August 2024

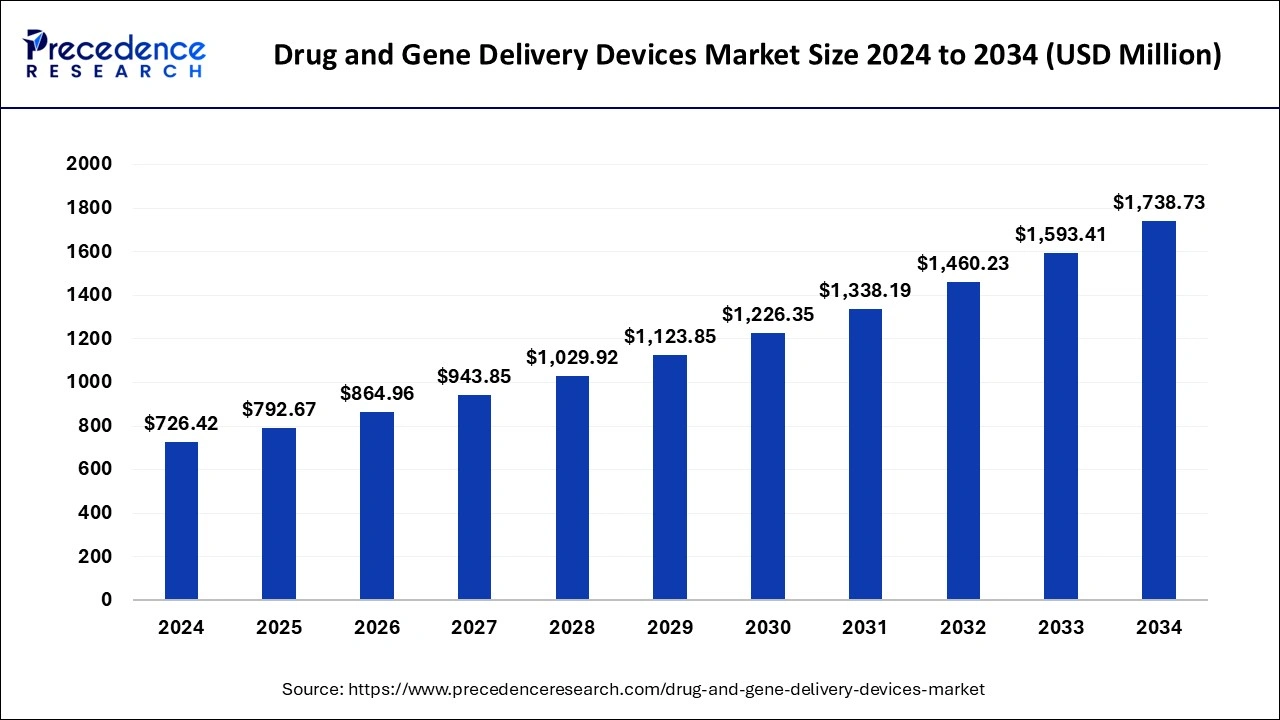

The global drug and gene delivery devices market size is calculated at USD 792.67 million in 2025 and is forecasted to reach around USD 1738.73 million by 2034, accelerating at a CAGR of 9.12% from 2025 to 2034. The North America drug and gene delivery devices market size surpassed USD 293.84 million in 2024 and is expanding at a CAGR of 9.13% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global drug and gene delivery devices market size was estimated at USD 726.42 million in 2024 and is anticipated to reach around USD 1,738.73 million by 2034, expanding at a CAGR of 9.12% from 2025 to 2034. The rising incidence of chronic diseases is a key factor driving the growth of the market. Moreover, technological innovations in gene therapy fuels market growth.

AI technology has the ability to transform drug and gene delivery devices, streamlining therapy and reducing side effects. Furthermore, AI algorithms help researchers predict drug release profiles and facilitate dosage regimens to get efficient therapies. AI-enabled devices monitor patient adherence to medication and provide real-time feedback, improving safety, reliability, and efficacy.

