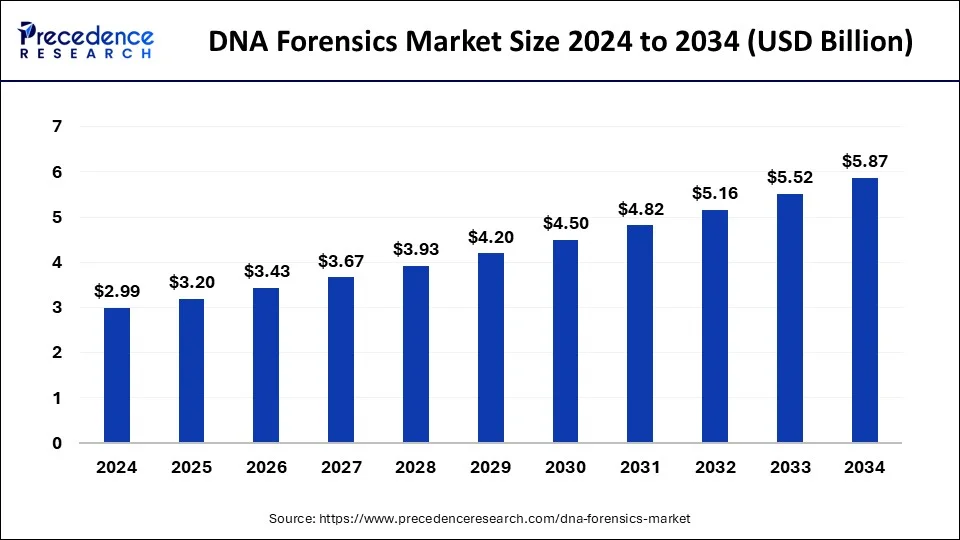

The global DNA forensics market size is calculated at USD 3.2 billion in 2025 and is forecasted to reach around USD 5.87 billion by 2034, accelerating at a CAGR of 6.98% from 2025 to 2034. The North America DNA forensics market size surpassed USD 1.26 billion in 2024 and is expanding at a CAGR of 7.05% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global DNA forensics market size was USD 2.99 billion in 2024, estimated at USD 3.2 billion in 2025 and is anticipated to reach around USD 5.87 billion by 2034, expanding at a CAGR of 6.98% from 2025 to 2034. Next-generation sequencing and the expanding utility of DNA databases drive growth in the DNA forensics market. Rising awareness of the efficacy of DNA evidence in criminal investigations, coupled with increasing demand for accurate identification methods, further accelerates the adoption of DNA forensics in law enforcement and civil applications.

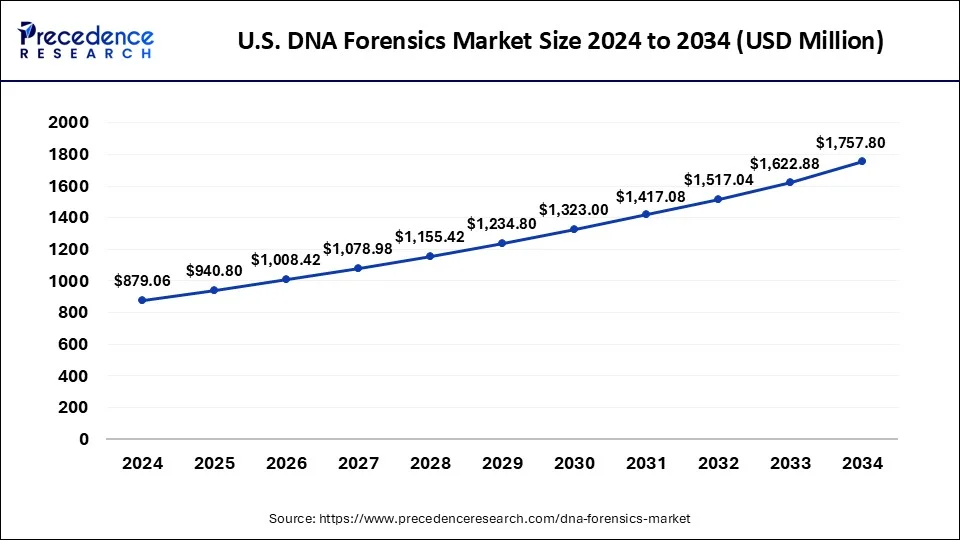

The U.S. DNA forensics market size reached USD 879.06 million in 2024 and is predicted to be worth around USD 1,757.80 million by 2034 at a CAGR of 7.18% from 2025 to 2034.

