December 2024

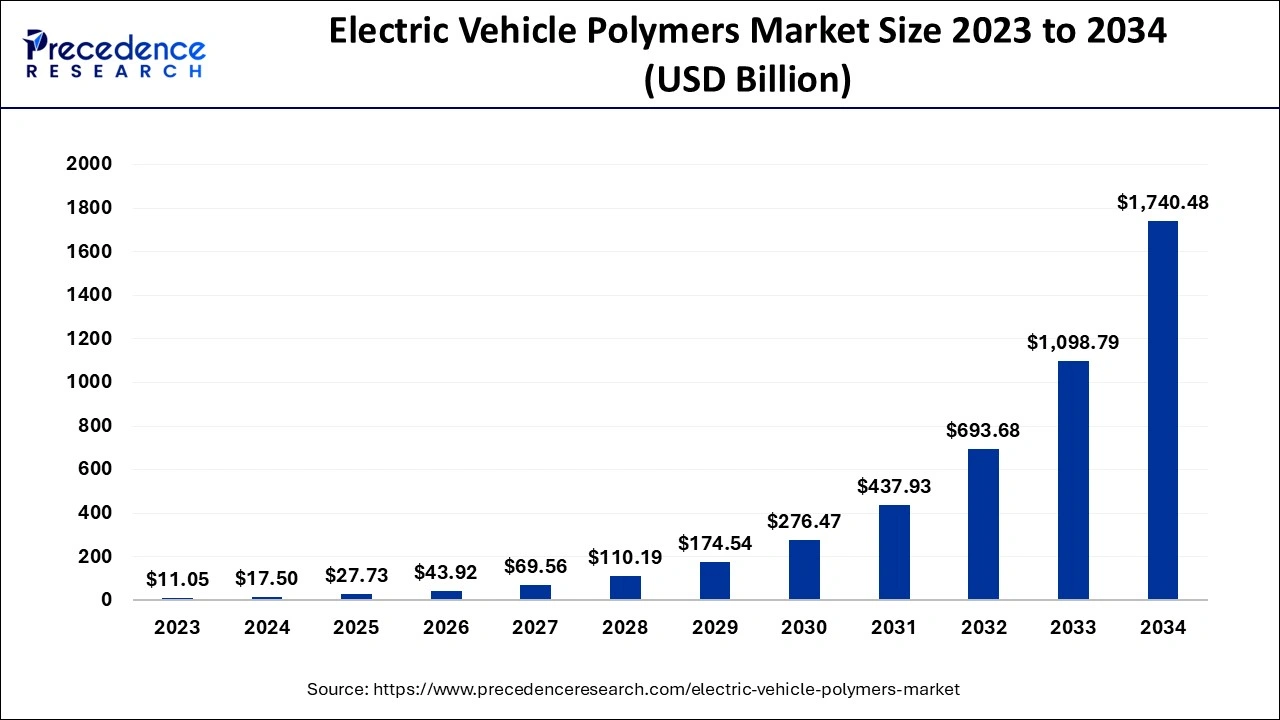

The global electric vehicle polymers market size accounted for USD 17.50 billion in 2024, grew to USD 27.73 billion in 2025 and is predicted to surpass around USD 1740.48 billion by 2034, representing a healthy CAGR of 58.40% between 2024 and 2034.

The global electric vehicle polymers market size is estimated at USD 17.50 billion in 2024 and is anticipated to reach around USD 1740.48 billion by 2034, expanding at a CAGR of 58.40% from 2024 to 2034.

