April 2025

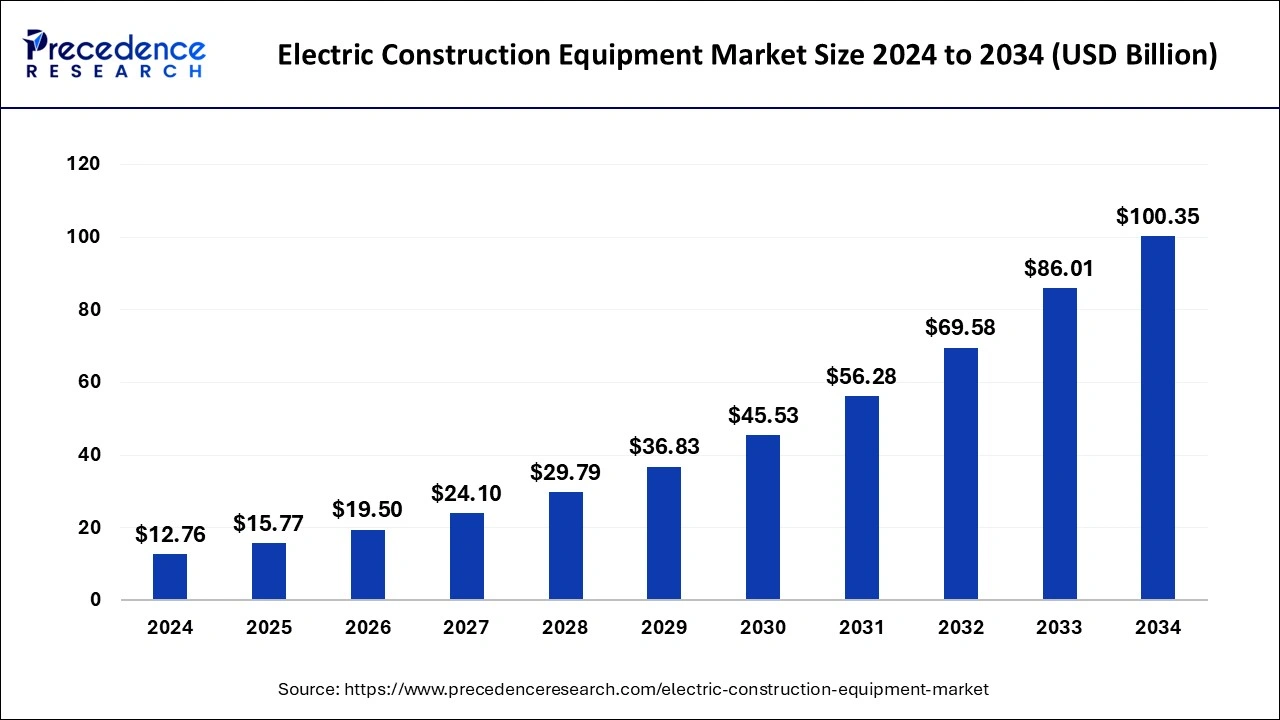

The global electric construction equipment market size was estimated at USD 12.76 billion in 2024 and is predicted to increase from USD 15.77 billion in 2025 to approximately USD 100.35 billion by 2034, expanding at a CAGR of 22.90% from 2025 to 2034.

