January 2025

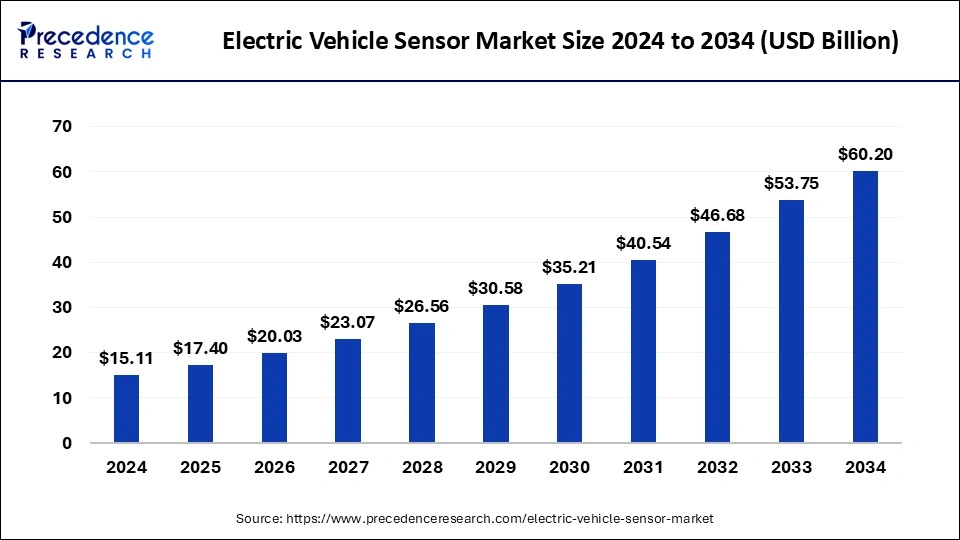

The global electric vehicle sensor market size is calculated at USD 17.40 billion in 2025 and is forecasted to reach around USD 60.20 billion by 2034, accelerating at a CAGR of 14.82% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electric vehicle sensor market size was estimated at USD 15.11 billion in 2024 and is predicted to increase from USD 17.40 billion in 2025 to approximately USD 60.20 billion by 2034, expanding at a CAGR of 14.82% from 2025 to 2034. The rise in adoption of electric vehicles due to the rising concern about the depleting fossil fuels and environmental pollution that accelerate the demand for the market.

Sensors are technologically advanced electronic devices that are used in advanced cars. Sensors are one of the essential parts of the electric vehicle, it can used to monitoring the various parameters in the vehicles such as coolant system, temperature, obstacles, faults, and alerting driver and signaling to the ECU (electronic control unit) to take informed decisions. The adoption of electronic vehicles by the population due to the rising concern towards the increasing carbon footprint in the environment that directly impacting the demand for the electric vehicle sensors that plays an important role in the safety of and performance of vehicle. Thus, all these factors are driving the growth of the electric vehicle market.

| Report Coverage | Details |

| Market Size by 2034 | USD 60.20 Billion |

| Market Size in 2025 | USD 17.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.82% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Propulsion, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising popularity of benefits associated with the automotive sensors

Sensors are one of the essential parts of the electric vehicles used in monitoring and measuring the safety standards and enhancing the performance of the car. Sensors are critical to supporting the advanced driver assistance system (ADAS), battery and thermal management, and personalizing in-cabin experiences. Sensors play a crucial role in the ADAS facilities in several automated functions such as lane-keeping assistance, adaptive cruise control, collision avoidance, emergency braking, and total safe driving.

It helps enhance safety systems, including object detection capabilities and high-resolution 3D mapping. Sensors are used in road signals and signs; they detect and identify road signs, traffic lights, and cones to help comply with traffic laws and adopt dynamic road conditions. Furthermore, it determines the lane boundaries, traffic, pedestrians, and parking. The complex motion sensors on electric vehicles also deliver tailored, seamless in-cabin experiences, such as gesture recognition sensors providing passenger and driver touch-less infotainment interaction. Thus, all these benefits are accelerating the electric vehicle sensor market adoption.

