August 2024

Drug Discovery Informatics Market (By Service: Sequence Analysis Platform, Molecular Modeling, Clinical Trial Data Management, Docking; By End-User: Pharmaceutical and Biotechnological Companies, Contract Research Organization (CRO)) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

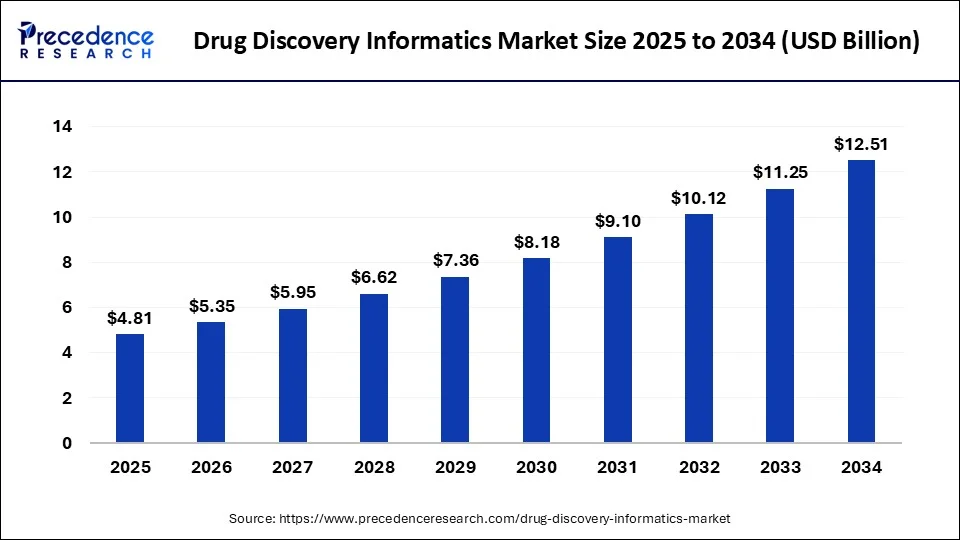

The global drug discovery informatics market size was USD 3.89 billion in 2023, accounted for USD 1.05 billion in 2024, and is expected to reach around USD 12.51 billion by 2034, expanding at a CAGR of 11.2% from 2024 to 2034. The North America drug discovery informatics market size reached USD 1.56 billion in 2023. The increasing prevalence of chronic diseases and the rising use of informatics solutions in drug discovery are driving the growth of the drug discovery informatics market.