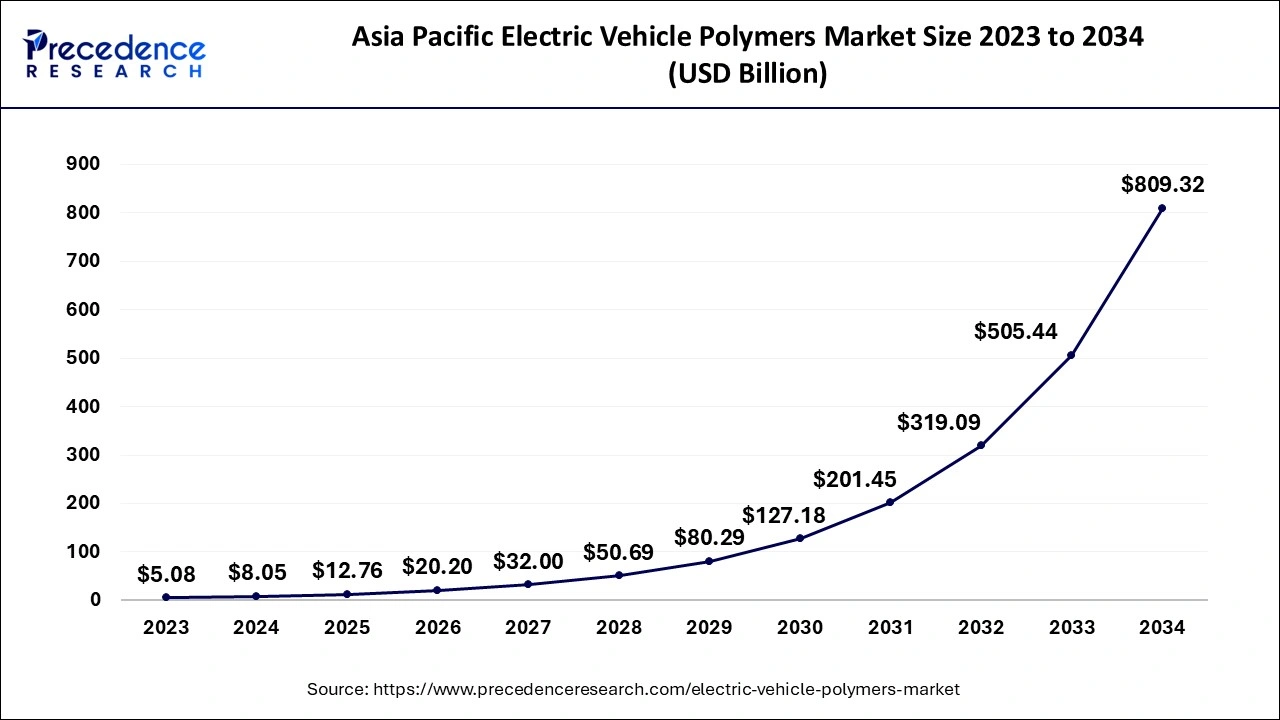

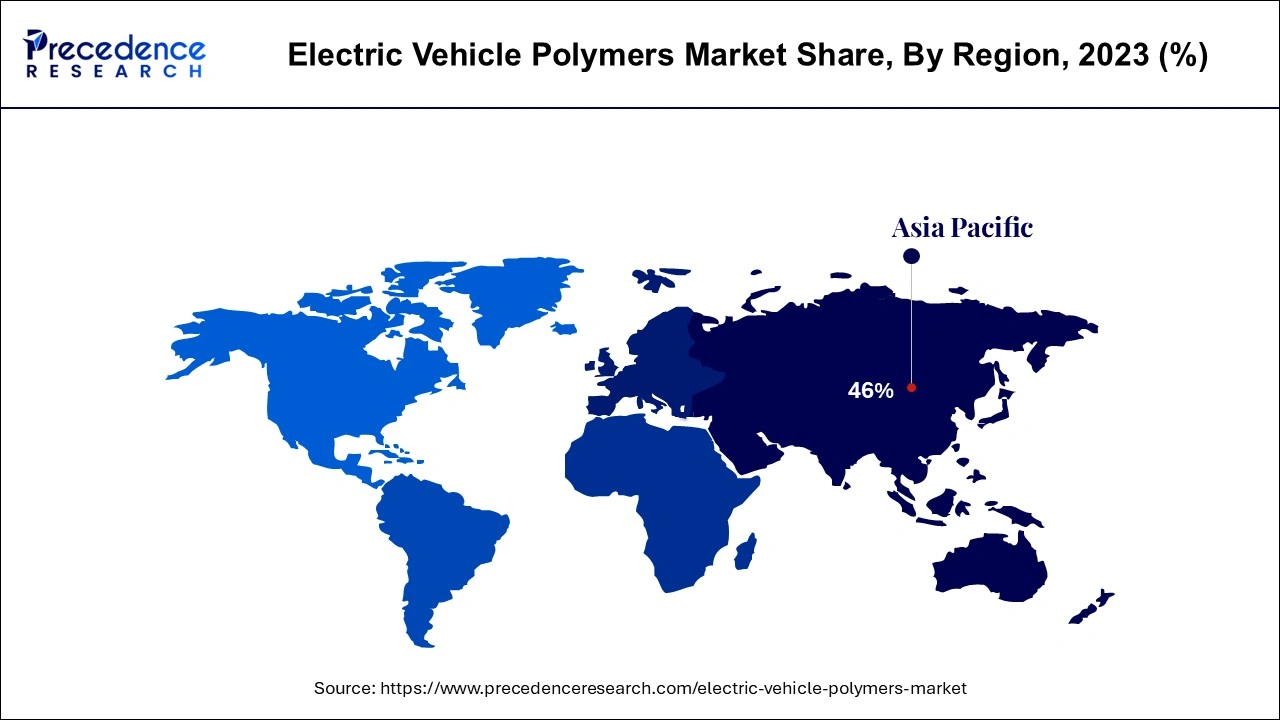

The Asia Pacific electric vehicle polymers market size is evaluated at USD 8.05 billion in 2024 and is predicted to be worth around USD 809.32 billion by 2034, rising at a CAGR of 58.56% from 2024 to 2034.

During the projected period, the Asia-Pacific region is anticipated to lead the global market for polymers used in electric vehicle (car) manufacturing. Due to the rapid increase in the manufacture of electric automobiles in countries like China, Japan, and South Korea, among others, the area has become the largest user of electric vehicle (car) polymers. The primary drivers driving the expansion of the market for electric vehicle (car) polymers in the Asia-Pacific region are the rising concern for decreasing carbon footprints, growing government backing, and decrease in the total weight of electric automobiles. During the projection period, North America and Europe are also anticipated to present potential development possibilities.

Electric vehicle polymers are the types of plastics used in electric vehicles to lighten them up without sacrificing performance. Only materials that can replace metals are polymers since they share many of their characteristics, including heat resistance, abrasion resistance, stiffness, and toughness. For the makers of electric vehicles, replacing metals with polymers is a crucial strategy for reducing the total weight of the vehicles. A vehicle's heavy weight is a major obstacle to running entirely on electricity for a lengthy period of time, however some lighter materials can lower a vehicle's weight without compromising its strength and endurance. Whether a vehicle is using gasoline or electricity as fuel, its total weight may be decreased to increase fuel efficiency.

Electric vehicles (EVs) are more effective for daily use since lighter cars can go farther with fewer batteries. Long-term performance, weight reduction, and improved fuel economy are all provided by polymers. Over the past several years, polymer technology has advanced quickly, expanding the range of applications for it in the automobile industry. Over the course of the projection period, the market will see revenue growth due to strict laws aimed at reducing vehicle emissions and rising consumer demand for lightweight and fuel-efficient vehicles.