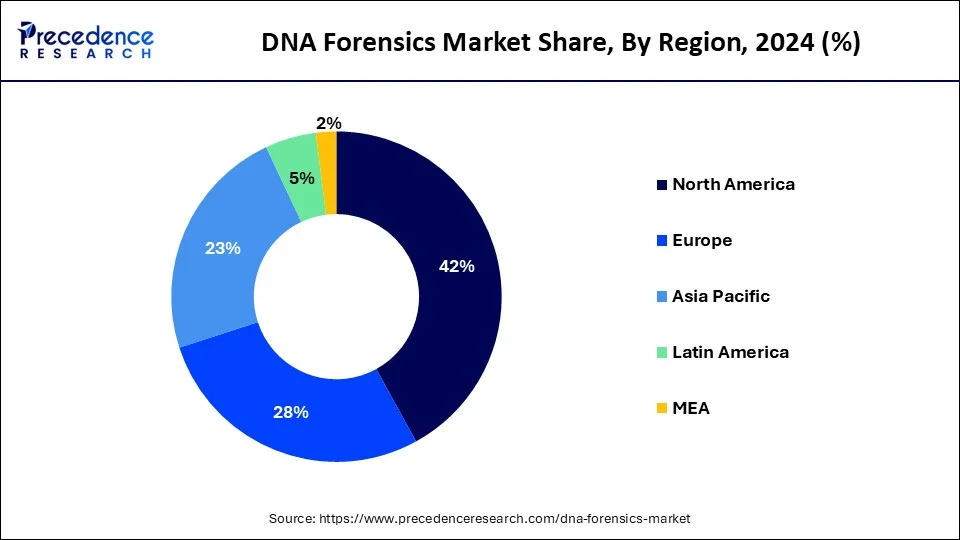

North America led the highest market share of 42% in 2024. North America has traditionally dominated the market, boasting advanced infrastructure, robust regulatory frameworks, and substantial investments in forensic technologies. The region’s strong emphasis on law enforcement and justice systems, coupled with high awareness levels about the importance of DNA evidence, has propelled the adoption of DNA forensics solutions. Additionally, North America houses some of the leading players in the DNA forensics industry, further consolidating its dominance in the market.

Asia-Pacific is expected to witness growth at a significant rate in the DNA forensics market during the forecast period of 2025-2034. The region is emerging as a key player in the market, fueled by rapid technological advancements, increasing forensic capabilities, and rising awareness about the importance of DNA analysis in criminal investigations. Countries such as China, India, Japan, and South Korea are witnessing significant growth in the adoption of DNA forensics technologies, driven by expanding forensic facilities, growing investments in research and development, and improving regulatory frameworks. Furthermore, the increasing prevalence of criminal activities and the need for effective law enforcement tools are driving the demand for DNA forensics solutions in the region.

DNA forensics refers to the application of genetic analysis techniques in the field of criminal investigations, identification of human remains, paternity testing, and other related areas. With advancements in technology, DNA profiling has become a cornerstone of forensic science, offering unparalleled accuracy and reliability in identifying individuals based on their unique genetic makeup. This has led to significant growth in the global DNA forensics market, driven by increasing demand from law enforcement agencies, government bodies, and research institutions.

The DNA forensics market encompasses various products and services, including DNA extraction kits, amplification kits, DNA sequencing services, and software for data analysis. Additionally, the adoption of automated DNA analysis systems and next-generation sequencing technologies has further propelled market growth, allowing for faster and more efficient processing of forensic samples. Moreover, the rising prevalence of criminal activities, coupled with the growing awareness about the importance of DNA evidence in solving crimes, is expected to fuel the expansion of the DNA forensics market in the coming years.