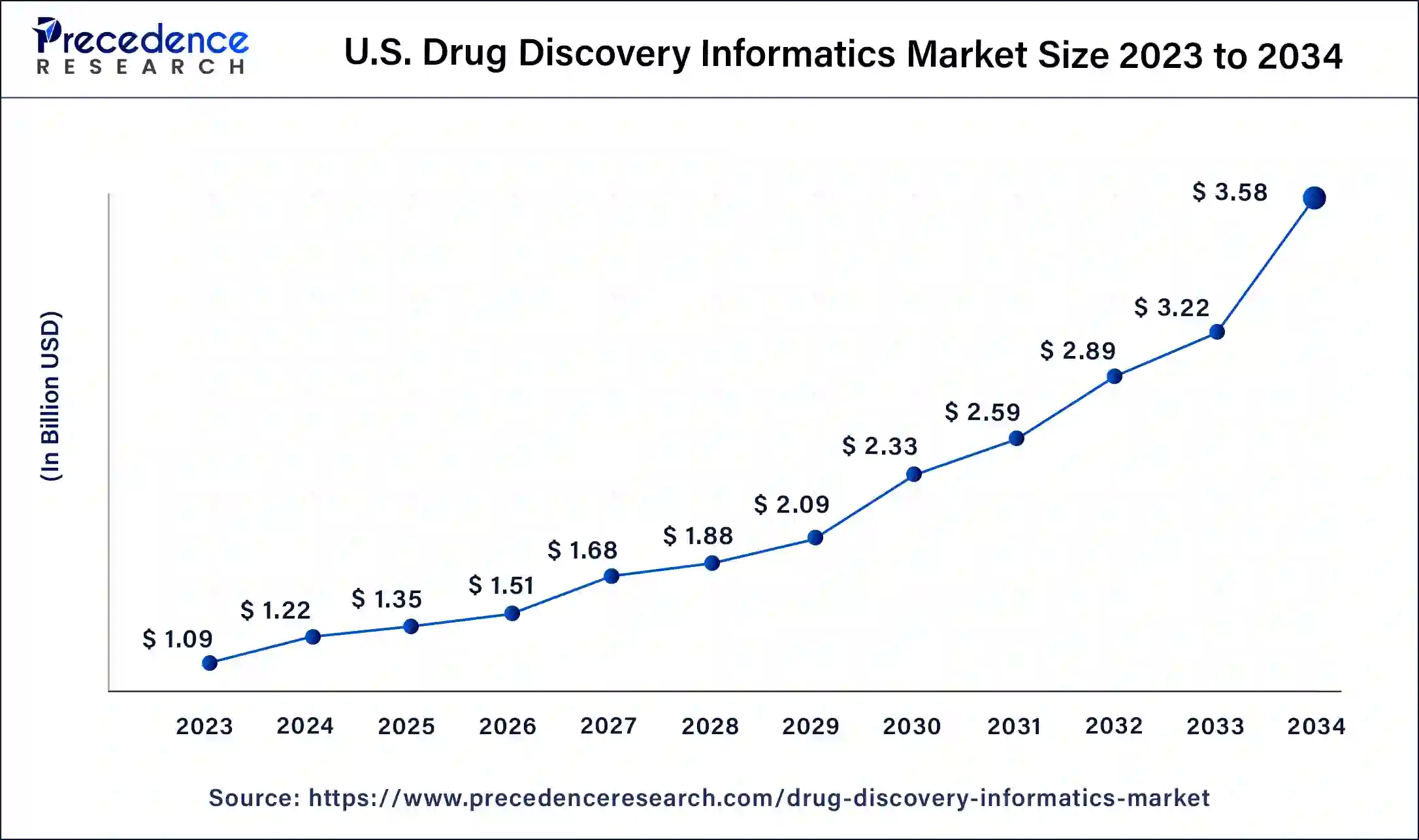

The U.S. drug discovery informatics market size was estimated at USD 1.09 billion in 2023 and is predicted to be worth around USD 3.58 billion by 2034, at a CAGR of 11.4% from 2024 to 2034.

