January 2025

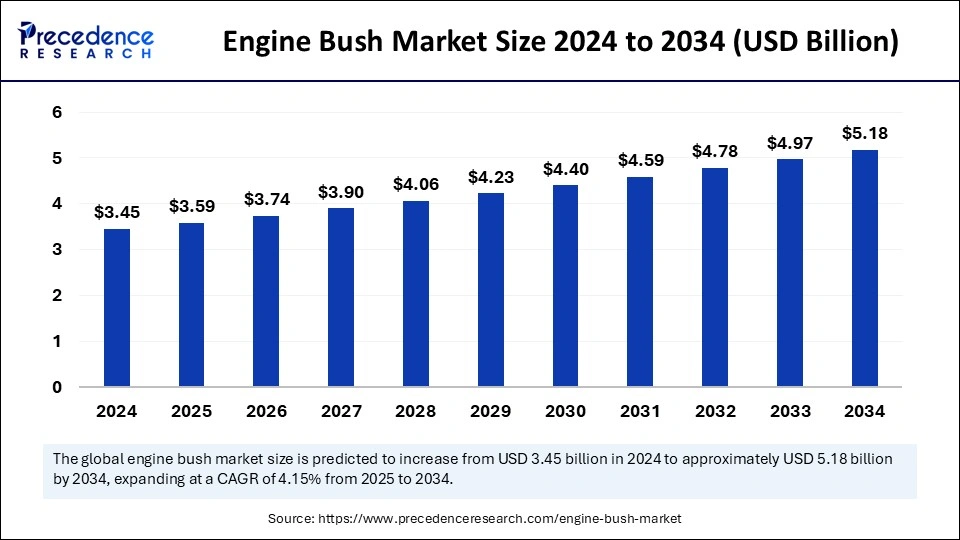

The global engine bush market size is calculated at USD 3.59 billion in 2025 and is forecasted to reach around USD 5.18 billion by 2034, accelerating at a CAGR of 4.15% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global engine bush market size was estimated at USD 3.45 billion in 2024 and is predicted to increase from USD 3.59 billion in 2025 to approximately USD 5.18 billion by 2034, expanding at a CAGR of 4.15% from 2025 to 2034. The rising demand for dependable and efficient engine parts across various sectors, such as automotive, aerospace, and industrial machinery, is driving the market forward. The incorporation of smart technologies into vehicles is shaping the design and operation of engine components. This includes integrating sensors and real-time monitoring systems, which facilitate improved maintenance and minimize downtime, ultimately enhancing engine performance and durability.

The impact of Artificial Intelligence on the engine bush market is primarily seen through innovations in manufacturing and performance assessment. In production, AI-driven visual inspection systems meticulously evaluate engine bushes, identifying tiny defects that conventional methods may overlook, thereby ensuring enhanced quality and uniformity. Additionally, AI optimizes manufacturing processes by examining production data, resulting in minimized waste and improved efficiency.

Outside of the manufacturing space, AI is important for predictive maintenance. By analyzing sensor information from vehicles, AI algorithms can detect subtle variations in vibration and noise patterns, forecasting when an engine bush is likely to fail. This facilitates proactive maintenance, preventing expensive breakdowns and boosting vehicle safety. Essentially, AI is improving both the production and monitoring of engine bushes, leading to better quality, efficiency, and reliability.

The push for improved engine performance and durability is driving manufacturers to invest in superior bush materials. In addition, the demand for decreased emissions and enhanced fuel efficiency is driving innovations in engine design, thereby increasing the need for specialized bush components capable of withstanding greater stress and higher operational temperatures.

There are numerous opportunities for players in the engine bush market to explore, particularly in emerging economies experiencing rapid industrialization. The growth in automotive vehicle manufacturing is bound to escalate the demand for engine bushes. Moreover, advancements in materials science are expected to yield new types of bushes that offer more favorable features, such as reduced friction and enhanced stability. This situation provides companies with opportunities to innovate and create new products that will meet the expectations of modern engines, which require more robust solutions.

