate nucleic acid testing: The demand for accurate and reliable nucleic acid testing is increasing rapidly, driven by the need for early detection and monitoring of infectious diseases, genetic disorders, and cancer. The Covid-19 pandemic has created a massive demand for nucleic acid testing to detect the presence of the virus in patient samples. PCR-based testing is currently the gold standard for Covid-19 testing, and there have been several recent innovations in PCR technology to improve the accuracy and speed of testing. Nucleic acid testing is also widely used in genetic testing for inherited diseases, carrier screening, and prenatal testing. Companies such as Invitae and 23andMe offer genetic testing services that use PCR-based technology to detect specific genetic variants.

The high cost of digital PCR is causing hindrances to the market

Digital PCR systems and consumables can be expensive, limiting adoption in some research and clinical settings. This could be a challenge for laboratories in low- and middle-income countries. Digital PCR requires specialized equipment and reagents, and the cost per reaction can be significantly higher than traditional PCR or other nucleic acid testing methods. It also requires specialized instrumentation, such as droplet-based or chip-based platforms, that can be expensive to purchase and maintain. The cost of instrumentation can be a significant barrier to entry for smaller labs or research groups.

Moreover, digital PCR requires specialized expertise to perform and analyze the data. Training and hiring skilled personnel can be a significant cost for labs and research groups. The high cost of digital PCR remains a challenge. The ongoing development of new technologies and approaches is helping to make the technology more affordable and accessible to a wider range of users.

These are the following factor which is likely to create opportunity over the forecast period.

On the basis of technology, digital PCR is segmented as quantitative, digital, and end-point. Quantitative digital PCR is expected to grow exponentially over the forecast period because it provides accurate and precise quantitative data. It is a type of digital PCR that allows for the absolute quantification of nucleic acid targets in a sample. It is widely used in research and clinical diagnostics applications.

It uses a limiting dilution approach, ensuring that each reaction chamber contains a small number of nucleic acid molecules, making quantifying the exact number of target molecules in the sample easier.

On the basis of product, the Digital PCR market is divided into consumables & reagents, instruments, and software & services, with the instruments accounting for most of the market. Specialized equipment is required for digital PCR testing. Digital PCR instruments are designed to perform highly accurate and sensitive nucleic acid quantification, which is necessary for clinical diagnostics, research, and forensics applications.

These instruments utilize various technologies, including droplet-based digital PCR, chip-based digital PCR, and bead-based digital PCR. These technologies have unique features and benefits but require specialized equipment to perform digital PCR testing.

As the demand for accurate and reliable nucleic acid testing continues to grow, the digital PCR market's instruments segment is expected to dominate. Advances in digital PCR technology, such as the development of automated systems and the standardization of protocols and guidelines, are also expected to drive growth in this segment.