Additionally, a lithium-ion battery pack made of an innovative polymer can boost battery power, guarantee temperature stability, and expand EV range on a single charge. These battery packs help protect car batteries from any negative events. The market for electric vehicle (car) polymers is primarily driven by the rising demand for electric vehicles in the emerging economies of the Asia-Pacific region, including China and India, the rapid escalation of governmental regulations aimed at reducing CO2 emissions, and the development of EV charging infrastructure in both developing and developed countries.

Demand for electric vehicle (car) polymers is rising as consumer taste for battery-powered, lightweight vehicles shifts, which is increasing market revenue growth. Government regulations that are encouraging and beneficial as well as incentives for EV owners have boosted the use of electric vehicles. In addition, the development of a wide range of electric automobiles with cutting-edge features and innovations is anticipated to increase demand for polymers, supporting the expansion of the worldwide electric vehicle (car) polymers market. However, changes in the price of polymer raw materials may partially restrain the market's revenue expansion for electric vehicle (car) polymers.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.50 Billion |

| Market Size by 2034 | USD 1740.48 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 58.40% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, End User, Type, and Geography |

The interior section of components is undergoing a considerable shift as metals are being replaced by polymers, which have reduced accident risk and safety concerns. As a result, the interiors of electric cars now use polymers rather than metals, which also helps to lighten the total weight of electric vehicles. Due to its durability, aesthetic appeal, and ability to dampen noise, vibration, and harshness (NVH), polymer has proven to be the best material for automotive interior parts. During the projection period, all of these elements are anticipated to fuel the segment's expansion.

