January 2025

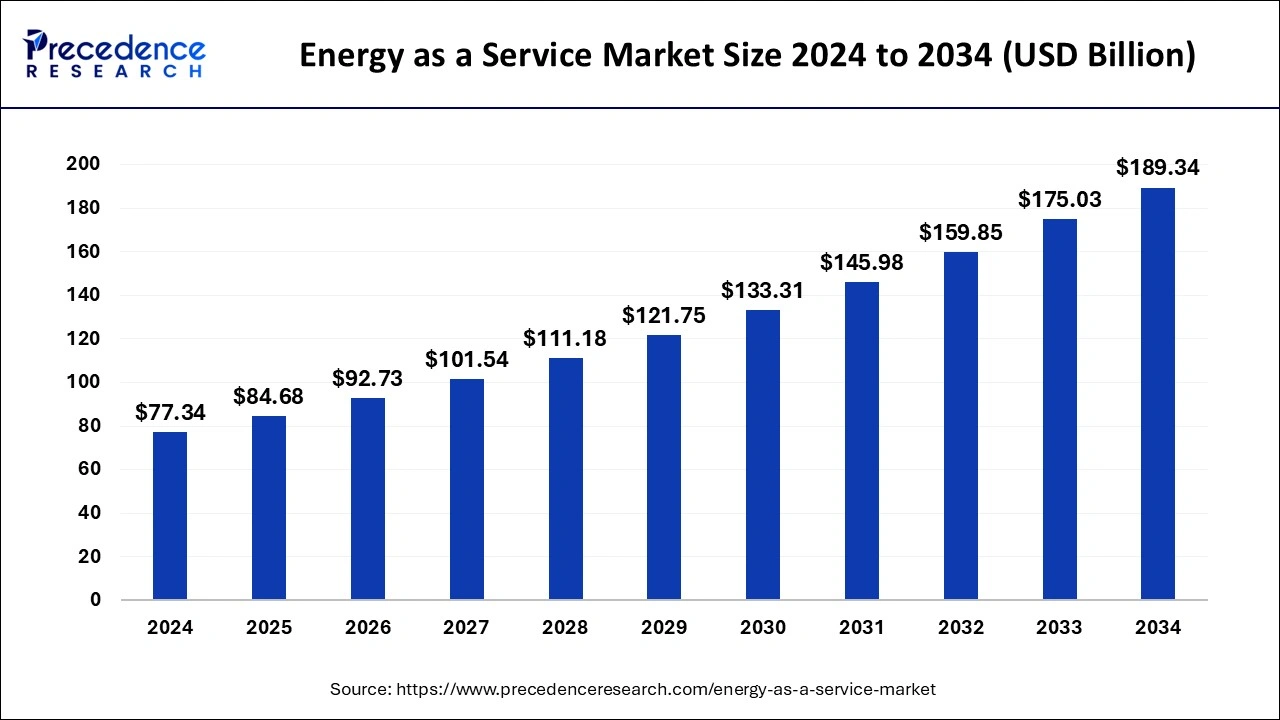

The global energy as a service market size is calculated at USD 84.68 billion in 2025 and is forecasted to reach around USD 189.34 billion by 2034, accelerating at a CAGR of 9.37% from 2025 to 2034. The North America energy as a service market size surpassed USD 34.03 billion in 2024 and is expanding at a CAGR of 9.40% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global energy as a service market size was accounted for USD 77.34 billion in 2024, and is expected to reach around USD 189.34 billion by 2034, expanding at a CAGR of 9.37% from 2025 to 2034.