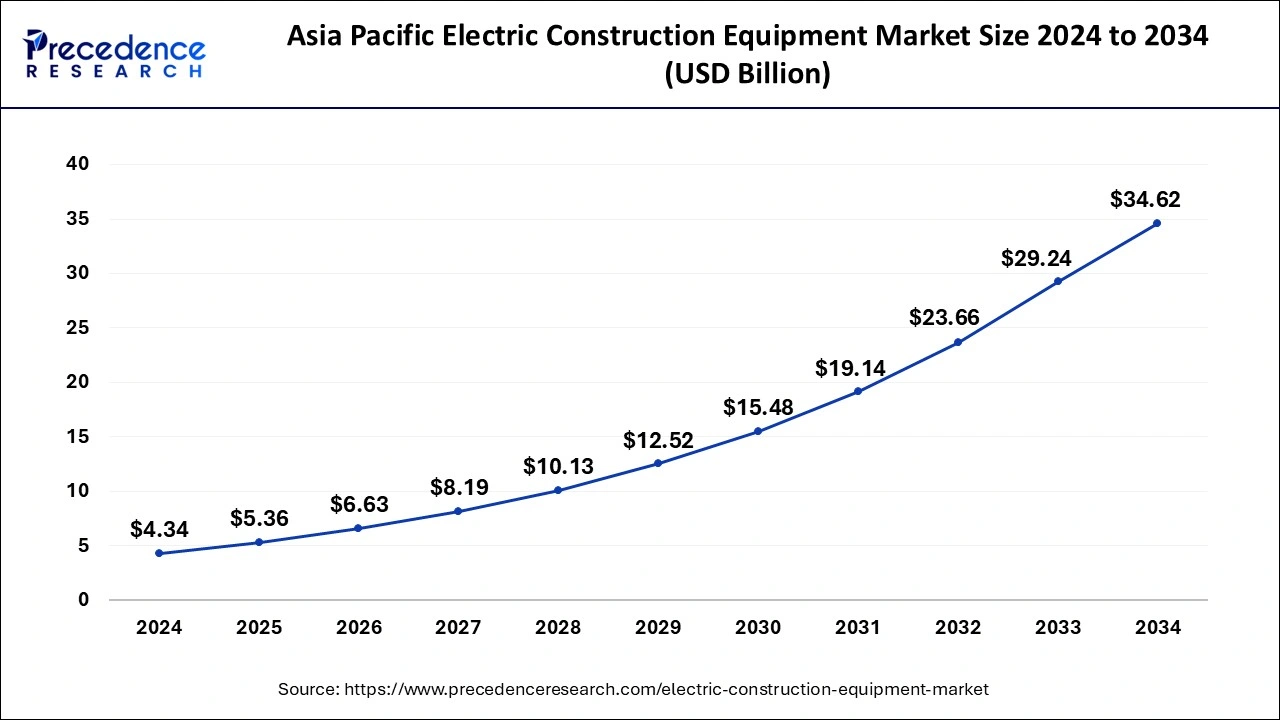

The Asia Pacific electric construction equipment market size was estimated at USD 4.34 billion in 2024 and is projected to surpass around USD 34.62 billion by 2034 at a CAGR of 23.08% from 2025 to 2034.