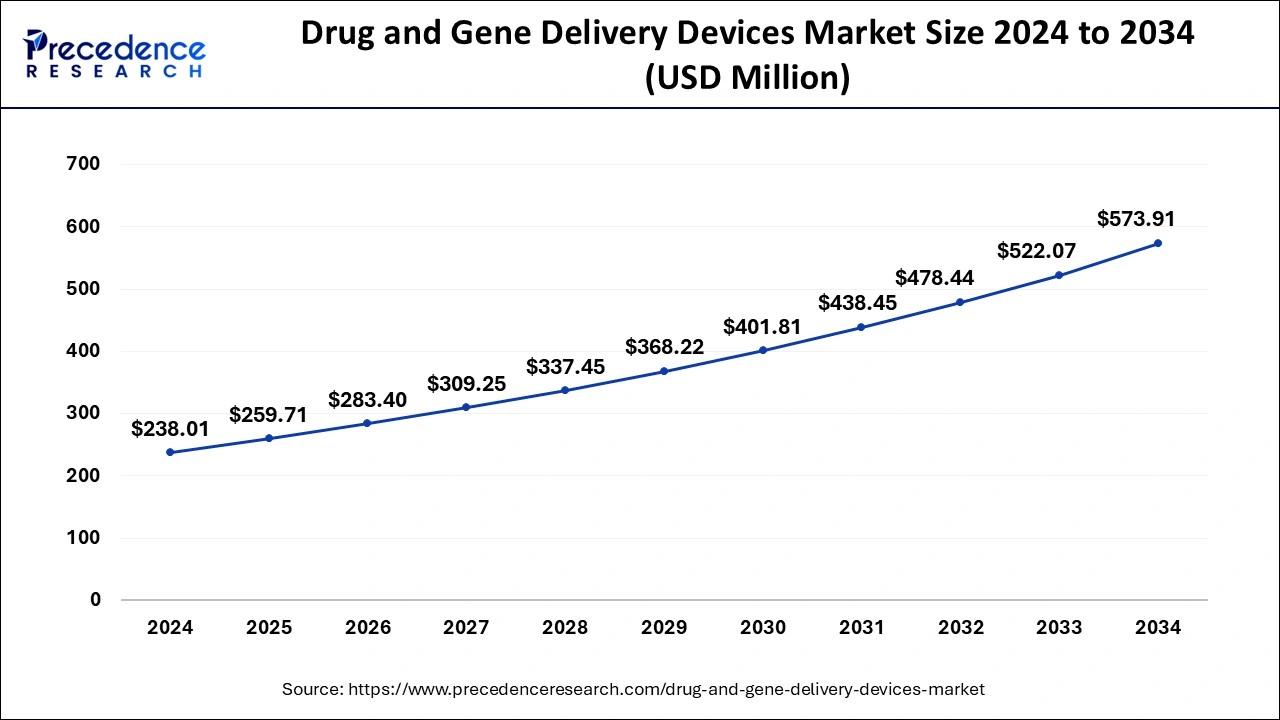

The U.S. drug and gene delivery devices market size was evaluated at USD 238.01 million in 2024 and is predicted to be worth around USD 573.91 million by 2034, rising at a CAGR of 9.20% from 2025 to 2034.