Due to increased PHEV sales globally, which are fueling high demand for polymers, the plug-in hybrid electric vehicles category is anticipated to show a consistent CAGR in the global EV (car) polymers market over the forecast period. Vehicles that are plug-in hybrids provide a choice of fuels and can run on both internal combustion engines and electric motors. PHEV cars may run on conventional fuel or alternative fuel sources, such batteries and gasoline. In this market, polymers are in great demand because to the widespread use of polymer technologies, particularly carbon fibre for PHEV inside and exterior components.

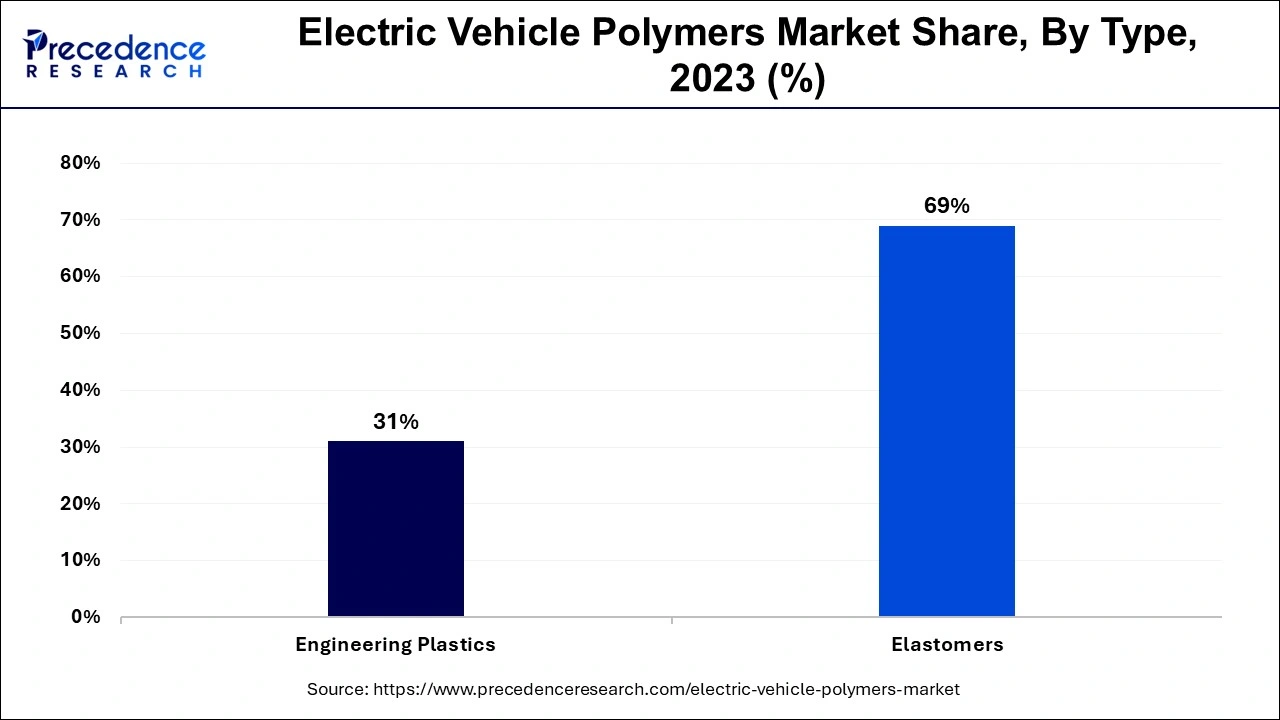

Due to the widespread use of elastomers in different vehicle components including the braking system, chassis, tires, and interior portions of vehicles, the elastomers segment is anticipated to see a substantially quick rate of revenue growth over the projected period. The use of elastomers in the aforementioned sections improves force and impact resistance in both hot and low temperatures. The infrastructure for electric vehicles is still in its infancy, but it is driving the quick development of elastomeric materials that can survive extreme weather conditions. Additionally, the need for elastomers in electric cars is growing, which drives businesses to create new products. For instance, Freudenberg Sealing Technologies created thermally conductive elastomers for EVs in July 2020.

Due to the growing usage of engineering plastics by original equipment manufacturers to provide consumers with sophisticated EVs, the engineering plastics segment revenue is anticipated to account for the biggest revenue share in the worldwide market during the projected period. OEMs create items and sell them with some or all customised attributes such great machinability, dimensional stability, strength and safety, and design flexibility. Additionally, a few of the biggest OEM producers worldwide set an electrification objective by 2034.

By Component

By End User

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

March 2025

August 2024