Recent trends indicate a shift toward lightweight materials and eco-friendly manufacturing processes for engine bushes. With companies striving for sustainability, there is a rising focus on recycling and the use of biodegradable materials in the production process. Furthermore, the incorporation of smart technologies into vehicles is shaping the design and operation of engine components. This includes integrating sensors and real-time monitoring systems, which facilitate improved maintenance and minimize downtime, ultimately enhancing engine performance and durability.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.18 Billion |

| Market Size in 2025 | USD 3.59 Billion |

| Market Size in 2024 | USD 3.45 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.15% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Vehicle Type, Material Type, Sales Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for automotive components

The engine bush market is witnessing considerable growth propelled by the increasing need for automotive components. As the global automotive industry continues to develop, driven by rising vehicle production and advancements, the importance of efficient engine performance becomes critical. Engine bushes are essential in bolstering the reliability and durability of engines, which subsequently improves vehicle performance and lifespan.

With the rise of electric and hybrid vehicles, manufacturers are concentrating on the creation of lightweight and high-efficiency engine parts, including bushes. Additionally, the growing consumer inclination towards cutting-edge automotive technologies compels manufacturers to invest in the research and development of enhanced engine bush materials and designs. This escalating demand within the automotive sector is expected to open up significant opportunities for the market.

Scarcity of raw materials

A major concern in the engine bush market is the instability in raw material prices, particularly with rubber and synthetic materials. The tightening of environmental regulations presents a challenge, as manufacturers must consistently adjust to meet the changing criteria related to emissions and material utilization. These regulations may incur additional costs tied to research and development and could potentially expose manufacturers to liabilities for non-compliance. Moreover, the market faces intense competition, with many players competing for market share. This competitive environment can trigger price wars, which may diminish profitability for companies unable to effectively set their products apart.

Expansion of the aftermarket segment

As the global vehicle fleet ages, there is an increasing requirement for replacement parts to sustain and improve vehicle performance. The aftermarket represents a profitable opportunity for engine bush manufacturers to provide products that address both standard replacement demands and the rising trend of vehicle customization and upgrades. In addition, the growth of e-commerce platforms creates an opportunity for manufacturers in the engine bush market to connect with a wider audience and optimize distribution channels, thereby enhancing market penetration and customer interaction.

The rubber bushes segment held the largest engine bush market share in 2024 due to the cost-effectiveness and adaptability of both natural and synthetic rubber materials. These bushes are effective in reducing noise and dampening vibrations, making them essential in both passenger and commercial vehicles. However, despite their affordability being a major benefit, rubber bushes can experience quicker deterioration when exposed to harsh environmental conditions, including oils, chemicals, and fluctuations in temperature. To address this issue, manufacturers are increasingly innovating with advanced rubber compounds and reinforcement methods, such as adding fabric or metal inserts, to improve durability and lifespan. Moreover, there is growing interest in developing specialized rubber formulations designed for specific uses, such as high-temperature scenarios or heavy-duty vehicles.

The polyurethane bushes segment is anticipated to grow at a remarkable pace between 2025 and 2034. Polyurethane bushes are becoming more favored due to their higher durability and performance attributes in comparison to conventional rubber bushes. They provide improved resistance to wear, chemicals, and environmental factors, making them ideal for high-performance and heavy-duty applications. The increasing trend toward vehicle customization and performance upgrades is fueling the demand for polyurethane bushes, which enhance vehicle handling and stability. Additionally, there is a growing adoption of polyurethane bushes in the aftermarket sector as consumers seek long-lasting and dependable alternatives to rubber bushes.

The passenger vehicle segment captured the biggest engine bush market share in 2024, which is bolstered by the rising global demand for personal and family transportation. As automotive manufacturers aim to enhance comfort, performance, and fuel efficiency in passenger cars, the need for high-quality engine bushes that efficiently reduce engine noise and vibrations has increased. This includes the creation of advanced bushing designs that utilize active vibration control technologies and adaptive materials. Continuous technological progress in passenger vehicle design and engineering, especially regarding electric vehicle powertrains and advanced suspension systems, is setting new quality standards for components, thus increasing the demand for premium engine bushes. This trend is further intensified by the growing popularity of luxury and performance vehicles, where reducing noise, vibration, and harshness (NVH) is crucial.

The commercial vehicle segment will expand at a notable rate over the projected period. Commercial vehicles, including trucks and buses, constitute another major segment for engine bushes. The strong growth of the logistics and transportation sector globally has resulted in a heightened demand for commercial vehicles, thus increasing the requirement for durable and high-performing engine bushes. These vehicles frequently operate under heavy loads and difficult conditions, requiring components that can endure substantial wear and tear. Consequently, manufacturers of commercial vehicles are progressively choosing advanced materials like polyurethane to improve durability and decrease maintenance expenses.