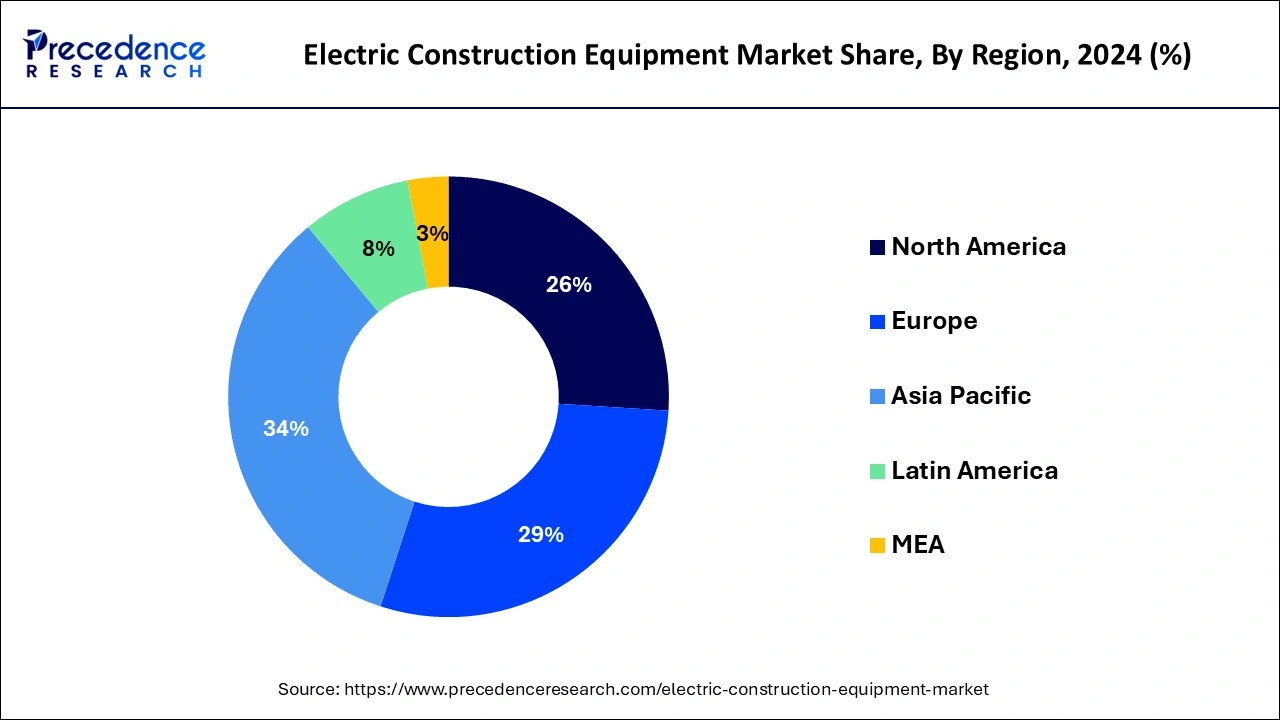

Asia-Pacific held a share of 34% in the electric construction equipment market in 2024 due to several factors. The region experiences rapid urbanization, leading to increased construction activities and infrastructure development. Additionally, governments in countries like China, India, and Japan are implementing stringent regulations to curb pollution, driving the adoption of electric construction equipment. Moreover, Asia-Pacific has a robust manufacturing sector, facilitating the production and distribution of electric machinery. The region's large population and rising disposable income further contribute to the demand for sustainable and efficient construction equipment, cementing its significant market share.

North America is experiencing rapid growth in the electric construction equipment market due to several factors. Firstly, stringent environmental regulations are driving the demand for cleaner, emissions-free construction equipment. Additionally, the region's advanced technological infrastructure supports the development and adoption of electric machinery. Moreover, increasing awareness of sustainability and the benefits of electric equipment among construction companies and government initiatives promoting renewable energy contribute to the market's growth. Finally, incentives and subsidies offered by governments further incentivize the transition towards electric construction equipment, fueling its rapid expansion in North America.

Meanwhile, Europe is experiencing notable growth in the electric construction equipment market due to several factors. Stringent environmental regulations, coupled with increasing sustainability initiatives, are driving the adoption of electric machinery. Additionally, advancements in battery technology and government incentives further promote the shift towards electric construction equipment. Rising fuel costs and growing public awareness of environmental impact also contribute to the market's expansion. As a result, construction companies in Europe are increasingly embracing electric alternatives to traditional fuel-powered machinery to meet sustainability goals and reduce carbon emissions.

The electric construction equipment market offers solutions in the form of machinery used in construction and excavation projects that operate using electricity rather than traditional fuel sources like diesel or gasoline. These machines utilize electric motors powered by rechargeable batteries to perform various tasks such as digging, lifting, and moving materials on construction sites. By employing electric power, this equipment produces zero emissions during operation, making them environmentally friendly alternatives to conventional diesel-powered machinery.

Additionally, electric construction equipment often produces less noise pollution compared to their fuel-powered counterparts, contributing to quieter and more pleasant working environments. The adoption of electric construction equipment is steadily increasing due to growing concerns about environmental impact and the desire for more sustainable construction practices. As technology continues to advance, electric machinery is becoming more efficient, cost-effective, and widely available, offering construction companies a greener and more sustainable option for their projects.

Electric Construction Equipment Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 22.90% |

| Market Size in 2025 | USD 15.77 Billion |

| Market Size by 2034 | USD 100.35 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Vehicles, By Source, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Government incentives and subsidies

Government incentives and subsidies play a crucial role in boosting the market demand for electric construction equipment. These incentives typically come in the form of financial assistance, tax breaks, or rebates offered by governments to businesses and individuals investing in environmentally friendly machinery. By providing financial support, governments aim to encourage the adoption of electric construction equipment, which helps to reduce carbon emissions and mitigate environmental impact. These incentives make electric construction equipment more affordable and economically attractive for businesses, as they offset some of the initial higher costs associated with purchasing electric machinery compared to traditional fuel-powered alternatives. As a result, construction companies and contractors are more inclined to invest in electric equipment, leading to increased market demand.

Additionally, government subsidies create a favorable business environment for manufacturers and suppliers of electric construction equipment, stimulating innovation and technological advancements in the industry. Overall, government incentives and subsidies act as powerful drivers in accelerating the transition towards sustainable construction practices and promoting the widespread adoption of electric construction equipment.

Concerns about equipment durability and longevity

Concerns about equipment durability and longevity act as significant restraints on the market demand for electric construction equipment. Some potential buyers hesitate to invest in electric machinery due to uncertainties surrounding the durability and lifespan of these newer technologies. Construction companies rely heavily on their equipment to withstand harsh working conditions and maintain high levels of productivity over extended periods. If there are doubts about the durability of electric construction equipment or concerns about its ability to endure heavy usage, businesses may opt to stick with traditional fuel-powered machinery that has a proven track record.