High cost of production

EV sensors are essential for the optimal functioning of various systems in electric vehicles, including battery management, autonomous driving, safety features, and more. These sensors require cutting-edge technology and materials, which are often expensive to develop and produce. The high precision and reliability needed for these sensors further add to their production costs. The higher cost of electric vehicles as compared to gasoline vehicles due to the integration of modern tools and technologies in electric vehicles are limiting the expansion of the electric vehicle sensor market.

Rising competition in the electric vehicle market

The increasing development in the automobile industry and the demand for environmentally friendly and sustainable mobility options drive the demand for electric vehicles. The rising concern about global warming is due to the increasing number of gasoline-based vehicles that release many carbon footprints into the environment and the primary cause of the rising global warming that anticipated the higher demand for electric vehicle adoption. The growing intervention of the major automobile players in the EV segment, considering the preference change in the population and the trends towards sustainability, drives the market for electric vehicles. The rising demand for electric cars drives the demand for the associated technologies such as IoT, sensors, AI, and others, further contributing to the growth opportunity in the electric vehicle sensor market.

The temperature sensor segment dominated the electric vehicle sensor market with the largest market share in 2024. The segment is expected to sustain its position in the market during the forecast period. Temperature sensors are one of the vital parts of electric vehicles; they are used to monitor and control the car's inner temperature and ensure the vehicle's safety and performance. The temperature sensor is the mandatory technology widely adopted by electric cars. Thus, the rising demand for electric vehicles and the increasing competition in automobile manufacturing firms drive the demand for temperature sensors.

The motion sensor segment is observed to grow at a significant rate in the electric vehicle sensor market during the forecast period. The integration of Internet of Things (IoT) technology in EVs is enhancing vehicle connectivity and smart functionalities. Motion sensors play a vital role in these connected systems by providing real-time data on vehicle dynamics, which can be used for various applications, including predictive maintenance and real-time traffic updates.

The overall growth of the EV market is a significant factor driving the demand for motion sensors. As more consumers and businesses adopt electric vehicles, the demand for all associated components, including motion sensors, increases. The global shift towards sustainable and environmentally friendly transportation solutions is accelerating the adoption of EVs and, consequently, the motion sensor market.

The battery electric vehicles segment held the largest share in the electric vehicle sensor market in 2024. The battery electric vehicles is generally known as the electric vehicles with the fully electric power grid and with no other type of combustion technology. It has the fully rechargeable batteries that is all the energy comes for operating the vehicle is come from the battery packed power engine. Battery electric vehicles are continuously rising its market due to the changing preference of population to the sustainability and eco-friendly mobility solution. The battery electric vehicles are the major consumer of sensors due to monitoring and ensuring the safety of the vehicle, pressure and temperature control in the vehicle, and other important operations in the vehicle. Thus, the rising adoption of the electric vehicles battery and rising manufacturing unit for the electric vehicles are driving the growth of the market.

Asia Pacific dominated the electric vehicle sensor market with the largest market share in 2024. The growth of the market is attributed to the rising demand for the electric vehicles in the countries like China, India, and Japan due to the rising concern about the environmental impacts of the vehicles emitting carbon pollution and the stringent regulation regarding the pollution and environmental safety standards. The rising population in the region is one of the major contributors in the expansion of the automotive industry that also drives the EV market in the regional countries. Additionally, the higher availability of the major automobile firms in the regional countries and the ongoing investment by the foreign players in the automobile market is further contributing in the growth of the electric vehicle sensor market.

How China Plays Pivotal Role in the Market’s Expansion?

The Chinese government has implemented a range of policies and incentives to promote the adoption of electric vehicles (EVs). These include subsidies for EV buyers, tax exemptions, and investments in charging infrastructure. These policies have significantly boosted the demand for EVs and, consequently, the market for EV sensors.

Europe is expected to surge its growth in the electric vehicle sensor market during the forecast period. The automotive market is showing a substantial growth in the electric vehicle segment due to the shifting preferences towards the electric vehicle by the population. The further investment in the technological advancement in the automobile sector is driving the integration of AI, sensors, IoT, and other technologies in the electric vehicles that drives the growth of the electric vehicles sensor market in the region.

By Product Type

By Propulsion

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

September 2024