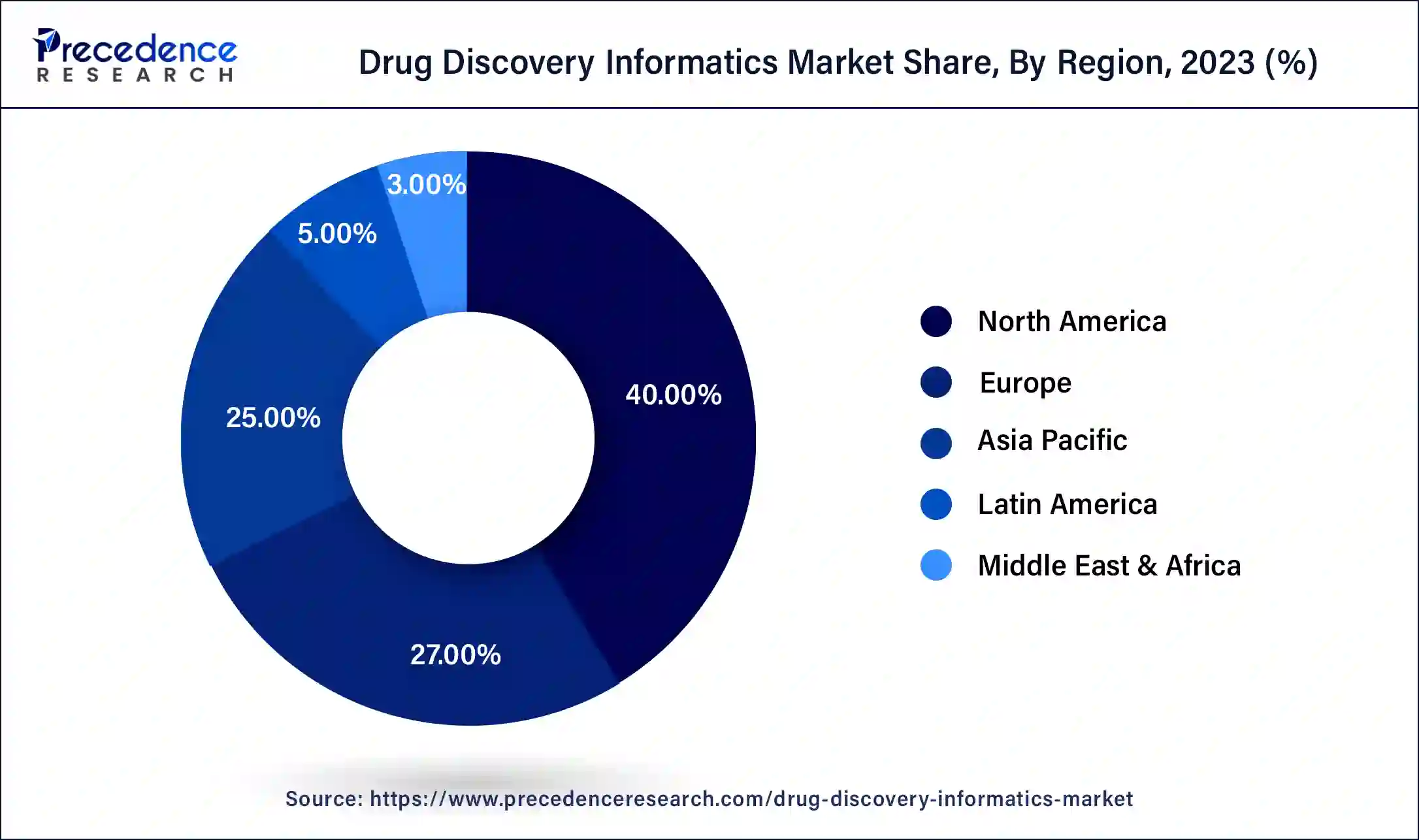

North America dominated the drug discovery informatics market with a 40% market share in 2023. The dominance of the region in the market is attributed to the established healthcare infrastructure, and investment in the research and development activities on drug development and the advancement in the data mining, analytics technologies. Technological developments in the area have enhanced the analysis quality of the large volume of data which accelerated the growth of the drug discovery informatics market. The increasing demand for precision medicines in North America has also contributed to the growth of the market in the region.

Asia Pacific is expected to witness significant growth in the market at a CAGR of 11.9% during the forecast period. The growth of the market in the region is attributed to the rising population and the increasing demand for the healthcare services. Many major market players and the regional governments are significantly investing the technological development in the pharmaceutical as well as in the biotechnological industries for efficiency in drug development and discovery which accelerates the growth of the market. The rise in the geriatric population and increasing prevalence of chronic diseases among the people leads to a higher demand for precision medicines which is fueling the demand for the drug discovery informatics market across the region.

Discovering treatments for certain diseases or patient demographics generates massive data for medical scientists. The drug discovery informatics market focuses on developing systems that can handle enormous amounts of clinical trial and treatment data more effectively. Such services enable more effective handling of large datasets from diverse sources by academics. This ultimately results in a quicker cycle time for the development of effective therapies.