The applications of DNA forensics extend beyond law enforcement to areas such as ancestry testing, immigration testing, and wildlife conservation. In recent years, the use of DNA profiling in civil cases, such as disputes over paternity and inheritance, has also increased, contributing to the diversification of the market. Overall, the DNA forensics market is poised for steady growth, driven by technological advancements, expanding applications, and the continuous demand for accurate and reliable genetic analysis tools in various fields.

The continuous evolution of technology has significantly enhanced the capabilities of DNA analysis techniques. Next-generation sequencing (NGS) technologies, such as massively parallel sequencing, have revolutionized the field by enabling rapid and cost-effective analysis of DNA samples. These technological innovations have not only improved the efficiency of forensic investigations but have also expanded the range of applications, driving growth in the DNA forensics market.

The increasing prevalence of criminal activities and the need for effective law enforcement tools have propelled the demand for DNA forensics solutions. Law enforcement agencies around the world are increasingly relying on DNA evidence to solve cold cases, identify suspects, and exonerate the innocent. The high accuracy and reliability of DNA profiling make it an invaluable tool in criminal investigations, contributing to the growth of the market.

The growing awareness among the general public about the importance of DNA evidence has led to greater acceptance and utilization of DNA forensics services. Television shows, documentaries, and media coverage of high-profile cases have played a significant role in educating the public about the capabilities of DNA analysis in solving crimes. As a result, individuals are more willing to undergo DNA testing for various purposes, including ancestry testing, paternity testing, and participation in genetic genealogy databases, further driving market growth.

The expansion of forensic DNA databases and international collaboration efforts have facilitated information sharing and cross-border cooperation in forensic investigations. The interoperability of DNA databases allows law enforcement agencies to compare DNA profiles across jurisdictions, increasing the likelihood of identifying suspects and solving cases. This global networking has led to greater standardization of DNA forensic practices and contributed to the overall growth of the DNA forensics market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.98% |

| Market Size in 2024 | USD 2.99 Billion |

| Market Size in 2025 | USD 3.2 Billion |

| Market Size by 2034 | USD 5.87 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solutions, Method, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Legislative mandates

One of the key drivers shaping the DNA forensics market dynamics is the implementation of legislative mandates. Governments worldwide are increasingly enacting laws and regulations mandating the collection, storage, and utilization of DNA profiles for criminal identification purposes. These regulations often require law enforcement agencies to expand their DNA databases and conduct routine DNA testing on individuals arrested or convicted of certain crimes.

Regulatory initiatives focus on ensuring the quality and reliability of DNA analysis procedures, driving the adoption of standardized protocols and accredited forensic laboratories. The stringent regulatory environment not only creates a demand for DNA forensics products and services but also fosters innovation in compliance solutions and quality assurance measures.

Technological advancements and automation

DNA forensics market is the continuous advancement of technology and automation in genetic analysis techniques. Innovations such as next-generation sequencing, microfluidic systems, and robotic sample processing have revolutionized the field by enabling faster, more accurate, and high-throughput DNA analysis.

These technological developments not only streamline forensic workflows and reduce turnaround times but also lower operational costs and increase scalability. Moreover, the integration of artificial intelligence and machine learning algorithms into DNA analysis software enhances data interpretation and decision-making, further driving the adoption of automated DNA forensics solutions. As technology continues to evolve, market players are focusing on developing cutting-edge tools and platforms that improve forensic capabilities and meet the growing demands of law enforcement and investigative agencies.

Regulatory hurdles

One significant restraint facing the DNA forensics market is regulatory hurdles related to privacy and data protection. As DNA analysis becomes more widespread, concerns about the ethical and legal implications of storing and sharing genetic information have grown. Regulations governing the collection, storage, and use of DNA samples vary between countries and regions, leading to complexities and uncertainties for companies operating in the DNA forensics sector.