The natural rubber segment dominated the engine bush market with the largest share in 2024. Natural rubber has long been favored for engine bushes due to its superior elasticity, resilience, and impressive vibration absorption properties. However, its vulnerability to deterioration from harsh environmental variables, like ozone, UV rays, oils, and extreme temperatures, has prompted considerable research into alternative materials. This trend includes the increased use of synthetic rubbers such as neoprene, EPDM, and polyurethane, which provide greater resistance to chemical and environmental degradation. Furthermore, the progress in advanced composite materials, which blend fibers and fillers into rubber matrices, is gaining traction, offering enhanced strength, durability, and temperature tolerance. The rise of thermoplastic elastomers (TPEs) is also notable, as they combine flexibility, durability, and recyclability. Additionally, companies are investigating bio-based materials and sustainable alternatives to minimize the environmental impact of engine bushes, reflecting a growing commitment to sustainability within the industry.

The synthetic rubber segment is projected to expand at a significant CAGR over the forecast period. Synthetic rubber has significantly gained popularity in the engine bush industry, offering improved durability, resistance to extreme temperatures, and chemical stability in comparison to natural rubber. Materials such as silicone and neoprene are increasingly being utilized for the manufacture of engine bushes, addressing the needs of modern vehicles operating in various challenging environments. These synthetic materials deliver superior performance in high-temperature scenarios and retain their structural integrity over extended periods, making them suitable for both original equipment manufacturer (OEM) and aftermarket purposes. The shift towards synthetic rubber is also influenced by the automotive industry's push for more sustainable and eco-friendly materials, aligning with worldwide environmental standards.

The OEM channel segment captured the largest engine bush market share in 2024. Original equipment manufacturers (OEMs) play a crucial role in the market by supplying engine bushes directly to vehicle manufacturers during the assembly phase. The demand in this channel is propelled by the continuous production of new vehicles and the integration of high-quality engine bushes to optimize vehicle performance and meet industry standards. The OEM channel is greatly influenced by the strategic alliances and relationships formed between engine bush manufacturers and vehicle producers. These collaborations often lead to innovations and customized solutions designed for specific vehicle models, ensuring that engine bushes fulfill precise specifications and quality criteria set by automotive manufacturers. Furthermore, the growing emphasis on sustainable and environmentally friendly vehicle components is encouraging OEMs to explore engine bushes crafted from advanced, eco-conscious materials.

The aftermarket channel segment is projected to witness notable growth over the forecast period. The aftermarket channel is motivated by the necessity for replacement engine bushes as vehicles age and parts wear down. This segment provides a broad range of products, from standard to high-performance engine bushes, meeting different customer preferences and demands. The aftermarket sector is marked by its diversity, with a myriad of small and large entities offering competitive pricing and product selections. The increasing number of vehicles on the road, along with the trend towards vehicle customization and performance enhancement, are key drivers of growth in the aftermarket sector.

Asia Pacific led the global engine bush market with the highest share in 2024. This is driven by rapid industrial growth and urbanization, especially in emerging economies such as China and India. The strong expansion of the automotive sector in these nations, fueled by increasing disposable incomes, higher vehicle ownership, and a growing middle-class population, is a primary factor contributing to the demand for engine bushes.

The extensive manufacturing infrastructure within the region is supported by favorable government policies that encourage automotive production and foreign investment. Moreover, the expanding aftermarket sector in the Asia Pacific, along with the rising adoption of electric vehicles and advanced vehicle technologies, presents significant opportunities for engine bush producers.

North America is estimated to expand at the fastest CAGR in the market between 2025 and 2034. This growth is fueled by technological advancements and a significant focus on sustainable automotive practices. The region's established automotive sector, known for its strong emphasis on research and development, plays a crucial role in driving market expansion. The rising popularity of electric and hybrid vehicles, aided by government incentives, infrastructure development, and consumer preferences, is leading to increased demand for sophisticated engine bushes that improve performance, efficiency, and noise reduction.

The presence of major automotive manufacturers, a sophisticated supply chain, and a highly qualified workforce further support the growth of the market in this region. Additionally, strict emission regulations and fuel economy standards introduced by the government are urging manufacturers to innovate and enhance their products, particularly in the area of lightweight, durable, and high-performance engine bushes. The escalating focus on vehicle connectivity, autonomous driving, and advanced driver-assistance systems (ADAS) is also propelling the need for specialized bushing solutions that can accommodate these technologies.

By Product Type

By Vehicle Type

By Material Type

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

August 2024