The developments in web services and high-performance computing, the expanding use of in-silico modeling tools, the volume of drug discovery data, and the growing need for novel therapeutic compounds are all expected to propel the market's growth. Increasing cases of chronic diseases and the demand for precision medicines drives the growth of the drug discovery informatics market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 11.2% |

| Global Market Size in 2023 | USD 3.89 Billion |

| Global Market Size in 2024 | USD 4.33 Billion |

| Global Market Size by 2034 | USD 12.51 Billion |

| U.S. Market Size in 2023 | USD 1.09 Billion |

| U.S. Market Size by 2034 | USD 3.58 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Service and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

AI in drug discovery and development

Artificial intelligence is the most emerging technology that is gearing up applications in various sectors, including the pharmaceutical industry. There are various uses of AI in pharmaceutical applications such as drug repurposing, improving pharmaceutical productivity, drug discovery and development, clinical trials, etc. AI algorithms optimize experimental design and parameter selection in drug discovery workflows, reducing the time and resources required for preclinical and clinical studies. Through adaptive learning and optimization techniques, AI expedites the iterative process of hypothesis testing and validation, accelerating drug development timelines. Artificial intelligence used in drug discovery and development opens potential for the drug discovery informatics market.

Higher cost

The increased cost and setup of the informatics software are restraining from adopting the market by middle and small-scale firms limiting the growth of the drug discovery and informatics market. The implementation of informatics solutions in drug discovery processes often requires substantial financial investments, including the acquisition of software, hardware, and specialized expertise. Additionally, the integration of informatics platforms with existing research infrastructure and workflows can further escalate expenses. These higher costs pose a barrier for many organizations, particularly smaller biotech firms and academic institutions with limited budgets.

Advancements in cloud computing

Increasing technological advancements such as new analytics and cloud-based technology open multiple opportunities for drug discovery informatics market. Cloud-based technology enables low-cost storage, analysis of larger data, and processing. Additionally, computational drug discovery uses the integration of artificial intelligence and cloud computing to enhance the drug discovery process in cost cost-effective manner. Major pharmaceutical companies have recently planned using cloud computing for the storage of data, management, and processing which is accelerating the growth of the market.

The sequence analysis platform segment dominated the drug discovery informatics market with the largest share in 2023. The increasing use of sequence analysis in drug discovery informatics for target discovery sequencing accelerated the demand for the segment in the market. Bioinformatics solution is highly adopted for the development of primary and secondary databases of proteins, nucleic acids, and other biomolecular sequences.

Sequence analysis platforms are indispensable tools in drug discovery, allowing researchers to analyze genetic sequences and identify potential drug targets, biomarkers, and therapeutic interventions. These platforms play a crucial role in understanding disease mechanisms and designing targeted therapies, driving their widespread adoption in drug discovery informatics.

The molecular modeling segment is observed to witness a significant growth rate during the forecast period of 2024-2034. Molecular modeling techniques offer a cost-effective alternative to traditional drug discovery methods by significantly reducing the need for experimental assays and laboratory testing. This allows researchers to explore a wide range of drug candidates in silico before investing resources in experimental validation.

Molecular modeling accelerates the drug discovery process by rapidly screening and prioritizing potential drug candidates based on their molecular interactions with target proteins. This enables researchers to identify promising leads more efficiently and expedite the development timeline.

The pharmaceutical and biotechnology companies segment dominated the drug discovery informatics market in 2023. The dominance of the segment is attributed to the wider adoption of informatics in the pharmaceutical industries for target identification, processing, compound screening, and maintaining the drug development process. The increasing research and development activities and the strategic partnership between the major market players for innovation in drug discovery and development are contributing to the growth of the segment.

The contract research organization segment is expected to grow in the market during the forecast period. The contract research organization is the company that offers clinical trial services for the biotechnology, pharmaceutical, and medical devices industries. The CRO offers the services of several applications in the healthcare industry such as clinical trial planning, regulatory affairs, recruitment support, site selection and initiation, data management, clinical monitoring, biostatistics, trail logistics, project management, and medical writing.

Market Segmentation

By Service

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

June 2023

January 2025

November 2024