Additionally, the perception that electric construction equipment may require more frequent repairs or replacements compared to their diesel counterparts can deter potential buyers. Businesses are wary of potential downtime and maintenance costs associated with less durable electric equipment, which could impact project timelines and overall profitability. Until electric construction equipment can demonstrate comparable durability and longevity to traditional machinery, concerns in this area will continue to restrain the market demand for electric alternatives.

Growth of rental and leasing services for electric equipment

The growth of rental and leasing services for electric equipment presents significant opportunities in the electric construction equipment market. Rental and leasing options allow businesses to access electric machinery without the need for a substantial upfront investment, making it more accessible to a wider range of construction companies. This lowers the barrier to entry for adopting electric equipment, particularly for smaller firms or those hesitant to make a long-term commitment to purchasing new machinery.

Furthermore, rental and leasing services offer flexibility and scalability to construction businesses, enabling them to adjust their equipment fleet according to project requirements and demand fluctuations. As more rental companies add electric construction equipment to their offerings, it increases exposure and familiarity with these technologies among contractors and encourages trial usage. This, in turn, can drive broader acceptance and adoption of electric machinery within the construction industry, fostering growth and expansion opportunities for manufacturers and rental service providers alike.

The excavators segment held the highest market share of 30% based on the vehicles. In the electric construction equipment market, the excavators segment refers to machinery used for digging, lifting, and moving materials on construction sites. Trends in this segment include a shift towards electric-powered excavators, driven by increasing environmental concerns and regulatory pressure to reduce emissions. Electric excavators offer zero-emission operation, lower operating costs, and quieter performance compared to traditional diesel models. As technology improves and charging infrastructure expands, the adoption of electric excavators is expected to continue growing in the construction industry.

The cranes segment is anticipated to witness rapid growth at a significant CAGR of 25.2% during the projected period. In the electric construction equipment market, cranes refer to heavy machinery used for lifting and moving materials on construction sites. A notable trend in this segment is the increasing adoption of electric-powered cranes due to their lower emissions and operational costs compared to traditional diesel-powered counterparts. Electric cranes leverage advanced battery technology and electric motors to provide efficient and environmentally friendly lifting solutions. This trend aligns with the broader industry shift towards sustainability and green construction practices.

The lithium-ion segment held a 44% market share in 2024. The lithium-ion battery segment in the electric construction equipment market refers to machinery powered by rechargeable lithium-ion batteries. These batteries offer higher energy density, longer lifespan, and faster charging capabilities compared to traditional lead-acid batteries. As technology advances, lithium-ion batteries are becoming more cost-effective and efficient, driving their widespread adoption in electric construction equipment. Additionally, advancements in battery management systems and safety features contribute to the growing popularity of lithium-ion batteries, making them a key trend in the market.

The lead-acid segment is anticipated to witness rapid growth over the projected period. The lead-acid battery segment in the electric construction equipment market refers to batteries that utilize lead plates immersed in an acidic electrolyte solution to store and discharge electrical energy. Despite being one of the oldest battery technologies, lead-acid batteries continue to find applications in electric construction equipment due to their affordability and reliability. However, there is a growing trend towards the adoption of more advanced lithium-ion batteries in the industry, driven by their higher energy density, longer lifespan, and superior performance.

The construction segment has held a 32% market share in 2024. The construction segment in the electric construction equipment market refers to the industry sector that utilizes machinery and equipment for various construction activities such as building, infrastructure development, and earthmoving projects. Trends in this segment include a growing preference for electric machinery due to environmental concerns, tightening regulations, and cost-saving opportunities. Construction companies are increasingly adopting electric excavators, loaders, and other equipment to reduce emissions, lower operating costs, and align with sustainability goals.

The industrial segment is anticipated to witness rapid growth over the projected period. The industrial segment in the Electric Construction Equipment market refers to the use of electric machinery in various industrial applications such as manufacturing, warehousing, and logistics. A notable trend in this segment is the increasing adoption of electric forklifts, pallet jacks, and other material handling equipment to enhance efficiency and reduce carbon emissions within industrial facilities. Companies are increasingly prioritizing sustainability and seeking electric alternatives to traditional fuel-powered machinery to align with environmental goals and regulations.

Case Construction

Greaves Retail

Volvo CE

By Vehicles

By Source

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

June 2025

June 2025

August 2024