December 2024

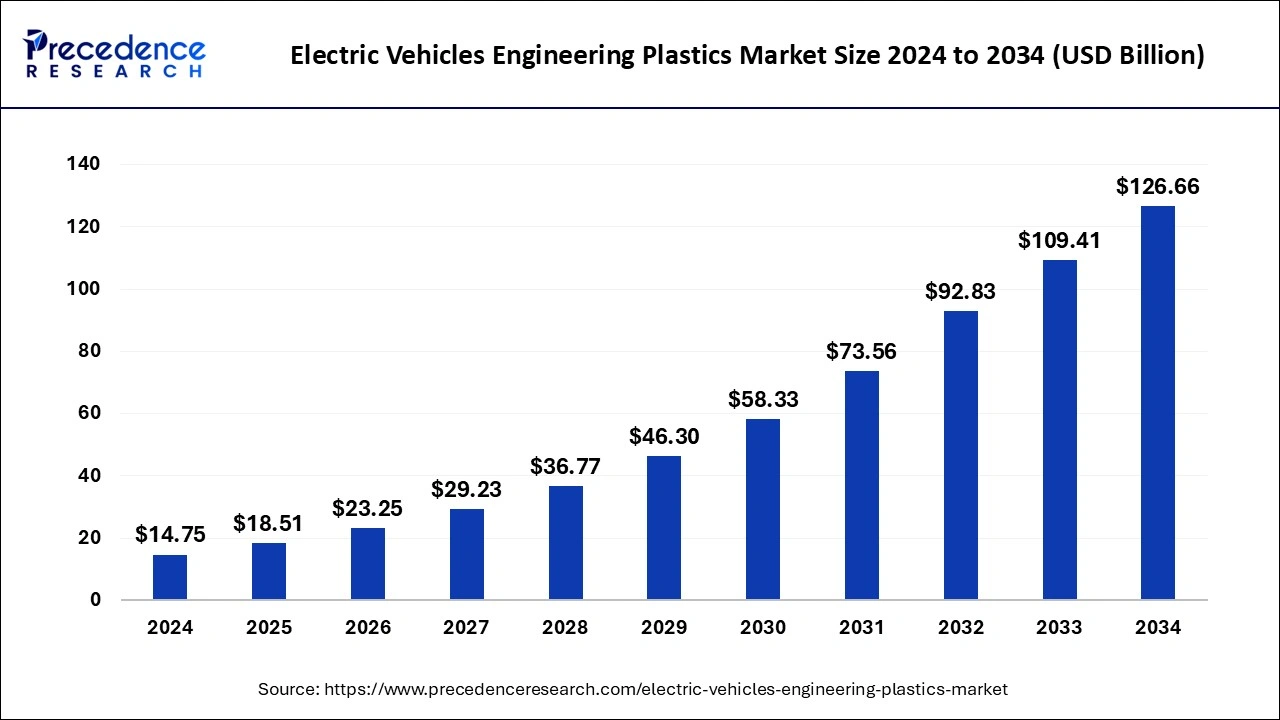

The global electric vehicles engineering plastics market size is estimated at USD 18.51 billion in 2025 and is predicted to reach around USD 126.66 billion by 2034, accelerating at a CAGR of 23.98% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global electric vehicles engineering plastics market size was estimated for USD 14.75 billion in 2024 and is anticipated to reach around USD 126.66 billion by 2034, growing at a CAGR of 23.98% from 2025 to 2034. The growth of the electric vehicles engineering plastics market is driven by the rising production and adoption of electric vehicles worldwide.

Artificial intelligence (AI) positively impacts the market for electric vehicles engineering plastics. Integrating cutting-edge technologies like AI and IoT in the production processes of engineering plastics enhances the design process. AI algorithms can analyze material properties and performance metrics during production, which further helps to improve the properties of engineering plastics, leading to improved performance of EVs. Moreover, AI algorithms automate production processes, reduce errors, and minimize waste generation, enhancing production efficiency.

The need for plastics in the sector is anticipated to rise in response to consumer demand for lighter BEV/PHEV and HEVs and improved plastic performance in challenging environments. Growing environmental concerns, strict emission regulations that encourage electrification as well as weight reduction, greater use of anti-microbial polymers in EVs, and other reasons are important market drivers. America, the United Kingdom, India, Japan, China, Germany, and Canada are the principal nations with the greatest potential for industry expansion on a worldwide scale.