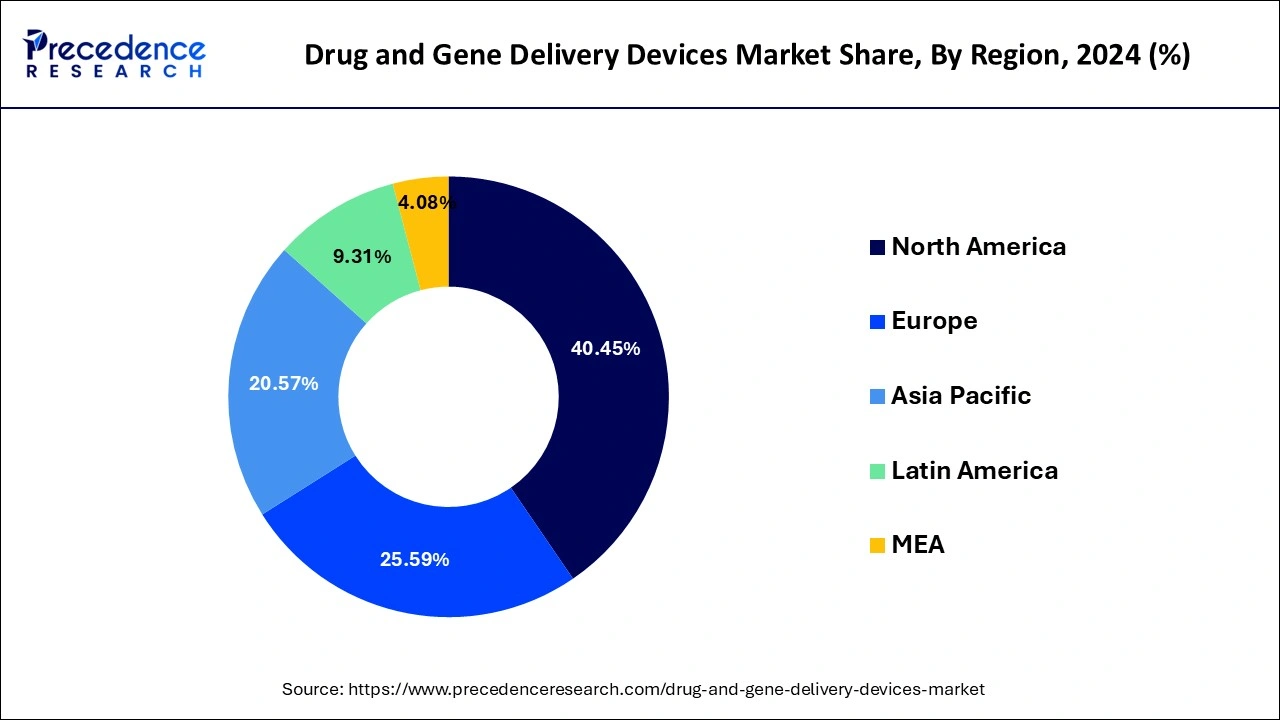

North America dominated the global drug and gene delivery devices market with the largest market share of 40.45% in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is attributed to the increased number of people suffering from various chronic diseases. According to a study, around 60% of the US population is suffering from at least one chronic diseases. Moreover, the development of various therapeutics and innovative drugs that can effectively treat chronic diseases and genetic diseases is fueling the demand for the drug and gene delivery devices market. Moreover, the rising popularity of personalized medicines may impact the market positively in the forthcoming years.

Asia Pacific is expected to grow at a solid CAGR of 10% during the forecast period. This is attributed to the rising prevalence of various chronic and infectious diseases, rapidly growing biopharmaceutical industry, presence of huge population, and rising prevalence of diseases caused by pollution owing to the rapid industrialization and urbanization.

The rising prevalence of various chronic diseases such as cancer, diabetes, cardiovascular diseases, and other chronic diseases coupled with the technological advancements in the drug delivery has propelled the growth of the global drug and gene delivery devices market. According to the International Agency for Research on Cancer The global cancer cases are estimated to grow by 47% from 2020 to 2040. It is expected that 28.4 million cases will be recorded in 2040, globally. Moreover, the increasing investments in the research and development by the top players in the field of genomics is driving the market growth. The shifting preferences of the patients and the doctors has propelled the demand for the drug and gene delivery devices. The introduction of auto injectors, biopharmaceutical classification systems, implants in customizable shapes and sizes, and smartcards and adaptive aerosol delivery systems have contributed significantly towards the development of the global drug and gene delivery devices market.

The rising adoption of the gene therapeutics and innovative drugs owing to the rising awareness regarding the availability of new drugs that can effectively cure the chronic diseases has fueled the demand for the drug and gene delivery devices. The rising investments in the research and development of the new drugs and therapies for treating the incurable diseases is among the significant drivers of the market. Moreover, the rapid growth of the biopharmaceutical industry across the globe is expected to play a crucial role during the forecast period. The presence of the numerous market players and the various strategies such as new product launches, acquisitions, mergers, and partnerships adopted by them highly influences the market growth. Therefore the rising penetration of the drug and gene delivery devices companies across the globe is boosting the market growth significantly.

| Report Highlights | Details |

| Market Size in 2025 | USD 792.67 Million |

| Market Size by 2034 | USD 1738.73 Million |

| Growth Rate From 2025 to 2034 | CAGR of 9.12% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Delivery Type, Method, Vector, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The oral segment has held the maximum market share of 53% in 2024 in terms of revenue and is estimated to sustain its dominance during the forecast period. The oral drug delivery is the most convenient and most popular route of administration all over the globe. It is economical, pain-free, and self-administered type of delivery where no sterile precautions are involved. Moreover, the development of various therapeutics that can identify the affected cell and can treat that cell without harming the normal cells is exponentially boosting the growth of this segment. Therefore, the rapid growth of the biosimilar, targeted therapeutics, and gene therapies had positively impacted the market growth in the past few years.