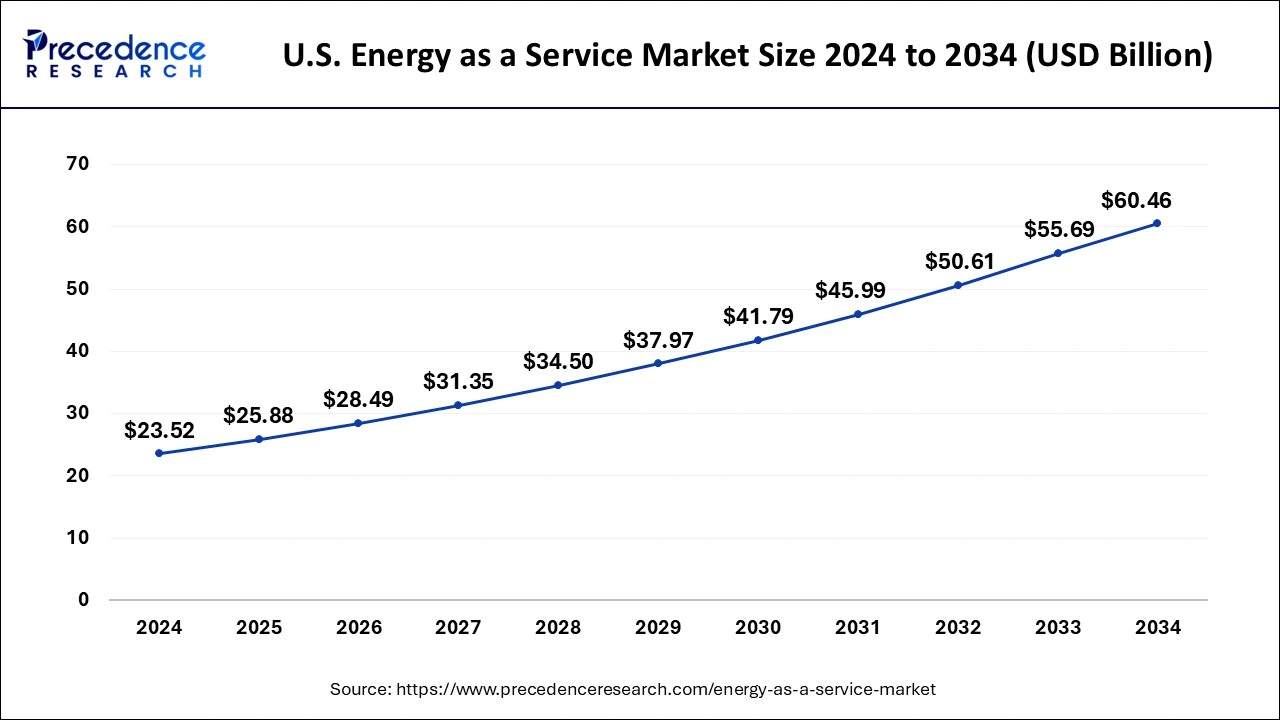

The U.S. energy as a service market size was estimated at USD 23.52 billion in 2024 and is predicted to be worth around USD 60.46 billion by 2034, at a CAGR of 9.90% from 2025 to 2034.