Since electric vehicles produce less heat than internal combustion engines (ICE), manufacturers may utilise polymers rather than pricey metals. Over the projection period, these elements are anticipated to fuel product demand. Plastics are appropriate for use in EVs due to their customizability, formability, affordability, performance, and organic fit. Low weight, part consolidation, moulding components which fit in non-linear areas, and noise and vibration dampening are important properties of plastics. The need for plastics in EVs is anticipated to be driven by these factors as well.

| Report Coverage | Details |

| Market Size in 2025 | USD 18.51 Billion |

| Market Size by 2034 | USD 126.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 23.98% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Resin, Components, Vehicle Type, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A growing interest in electric vehicles and weight loss

Stringent mechanical and chemical property requirements for EV components propell innovations

In 2024, the Polyurethane (PU) sector led the industry globally and was responsible for the biggest portion of revenue—more than 27%. It has improved chemical resistance, toughness, radiation resistance, water resistance, and other properties. In EV batteries, polyurethane increases power and enhances crash safety. Additionally, it is utilised in foam seats, cushions, electrical compounds, suspension bushings, and insulation panels. Over the projection period, these elements are anticipated to fuel the need for plastics in EVs. The PP segment, on the other hand, is anticipated to develop at the quickest rate over the projection period. Different grades of polypropylene are being developed by manufacturers in order to decrease the weight of the car and increase the range of electric vehicles. Its use extends to both interior and external components as well as structural and non-structural components. Additionally, it's employed in things like carpet fibres, bumpers, tailgates, and cable insulation.

In 2024, the Electric Vehicle Battery (EVB) type category led the global market and was responsible for the highest revenue share of more than 75%. The need for plastics in EVs is rising as a result of the expanding population and strict emission laws. In order to enhance the range of the EV, BEV is focused on decreasing the vehicle weight, which is made possible by the use of plastics. Vehicle safety and durability are top priorities for manufacturers, who also use economical polymers for the battery compartment. It is anticipated that these developments would increase demand for plastic over costlier metals.

The Plug-in Hybrid Vehicle (PHEV) & Hybrid Electric Vehicle are two other types of electric vehicles (EVs) in addition to BEVs (HEV). PHEVs feature an alternate fuel supply to power the ICE in addition to batteries to power the electric motor. When the battery is totally discharged, the car turns over to the ICE. However, because they are more cost-effective and efficient than PHEVs, BEVs are favoured. HEVs combine an ICE with an electric engine that draws power from batteries. A smaller ICE and less idle time while the car is stopped may be possible because to the increased power the electric motor produces. These elements improve performance while while offering superior fuel efficiency.

In 2024, the exterior application segment controlled the majority of the market and generated more than 30% of the total revenue. The need for plastics is rising as more plastics are used in place of metal in various components of automobiles, such as the bumper, lights, door assembly, and other sections. Utilizing plastics, which function as an absorbent body in the case of an accident, reduces danger. Plastics also improve the looks of vehicles, reduce total vehicle weight, and offer the necessary strength. Interior components are more aesthetically pleasing than practical. Their main functions are to provide the interior of the car a nice appearance and make it comfortable. Plastics offer physical and electrical characteristics that are anticipated to drive the market, including heat resistance, chemical stability, abrasion resistance, and others. Metals were previously used for the under-the-hood parts of automobiles, but plastics are gradually taking their place since they contribute to lighter vehicles.

Some of the most common plastics used in automobiles include nylon, polypropylene, and polyphenylene sulphide, which offer advantages such component consolidation, resistance to corrosion, sound dampening, cost savings, and others. Given its strong strength and ability to tolerate high temperatures, nylon is the thermoplastic that is used in engine compartments the most frequently. Polyethylene can be employed in applications wherein moisture resistance is needed because of its low density, strong impact resilience, and robust durability. It may be utilised to produce inexpensive electrical insulations. PVC is also used to manufacture the sheathing for electrical cables.

The interior component sections include things like the steering cover, seat trim, steering lining, and roof lining. The goal of interior trim is to make the interior of the car comfortable and suitable. Wheel covers, headlamp covers, fenders, and other exterior trim components give the car its aesthetic appearance. Plastics reduce the cost of battery manufacture and eventually take the place of metallic components. Plastics, like PP, offer improved shock-absorbing capabilities and shield the batteries from harm from unintentional shocks. PET also serves as a separator and an excellent insulator that guards against short-circuiting.

In 2024, Asia Pacific held a commanding position and generated more than 52% of worldwide revenue. The principal nations with high production capacities in the area are China, Japan, South Korea, and India. The simple accessibility of raw resources and the affordable, competent labour force facilitate this. One of the biggest EV markets in the world is China. Over the projected period, it is predicted how an increase in disposable income and growing preference for EVs from the middle-class population in emerging nations like China and India would propel the growth of the sector. Additionally contributing significantly to income in 2021 was Europe. On a vast scale, the chemical businesses in the area produce polymers for EVs. The region's market for EVs is growing thanks to tax exemptions, subsidies, and supporting regulations, which will fuel product demand throughout the projected period. Volkswagen, a major global automaker, is to spend USD 7.1 billion to expand its current lineup of electric vehicles in North America by adding 25 new models. In addition, the firm projects that in the upcoming years, electric vehicles will account for 55% of all car sales in the United States.

Segments Covered in the Report

By Resin

By Components

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

December 2024

March 2025

February 2025