Strict compliance with these regulations adds additional costs and administrative burdens to businesses, hindering market expansion. Furthermore, public apprehension regarding potential misuse or unauthorized access to genetic data has led to calls for tighter regulations and increased oversight, further complicating the regulatory landscape. Addressing these regulatory challenges will be crucial for the sustained growth of the DNA forensics market as companies navigate the complex legal framework while striving to maintain public trust and confidence in their services.

Expansion of civil applications

Beyond its traditional use in criminal investigations, the DNA forensics market presents significant opportunities in civil applications such as ancestry testing, immigration verification, and identification of human remains in mass disasters. As public awareness of DNA technology increases and regulatory frameworks evolve to accommodate civil uses, the market for DNA forensics is poised for substantial growth. Companies specializing in DNA analysis services can capitalize on these emerging opportunities by diversifying their offerings and targeting new customer segments.

The growing interest in personalized medicine and genetic testing presents an opportunity for DNA forensics companies to expand into the healthcare sector. By leveraging their expertise in DNA analysis, these companies can provide valuable insights into individuals’ genetic predispositions to diseases, response to medications, and ancestry.

Collaborations with healthcare providers and pharmaceutical companies can facilitate the integration of DNA forensics into medical practice, opening up new revenue streams and positioning DNA forensics firms as key players in the genomics market.

The analyzers and sequencers segment is observed to witness a notable rate of growth during the forecast period. Analyzers and sequencers are widely adopted along with technological advancements in the industry. The growth of the segment in the industry can be attributed to the evident application of analyzers and sequencers as they play a crucial role in analyzing and sequencing DNA samples, which are essential steps in forensic investigations. These instruments allow forensic scientists to accurately examine DNA evidence, identify suspects, and solve crimes more efficiently. Their precision, speed, and reliability make them indispensable tools in forensic laboratories worldwide.

The PCR amplification segment dominated the DNA forensics market in 2024. Capillary electrophoresis is a technique used to separate DNA fragments based on their size and charge. It offers high resolution and sensitivity, allowing forensic analysts to analyze DNA samples accurately, even in complex mixtures. CE is particularly valuable in DNA profiling, where it is used to generate DNA profiles from forensic samples such as blood, saliva, or hair follicles found at crime scenes. Its ability to separate and detect DNA fragments quickly and efficiently makes it an indispensable tool in forensic laboratories.

The capillary electrophoresis segment is expected to show notable growth in the DNA forensics market during the forecast period. PCR amplification, on the other hand, is essential for amplifying specific regions of DNA from minute samples. This technique allows forensic scientists to generate sufficient DNA material for analysis from limited or degraded samples commonly encountered in forensic casework. PCR amplification is widely used in forensic DNA analysis for tasks such as STR (short tandem repeat) typing, which is the basis for DNA profiling in forensic investigations. Its sensitivity, specificity, and speed make PCR amplification an essential component of DNA forensics workflows.

The criminal testing segment dominated the DNA forensics market with the largest share in 2024. Criminal testing involves the use of DNA analysis to identify individuals involved in criminal activities, link suspects to crime scenes, and exonerate innocent individuals. DNA evidence plays a pivotal role in solving crimes by providing irrefutable identification of suspects, corroborating witness testimony, and establishing connections between perpetrators and victims. The accuracy and reliability of DNA profiling make it a cornerstone of forensic investigations, ensuring fair and just outcomes in criminal cases. As a result, law enforcement agencies worldwide rely heavily on DNA forensics to apprehend criminals and ensure public safety.

The paternity and familial testing segment is expected to show the fastest growth in the DNA forensics market during the forecast period. Paternity and familial testing, on the other hand, address issues related to biological relationships and familial lineage. Paternity testing is commonly used to determine biological parentage in legal disputes, child support cases, and inheritance claims. Similarly, familial testing is utilized to establish relationships between individuals in cases where direct biological samples are unavailable or inconclusive. These tests provide invaluable insights into family dynamics, legal rights, and medical histories, offering peace of mind and resolution in sensitive personal matters. The accuracy and sensitivity of DNA testing technologies make them indispensable tools in paternity and familial testing, ensuring reliable results and fostering trust in the outcomes.

By Solutions

By Method

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client