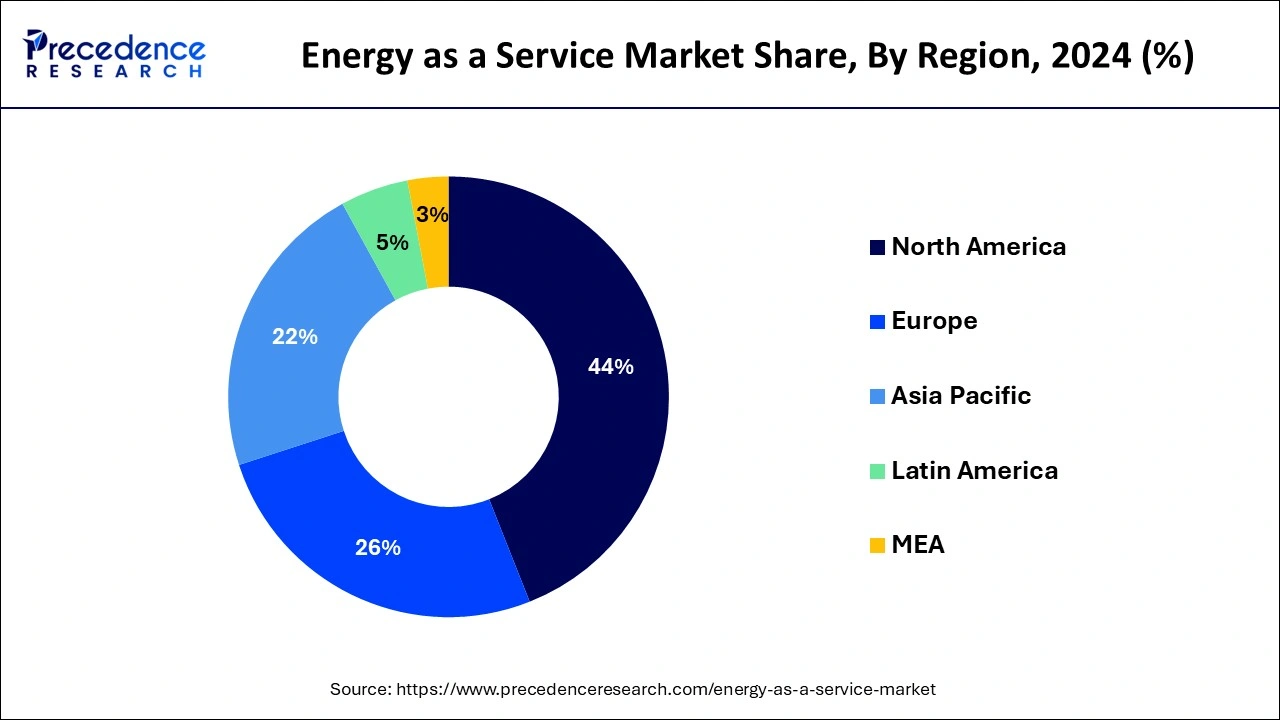

Energy as a service is predicted to be dominated by North America during the forecasted period, with the U.S. accounting for the majority of demand. The nation stands out among others for having used Energy as a service in a number of industries. Particularly in the commercial sector, the area has embraced a number of initiatives that are anticipated to boost energy storage efficiency and assist reduce operational costs. The region has also seen notable investment in the exploration, production, and refining sectors, which is expected to increase demand for the energy as a service model in the upcoming years. Moreover, energy efficiency projects are being implemented by utilities in the U.S., Canada, and Mexico in an effort to lower the cost of energy production. In the U.S., fresh strategies like pay-for-performance are being adopted to boost business energy efficiency on a bigger scale. The energy as a service market in this region is also anticipated to be driven by a rise in the share of renewable power generation and energy efficiency efforts.

Europe region will grow at a significant rate during the projected period. By supporting governmental and organizational policy frameworks to implement green energy solutions and significantly installing power production technology in various places, Europe's market is benefited. At the moment, the main nations making a significant contribution to the market for energy as a service in the area include Germany, the UK, and Italy, among others. Additionally, it is projected that rising investments and plans to strengthen and expand grid infrastructure networks to support the rising installation of renewable energy will further advance the business.

The necessity to address the demand & supply gap as well as the region's growing interest in clean energy will support the industry outlook in Asia Pacific. The establishment of new industrial gas facilities and the construction of new homes and businesses facilitated the acceptance of these models in the area.

The centralized, asset-focused method of generating electricity to passive consumers is replaced by the energy-as-a-service model. Instead, it provides total administration of a customer's energy resources and services. EaaS providers are able to merge markets, provide predictable load balancing, and update the grid in a variety of ways by pooling the resources of their clients into a sizable smart energy community. A rapidly expanding and recently created business model called energy as a service offers a range of energy-related services and offers energy optimization solutions for small, medium-sized, and big organizations.

Additionally, it raises awareness of better management practices and enhanced distributed generation source installations. Different service types employ energy as a service, and the market analysis provides a full review of these areas. On the end use category, which includes commercial and industrial uses, the EaaS market offers comprehensive information.

The growing emphasis on developing federal rules and standards to meet the need for energy solutions supports the size of the EaaS industry. Market shares are boosted by the growing use of distributed energy resources (DER) and the decarburization of the world economy. Additionally, the booming global transportation industries, the spread of electric vehicles (EVs), and a greater emphasis on sustainable energy all have an impact on market expansion.

All industries have been severely harmed by the COVID-19 epidemic. Since 2020, most nations have noticed a significant increase in the number of impacted cases. Unrest in the economies of numerous rapidly emerging nations was caused by the pandemic's conclusion.

| Report Coverage | Details |

| Market Size in 2025 | USD 84.68 Billion |

| Market Size by 2034 | USD 189.34 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.37% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

According to service type, the energy supply segment is in the lead and is anticipated to contribute most to the energy as a service market. Consumers are searching for a reliable energy supply to ensure that they can function off the grid in the face of rising rates. Additionally, energy as a service models primarily support renewable energy due to its lower costs, smaller carbon footprint, higher energy efficiency, and environmental friendliness. This is because renewable energy is increasingly being focused on as a variety of energy supply sources, including biomass, renewable, fossil fuels, nuclear, and biofuels.