The injectable segment is expected to expand at a healthy CAGR of 11.2% during the forecast period. The technological advancements in the injectable devices has propelled the adoption of the self-injectable devices among the patients. The rising number of diabetic population is fostering the growth of this segment as the diabetic patient need to regularly inject insulin. The increasing popularity of the self-injectors, needle-free injectors, pen-injectors, and auto-injectors has allowed the patients to conveniently administer drugs from the convenience of their home, eliminating the medical assistance. All these factors are estimated to have a significant impact on the drug and gene delivery devices market and will foster the demand for the injectable segment in the forthcoming years.

Based on method, the in situ segment accounted largest revenue share in 2024 and is projected to remain its dominance during the forecast period. This can be attributed to the certain advantages associated with the in situ method such as low complication in fabrication and ease of drug administration. Moreover, the majority of the drugs that are currently used follows the in situ method.

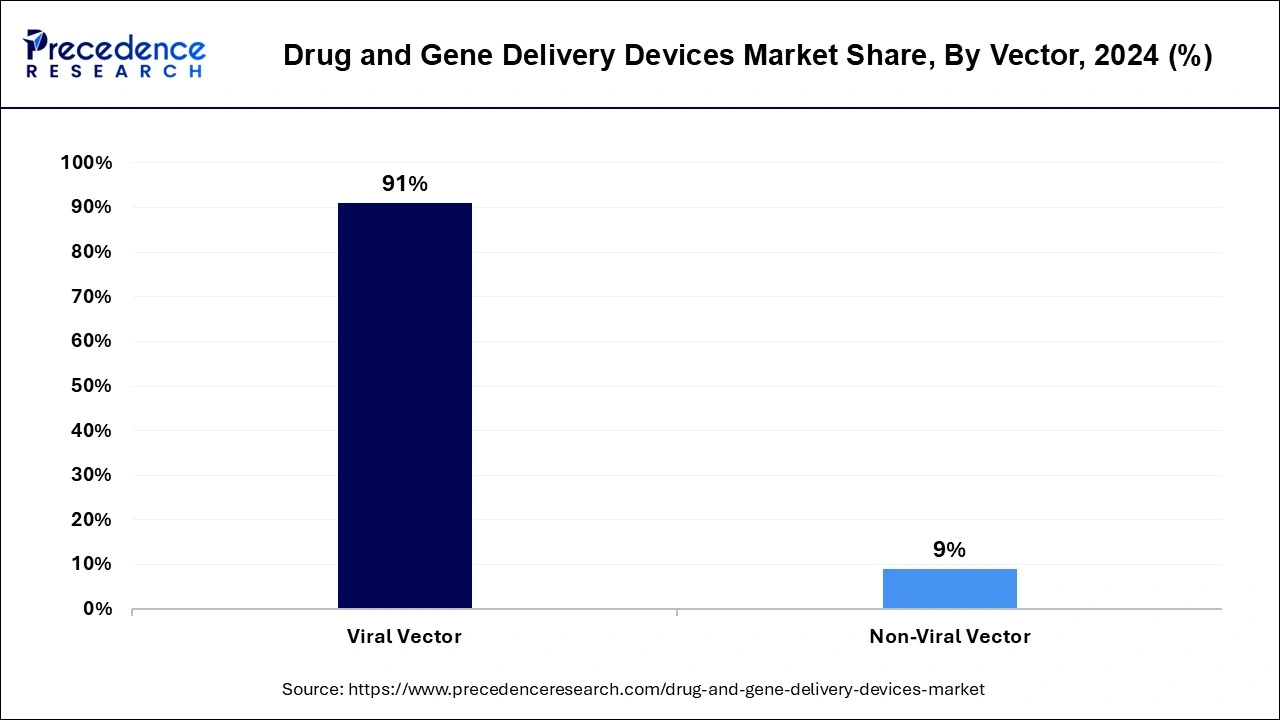

The viral vector segment contributed the highest market share of 91% in 2024. Most of the clinical trials that are based on the gene therapies are dependent on the viral vectors for transfection. The rising prevalence of the genetic diseases is the major factors that boosts the growth of this segment. The extensive usage of viral vectors in the treatment of various chronic diseases has fueled the segment’s growth in the past few years.

The non-viral vector segment is projected to grow at a healthy CAGR of 12.3% during the forecast period. This can be attributed to the increasing number of clinical trials related to cardiovascular diseases that uses non-viral vectors as the gene transfer mode. The rising number of cardiovascular diseases among the global population is expected to foster the growth of this segment.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

The various developmental strategies like acquisitions and mergers fosters market growth and offers lucrative growth opportunities to the market players.

By Delivery Type

By Method

By Vector

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

June 2023

November 2024

January 2025