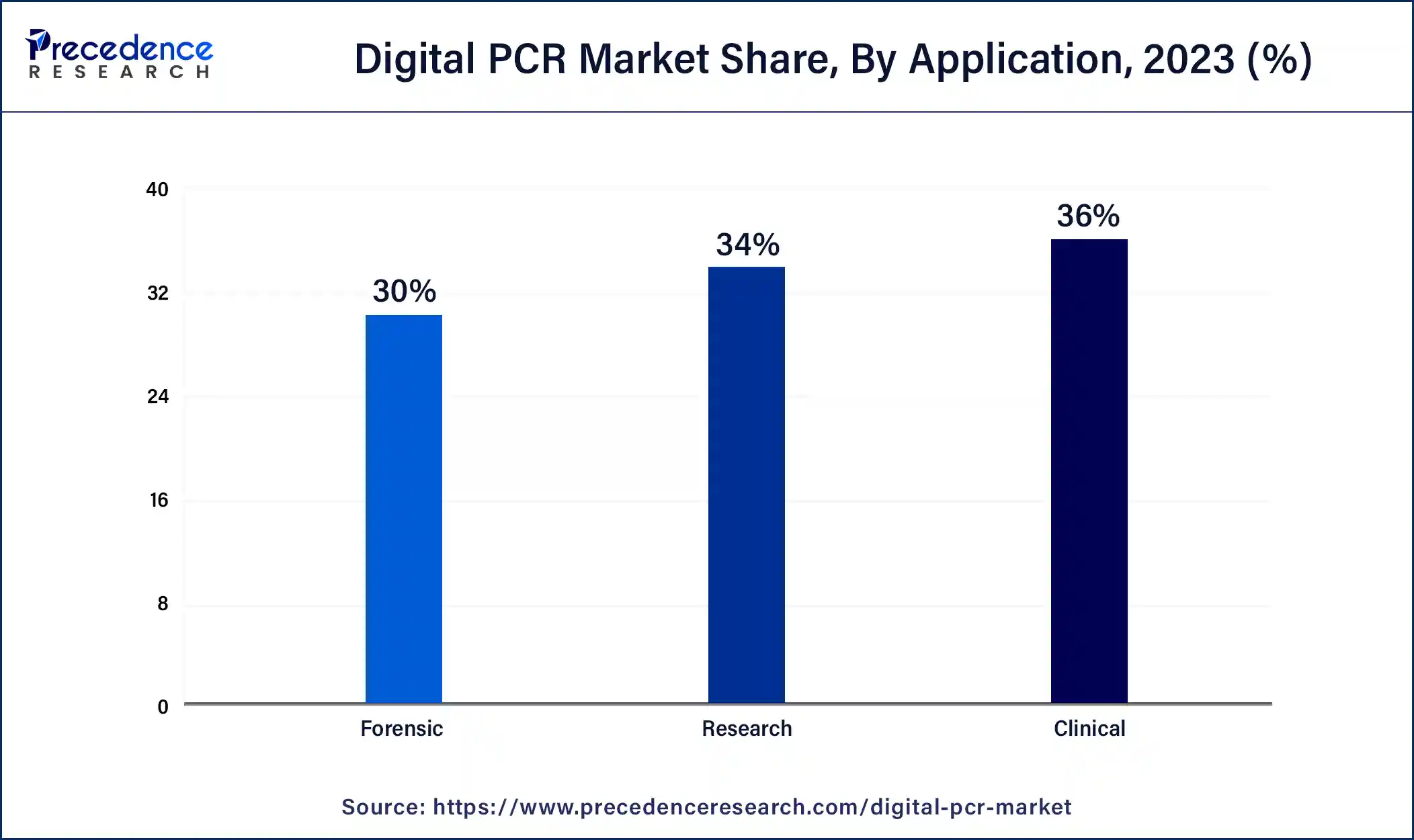

Application Insights

On the basis of application, the Digital PCR market is divided into clinical, research, and forensic, with the clinical accounting for most of the market. Increasing demand for accurate and reliable nucleic acid testing in healthcare. Furthermore, Nucleic acid testing is a technique used to detect and identify genetic material, such as DNA or RNA, in biological samples.

It is widely used in clinical diagnostics to diagnose and monitor various infectious diseases, including viral infections like HIV, hepatitis, and COVID-19.

On the basis of geography, North America dominates the market owing to the high adoption rate of advanced technologies in the healthcare sector, increasing investments in research and development activities, and the presence of major players in the region. Also, increasing prevalence of chronic diseases, rising demand for accurate and reliable diagnostic tests, and the availability of advanced healthcare infrastructure.

The region in Asia-Pacific is anticipated to have the greatest CAGR due to increasing investments in research and development, the increasing adoption of advanced healthcare technologies, rising healthcare expenditure, and the increasing prevalence of infectious diseases in the region.

South Korea is one of the fastest-growing markets for digital PCR in the Asia-Pacific region. The market is driven by increasing research and development activities in life sciences, the rising prevalence of chronic diseases, and the increasing demand for accurate and reliable diagnostic tests. Furthermore, the South Korean government is investing heavily in developing the healthcare industry, driving the growth of the digital PCR market. For instance, in 2020, the government announced plans to invest $160 million to develop new diagnostic technologies, including digital PCR, to tackle the COVID-19 pandemic.

India's digital PCR market is growing rapidly due to increasing research and development activities, rising demand for accurate and reliable diagnostic tests, and a large patient population. The Indian government is taking initiatives to promote the adoption of digital PCR technology in the country. In 2021, the Indian Council of Medical Research (ICMR) approved using digital PCR for COVID-19 testing, which is expected to boost the adoption of digital PCR technology in the country.

Segments Covered in the Report

By Technology

By Product

By Type

By Indication

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

January 2025