The segment is expanding as a result of each region having more clients due to the growing population. The implementation of these services is cost-effective in the long run because the customer makes service payments based on actual energy savings or other equipment performance metrics, which leads to a reduction in operating costs right away.

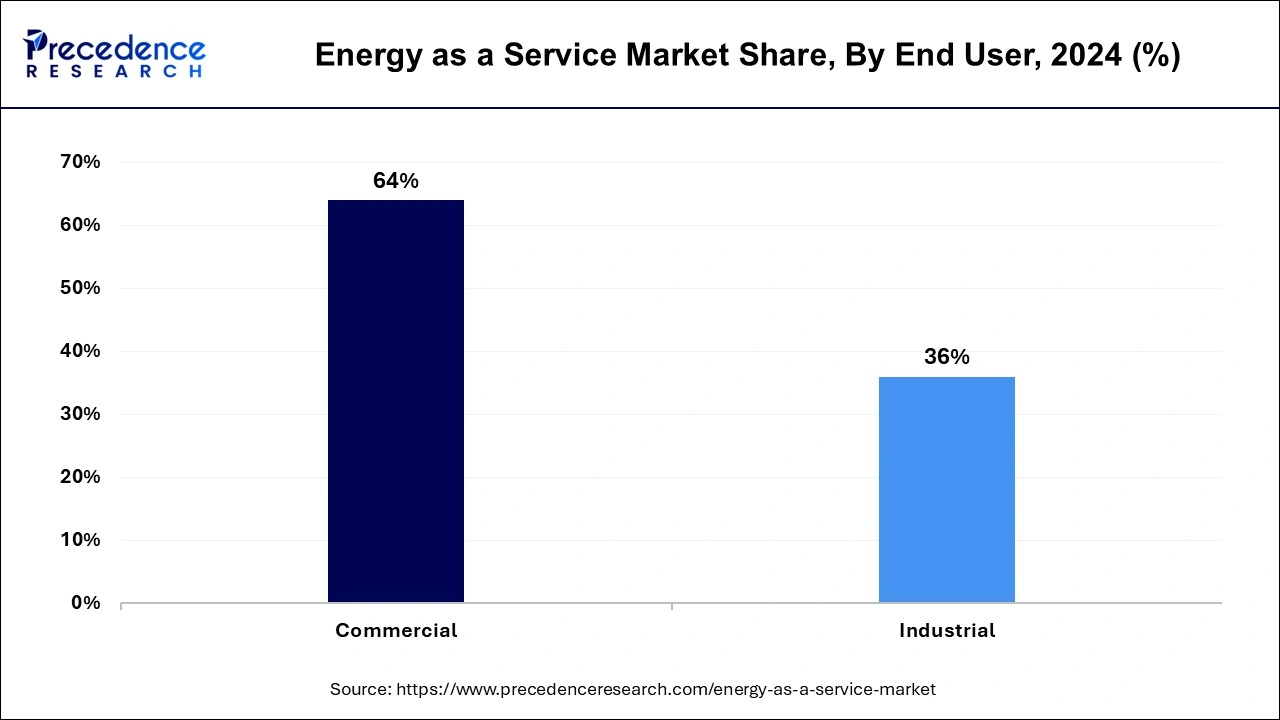

The services offered by an EaaS company to conserve energy or deliver electricity for various needs are included in the commercial sector. EaaS providers provide a range of technical and software solutions that help businesses comprehend the patterns of power consumption. With energy service implementations being required in the business sector across all worldwide regions, the commercial segment is anticipated to have the greatest market share and the fastest expanding market. This is primarily due to important structural effects, specifically, economic expansion. Additionally, energy as a service will give commercial users access to their energy efficiency, which will assist them reduce their energy use. A sizeable portion of the worldwide market is controlled by the industrial sector.

A sizeable portion of the worldwide market is controlled by the industrial sector. Production facilities and manufacturing facilities are included in the industrial sector. These facilities depend on a steady supply of electricity and cannot tolerate disruptions in energy storage or delivery. As a result, these elements are anticipated to fuel market growth in this sector.

By Service Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

August 2024